(10 ratings, average: 5,00 out of 5)

The purpose of the director’s business trip can be formulated in any order, since legislative acts do not provide specific, strictly defined examples. On the other hand, inspection authorities may be interested in the purpose of the trip - primarily the Federal Tax Service. Therefore, it is better to use generally accepted formulations, examples of which are given below.

- Legislative framework: 7 examples of wording

- Where is the purpose of the trip reflected?

- How to arrange a business trip

Why do you need a trip report?

In accordance with Decree of the Government of Russia dated October 13, 2008 No. 749, as amended on October 16, 2014, employers who sent employees on business trips were required to oblige employees who returned from business trips to draw up a report on the work performed within 3 days.

The report was compiled according to the unified form No. T-10a. In the current version of Resolution 749 of July 29, 2015, there are no rules regulating the use of a travel report. Thus, this document is no longer mandatory for employers.

However, in many companies the obligation to compile such reports is established for employees at the level of local standards. This may be due, in particular, to the fact that in such organizations the mechanisms of document flow and internal reporting familiar to employees have already been formed, providing for the preparation of travel reports as sources of data that is exclusively significant for the management and accounting department of the enterprise.

As a form on the basis of which a report can be drawn up, the company has the right to approve the unified document No. T-10a. For example, as an appendix to the Regulations on business trips of the organization.

Let us now study what information can be reflected in the report in question.

Is the purpose of the business trip required?

Since 2015, amendments have been made to Resolution 749, according to which the legislator did not directly define as an employer’s obligation to set the purpose of the trip. This means that the manager does not have to rack his brains over the wording of the job assignment indicating the purpose of the trip, and a task like “I’m directing you to figure it out” can be given orally. Accordingly, the travel certificate was cancelled.

In this regard, the question of the need to indicate the goal becomes relevant. In the absence of the latter, negative consequences may arise for any of the parties to the employment relationship, for example, refusal to pay for travel allowances and the imposition of disciplinary sanctions (in the case where a person traveled to perform certain tasks of the employer, he must provide a detailed report). Erroneous formulations or the absence of a purpose as such may lead to the recognition of the departure by regulatory authorities as invalid, as a result of which the costs will be subject to personal income tax and insurance payments.

Therefore, the preferred option for the employer is to have a formalized assignment.

Information in the business trip report: purposes of the trip

If document No. T-10a is used as a form for a business trip report, then you need to know that the reporting (reflecting the result of the work performed) information is indicated in it in relation to the initially set goals of the trip.

If another form of report is used, it is nevertheless advisable to indicate the purposes of the business trip in it, since their content may be important in choosing the correct entries when maintaining accounting procedures that characterize the business trip.

You can learn more about the features of accounting when traveling on a business trip in the article “What are the types of entries for accounting for travel expenses.”

The legislator does not establish strict criteria for the formulation of goals (just as he did not establish them earlier - during the period of validity of the previous edition of Resolution 749). Thus, the goals of a business trip can be both very general and quite detailed.

If we talk about a certain detail of the goals of the trip, examples of their formulation may sound like this:

- signing an agreement for the supply of fasteners with Contractor LLC;

- participation in the conference “Investment Innovations” and a speech on the topic “Energy efficiency in light industry”;

- unscheduled inspection of a branch in Nizhny Novgorod based on audit report No. 1 dated February 17, 2020;

- participation in the court hearing in case No. A111222333 as a representative of the plaintiff.

Since a legal entity has the right to independently develop a report form, having approved certain indicators taking into account the specifics of its work, in this article we will rely on the data of the unified form No. T-10a.

Let's study in more detail the wording in which the results (based on the goals) can be reflected in the report on form No. T-10a.

What are the goals?

They are of a different nature and are conventionally divided into universal and special:

- Universal ones are aimed at developing the company’s business and include searching for customers or attracting investors, expanding the sales market.

- Special goals can be of a different nature and reflect the need of the enterprise at a particular point in time, for example, participation in a court case.

It is recommended to make the wording specific and include complete information about the task.

The most common examples of the purpose of a business trip in an order:

- participation of a company representative in negotiations (the counterparty must be indicated) on issues (the subject of negotiations is indicated);

- representation in a court hearing of the arbitration court (full name of the court) in the case (case number);

- conducting an inspection of the branch (branch address).

It is recommended that the task for the business traveler be indicated in the work travel plan. This is done necessarily if such a requirement is enshrined in the local regulatory act of the organization. The director or other authorized person draws up and signs the document. The employee signs the plan after reviewing it.

In addition to the task, the plan contains information about the place or organization where the employee is going, a list of issues to be resolved, and the duration of the trip.

Sample Business Travel Plan

Based on government decree No. 1595 of December 29, 2014, which came into force on January 8, 2015, the preparation of a travel certificate, plan and report on the completion of the task is no longer mandatory and is necessary only if the corresponding requirement is contained in the local regulations of the enterprise.

ConsultantPlus experts examined whether, when calculating income tax, compensation for the cost of fuel and lubricants is taken into account in full (without rationing) as the cost of travel to the place of business trip and back in a personal car used for business purposes. Use these instructions for free.

Reflection of the results of a business trip in a report: examples of wording

Let's assume that a brief report (reports from several employees) shows the goals of the employee's participation on a business trip, which we discussed above. In this case, the document may contain the following language:

1. If the purpose of the trip is to participate in negotiations with a counterparty (investor, creditor):

“As a result of the negotiations, a fastener supply agreement No. 1 dated February 18, 2020 was signed. A copy of the agreement is attached to this report."

2. If the purpose of the trip is to participate in a business conference:

“The traveler gave a report on “Energy Efficiency in the Textile Industry” and won the “Best Speaker” award from the conference organizers.”

3. If the purpose of the trip is to check the activities of the branch:

“The business traveler checked the financial statements of the branch in Nizhny Novgorod for 2022, as well as a number of primary documents (according to the list specified in Appendix No. 1 to this report). Based on the results of the inspection, a number of instructions were issued to the branch management.”

4. If the purpose of the trip is to participate in a court hearing:

“The business travelers gave testimony in case No. A111222333, which allowed the court to discover a number of new significant circumstances of the dispute. Due to the discovery of these circumstances and the need for their detailed study by the parties, the court scheduled a new hearing for 04/18/2020.”

The report, in addition to the purposes of the traveler’s trip and their results, may reflect other important information. Let's study them.

How to formulate a goal

In order for an employer to correctly draw up consumable documents for a work trip, it is important to correctly formulate the purpose. The task received by the employee during the departure must be completed in full (Part 1 of Article 166 of the Labor Code of the Russian Federation, Clause 3 of Resolution No. 749).

IMPORTANT!

The employer does not have the right to demand that work not provided for in the employment agreement be performed, so the task is established in accordance with the functionality.

The purposes of travel can be divided into two groups:

- General (contribute to the development of the institution’s activities).

- Special (characterize the needs of the institution in a specific period, for example, to conduct negotiations).

Purpose of the trip and examples:

- conduct negotiations with the investor;

- represent the interests of the enterprise in court proceedings;

- check the activities of a separate department of the institution.

Trip report: other information

In the report on form No. T-10a, in addition to the purposes and results of the trip, the following information is expected to be indicated:

1. Names of the employing company and the company that paid for the business trip (as a rule, this is one business entity).

2. The name of the document (it can be the same as that given in the unified form - “Official assignment for a business trip and a report on its implementation”);

3. Full name, personnel number of the employee, his position, the structural unit in which he works.

4. Trip information:

- destination (state, city, business entity);

- start and end dates of the business trip;

- duration of the business trip in days (not counting travel time);

- document - the basis for sending the employee on a business trip.

The document is signed:

- posted worker;

- his immediate supervisor;

- director of the employing company.

The report may also contain the conclusion of the employee’s immediate supervisor on the performance of the job assignment. If the goals are successfully achieved, you can write here “The task has been completed in full.” If drawing up a report is one of the conditions for assigning a bonus to an employee, then you can add the wording “Based on the results of the business trip, the employee deserves financial incentives in the form of a bonus.”

If an employee was unable to achieve his business trip goals, then his manager can reflect in the report:

- the fact of non-fulfillment of an official task;

- an instruction addressed to the posted employee to draw up a memo with explanations.

The memo is usually sent to the director.

Let's sum it up

- The purpose for which the employee goes on a business trip must be significant for the financial and economic activities carried out by the employer. This will allow you to take travel costs into account when determining your income tax base. The formulation of the goal should be brief, but reflecting the essence of the task and those of its characteristics that will unambiguously link this task to a particular event.

- Each category of personnel has its own dominant goals, to achieve which employees of this category are sent on business trips. But there are also topics common to all workers.

- The purpose of the trip must be indicated in the only document required for registration - an order (instruction) about it. It will also be included in all other documents issued by the employer in connection with the business trip.

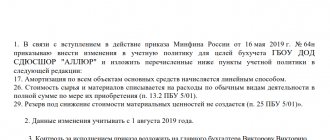

Application of the T-10a report: nuances

The algorithm for applying the report in question is established by each organization independently. But the following scheme for using the document can be called generally accepted:

1. The management (director or immediate supervisor of the traveler) makes a decision on a business trip (scheduled or unscheduled) and documents it in the prescribed manner.

2. An employee who is decided to be sent on a trip is sent a memo about the need to prepare for departure.

It may be noted that documentary consent from the employee for the trip is not required if he does not belong to the category of citizens who are prohibited from being sent on a business trip in accordance with the Labor Code of the Russian Federation.

3. The official assignment in form T-10a is filled out regarding the purposes, information about the trip, about the employer and employee. The document in this part is filled out and signed by the director and the employee’s immediate supervisor.

4. Based on the T-10a form, an order is issued from the director of the company to send the employee on a trip, and a travel certificate is issued (again, if it is provided for by local regulations - since, like the report in question, it is not a mandatory document).

5. Upon completion of the business trip, the employee fills out a report regarding the achievement of goals. The document reflects the assessment of the subordinate’s work results by the direct supervisor of the traveler and is certified by a signature.

Thus, the document in question, unlike many other internal corporate reports, cannot be filled out by the employee alone.

Who cannot be sent on a business trip

When choosing an employee sent on a business trip, it is important to take into account that the Labor Code of the Russian Federation provides certain categories of citizens with certain guarantees of respect for their rights. In particular, for some groups of employees there is a ban on business trips, because for many citizens they create certain difficulties in everyday life and require a long absence from home. A complete ban has been established for:

- pregnant women;

- minor employees (with the exception of representatives of creative professions employed in relevant positions);

- accepted under a student agreement;

- employees participating in elections and running for certain positions.

Representatives of the following categories of employees have the right to refuse assignment:

- women - mothers of children under 3 years of age;

- citizens raising children alone who are under 5 years old;

- disabled people or workers under special conditions;

- citizens caring for sick family members (if this is necessary in accordance with a medical report obtained in accordance with the procedure established by law);

- parents or guardian providing maintenance and education of disabled people who have not reached the age of majority.

Checking and organizing report storage: nuances

Once the report is completed by the employee and certified by management, what to do next with the document?

Previously, the main purpose of a business trip report was to certify the targeted expenditure of funds that the accounting department allocated to the employee for participation in the trip. Certification of the targeted expenditure of the organization’s funds is one of the elements of internal control that an economic entity is obliged to carry out in accordance with paragraph 1 of Art. 19 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Now, according to the law, confirmation of the economic feasibility of expenses is carried out using other documents - first of all, an advance report (clause 26 of resolution 749), as well as travel and hotel documents. The main purpose of the document in question may be, as we noted above, to document the results of the employee’s performance of the task, which affect the assignment of the bonus.

Therefore, the main addressee when submitting a report may, in general, be the management of the company. Based on the T-10a form, the director will issue an order to assign a bonus to the employee, which, in turn, is transferred to the accounting department for execution.

At the same time, the final destination of the report should be the organization’s archive. The fact is that such documents must be stored in the company for 5 years. And if the business trip was foreign - 10 years (Order of the Federal Archive of Russia dated December 20, 2019 No. 236).

We talked more about the storage periods for documents in the article “From February 18, 2022, the storage periods for documents on taxes and personnel will change.”

Let us note that the storage periods for documents determined by Order 236 are mandatory not only for state and municipal structures, but also for private companies (decision of the Supreme Arbitration Court of the Russian Federation dated September 6, 2011 No. 7889/11).

Why is the purpose of a business trip important?

A business trip involves an employee traveling for a limited period of time outside the territory where his permanent place of work is located to complete a task issued by the employer (Article 166 of the Labor Code of the Russian Federation).

Two important conclusions follow from this formulation:

- the employee sent on the trip must be a full-time employee, signed under an employment contract, and work primarily in the same place;

- the concept of a business trip is not applicable to systematically carried out trips of persons whose work is carried out on the road or in the process of traveling (this clarification is even enshrined in a separate phrase in the text of Article 166 of the Labor Code of the Russian Federation).

The list of purposes for which a business trip may be required is not recorded anywhere, and, accordingly, the range of issues that can be resolved through a business trip is not limited by law.

But it is obvious that trips, called business trips, must be carried out to solve problems that are significant for the financial and economic activities of the employer. If this condition is met, the costs of such a trip can be easily taken into account in expenses that reduce the income tax base.

That is why the official purpose of the trip should be characterized in the formulation of its purpose. And the more precise and complete this formulation is, the better.

Where can I get a business trip report?

You can download a completed sample business trip report on our website - click on the link below.

This document was compiled on the basis of the common and familiar to many organizations form No. T-10a. It contains the goals of the trip and the results of their implementation.

Note that, based on the content of the business trip and the specifics of the goals characterizing it, the report can be supplemented with various applications. Form No. T-10a by default does not provide links to applications, but the employer has the right to modify it so that such links can be indicated. The procedure for applying the document, as well as drawing up appendices to it, may be regulated by local regulations.

The report on Form T-10a is essentially short. It reflects only general information about the work carried out by the posted employee during the trip. Along with a brief report, an organization can establish a procedure for drawing up more complete reports, by analogy with the standards in force at the level of government departments (for example, the preparation of a full report complementing the T-10a form is provided for by Order of the Federal Customs Service of Russia dated July 14, 2010 No. 1333) .

The report in question can be submitted to the accounting department simultaneously with the advance report, the preparation of which, in turn, is mandatory (clause 26 of resolution 749).

You can learn more about the use of an advance report based on the results of a business trip in the article “Advance report on a business trip - sample.”

What if the stated purpose of the trip is not achieved?

In this case, can business trip expenses be taken into account to reduce the tax base? This issue still causes controversy between accountants and representatives of the Federal Tax Service. The latter claim that expenses for an unsuccessful trip are not taken into account for tax purposes.

Accountants and company owners, in turn, bring claims to recognize that an employee’s business trip is of a production nature, regardless of its result. They often manage to defend their point of view in court.

In particular, a very common example of the purpose of business trips is “Sign a contract with the customer.” There is a possibility that the deal will not go through. In this case, tax officials consider it unreasonable to classify business trip expenses as expenses to reduce profits. However, company managers have repeatedly been able to prove that during the negotiations strong business ties were established with potential customers, which could lead to the conclusion of a contract in the future. The court recognized the right of the taxpayer to accept travel expenses for tax accounting.

Results

Drawing up a business trip report is no longer the responsibility of an employee of a private organization (while employees of government departments may be required to prepare such a document). But the company has the right to develop its own form and approve it in a local regulatory act, which will oblige employees to draw up a report on business trips. Its structure may be based on the unified form T-10a (previously mandatory for employers).

You can learn more about the procedure for documenting employee business trips in the following articles:

- “Unified form No. T-9 - business trip order”;

- “Order for a business trip - sample in 2020”.

Sources:

- Decree of the Government of Russia dated October 13, 2008 No. 749

- Law “On Accounting” dated December 6, 2011 N 402-FZ

- order of Rosarkhiv dated December 20, 2019 N 236

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

If the purpose is not specified or does not correspond to the objectives of business trips

In connection with the abolition of the mandatory issuance of a travel certificate and the preparation of a business trip plan, the task is indicated in the order. Certificates and a plan are prepared only if this requirement is enshrined in the local regulations of the organization.

The rationale must be consistent with the business focus. If it is indicated incorrectly or is missing, the employee’s work trip, as directed by management, will be declared invalid by the inspection authorities.

A few principles on how to correctly write the goals and objectives of a business trip to prevent this from happening:

- in accordance with the interests of the company, production needs;

- describe in detail with specific details;

- in accordance with the employee’s job description;

- in accordance with the timing and route of the trip.

If the task is large, it can be divided into a number of subtasks. For employees with a traveling nature of activity, travel to another locality associated with the performance of standard tasks is not a work trip.

Acceptable examples of the purpose of a business trip for a director:

- representation at presentations, participation in management conferences;

- participation in inspection activities of regulatory authorities;

- presence at the opening of a new division, branch, store, shopping center, workshop, etc.;

- conducting negotiations with the aim of concluding new or amending existing contracts, discussing the terms of contractual obligations;

- checking the activities, performance efficiency and real indicators of a division or branch.

The most common examples of the purpose of a sales manager’s business trip:

- concluding an agreement for the supply of goods and products of the company;

- participation in a conference or presentation;

- participation in negotiations with potential clients;

- resolving supply disputes;

- conducting marketing research;

- market research.

And these are examples of the purpose of a driver’s business trip:

- manual delivery;

- cargo delivery;

- delivery of inventory items, invoices;

- purchasing spare parts for vehicles;

- carrying out technical inspection, carrying out scheduled or unscheduled repairs of the vehicle.

Business trips of employees: we arrange them correctly

Source: Electronic magazine “Working with Personnel”

What is the difference between an employee business trip and a business trip? What is considered a business trip? Who should not be sent on a business trip? What is the maximum duration of a business trip? How to properly arrange a business trip for employees?

Business trips

- this is an employee’s trip by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation).

Business trips must be distinguished from business trips by employees whose permanent work takes place on the road or has a traveling nature (for example, flight attendants, train conductors, couriers). Such working conditions are normal for them, as they were initially reflected in the employment contract.

Should an employee’s trip to another city, but to another district of the same city, be considered a business trip?

For the purposes of the law, the place of permanent work is considered to be a company (structural unit) in which the employee performs his or her job function permanently. Therefore, an employee’s trip to another company (another structural unit) located in the same area can be considered a business trip. However, if an employee has the opportunity to return daily from a business trip to his place of permanent residence, daily allowances (allowances in exchange for daily allowances) are not paid to him (clause 15 of the instructions of the USSR Ministry of Finance, the USSR State Committee for Labor and the All-Russian Central Council of Trade Unions dated April 7, 1988 No. 62 “On business trips within the USSR."

The legislation does not clearly define the duration of a business trip. There is no minimum period set at all. As for the maximum duration of the trip, paragraph 4 of the instructions of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Union Central Council of Trade Unions “On official business trips within the USSR” indicates a period of up to 40 days, and for builders, installers, adjusters - up to 1 year (excluding the time spent on the road). However, the current Labor Code does not contain any time restrictions, so if necessary, business trips can last more than 40 days.

What is the maximum duration of a foreign business trip?

The maximum duration of a foreign business trip is not established by law. For business trips abroad, only daily allowance rates have been approved, which can be included in expenses when taxing profits. These standards are differentiated by the length of stay on a business trip: up to 60 days and over 60 days (Resolution of the Government of the Russian Federation of February 8, 2002 No. 93).

Who should not be sent on a business trip

You can bring disciplinary action against an employee who, without good reason, refuses to go on a business trip - reprimand or reprimand him. However, there are employees who cannot be sent on business trips at all or can only be sent with their written consent. You must notify the latter in writing about the possibility of refusing the proposed trip (Article 259 of the Labor Code of the Russian Federation).

For violating the rules for sending employees on business trips, a company can be fined from 30,000 to 50,000 rubles (from 300 to 500 minimum wage). And for the head of the company - in the amount of 500 to 5000 rubles (from 5 to 50 minimum wages). This violation may also entail another penalty - administrative suspension of the company’s activities for up to 90 days. The basis is Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Guarantees for individual employees when sent on business trips

Employees who are prohibited from being sent on business trips:

Pregnant women (Article 259 of the Labor Code of the Russian Federation)

Minors under the age of 18, with the exception of creative employees (Article 268 of the Labor Code of the Russian Federation)

Employees who are allowed to be sent on business trips only with their written consent:

Women with children under 3 years of age, and persons raising such children without a mother (Articles 259, 264 of the Labor Code of the Russian Federation)

Employees with disabled children or people with disabilities from childhood to 18 years (Articles 259, 264 of the Labor Code of the Russian Federation)

Employees caring for sick members of their families in accordance with a medical report (Article 259 of the Housing Code of the Russian Federation)

Example:

Chief technologist of Alfa CJSC M.I. Dudnikova is about to go on a business trip. The employee has the right to refuse the trip because she is the mother of a young child. The HR inspector sent M.I. Dudnikova such a notice.

How to arrange a business trip

The decision to send an employee on a business trip is made by the head of the company. He usually learns about the need for a business trip from a memo from the head of the structural unit in which the employee works. If the director of the company puts a positive resolution on it, a corresponding package of documents is prepared for the employee. Travel documents are drawn up according to unified forms approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

First, a job assignment is drawn up in Form No. 10-a, which sets out in detail the purpose of the business trip. It is drawn up and signed by the head of the structural unit, and also signed by the head of the company.

Based on the official assignment, an order is prepared to send the employee on a business trip using the unified form No. T-9. If several employees are going on a business trip at once, use list form No. T-9a. The order is signed by the head of the company. This document must be presented to the employee against signature.

After issuing the order, you need to issue the employee a travel certificate in the unified form No. T-10. The certificate indicates the time of arrival of the employee at the destination and the time of departure from there. Using these marks, you can determine the actual time spent on a business trip, and the accounting department can determine the amount of monetary compensation (travel allowance). If an employee had to visit different places, then the date and time of arrival and departure must be entered in each of them. These marks are certified by the signature of the responsible person and the seal of the company to which the employee was sent.

Upon returning from a business trip, the employee must fill out the “Brief report on the completion of the task” column in the official assignment and sign under it. In this column you can describe the work done, but not recorded on paper (searching for clients, attending presentations, conducting negotiations). The head of the structural unit checks the employee’s report, makes a note about whether the task was completed, and puts his signature and date.

In the accounting department, an employee fills out an advance report using the unified form No. AO-1 (the form of the advance report and instructions for filling it out were approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55). On the front side of the report, the employee indicates his last name and initials, profession (position), purpose of the advance, etc. On the reverse side, he lists the travel expenses incurred during the trip (including daily allowances), and indicates the details of supporting documents. For example, this may include: payment for travel to the place of business trip (railway, air or bus tickets, etc., payment for a taxi to the airport, payment for additional entertainment expenses for an employee, etc. These expenses must also be taken into account by the organization under the relevant items .

Keep records of business trips in special JOURNALS. You will find the forms for registering employees leaving and arriving on business trips in Appendices 2 and 3 to the instructions of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Russian Central Council of Trade Unions dated April 7, 1988 No. 62 “On business trips within the USSR.”

The text of the travel certificate practically coincides with the text of the order for sending on a business trip. Is it possible not to draw up both of these documents, but to choose one of them?

You can issue only an order or only a travel certificate. For example, if an employee is not sent to a specific company, but with the goal of collecting information, finding clients, and creating a network of points of sale of goods, then the travel certificate loses its meaning. Taking into account this situation, the Russian Ministry of Finance issued a letter dated December 6, 2002 No. 16-00-16/158, in which it explained that the employer may not draw up both documents at once, but limit himself to one of them.

Representative offices and branches of foreign companies do not have to issue a travel certificate; an order is sufficient (letter of the Ministry of Finance of Russia dated July 29, 2003 No. 16-00-25/04).

Travel expenses

The Labor Code provides for an employee who is sent on a business trip certain guarantees - preservation of his place of work (position), average earnings, reimbursement of expenses associated with a business trip (Article 167 of the Labor Code of the Russian Federation). Currently, for business trips in Russia, the daily allowance standards established by Decree of the Government of the Russian Federation of February 2, 2002 No. 729 apply. In commercial organizations, the amount of daily allowance must not be lower than that established by this act.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Why do you need business trips?

When an employee goes on a business trip, management determines for him a clear task that he must complete during the trip. The task may concern various areas of the organization’s economic activity. Examples of business trip purposes include the following:

- concluding contractual relations for supplies or sales with contractors;

- negotiations on cooperation;

- resolution of disputes, conflicts and other issues related to the legal side of activities;

- purchase of equipment, raw materials and materials;

- business conferences, participation in gatherings and exhibitions related to the company’s activities;

- promoting goods in new markets, expanding the customer base;

- participation in research projects related to the company’s activities;

- staff development;

- research of sales markets, competing organizations and other marketing issues;

- setting up equipment, software and working with other technical issues in subsidiaries or divisions;

- Conducting inspections of the operation of the branch network and divisions.

Which ones?

Practicing accountants easily give various examples of business trip purposes and point out the following:

- An employee's business trip must clearly be in the best interests of the company. The purpose of the business trip is formulated so that it is clear: the “travel” is beneficial for the company, directly or indirectly contributes to the enterprise earning profit, increasing the volume of activities, and improving the quality of goods and services. An employee of an organization cannot be sent on a business trip with the task of “resting,” “recuperating,” or “recovering.” For this purpose, vacations are provided - annual or for health reasons.

- The purpose of the business trip should not contradict the employee’s job description. Thus, an accountant cannot be sent on a business trip to negotiate with clients. And the commercial director of a company cannot be sent to another city for the purpose of “transporting employees.”

- The reason for a business trip must correspond to the duration of the “travel” and its route. If the purpose of a business trip is, for example, participation in an exhibition, an employee of the organization is obliged to “move” in the opposite direction within 24 hours after the end of the event.

- You should be extremely careful when justifying business trips on weekends. If a company employee goes to another city, for example, for negotiations on Monday, and the travel time is one day, then he can leave no earlier than Saturday evening. Otherwise, the cost of tickets or fuel and lubricants cannot be classified as expenses.

- It is better to avoid general language. It is important to indicate why exactly an employee of the organization is sent to work outside his place of permanent duty. Otherwise, controllers may have doubts about the legality of attributing travel expenses to tax accounting.

- The purpose of the trip should be formulated in such a way that one can make an unambiguous conclusion about whether the assigned task was completed or not. After the trip, the employee will have to submit a report on the results and attach documents confirming the completion of the task. By the way, it is possible that the purpose of a business trip is not achieved. In this case, the employer requires an “explanatory statement” from the employee indicating the reasons why the official task could not be completed. If you have this document, travel expenses can be taken into account for tax purposes.

- If the purpose of the business trip is extensive and consists of several tasks, it is important to also write down the individual tasks of the trip, the completion of each of which will also need to be confirmed.

- If a specialist’s work is of a traveling nature and moving to another locality is associated with the performance of everyday affairs, then such a “travel,” according to the Labor Code, is not recognized as a business trip at all.

Order to send an employee on a business trip

Form T-9 - order (instruction) to send an employee on a business trip - is a unified form of primary accounting documentation for recording labor and its payment and is used to formalize and record the sending of an employee on a business trip. Form T-9a is used for registration and accounting if several employees are sent on a business trip at the same time.

The order (instruction) indicates the surname and initials of the employee, structural unit, position (profession), as well as the purpose, place of business trip and duration of the business trip in calendar days.

As a general rule, when an employee of the parent organization is sent on a business trip to a branch, an order (instruction) is prepared by an employee of the personnel service (if there is no personnel service in the organization, another authorized person), and signed by the head of the organization or a person authorized by him ( Appendix

2). In a separate subdivision, the order is prepared by the official who, by virtue of his official duties, manages the personnel and other document flow of the separate subdivision.

There is a practice when an order to send an employee of a separate unit on a business trip to the head office of the organization is prepared directly at the head office. In advance, such an order, as a rule, is transmitted by fax or e-mail to a separate unit for the information of both the posted employee and the head of the separate unit. The original order is brought to the attention of the employee against signature and is transferred immediately upon his arrival at the head office. The issue with a travel certificate is resolved in a similar way, when the “arrived” and “departed” columns are filled in at the organization’s head office, and then upon the employee’s return from a business trip in a separate unit, the missing columns are filled in: “departed” and “arrived,” respectively.

Resolution No. 1 of 01/05/04 does not establish how many copies the order is issued in. In practice, usually as many copies of orders (instructions) for sending on a business trip are made as necessary according to the document flow diagram and the structural division of the organization.

The employee gets acquainted with the order, which is confirmed by his personal signature.

An order to send an employee of a separate unit on a business trip to the head office of the organization is drawn up in a similar way ( Appendix

3).