Check

A business trip is required to resolve pressing issues for the employer’s company.

When sending an employee on a trip, the company reimburses him for expenses, including accommodation. Often the most convenient option for an employee is a hotel located close to the business trip. At the end of the client’s stay, the hotel issues reporting documents for business travelers to confirm the fact of their stay at the hotel on certain days. Letter of the Ministry of Finance of the Russian Federation dated February 25, 2015 No. 03-07-11/9440 indicates that if the hotel does not use cash register payment, the accommodating party is obliged to draw up a strict reporting form, which is developed independently. It is allowed to call the form by different names, such as a voucher or a hotel check.

Upon returning from a business trip, you must provide documents issued by the hotel to the accounting department, which confirm your accommodation there. A cash receipt is required for the advance report. The basic requirements for the form provided by the hotel enterprise are as follows:

- The strict reporting form must contain the following details: name of the document, six-digit number and series of the document, full name of the organization providing the services, address, TIN of the organization and seal.

- It is necessary that the strict reporting form be produced using a printing method or generated using automated systems. System requirements: mandatory protection from unauthorized access, identification and preservation of the number and series of the form for at least 5 years (Resolution of the Government of the Russian Federation of May 6, 2008 No. 359). Forms printed on a computer without the use of automated systems will not be accepted by the organization as confirmation.

Payment for accommodation on a business trip in a budgetary organization and in a commercial one is equally made on the basis of a hotel invoice or an invoice and a cash receipt.

IMPORTANT!

If a seconded employee provides his organization with a document on hotel accommodation that does not meet the specified requirements, and the organization takes expenses into account in tax reporting, the Federal Tax Service will have claims. In this case, the company defends the costs through the court. To do this, we recommend that you read the Resolution of the Federal Antimonopoly Service of the North-Western District dated November 1, 2010 in case No. A52-3413/2009.

If a hotel-type enterprise uses cash registers, the reporting includes a check and invoice or other documentation of the employee’s stay at the hotel.

The employer paid for the hotel: we confirm expenses

If an organization paid for the accommodation of business travelers in a hotel by bank transfer, then is it necessary to mention hotel services in their advance reports and can an invoice for accommodation printed on a printer serve as a document confirming their provision for profit tax purposes? Experts from the Legal Consulting Service GARANT, Marina Pivovarova and Elena Melnikova, answer.

Two employees were sent on a business trip. Payment for hotel accommodation was made by the employer by bank transfer. The hotel issued an invoice for the room indicating the full names of the residents. How to “close” expense reports? Is it possible to take into account the cost of hotel accommodation when taxing profits on the basis of an invoice printed on a printer?

In accordance with Art. 166 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. According to Art. 168 of the Labor Code of the Russian Federation, a posted worker is reimbursed for the costs of renting residential premises.

The procedure for sending employees on business trips is determined by the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749 (hereinafter referred to as Regulation N 749).

In accordance with clause 26 of Regulation No. 749, upon returning from a business trip, an employee is obliged to submit to the employer within 3 working days an advance report on the amounts spent in connection with the business trip and make a final payment on the cash advance issued to him before leaving on a business trip for travel expenses.

Thus, employees submit advance reports only about the expenditure of funds received on account before the start of the business trip. Services paid by the employer from the current account for employee accommodation in a hotel during a business trip are not included in the advance report (see, in particular, letter of the Ministry of Finance of Russia dated September 15, 2005 N 03-03-04/2/58).

Indeed, according to the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) (hereinafter referred to as the Instructions for the Chart of Accounts), account 71 “Settlements with accountable persons” is intended to summarize information on settlements with employees according to the amounts given to them on account for administrative, economic and operating expenses.

For the amounts issued for the report (amounts of overexpenditure issued according to the approved advance report), account 71 “Settlements with accountable persons” is debited in correspondence with the cash accounts. For the amounts spent by accountable persons (amounts returned to the cash desk of unused funds), account 71 “Settlements with accountable persons” is credited in correspondence with the accounts that record costs and acquired values (cash accounts). Analytical accounting for account 71 “Settlements with accountable persons” is carried out for each amount issued for reporting.

In this situation, payment for hotel services is made by the organization, and not by the employee. Therefore, when an organization pays living expenses in cash, account 71 “Settlements with accountable persons” is not applied, and the cost of living is not included in the advance report.

The organization's expenses for purchasing hotel services are reflected in accounting as follows:

Debit 76 (60) Credit 51

- paid for hotel services.

These expenses are written off after the manager approves the employee’s advance report:

Debit 26 (20, 44) Credit 76 (60)

— the cost of hotel services is written off as expenses.

Regarding the legality of accepting, when calculating income tax, expenses for hotel accommodation on the basis of an invoice printed on a printer, we note the following.

According to paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and (or) sales include business travel expenses, which include, among other things, expenses for renting living quarters.

In accordance with paragraphs. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation for taxpayers who use the accrual method of tax accounting, the date of incurring business trip expenses is the date of approval of the advance report.

This procedure for recognizing business travel expenses Ch. 25 of the Tax Code of the Russian Federation is established regardless of whether these expenses were paid by the employee himself, which means these expenses are reflected in his advance report, or whether the employer paid for the business trip expenses, which means they are not included in the advance report of the posted worker (see letter from the Ministry of Finance of Russia dated 09.15.2005 N 03-03-04/2/58).

In cases where posted workers pay for the hotel on the spot themselves (from accountable amounts), documentary evidence of the expenses incurred may be attached to the expense report:

— hotel accounts (confirming living expenses) (letters from the Federal Tax Service of Russia for Moscow dated June 22, 2009 N 16-15/ [email protected] , dated June 5, 2009 N 16-15/057712, Ministry of Finance of Russia dated November 10, 2009 N 03 -03-06/1/733, Federal Tax Service dated 06/22/2011 N ED-4-3/ [email protected] ). Until December 1, 2008, when calculating payment for reservations and accommodation by bank transfer, Form 7-G was used, approved by Order of the Ministry of Finance of Russia dated December 13, 1993 N 121. However, by virtue of clause 2 of the Regulations on making cash payments and (or) settlements using payment cards without the use of cash register equipment, approved by Decree of the Government of the Russian Federation dated May 6, 2008 N 359 (hereinafter referred to as Regulations N 359), the specified form, along with, for example, Form 3-G, cannot currently be used (see also letter from the Ministry of Finance of Russia dated 18.08.2010 N 03-03-06/1/556);

- strict reporting forms produced by printing or using automated systems (letters of the Ministry of Finance of Russia dated 08/18/2010 N 03-03-06/1/556, dated 08/07/2009 N 03-01-15/8-400). Here we note that strict reporting forms (SSR), which are currently used by hotels, are issued only when providing services to the public when making cash payments and (or) payments using payment cards without the use of cash register equipment (clause 2 of the Regulations N 359).

- receipts or invoices for hotel accommodation (in relation to accommodation in a foreign country) (letters of the Ministry of Finance of Russia dated 01/30/2012 N 03-03-06/1/37, dated 02/14/2008 N 03-03-06/4/8, letter of the Federal Tax Service of the Russian Federation for Moscow dated 08.08.2008 N 28-11/074505).

In general, documents confirming the provision of services may include: an agreement for the provision of services, an act confirming the provision of services, invoices, payment orders, and other documents indicating the fact of payment for services. Therefore, since in the situation under consideration the cost of hotel accommodation is paid by bank transfer, an act of services rendered can be used to confirm these expenses.

Thus, the letter of the Ministry of Finance of Russia dated September 15, 2005 N 03-03-04/2/58 states that the costs of renting residential premises, paid by the employer by bank transfer, are recognized in tax accounting on the basis of a certificate of work performed (services rendered) and documents confirming payment of these expenses. At the same time, in the resolution of the Ninth Arbitration Court of Appeal dated January 15, 2009 N 09AP-17459/2008, the judges actually agree with the opinion of the Ministry of Finance of Russia, given in the specified letter: in case of non-cash payment by an organization for accommodation services, acts of acceptance and transfer of services are documents confirming expenses in the sense Art. 252 of the Tax Code of the Russian Federation.

We also note that in a later letter from the Ministry of Finance of Russia dated October 18, 2011 N 03-03-06/1/672, regarding the possibility of recognizing expenses for hotel accommodation on the basis of an act of services rendered, employees of the financial department did not give a direct answer, indicating together with the fact that such expenses must be confirmed by documents drawn up in accordance with the legislation of the Russian Federation (that is, they did not refute the preparation of such a document as an act). The Ministry of Finance of Russia did not give a direct answer to the question about documentary evidence of the costs of booking and paying for the room (letter of the Ministry of Finance of Russia dated March 10, 2011 N 03-03-06/1/131).

However, it should be taken into account that according to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, documented expenses mean expenses not only confirmed by documents drawn up in accordance with the legislation of the Russian Federation, but also confirmed by documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were made, as well as documents indirectly confirming expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Consequently, the Tax Code of the Russian Federation does not establish a closed list of documents that must be drawn up when a taxpayer carries out certain expense transactions. The decision on the possibility of accounting for certain expenses for profit tax purposes depends on whether the documents available to the taxpayer confirm the fact of the expenses declared by him or not. A similar opinion was reflected in the resolution of the Federal Antimonopoly Service of the North-Western District dated November 1, 2010 N F07-10512/2010.

Clause 8 of the Rules for the provision of hotel services in the Russian Federation, approved by Decree of the Government of the Russian Federation of April 25, 1997 N 490 (hereinafter referred to as the Rules), establishes that when registering a stay in a hotel, the contractor issues a receipt (coupon) or other document confirming the conclusion of an agreement for the provision of services , which should contain:

— name of the performer (for individual entrepreneurs, last name, first name, patronymic, information about state registration);

— last name, first name, patronymic of the consumer;

— information about the room provided (place in the room);

— price of the room (place in the room);

— other necessary data at the discretion of the contractor.

As stated earlier, a document confirming the provision of accommodation services can be an act of services rendered. Since the legislation does not provide for a unified form of the act of services rendered, it is drawn up in any form in compliance with the requirements of Part 2 of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ). In the situation under consideration, such an act was not presented by the hotel.

At the same time, from a direct reading of clause 8 of the Rules, it follows that when registering accommodation, the contractor issues a receipt (coupon) or other document confirming the conclusion of an agreement for the provision of services. Taking into account the above explanations from the financial department, such a document could be, for example, a document called an accommodation bill, which also contains the information specified in clause 8 of the Rules. Considering that clause 8 of the Rules provides for the indication of “other necessary data at the discretion of the contractor,” we believe that such data may be the mandatory details of the primary document listed in Part 2 of Art. 9 of Law N 402-FZ “On Accounting”. At the same time (unlike BSO), the legislation does not contain requirements for the production of such a document by printing or using automated systems. Therefore, it can also be printed on a printer.

In addition to this document, employees’ living expenses will also be confirmed by an invoice for payment, a payment order, an agreement with a hotel (if any), as well as documents indirectly confirming the expenses incurred: an official assignment for sending on a business trip and a report on its implementation (unified form N T -10a), order (instruction) on sending on a business trip (issued in the unified form N T-9 (in relation to one employee) or in form N T-9a (in relation to a group of workers)), travel certificate (unified form N T- 10) etc.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

If there is no account

In the absence of supporting documents, payment for hotel accommodation on a business trip is made on the basis of a request to a hotel-type enterprise to confirm the fact of the employee’s residence during the specified period of time and obtain a certificate.

In Moscow, a request is allowed to confirm an employee’s expenses, which is confirmed by Letter of the Federal Tax Service for Moscow and the Moscow Region dated August 26, 2014 No. 16-15/084374. The certificate must contain details of the services provided and confirmation of payment. The company must have other documentation confirming the employee's business trip, in particular, a business trip order, travel documents, etc.

Based on a certificate received upon request, payment for a hotel on a business trip is not always accepted by the tax authorities. Clause 1 Art. 252 of the Tax Code of the Russian Federation allows for indirect confirmation of expenses to be taken into account, so the company has the opportunity to appeal the decision of the tax authorities.

Decree of the Government of the Russian Federation 1085 dated October 09, 2015 approved new Rules for the provision of hotel services. This Decree indicates the obligation to issue a strict reporting form or check.

Also, there are no documents on hotel accommodation if the company rents residential premises to accommodate employees during a business trip. Then payment for the premises is made by the employer himself, so payment of expenses and reporting documents for living in an apartment on a daily basis are not provided.

In what cases does it become necessary to prepare reporting documents for business travelers?

If there is a production need to send an employee on a business trip, you need to determine which of the company’s employees will be able to fulfill the mission assigned to him. We are not talking about a person’s powers, but about some restrictions provided for by the Labor Code. Thus, it is not allowed to send the following persons on business trips :

- Employees during the period of validity of the student contract, if the business trip disrupts the educational process. That is, if an employee went on a business trip outside of school hours or after training, this is considered legal (Article 203);

- Pregnant women (Article 259 of the Labor Code);

- Employees under 18 years of age, unless they are creative individuals, such as an athlete, artist or journalist, who may be sent on a business trip (Article 268).

Women with young children can be seconded by the enterprise if they have their written consent and there are no medical contraindications.

The employer must notify the employee that she has the right to refuse. The same rules apply to business trips:

- Single mothers and fathers, guardians of children under 5 years of age (Article 264 of the Labor Code);

- Employees raising a disabled child;

- Workers who care for sick relatives, which is confirmed by a medical report (Article 259 of the Labor Code).

Only employees who have entered into employment contracts with this organization have the right to officially go on business trips.

But employers ignore this rule and send them on a trip:

- Employees registered under a civil contract or agreement;

- Representatives of partner companies, that is, persons who did not enter into any labor relations with them.

In such situations, you should not prepare documents for a business trip . However, reimbursement of travel expenses (travel expenses) and reporting documents (accounting for these expenses by the organization) are quite possible. To do this, it is necessary to formally provide for the procedure for compensation payments and their relationship with the completed area of work.

Not long ago, a package of official travel documentation was completed on the basis of an official assignment, a travel certificate and a report on the work done. Then it was improved and expanded.

Now a business trip is accompanied by the following documents:

- A business trip order in a standard form, acting as an instruction from management.

- Advance report or report on funds spent, confirmed by relevant documents.

- A work time sheet with marked business trip days for which the employee receives average earnings.

- An official note drawn up in the event that an employee uses his personal vehicle for a trip.

Let's talk in more detail about what each of the travel documents is needed for, and what follows violations in their execution.

How is a travel order prepared?

Any organization has an approved standard order form, provided for by the State Statistics Committee in Resolution No. 1 of 01/05/2004. It must include the employee’s full name, purpose of travel and destination, departure date and duration.

This order is approved by the employer, registered in the appropriate journal and handed over to the future contractor for review.

Advance report

In order for the employee to be able to purchase tickets for the trip and book a hotel room for accommodation, he is given accountable cash. When returning to the enterprise, he is obliged to make reporting documents for business travelers, that is, fill out an advance report form with documentary evidence of all his expenses paid from the amount received.

The advance report is submitted to the accounting department no later than 3 days from the time of return to the workplace. Accountants check the correctness of its preparation and the authenticity of supporting documents. If no comments or violations are found, the amount of money given to the employee is written off and, accordingly, his expenses are compensated.

How is a business trip recorded on the timesheet?

The days of absence of an employee on a business trip are entered in the working time sheet under the index “K” without indicating the actual hours worked, which is considered optional.

When an employee, in agreement with management, works on weekends or holidays, this must be indicated in the timesheet with the letter code “K-V”, and payment for these days is made twice as much.

How to draw up a memo?

When an employee goes on a business trip in a personal vehicle, travel tickets are not issued for him. In this case, upon returning to work, he submits a memo indicating the duration of the trip (departure and arrival times).

Expenses incurred during a business trip using a personal car (fuel, parking) are considered business expenses and are reimbursed by the employer. Write-off of the debt amount, supported only by a memo, is not allowed. Relevant reporting documents for business travelers must be present.

There is no standard form for this document; it is drawn up in free form, but it must contain the name of the organization, position and full name of the employee, destination and duration of the business trip, car information, date and signature of the traveler.

A memo is issued if an employee uses government, associated or other types of vehicles, or more precisely, if it is impossible to purchase tickets for travel.

Is it possible to include breakfast on the bill?

If breakfast costs are indicated as a separate item on the invoice, it is not recommended to include them in reporting documents for hotel stays. Subclause 12, clause 1, art. 264 of the Tax Code of the Russian Federation indicates that accommodation costs include additional services, with the exception of service in bars and restaurants, in the room, and use of recreational and health facilities.

Letter of the Ministry of Finance dated October 14, 2009 No. 03-04-06-01/263 explains that if the cost of food is allocated as a separate item, the employee receives income in kind. According to the Ministry of Finance, compensation for food does not apply to reimbursement of living expenses, therefore it is subject to personal income tax and insurance payments.

If breakfast is not listed as a separate item on your hotel bill, including it as an expense is fraught with tax risks. This situation has conflicting judicial precedents, so the tax authorities charge personal income tax on the specified amount. Then insurance premiums are not charged, as indicated by Letters of the Ministry of Health and Social Development of the Russian Federation dated 05.08.2010 No. 2519-19, FSS of the Russian Federation dated 17.11.2011 No. 14-03-11/08-13985.

How travel documents are reflected in tax accounting

Business travel expenses are reflected in tax reporting among other expenses in accordance with Art. 253 Tax Code of Russia. The date of the advance report is considered the date of confirmation of expenses for business travel.

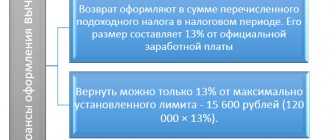

When calculating income tax, the tax base can be reduced by the amount of travel expenses.

When taxing, the following expenses may be taken into account (Article 264, clause 1, clause 12 of the Tax Code):

- Transport (travel to your destination both ways);

- For accommodation (payment for a hotel or rental housing);

- Daily costs;

- Registration of passports, visas and similar documents;

- Airport and consular fees, entry, transit, passage and other fees.

Additional costs at the hotel for room service (dry cleaning, housekeeping, porter assistance), feeding in a restaurant or bar, health services (gym, swimming pool, sauna) are not travel expenses and are not included in reporting documents, therefore they do not reduce the tax base when calculation of income tax.

The conditions and amounts of compensation for business travel expenses are independently approved by enterprises in internal regulations.

Any travel expenses are taken into account when determining income tax, deductions for personal income tax and the simplified tax system in the amount prescribed by the organization’s local documents.

When calculating this tax, documented travel expenses are considered as of the date of acceptance of reporting documents for travel expenses (in particular, advance reports).

VAT on travel expenses is deductible if they:

- Paid by an employee or organization;

- Have an invoice.

Recognition of VAT for deduction on other documents (in addition to the invoice), where it is placed on a separate line, is possible to pay for the accommodation and travel of a business traveler. Such documents include:

- For travel - a ticket (including an electronic one), a route sheet or receipt (control coupon), a receipt for ordering a passenger taxi;

- For accommodation - a strict reporting form.

Each of these documents is entered into the purchase ledger.

How to pay insurance premiums and personal income tax on travel expenses

1) Daily allowance is not taxed:

- Insurance taxes in the amounts approved by the internal regulatory framework of the organization;

- Personal income tax in amounts not exceeding 700 rubles. for each business trip within the country and 2500 rubles. Abroad.

If the daily allowance exceeds these limits, the difference in the amount should be included in the 2-NDFL certificate (code 4800) in the month when the advance report was approved (reporting documents for business travelers). This certificate does not reflect daily allowances in an amount not subject to personal income tax.

2) Compensation for the cost of:

- Food, including its cost, which is allocated separately in the hotel bill;

- Travel when, before or after a business trip, the employee was on vacation at the point of stay (i.e., the date of the tickets and the dates of the business trip do not match).

If the cost of accommodation and travel on a business trip (including taxi, Aeroexpress) is documented, it is completely exempt from insurance premiums and personal income tax.