Companies strive to take care of maintaining a positive microclimate within the team. For this reason, among the constant expenses of companies, one can often find expenses for the purchase of water, tea and coffee. This is not only a tribute to fashion trends, but also compliance with the requirements of current legislation. In the article we will talk about accounting for water, tea, coffee, sweets, and give examples of postings.

Having the opportunity to offer tea or coffee to partners, the organization creates a positive image and increases the likelihood of concluding a deal or continuing productive cooperation. Like other company expenses, the cost of purchasing tea or coffee must be taken into account. The accountant who will be entrusted with the responsibility for carrying out the action must know all the features of its implementation.

Accounting for drinking water at an enterprise

Drinking water is included in the MPZ. The actual cost of the product is taken into account. It represents the amount the company spent on the purchase. In this case, VAT and other refundable taxes are excluded.

To reflect the flow of water, the accountant will need to make the following entries: (click to expand)

- Dt 10 Kt (76) (receipt of water received from the supplier).

- Dt 19 Kt (76) (VAT accounting has been completed.) The action is carried out if there is an invoice containing the tax amount.

- Dt 68, subaccount “Calculations for VAT” K-t 19 (Acceptance of the VAT amount for accounting.) During the manipulation, it is necessary to comply with all the conditions specified in Chapter 21 of the Tax Code of the Russian Federation.

According to the provisions enshrined in PBU 10/99, expenses incurred by the company are divided into other costs and expenses for ordinary activities.

Coffee at the expense of the employer: the Ministry of Finance assessed the consequences

Companies strive to take care of maintaining a positive microclimate within the team. For this reason, among the constant expenses of companies, one can often find expenses for the purchase of water, tea and coffee. This is not only a tribute to fashion trends, but also compliance with the requirements of current legislation. In the article we will talk about accounting for water, tea, coffee, sweets, and give examples of postings.

Having the opportunity to offer tea or coffee to partners, the organization creates a positive image and increases the likelihood of concluding a deal or continuing productive cooperation.

Like other company expenses, the cost of purchasing tea or coffee must be taken into account.

The accountant who will be entrusted with the responsibility for carrying out the action must know all the features of its implementation.

Accounting for drinking water at an enterprise

Drinking water is included in the MPZ. The actual cost of the product is taken into account. It represents the amount the company spent on the purchase. In this case, VAT and other refundable taxes are excluded.

To reflect the flow of water, the accountant will need to make the following entries: (click to expand)

- Dt 10 Kt (76) (receipt of water received from the supplier).

- Dt 19 Kt (76) (VAT accounting has been completed.) The action is carried out if there is an invoice containing the tax amount.

- Dt 68, subaccount “Calculations for VAT” K-t 19 (Acceptance of the VAT amount for accounting.) During the manipulation, it is necessary to comply with all the conditions specified in Chapter 21 of the Tax Code of the Russian Federation.

According to the provisions enshrined in PBU 10/99, expenses incurred by the company are divided into other costs and expenses for ordinary activities.

How to write off tea and coffee for employees

Moreover, this is allowed only in one single case - when there is a conclusion from the sanitary service confirming the unsatisfactory quality of the liquid flowing from the tap. In other cases, a more serious justification should be found.

The following options are commonly used. First of all, the purchase of equipment for supplying water to workplaces is considered an activity related to labor protection.

The corresponding statement is present in the 11th resolution of the Ministry of Labor dated February 27, 1995.

In addition, the rulings of the Constitutional Court (No. 350 OP and 366 OP), issued on June 4, 2007, state that it is unacceptable to assess the validity of spending solely on the basis of rationality. An enterprise is able to decide on its own which expenses are appropriate for it.

All products purchased by the company for employees must be included in the inventory.

Typically the following wiring is used:

- Product accounting for inventories is carried out using debit account 10 and credit account 60 (or 76);

- after the purchased volume is used up, a write-off is made (respectively, debit 91 (92) and credit 10).

Coffee and tea are accepted for balance only at actual cost. It must be indicated in the contract concluded with the supplier. Important point: VAT is not taken into account.

In a situation where there is a separate clause in the collective agreement that obliges the employer to provide employees with certain drinks (sweets, etc.), then the expenses incurred must be attributed to expenses for ordinary activities.

Is there a specific person responsible for food distribution? In this case, coffee or tea (at actual cost) is written off in the following order:

- from the 10th credit account;

- on the 26th debit.

This is all done on the basis of the provided primary document.

In the absence of a collective agreement norm regulating the procedure for providing drinks and other products, accounting changes in a certain way. The accountant should include these expenses as other expenses.

1 clause 1 art. 146 of the Tax Code of the Russian Federation). At the same time, it was said that in accordance with paragraph 2 of Art. 154 of the Tax Code of the Russian Federation, the tax base for VAT for the gratuitous transfer of goods is determined based on market prices, taking into account excise taxes (for excisable goods) and without including VAT.

The taxpayer’s second question was clearly tricky, since formally the employer is required to issue an invoice to each employee for each “shipment” from government reserves. The Ministry of Finance came out of the situation simply.

Accounting support for the purchase of drinking water for employees and partners of the organization, including the preparation of accounting entries, is carried out in the following sequence:

- Purchasing a cooler or renting it out.

- Purchase of drinking water, settlements with suppliers, write-off of costs.

- Accounting for bottles – returnable containers in which water is delivered. Payment of the deposit value, if necessary, in accordance with the terms of the drawn up supply agreement.

To ensure normal working conditions for employees, as well as to improve the level of service to partners, many organizations enter into contracts for the supply of drinking water, which is reflected in accounting entries.

The company can purchase a cooler or lease its use. Water is usually purchased in bottles, which are subject to exchange and return. Since ownership of the bottles does not pass to the organization, accounting for settlements on it is carried out in accordance with the company’s accounting policies on the main accounts or off-balance sheet accounts.

- Drinking water: refers to material reserves used for business activities, therefore its receipt and consumption are recorded in accounting on active account 10. The debit shows the posting to the warehouse in correspondence with the account for settlements with suppliers (account 76 can be used in depending on the established accounting rules at the enterprise), for a loan - transfer to work units on the basis of a demand invoice. To distribute MPZ according to their intended purpose, an additional sub-account 10.06 can be opened to account for drinking water. Note! In the company's financial statements, information about all the organization's material reserves is displayed in total in line 1210 of the balance sheet.

- Returnable containers: most often, the supply agreement involves the payment of a deposit for the bottles. This payment does not relate to the organization’s expenses and, accordingly, is recorded as part of the receivables of counterparties and on off-balance sheet account 009. The bottles themselves can be credited to subaccount 10.04 and written off from there when returned to the counterparty. Note! When purchasing your own bottles, ownership passes to the enterprise, so accounting is carried out in accordance with the standard procedure for purchasing materials.

- Cooler: If you purchase your own cooler, the organization accepts it for registration.

Since the average cost of coolers in 2020 does not exceed 20 thousand rubles, it can be included in the company’s inventory (for example, attributed to the subaccount 10.09), and the acquisition costs can be written off immediately when the asset is put into operation. If the use of a cooler is leased, then it should be reflected in an off-balance sheet account (account 001 can be used). Rent payments are written off as expenses of the organization.

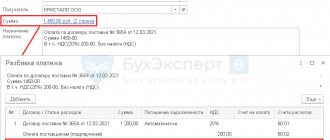

- Dt 10 Kt 60 – water supply to the enterprise.

Dt 60 Kt 50, 51 – settlements with the supplier in cash or by bank transfer. Dt 20, 23, 25, 26, 44, 91 Kt 10 – expenses for the purchase of drinking water are charged to expenses (the cost account is selected by the organization depending on the chosen accounting policy). - Dt 60, 76 Kt 50, 51– payment of a deposit for bottles. Dt 009 – display of the deposit paid.

Dt 10.04 Kt 60 (76) – receipt of returnable bottles to the warehouse (return of containers is processed by return posting).Dt 50, 51 Kt 60, 76 – return of the previously paid deposit.

Kt 009 – write-off of the displayed collateral.

- Dt 10 Kt 60 – purchase of your own cooler for the company.

Dt 20, 44, etc. Kt 10 – putting your own cooler into operation. Dt 20, 25, 26, etc. Kt 60 – attribution of rental payments for the use of the supplier’s cooler to expenses.

Currently, a rather pressing issue for an accountant is the registration of various food products purchased for both employees and guests of the organization. In addition, many of them provide free meals to their employees on their own initiative.

The issue is relevant because it is necessary to improve working conditions in an organization and thereby increase its attractiveness in the labor market at one’s own expense, and tax authorities do not always recognize such costs as economically justified.

Each office has drinking water equipment (coolers) or filtering and purification systems. This is a common occurrence, and the lack of clean drinking water is considered simply bad manners. In the Letter of the Ministry of Finance of Russia dated June 10.

2010 N 03-03-06/1/406 it was noted that in accordance with paragraphs. 7 clause 1 art. 264 of the Tax Code of the Russian Federation, other costs associated with production and (or) sales include costs to ensure normal working conditions and safety measures provided for by the legislation of the Russian Federation.

Source: //imdbmedia.info/otrazit-kollektivnom-dogovore-chaykofe-sotrudnikov/

Accounting for tea and coffee in the organization

Products that a company purchases for its employees and customers must be included in the inventory. In this case, the following transactions are carried out:

- Dt 10 Kt 60 (76) – the received product was recorded as inventory.

- Dt 91-2 Kt 10 – written off.

Products are accepted for accounting at actual cost. To find out, you need to refer to the contract with the supplier. The figure indicated there will appear in other company documents. As in the case of water, VAT is not taken into account.

Features of accounting for tea and coffee depend on the presence of the corresponding clause in the collective agreement.

So, if the document contains a provision according to which the organization is obliged to provide its employees with drinks and sweets, expenses for the purchase of products are classified as expenses for ordinary activities.

If the products are transferred to the person who is responsible for replenishing them, the actual cost of tea and coffee is written off from account 10 to the debit of account 26.

The basis for the manipulation is the corresponding primary document.

While it is possible to include water in expenses for tax purposes, it will not be possible to perform a similar manipulation in relation to tea and coffee.

Tax authorities will certainly have questions regarding the legality of the action.

The absence of a clause on the provision of drinks and sweets in the collective agreement leads to changes in the accounting procedure for tea and coffee. In this situation, the accountant must include the products among other expenses.

Source: https://k-nt.ru/provodki/priobretenie-kofe-dlya-ofisa.html

Accounting for tea and coffee in the organization

Products that a company purchases for its employees and customers must be included in the inventory. In this case, the following transactions are carried out:

- Dt 10 Kt 60 (76) – the received product was recorded as inventory.

- Dt 91-2 Kt 10 – written off.

Products are accepted for accounting at actual cost. To find out, you need to refer to the contract with the supplier. The figure indicated there will appear in other company documents. As in the case of water, VAT is not taken into account.

Features of accounting for tea and coffee depend on the presence of the corresponding clause in the collective agreement.

So, if the document contains a provision according to which the organization is obliged to provide its employees with drinks and sweets, expenses for the purchase of products are classified as expenses for ordinary activities. If the products are transferred to the person who is responsible for replenishing them, the actual cost of tea and coffee is written off from account 10 to the debit of account 26. The basis for the manipulation is the corresponding primary document.

While it is possible to include water in expenses for tax purposes, it will not be possible to perform a similar manipulation in relation to tea and coffee. Tax authorities will certainly have questions regarding the legality of the action. The absence of a clause on the provision of drinks and sweets in the collective agreement leads to changes in the accounting procedure for tea and coffee. In this situation, the accountant must include the products among other expenses.

How to hold tea for the office in 1c

The tax deduction for VAT is reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of account 19, subaccount 19-3.

The costs of maintaining the rest room (including the costs of purchasing tea, coffee and sugar), which the organization incurs in accordance with the collective agreement, are expenses for ordinary activities (as management expenses) and, if there is an appropriate provision in the accounting policy of the organization, can form the cost price of products sold, goods, works, services in the reporting period for recognizing these expenses (clauses 7, 9 of the Accounting Regulations “Organization's Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

What is the procedure for paying VAT on tea, coffee, sugar, cookies in the office?

The last type includes expenses that the company incurs in connection with:

- manufacturing of goods;

- sales of finished products;

- carrying out work;

- provision of various services;

- purchasing products.

Expenses for purchasing water may be included in this list.

However, if the company transfers the product to employees, the following entry must be made in accounting: Dt 20(26) Kt 10 (the cost of purchased drinking water has been written off).

Accounting for tea and coffee in an organization Products that a company purchases for its employees and clients must be included in the inventory. In this case, the following transactions are carried out:

- Dt 10 Kt 60 (76) – the received product was recorded as inventory.

- Dt 91-2 Kt 10 – written off.

Products are accepted for accounting at actual cost.

Reflection of VAT in 1C accounting without sending it to the tax office

Reflection in 1C Accounting of VAT without sending to the tax office 14.11.

2016Procedure for reflecting in the 1C Accounting information system VAT paid when purchasing goods for office needs. Many companies, trying to increase customer loyalty and improve the efficiency of working with partners, offer them tea, coffee and confectionery.

This makes the wait more pleasant and comfortable, and nowadays offering visitors tea or coffee is an element of culture. However, this procedure has its own taxation features.

In particular, the transfer of tea, coffee and confectionery products to customers is not considered a sale and is not subject to value added tax. At the same time, it is also prohibited by regulations to accept VAT for accounting on such values. The Ministry of Finance of the Russian Federation has repeatedly expressed its position on this matter in various letters and clarifications.

Source: https://dolgoteh.ru/kak-v-1s-provesti-chaj-dlya-ofisa/

Spending on water, tea, coffee: taxation features

The main problem that a company may face during taxation is justifying the costs of purchasing drinks and sweets for employees and clients. At first it may seem that spending money on buying water is inappropriate. Each office building is equipped with a water supply system and each employee or visitor has free access to unlimited quantities of liquid. However, practice shows that the water that flows from the tap is more like technical water than drinking water.

In most cases, the liquid does not meet the requirements that SanPiN imposes on it.

The expediency of spending on purchasing water can be proven by obtaining a conclusion from the State Sanitary and Epidemiological Supervision Service that the liquid from the tap does not meet the requirements of Sanitary Regulations and Regulations. If such a certificate is missing, tax authorities may consider that incurring such expenses is inappropriate.

If a company makes contributions to the state under the simplified tax system, and the object of taxation is income minus expenses, it will not be possible to take into account expenses for the purchase of water. The list of expenses that reduce the amount of profit received is given in the Tax Code of the Russian Federation. The list is closed. You won't be able to add new items to it.

If you carefully study the list, you will not be able to find the costs of ensuring normal working conditions, which include the purchase of drinking water. A similar rule applies to the purchase of sweets and coffee. To know the tax implications, you must carefully study the table below.

| Types of taxes | Expenses for purchasing tea for employees | Representation expenses | |||

| Impact on income tax accounting | |||||

| Taken into account | Accounting cannot be performed | Taken into account | Accounting cannot be performed | ||

| Personal income tax | Determine the profit of an enterprise employee: | ||||

| Can | + | + | – | – | |

| Will not work | – | – | – | – | |

| UST + contributions to mandatory pension insurance | Can | + | – | – | – |

| Will not work | – | – | – | – | |

Is it possible to write off expenses for tea and coffee in accounting?

This statement is completely false.

But will the tax inspector take this rule into account during the audit? There is a risk that the transfer of tea will be qualified as payment for goods for the employee’s personal consumption, and such expenses, based on paragraph 29 of Article 270 of the Tax Code of the Russian Federation, will not be taken into account for tax purposes.

If the costs of purchasing tea, coffee, etc. are insignificant. as part of entertainment expenses. But many organizations, avoiding disputes with tax authorities, make expenses for the purchase of tea, coffee and other food products from the profit remaining after taxation.

This means that in accounting such expenses are recognized as other and are subject to reflection in the debit of account 91 “Other expenses”, and in tax accounting they do not participate in the formation of the tax base for income tax. Providing employees with the opportunity to drink a cup of coffee or tea does not mean gratuitous transfer of goods, but is an expense of the organization aimed at creating additional working conditions that contribute to maintaining the necessary performance.

How to deal with VAT when accounting for costs

If a company purchases tea and sweets for employees, it is considered that a gratuitous transfer of goods occurs. This is the official position of the Ministry of Finance. Sales of products in Russia are subject to VAT. It turns out that it is necessary to calculate the tax base. However, the courts have a different opinion.

Representatives of government bodies believe that the gratuitous transfer of drinks and sweets will not be subject to VAT for the following reasons: (click to expand)

- There is no personalization of users by the product. The company does not take into account exactly who drank the tea and ate the cookies purchased for all employees.

- Tea is consumed only at work. A person cannot take a drink or sweets home. This means that there is no ownership right.

- The employer, on his own initiative, purchases drinks and sweets, expecting positive consequences - increasing productivity or creating a positive image of the company.

VAT that the company paid when purchasing drinks and sweets for visitors or office employees cannot be deducted. It can be included in the cost of purchased tea, coffee, sugar and other goods belonging to this category.

How to write off tea and coffee for employees in 2022

“Our company provides real estate services. Many visitors come to us, to whom we offer tea, coffee, sweets and cookies.

Can we write off the purchase of these products?

If yes, then under what article? What documents can we confirm such expenses with?” Elena Khoroshilova, accountant at Magistrat LLC, Moscow Offering tea, coffee and simple treats to waiting clients has already become a rule of good manners.

This is understandable - after all, the client is ready to pay money for the services provided by the organization.

Waiting gives him inconvenience, which needs to be compensated somehow.

As a result, the organization incurs costs for the purchase of products, services, napkins, etc. In such a situation, the accountant is concerned about whether these expenses can be taken into account when taxing profits. The Income Tax Administration Department of the Federal Tax Service of Russia reported that SUCH EXPENSES CAN BE ACCOUNTED for the income tax. profit

Can tea and coffee be expensed?

Sales of products in Russia are subject to VAT. Representatives of government bodies believe that the gratuitous transfer of drinks and sweets will not be subject to VAT for the following reasons:

- Tea is consumed only at work. A person cannot take a drink or sweets home.

- There is no personalization of users by the product. The company does not take into account exactly who drank the tea and ate the cookies purchased for all employees.

- Inventories

This is not only a tribute to fashion trends, but also compliance with the requirements of current legislation.

What document is needed to justify the write-off of coffee in an organization?

However, practice shows that the water that flows from the tap is more like technical water than drinking water.

In most cases, the liquid does not meet the requirements that SanPiN imposes on it. The expediency of spending on purchasing water can be proven by obtaining a conclusion from the State Sanitary and Epidemiological Supervision Service that the liquid from the tap does not meet the requirements of Sanitary Regulations and Regulations. If such a certificate is missing, tax authorities may consider that incurring such expenses is inappropriate.

If a company makes contributions to the state under the simplified tax system, and the object of taxation is income minus expenses, it will not be possible to take into account expenses for the purchase of water. The list of expenses that reduce the amount of profit received is given in the Tax Code of the Russian Federation.

The list is closed. You won't be able to add new items to it.

Important However, the courts have a different opinion.

Representatives of government agencies believe that the gratuitous transfer of drinks and sweets will not be subject to VAT for the following reasons: There is no personalization of product users.

Tea drinking is an integral process in the life of companies.

Over a cup of tea or coffee, business negotiations are held with clients and production issues are discussed.

However, the cost of these tonic drinks is a source of headache for the accountant.

Victoria Vladimirovna Varlamova Is it possible to take into account the costs of purchasing tea, coffee, sugar when calculating income tax? At whose expense does the employee drink tea? In accordance with paragraph 25 of Article 255 of the Tax Code of the Russian Federation, labor costs include all expenses incurred in favor of the employee provided for by the labor and (or) collective agreement.

How to account for the cost of tea and coffee for employees

; Many enterprises, taking care of creating a pleasant microclimate for all workers, purchase drinking water, coffee and tea. It should be understood that this practice is not an attempt to follow fashion trends, but only to comply with the requirements of labor legislation.

How to correctly account for the expenses of funds allocated for tea and coffee for your employees?

Not all accountants are ready to answer this question. Meanwhile, the methods can be very different - we will talk about this in more detail below.

Typically the following wiring is used:

- after the purchased volume is used up, a write-off is made (respectively, debit 91 (92) and credit 10).

- Product accounting for inventories is carried out using debit account 10 and credit account 60 (or 76);

Coffee and tea are accepted for balance only at actual cost.

What orders are needed to cover office expenses tea coffee sugar

It can be included in the cost of purchased tea, coffee, sugar and other goods belonging to this category.

However, if the company indicates in the document the provision of tea and coffee to employees, disputes may arise with representatives of the tax service. The Ministry of Finance claims that only expenses for the purchase of drinking water can be taken into account to reduce taxes. In this case, there must be a document confirming that the tap liquid does not comply with SanPin standards.

However, practice shows that the water that flows from the tap is more like technical water than drinking water.

Is it possible to write off expenses for tea and coffee in accounting?

Is there a specific person responsible for food distribution?

In this case, coffee or tea (at actual cost) is written off in the following order:

- on the 26th debit.

- from the 10th credit account;

This is all done on the basis of the provided primary document. In the absence of a collective agreement norm regulating the procedure for providing drinks and other products, accounting changes in a certain way. The accountant should include these expenses as other expenses.

The issue of taxation of coffee and tea The main problem, as practice shows, is the justification of expenses for drinks. With a shallow study of the issue, it may seem that spending on them is completely unnecessary, because virtually every building in the country is connected to the water supply, and, therefore, both staff and visitors can quench their thirst without restrictions. This statement is completely false.

If the costs of purchasing tea, coffee, etc. are insignificant.

Tea and coffee for employees: taxation and accounting

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

- Accounting and Taxation

04/03/2009 subscribe to our channel In many organizations, management provides their employees with free tea and coffee. The accountant should remember that the procedure for accounting and taxation of transactions for the purchase of tea and coffee for employees directly depends on whether this is provided for by the collective agreement or not.

Detailed explanations are provided by specialists of the 1C:Consulting.Standard project. According to Article 22 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the employer is obliged to provide for the everyday needs of employees related to the performance of their labor duties.

Source: https://lawyerms.ru/kak-spisat-chaj-kofe-dlja-sotrudnikov-v-2019-18204/

How to prove to tax authorities the legitimacy of expenses?

Some companies count the cost of purchasing coffee and tea as expenses to ensure normal working conditions. To clarify what exactly this includes, you can make an appropriate entry in a collective agreement or other local act of the organization. However, if the company indicates in the document the provision of tea and coffee to employees, disputes may arise with representatives of the tax service.

The Ministry of Finance claims that only expenses for the purchase of drinking water can be taken into account to reduce taxes. In this case, there must be a document confirming that the tap liquid does not comply with SanPin standards.

If the company wants to defend its position, it will have to enter into a dispute with representatives of the government agency. Practice shows that in this situation the courts side with the taxpayer. The arguments presented in the table below can be cited as arguments confirming the company’s correctness.

| Statement | Rationale |

| The purchase of equipment that allows the supply of drinking water and other drinks to the place of work of employees is included in the category of occupational safety measures | Resolution of the Ministry of Labor dated February 27, 1995 No. 11 |

| It is impossible to assess the validity of costs that reduce taxation from the point of view of rationality. The company is able to independently decide how appropriate certain expenses are. | Determination of the Constitutional Court dated June 4, 2007 No. 320-O-P, No. 366-O-P |

Tea with taxation

Tea drinking is an integral process in the life of companies. Over a cup of tea or coffee, business negotiations are held with clients and production issues are discussed. However, the cost of these tonic drinks is a source of headache for the accountant.

Varlamova Victoria Vladimirovna

income tax

Is it possible to take into account the costs of purchasing tea, coffee, sugar when calculating income tax? At whose expense does the employee drink tea?

In accordance with paragraph 25 of Article 255 of the Tax Code of the Russian Federation, labor costs include all expenses incurred in favor of the employee, provided for by the labor and (or) collective agreement. In addition, labor costs include the costs of free or reduced-price meals provided for in employment agreements (contracts) and (or) collective agreements. This means that expenses for tea and coffee can be classified as labor costs. The main thing is to provide for the provision of sweet tea or coffee to employees in labor and (or) collective agreements. The Russian Ministry of Finance adheres to a similar point of view.

The only thing that is alarming in this situation is the term “nutrition”. The Tax Code does not decipher it. But can a bag of tea, coffee beans (powder), and sugar, from which the employee prepares tonic drinks, qualify as free food for the employee? There are no explanations from official bodies on this issue. You can, of course, use paragraph 7 of Article 3 of the Tax Code of the Russian Federation. It states that all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the taxpayer (payer of fees). But will the tax inspector take this rule into account during the audit? There is a risk that the transfer of tea will be qualified as payment for goods for the employee’s personal consumption, and such expenses, based on paragraph 29 of Article 270 of the Tax Code of the Russian Federation, will not be taken into account for tax purposes. It turns out that accounting through labor costs is a slippery slope.

There is a second option - to include “tea” expenses among other expenses associated with production and (or) sales, as expenses for ensuring normal working conditions and safety measures provided for by the legislation of the Russian Federation. But even in this case, not everything is so easy and simple.

According to Article 223 of the Labor Code of the Russian Federation, the employer is responsible for providing sanitary, medical and preventive services to employees of organizations in accordance with labor protection requirements. For these purposes, the employer, in accordance with established standards, equips sanitary facilities, premises for eating, installs apparatus (devices) to provide workers in hot shops and areas with carbonated salt water, etc.

As can be seen from the above norm, labor legislation obliges the employer to create conditions for eating. However, the mandatory provision of food and drinks is provided only for certain categories of workers (for example, workers in hot shops, hazardous industries). Therefore, if the legislation does not provide for the provision of tonic drinks to employees, then the employer will most likely not be able to sweeten their work through income taxes without tax consequences. According to the main financial department, the taxpayer has the right to independently and individually assess the effectiveness and feasibility of his economic activities, that is, to assess the economic feasibility of expenses. But, when carrying out tax control of expenses, the tax inspectorate evaluates their compliance with the criteria established by Article 252 of the Tax Code of the Russian Federation, that is, it checks whether the expenses incurred are economically justified and documented. Consequently, in practice, it will not be easy for the payer to prove the production nature of expenses for coffee, cocoa and tea. And there is nowhere to gain experience, since judicial practice on this issue has not developed.

Come in, dear guests!

The situation is completely different with the tea party on the occasion of the official reception and service of representatives of other organizations participating in negotiations in order to establish and maintain cooperation. In this case, tea, coffee and sugar consumed together with partners are entertainment expenses, which are taken into account as part of other expenses associated with production and sales. After all, the Tax Code includes expenses for breakfast, lunch or other similar event, and buffet service during negotiations.

At the same time, do not forget that the official reception is confirmed by the following documents: - order (instruction) of the head of the organization on the implementation of expenses for these purposes; – estimate of entertainment expenses; – an act on the implementation of entertainment expenses, signed by the head of the organization, indicating the amounts of entertainment expenses actually incurred.

According to the tax authorities, the report on entertainment expenses, compiled specifically for the entertainment events carried out, should reflect: – the purpose of the entertainment events and the results of their implementation; – date and place of their holding; – program of events; – composition of the invited delegation; – participants of the receiving party; – the amount of expenses for entertainment purposes.

Be careful! The Russian Ministry of Finance believes that the costs of receiving and servicing clients – individuals and individual entrepreneurs – do not reduce profits. Argument: entertainment expenses, according to paragraph 2 of Article 264 of the Tax Code of the Russian Federation, include the taxpayer’s expenses for the official reception and (or) servicing of representatives of other organizations. Therefore, if a company works with the public or individual entrepreneurs, it will not be possible to recognize expenses for tea without disputes in court.

Add, add a tenth spoonful of sugar, no one counts it anyway...

If tea and coffee were taken into account as entertainment expenses, then the participants in the negotiations do not have income and “salary” taxes do not need to be calculated.

If a company employee has taken tea, the accountant will have to take into account some nuances. It is known that when determining the tax base for personal income tax, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account. Income in kind, in particular, includes payment (in whole or in part) for it by organizations or individual entrepreneurs for goods (work, services), including food in the interests of the taxpayer. This means that the organization’s expenses for tea, coffee and sugar relate to income received by employees in kind and are subject to personal income tax in accordance with the generally established procedure.

The tax base in this situation is defined as the cost of the products provided (including VAT), determined in accordance with Article 40 of the Tax Code of the Russian Federation.

True, there is one thing. To calculate personal income tax, you need to accurately determine the amount of income of each employee, and to do this, keep records of the amount of drink consumed by each employee. Organizations in which tea bags, coffee or lumps of sugar are given to employees “on signature” are quite rare. Without such accounting, only estimated income can be established, that is, income determined by calculation. But it is not subject to inclusion in the employee’s total income. This point of view was expressed by the Supreme Arbitration Court of the Russian Federation in paragraph 8 of the Review of the practice of considering disputes related to the collection of income tax. It can also be applied to personal income tax.

The object of taxation of the unified social tax and contributions to compulsory pension insurance are payments and other remunerations accrued by taxpayers in favor of individuals under employment and civil law contracts, the subject of which is the performance of work or the provision of services. However, the tax base is determined separately for each individual, that is, just like for personal income tax, employers must keep personalized records of income. This means that in this case, it is necessary to determine the cost of tea and coffee consumed by each employee. Otherwise, the object of UST taxation and contributions to compulsory pension insurance do not arise.

But, if the organization does not recognize expenses for tea when calculating income tax, then there are no questions regarding UST and contributions to compulsory pension insurance, since under such circumstances these payments are not recognized as an object of taxation.

Attention! In tax matters, the payer is not his own boss. The Supreme Arbitration Court of the Russian Federation indicated that if there are relevant norms in Chapter 25 of the Tax Code of the Russian Federation “Organizational Income Tax,” the taxpayer does not have the right to exclude amounts classified by law as expenses that reduce the tax base for income tax from the tax base for the unified social tax on the basis of clause 3 Article 236 of the Tax Code of the Russian Federation.

Tea consumption is not insured against accidents

Insurance premiums for industrial accidents and occupational diseases are calculated on the accrued wages (income) of employees on all grounds, and in appropriate cases - on the amount of remuneration under a civil contract. If the employer does not recognize the provision of tea and coffee to the employee as part of the salary, then the answer to the question of whether or not to charge insurance premiums will most likely be received in court. If the organization is not ready for disputes with regulatory authorities, contributions must be assessed. After all, the List of payments for which insurance contributions to the Social Insurance Fund of the Russian Federation are not charged does not include payment for tonic drinks. To be fair, it is worth noting that judicial practice on this issue is contradictory. Thus, the Federal Antimonopoly Service of the Volga-Vyatka District, in one of its decisions in favor of the policyholder, indicated that the existence of an employment relationship does not mean that all payments to the employee are wages. If payments are not related to the fulfillment of labor obligations, insurance premiums do not need to be charged.

Dessert with bitterness

According to the Russian Ministry of Finance, the transfer of food products (tea, coffee, etc.) to employees of an organization for the purposes of applying value added tax should be considered as a gratuitous transfer of goods and subject to VAT in the generally established manner.

Moreover, according to paragraph 2 of Article 154 of the Tax Code of the Russian Federation, the tax base for value added tax must be determined based on market prices. In our opinion, we can talk about the emergence of an object under VAT only if the “tea” expenses are not related to production activities.

If these expenses are taken into account when calculating income tax, then some arbitration courts regard such transfer of products to employees as the transfer of goods (work, services) for their own needs and, on the basis of paragraph 2 of Article 146 of the Tax Code of the Russian Federation, confirm that the object of VAT taxation does not arise. However, with regard to specifically “tea” expenses, there is no arbitration practice and proving the validity of such expenses, as already mentioned, is quite difficult.

Therefore, the taxpayer needs to decide what to do: – unconditionally follow the explanations of the Russian Ministry of Finance and in any case impose VAT on the transfer of tea to workers; – do not impose VAT on drinks taken into account when determining the tax base for income tax, and prepare to defend your point of view in court.

At the same time, in both options, the “tea” input tax can be deducted if the conditions established by Articles 171 and 172 of the Tax Code of the Russian Federation are met.

However, it will not be possible to recognize in the expenses taken into account when calculating income tax in accordance with paragraph 1 of Article 264 of the Tax Code of the Russian Federation the VAT calculated for the gratuitous transfer without a dispute with the tax authorities. And the Ministry of Finance of Russia (one might say, in a similar situation), when considering the issue of recognizing VAT as an expense, calculated on the free distribution of souvenirs for advertising purposes, did not recognize this expense as economically justified.

If tea expenses are taken into account when calculating income tax as entertainment expenses, then there is no VAT item, and input tax is deducted within the limits established for income tax.

According to the Russian Ministry of Finance, the taxpayer’s expenses (tea, coffee, sugar) for servicing representatives of other organizations participating in the negotiations, which are not properly documented (there are no estimates, reports, etc.), should be considered as expenses for their own needs, not related to production and sale of goods (works, services). At the same time, if operations for the transfer of these goods to structural divisions are not carried out, the object of taxation with value added tax does not arise, but input tax is not accepted for deduction. As you can see, the accountant has a lot to think about.

Instead of a tip

The issue of accounting for such harmless drinks as tea and coffee turned out to be quite difficult.

Moreover, disputes with tax authorities may arise regarding various taxes. What to do with tea? Decision is on you. To adopt it, we propose to consider the tax consequences of “tea” expenses depending on the chosen accounting method (see table).

Thus, the procedure for accounting for expenses on tea for employees depends on the company’s willingness to defend its position, including in court. If a company wants to minimize tax risks, then these expenses should not reduce taxable profit and VAT must be charged when transferring tea, coffee and sugar. The taxation of entertainment expenses depends on the availability of properly executed documents.

Enjoy your tea without tax consequences!

The author is a curator on taxation and accounting issues

READER'S OPINION We drink tea at the expense of the remaining profit. Companies often classify expenses for tea and coffee for employees as entertainment expenses. The Russian Ministry of Finance qualifies such expenses as a gratuitous transfer of goods. In our opinion, the position of officials can only be applied in the case of targeted transfer of these food products. But, if an organization adheres to this point of view, it may face increased tax risks. Therefore, we consider the safest option to be writing off expenses for tea and coffee using the funds remaining after taxation. Victoria Aleksandrovna Sholts , accountant, Mashpribor LLC, Moscow Taxes | Tea expenses for employees | Entertainment expenses | |||

| We take into account when calculating income tax on the basis of clause 25 of Art. 255 or pp. 7 clause 1 art. 264 | We do not take it into account when calculating income tax (no reason) | We take it into account when calculating income tax (within the norms) | We do not take into account when calculating income tax (documents are missing (clause 1 of Article 252 of the Tax Code of the Russian Federation)) or expenses exceed the standard (clause 2 of Article 264 of the Tax Code of the Russian Federation) | ||

| Personal income tax | The income of each employee: a) can be determined | + | + | – | – |

| b) cannot be determined | – | – | – | – | |

| UST and contributions to mandatory pension insurance | The income of each employee: a) can be determined | + | – | – | – |

| b) cannot be determined | – | – | – | – | |

| VAT | deduction | + | + | + | – |

| object of taxation | – | + | – | – | |

Table

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

How to document expenses

All operations related to the company’s business activities must be accompanied by primary documentation (Law No. 402-FZ). Such papers can be accepted for accounting only if they were compiled according to the form that is present in the albums of primary documentation forms. If an accountant needs to draw up a document for which a special form is not established, it is necessary to include the details specified in the law.

The papers required to record sweets and drinks purchased for employees and visitors are presented in the table.

| Type of transaction | Document's name | Form |

| Accounting after purchase | Packing list | No. TORG-12 |

| Receipt order | No. M-4 | |

| Moving products within the company | Request-invoice | No. M-11 |

| Write-off of drinking water | Act on write-off of materials for production | A form that the company specialist developed independently. It must be drawn up taking into account the requirements of Federal Law No. 402-FZ |

To confirm the validity of classifying water as an expense, experts advise drawing up internal organizational and administrative documents. An example could be an order from a manager. The company has the right to develop its own corporate standards in accordance with which workers are provided with drinking water and sweets. The action is carried out with the aim of creating favorable conditions for carrying out work activities.

Writing off expenses

Companies often classify expenses incurred due to the purchase of tea and coffee for their employees as entertainment expenses. However, such an action will be considered erroneous (Tax Code of the Russian Federation, Article 264). Some experts suggest including expenses for the purchase of drinks and sweets as other expenses that arose due to ensuring normal working conditions. But in this case there will be a problem with VAT calculation.

Experts recommend writing off expenses for the purchase of drinks and sweets for employees using the funds remaining after taxation.