Example

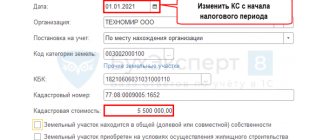

The organization (Moscow) owns land plots with the cadastral value:

- in Moscow - 14,000,000 rubles;

- in Samara - 2,518,000 rubles.

The plot in Moscow was purchased in 2022, the entry was made in the Unified State Register of Real Estate on October 20.

Both plots are classified as other land plots, the tax rate is 1.5%.

For a land plot in Moscow, an organization has the right to a benefit: payment of tax in the amount of 30% of the calculated amount (clause 1.4 of article 3.1 of the Moscow Law of November 24, 2004 N 74).

General formula

Land tax is local in nature, therefore a number of rules on it are established by municipal authorities, as well as Moscow, St. Petersburg and Sevastopol on their territory. However, how to calculate the advance payment for land tax is regulated by the Tax Code of the Russian Federation. Namely, paragraph 6 of Article 396. The rules regarding the calculation of advance payments for land tax in 2022 have not changed.

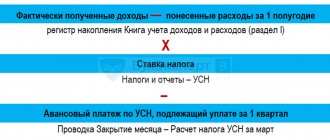

Thus, tax calculations of advance payments for land tax are made based on the results of each of the first three quarters of the current year. And then, based on the total amount of land tax advances transferred during the year, the total final payment is calculated.

From this norm of the Tax Code of the Russian Federation a general formula can be derived. It will be the same for each quarter:

| ADVANCE = COST OF THE PLOT ACCORDING TO THE CADASTRE × TAX RATE × 1/4 |

Let us immediately clarify that the calculation takes into account the percentage of the value of the land according to the cadastre as of January 1 of the year. That is, the tax period.

Also see “Advance payments for land tax: payment deadlines in 2017.”

Regulatory regulation

Land tax is calculated and paid in accordance with the legislation of municipalities on the territory of which land plots owned by the organization are located.

General calculation formula:

Where:

- Kv - coefficient of land ownership, if the organization owns the object for an incomplete reporting (tax) period;

- Ki is the coefficient of use of the cadastral value (CV), if the CV changed during the period;

- Kl is the coefficient of use of the benefit if the benefit is applied during an incomplete reporting (tax) period.

The deadline for paying land tax for 2022 (4th quarter) is the same for all taxpayers, until March 1, 2022 (clause 1 of Article 397 of the Tax Code of the Russian Federation).

How is land tax calculated?

The basic value that affects the amount of land tax is the cadastral value (Kc). The tax calculation form for 2016 under the Land Code is as follows:

Tax = Ks x P x Ns x D x Kf - L, where:

Kc – cadastral value;

P – area of the land plot;

D – share in total real estate;

L – benefits;

Нс – tax rate;

Kf - coefficient that is used if ownership of the plot was limited for a period of up to 1 year.

As you can see from the formula, the main reducing values are the size of your share in real estate, as well as the tax rate, which you can check with the Federal Tax Service for your region. You can find out how to calculate the cadastral value of land using a calculator by contacting the Cadastral Chamber. It is much easier to order an extract from Rosreestr, which, among other information, will indicate the cadastral value of the land plot.

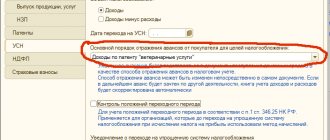

Setting up land tax in 1C

Install or check the land tax settings (Main - Taxes and reports - Land tax). Let's look at filling out each link.

Registration of land plots

Check the registration card of the land plot that has been owned since the beginning of the year.

Create a record Registration of a land plot for a new plot registered in the Unified State Register of Real Estate in the 4th quarter.

In the Tax benefit , indicate the type of benefit and its amount (in our example, the tax is reduced by 70% - the tax is 30% of the calculated tax).

After setting up a land tax benefit, a link appears under the Tax benefit to fill out an Application for a benefit to the tax authority.

Payment of advance payments

Check the settings for advance payments in land tax payment areas. If the Advances are paid is set, the calculated tax for the year will be reduced by advance payments for the 1st, 2nd, 3rd quarters.

When calculating land tax in the Accounting 8 configuration in databases with releases before 3.0.106.60 , an error may appear: “At the end of the month, the operations for calculating advance payments for transport and land taxes are not filled in by mistake.”

To resolve the error, update to the specified release.

Ways to reflect expenses

The method of reflecting expenses can be established for all land plots or for each one separately.

Advance on income tax

Mutual settlements for income tax provide for mandatory advance payment (Article 286 of the Tax Code of the Russian Federation). Prepayment of tax must be calculated and included in the budget for all organizations that officially receive a profit. Tax payment options are monthly and quarterly advances. Advance payments in this case should be calculated depending on the method of making the advance payment.

Options for advance income tax:

- Monthly deductions with additional payments based on the results of each quarter. The calculation of the advance payment is carried out as follows: the organization records the indicators of the actual profitability received in the reports for the previous period, after which it can preliminarily calculate the advance tax for the current period of time. The prepayment of the tax is made monthly, and at the end of the quarter the transferred advance payment is consolidated. As a result, part of the money that is not enough to reach the calculated value must be paid into the budget. If there is an overpayment of tax on the amount of monthly advances, it can be returned or offset against future payments. The deadline for transferring the advance payment is the 28th of each next month. The total amount for the quarter must be calculated and paid no later than the declaration is submitted.

- Voluntary monthly payments. This option for prepayment of tax must be calculated from the actual amount of profit received. The decision to switch to such a tax payment scheme is made by the payer himself. Often this option is relevant for those companies and individual entrepreneurs who receive irregular and unstable income, therefore it is advisable to calculate the tax and advance payment based on the actual amount of profit. After submitting an application (this can be done at any time before the end of the year) and switching to the monthly tax advance scheme, the reporting periods will be one month, two months, and so on every month until the end of the year. The advance tax payment must be calculated from the amount of profit on an accrual basis - the total profitability indicator is multiplied by the current rate (Article 284 of the Tax Code of the Russian Federation). The deadline for payment is the same - the 28th of each subsequent month.

- Quarterly payment without monthly deductions. Some institutions can calculate and make advance tax payments based on the results of the first quarter, half a year and nine months. Not all enterprises can calculate and transfer tax prepayments quarterly - this right is granted to budgetary, autonomous and non-profit organizations, foreign companies with a permanent official representative office in Russia, enterprises whose quarterly income does not exceed 15 million rubles and a number of other payers. The payment must also be calculated and transferred to the budget within the deadline for filing the declaration - before the 28th of the next quarter.

For each tax advance method, different formulas for calculating amounts are used. In the case of monthly payments with an additional payment of the final tax amount, legislators established the following rules:

- monthly payments for the 1st quarter of the new reporting period are equal to the monthly prepayment for the 4th quarter of the previous year;

- monthly payment for 2 quarters is determined as ⅓ of the advance for 1 quarter;

- the monthly prepayment for the 3rd quarter should be calculated as ⅓ of the difference between payments for the half-year and the prepayment for the 1st quarter;

- monthly advance payment in the 4th quarter is determined as ⅓ of the difference in advance tax payments for three quarters and six months.

If, after calculation by this method, the advance payment for income tax in any period is negative or has a zero value, then mutual settlements with the budget for this period do not need to be carried out. When making monthly advance tax payments, the formula will be as follows:

AP = A current – A previous

That is, the amount to be paid additionally must be calculated as the difference between payments for the current month (based on the actual profit value) and the previous prepayment. If an organization transfers tax quarterly, then the advance payment should be calculated as follows:

AP = A reporting – A previous

The scheme is similar - to determine the prepayment, you need to calculate the difference between the current payment and the previous advance amount.

Calculation of land tax

Land tax is calculated automatically by the regulatory operation Calculation of land tax in December 2022 (Operations - Closing the month - Calculation of land tax).

Postings

You can check the calculated tax in the Help-calculation of land tax for 2022 .

Example of tax calculation based on cadastral value

To quickly calculate land tax based on cadastral value, use a calculator, but you can do without it.

Let's say you own a fourth part of a plot (0.25), the cadastral value of which was 1,000,000 rubles. You checked with the Federal Tax Service the current land tax rate for your property, and received a rate of 0.2%.

Basic calculations:

Tax = 1 million rubles *0.2/100*0.25 = 500 rubles – Land tax at the current cadastral value for ¼ of the land plot. You can read how to calculate the cadastral value of a land plot on the pages, or order a consultation with taxation specialists.

It is worth noting that the Tax Code provides benefits for different categories of citizens, which make it possible to reduce the land tax rate, up to complete or temporary exemption from payments. You can find a list of categories of citizens and real estate to which benefits apply on the website of the Federal Tax Service.

Land tax calculations for 6 months (6 months / 12 months = 0.5) under the same conditions, but with tax benefits (100 rubles):

Tax = 1 million rubles *0.2/100*0.5-100= 150 rubles.

The calculation of the cadastral value of a land plot using a calculator is carried out by tax control authorities; citizens themselves should not provide any types of miscalculations. After the Federal Tax Service has calculated all tax rates, notifications are sent out in the prescribed manner to the place of residence of property owners (addresses are taken from Rosreestr based on information about the owner). The notification indicates the final calculation (indicating benefits, coefficient, share), as well as the deadlines within which payment must be made. Most often, this type of notification is sent out in the summer or autumn, but the tax calculation process is regulated directly by the Federal Tax Service.

If an error was made in the calculations provided, every citizen has the right to appeal the amount of land tax, including through equating the cadastral value to the market value. The cadastral value calculator of a land plot often does not take into account a number of important factors, which sharply increases the tax base for the population. Therefore, we recommend that if you receive an unreasonably high land tax, you contact our company to review the cadastral value.

Payment of land tax

Form a payment order for the payment of land tax from the List of Organizational Tasks (Main - Organizational Tasks).

The link opens the Land Tax Payment Assistant .

If, when opening the assistant, in the Calculation of amount it is indicated No tax payable , make sure that the routine operation Calculation of land tax is carried out for the reporting (tax) period.

Follow the link Calculation of land tax for 2022, go to Help-calculation of land tax for 2022. It is formed with selection by the Federal Tax Service, where the tax is paid. And it is convenient for checking the correctness of land tax calculations.

We looked at how to calculate land tax for 2022 in 1C 8.3 Accounting, the deadlines for paying land tax for 2022, and how to check the correctness of land tax calculation in 1C.

How to calculate land tax for citizens?

Individuals pay tax on land plots of which they are the owner only once a year - for all 12 months in one amount based on annual results.

Once a year, citizens receive a notification from the tax office containing the amount to be paid, as well as the initial data used for the computational process. It is recommended to check the calculation; to do this, the citizen needs to familiarize himself with the local legislative acts relating to the tax on land plots of individuals.

Of these legislative and regulatory acts, it is necessary to clarify:

- Opportunity to take advantage of the benefit system;

- The value of the object subject to land tax;

- The approved rate for the desired land category.

Each municipality has its own system of providing benefits to individuals. To find out information about whether you can use it, you need to contact the Federal Tax Service branch to which the land subject to taxation belongs.

If a benefit is granted, then the right to it is documented - a statement is written for the tax office, to which supporting documentation is attached.

If an individual does not have the right to be exempt from the tax burden, then you should find out what is the basis for the calculation. Calculation for individuals is carried out based on the cadastral value of the land property. This indicator is taken at the beginning of the reporting year. The tax office requests such information from Rosreestr and uses it for calculations.

If there are doubts about the correctness of the cost used for calculation, then you can clarify the current data in Rosreestr yourself - submit a request in writing to Rosreestr or the cadastral chamber at the address of the land location. Information is provided in the form of a certificate without charging additional fees. The application should indicate the cadastral value of which property the applicant is interested in. The date on which the information must be provided is also written; this detail is necessary, otherwise the cost will be indicated on the day the application is submitted.

Once data on the cadastral value is received, you need to find out the current rate, and then begin calculations.

The rate is also set by the Ministry of Defense, its value depends on the land category of the site. To find out the rate, you can look at local regulations yourself or contact the tax office for help.

The Tax Code does not allow regions to exceed the maximum land tax rates:

- 0.3% – for certain categories, in particular for summer cottages, agricultural land;

- 1.5% – for other categories.

If an individual has clarified the rights to the benefit, the cadastral value, and the rate, then you can start making calculations.

The following formula should be used:

Land tax = cadastral cost. * bid

If an individual has the opportunity to apply a benefit in the form of a tax-free amount that reduces the basis for calculation, then this should be taken into account in the formula.

Land tax taking into account benefits = (cadastral value - tax-free amount) * rate.

If the land is received or lost by a citizen within a year, then the number of months during which the individual was listed as the owner of the plot should be taken into account. There will be no need to pay tax for those months during which the person was not the owner of the land. In this case, only full months of ownership are taken into account when calculating land tax.

If there are several owners of land, the tax is distributed in proportion to the size of the shares of each owner. If shares are not allocated, then the tax is distributed equally among all participants.

Basic calculation methods

Land tax is a mandatory fee to the local budget, which is established in relation to certain categories of land owners. As with most other types of tax, this one can be calculated using the following basic methods:

Manually

In this case, the payer makes all the calculations independently, without using any special tools (except perhaps just a calculator). This is done according to the established formula and in accordance with the data that the payer must have.

This method is quite time-consuming and complex, and also involves the risk of making mistakes.

Using an online calculator

In this case, calculations are carried out automatically, using special

calculators that are posted on individual websites on the Internet. Depending on the specific type of instrument, the user may need to either enter all the data (in particular, the exact rate) or indicate only general information (location of the plot and category of land).

In the latter case, the bet will be selected automatically.

In addition, online you can not only calculate the amount required for payment, but also generate a payment document (payment order) based on it. In particular, this function is available in a special section on the official website of the Federal Tax Service.

Below is a convenient online calculator that will help you determine the tax amount: