Purpose of 11 accounts

The eleventh account in accounting practice is not so common in practice. He is a “worker” for agricultural enterprises involved in raising livestock.

What happens in life is that, due to the specific nature of production activities, certain enterprises use highly specialized balance sheet accounts, which include item 11 “Animals for fattening and rearing.” They are usually used by zoos, circuses, livestock farms, etc.

The indicated position summarizes data on existing animals representing the property of an economic entity and their movement. Such animals include fattening herds, young animals, birds, service dogs, etc.

If we consider the structure of the balance sheet, then the balances on the 11th position of the Chart of Accounts are part of inventories and are reflected in the second asset section of the balance sheet. To make it more convenient to keep track of such transactions, account 11 has sub-accounts, including:

- 11/1, in which young animals are taken into account until the animals reach a certain age and indicators;

- 11/2, which takes into account the main animals in fattening herds;

- There are a number of other sub-accounts that are opened depending on the type of animal.

The costs of keeping animals are reflected in such items as main production (20), auxiliary production (23) and service farms (29).

How to keep track of animals being raised and fattened

Livestock farming is an industry whose importance cannot be overestimated. The production of dairy or meat products, especially now, is a popular and profitable business that can generate a stable income.

However, due to the nature of the industry, accounting processes in livestock farming are a bit complicated. This article examined in detail all the issues that will help in organizing the correct accounting of animals for growing and fattening.

Farm Accounting

We all know these trivial things that it is necessary to keep accounting records in an organization correctly and without errors, otherwise problems with the tax authorities may arise.

However, in the livestock industry, due to the peculiarities of accounting, errors and inconsistencies in reporting occur most often. Therefore, before talking about accounting for animals in production, you should understand what is an asset in the enterprise.

Assets are all the property, cash, equipment and other things that a business owns . Also in accounting, it is customary to mention liabilities, which are understood as all sources of formation of property (assets) of the enterprise.

For example, you decided to organize a farm and invested 100,000 rubles as authorized capital and a plot of land for a cowshed and pasture - these are the assets of your enterprise. Due to these assets, authorized capital appeared, which acted as a source of formation of the farm’s property and became a liability.

Following the above logic, it becomes clear that the animals that you buy to develop your farm will also become assets of the enterprise. However, everything is not so simple. After all, even livestock is divided into different types of assets, so accounting for the main herd and young animals should be kept separately.

Livestock for fattening and growing

All animals owned by the enterprise can be divided into two groups:

- The main herd consists of adults, productive and breeding cattle. These animals bring profit to the farm, so they are accounted for as part of fixed assets.

- Animals in growing and fattening are young or old animals that are sent for fattening, so accounting for these livestock is kept as part of current assets.

What's the catch here? Fattening cattle can be considered as work in progress, therefore such animals are classified as tangible current assets.

The fattening group includes the following cattle:

- Young animals;

- Animals for sale;

- Adults for fattening;

- Animals obtained from the public for sale.

When animals become part of fixed assets

Fattening animals are biological assets that can be converted into fixed assets at any time.

Let's consider the situations of transition of young animals to the main herd:

- Breeding bulls are transferred to the main herd after fattening at the age of 18 months;

- Cows become part of the main herd at two years of age after the first covering;

- Sows are transferred to the main herd after the first farrowing and weaning of the piglets;

- Replacement boars are transferred after reaching a weight of 160 kg and starting mating at the age of 12-14 months;

- Tested boars are included in the herd at the age of 18 months after assessing the productivity of the females covered by them.

An animal also becomes a current asset when it loses productivity and goes to fattening for further slaughter.

Due to the constant movement of animals between working capital and fixed assets, keeping records of livestock by groups becomes extremely difficult. After all, in just one reporting period, several heads of the herd can be culled and the cattle will go to fattening, while younger individuals will gain weight and be asked to join the main herd.

In this sense, accounting plays an important role in livestock farming, because monitoring indicators and competently filling out documents affects not only the rapid closure of the reporting period, but also helps to increase the number of offspring, ensure a low mortality rate, increase productivity and live weight gain.

Objectives of accounting in agriculture

An accountant at a livestock farm is always full of work. After all, the weight of livestock is growing every day, and animals replace each other, so all indicators must be constantly recorded in reports and not retroactively, but by the date when these data were received. Therefore, control on the farm must be carried out continuously.

Animals included in working capital are recorded in documentation at three levels: receipt, fattening and disposal. It is these indicators of transfer from one group to another, as well as the counting of goals, that the accounting department must promptly and clearly reflect in the documentation.

The work of a specialized employee moves at a constant and frantic pace, where the main goals of the accountant are based on key production tasks:

- It is necessary to constantly monitor the update of data;

- Reasonably evaluate incoming animals;

- Monitor the safety of fattening livestock;

- Record the results of fattening;

- Conduct inventory.

If on small farms one person can cope with these tasks, then with an increase in the number of livestock, additional forces may be needed.

How to evaluate assets in a livestock enterprise

At the very beginning, we said that the assets of an enterprise consist not only of cash, but also of property and equipment. In livestock farming, the main herd is also considered an asset, and therefore must be recorded in accounting.

To value assets, an accountant must assign an actual value to an asset. However, difficulties arise with the registration of animals due to the constant change in their value, therefore, for each animal, its own asset valuation system was developed.

- Dairy production : accounted for at the planned cost of a unit of offspring;

- Beef production : calf weight is multiplied by the target cost per kilogram.

- Purchasing an animal : actual cost per unit;

- Cull cattle : book value of animals.

At the end of the year, the cost of production is calculated, where the planned cost is brought to the actual cost.

The accounting report must also include transportation costs and the cost of purchasing livestock, minus refundable VAT.

How to keep track of live weight gain

The main purpose of transferring an animal to fattening is to obtain an increase in live weight as the main type of product. The results of weight gain must be recorded monthly in the statement (form N SP-43) of weighing animals, indicating the date and weight.

Based on the results obtained, a calculation is made (form N SP-44) of the gross increase in live weight of livestock by age group.

To the mass recorded in the report, add the mass of the retired livestock and subtract the mass of the livestock at the beginning of the reporting period and those received during the reporting period. The final calculation is the gross increase in live weight of livestock by age group being raised and fattened.

Which account should an accountant use? Fattening animals will be combined into one group and account 11 is used to keep records. This is a specialized account designed to record transactions with young animals, adults, birds, rabbits, and bees.

Debit (DT) is capitalized, and Credit (CT) is written off. The debit of the account reflects the receipt of animals for fattening. And depending on the source of income, the credit varies: from suppliers - credit 60; getting offspring - credit 11; from the main herd - credit 01

Account 11 is also used to demonstrate information on animals accepted from the public for sale. Analytical accounting is also maintained through this account.

For example, when registering offspring for each species, a report is drawn up in form No. SP-39 on the day of the increase in the number of livestock. The act indicates the full name of the employee to whom the animal is assigned, the name or uterus number, the number of heads and the weight of the offspring. Stillborn individuals are recorded separately.

The report is submitted to the accounting department and a record is made based on it:

DT 11 CT 20 subaccount “Livestock” The offspring of young cattle has been registered

To account for animals being raised and fattened when culled from the main herd, the following report is compiled:

DT 11 KT 01 Productive livestock was registered at original cost

Problems with record keeping in livestock farming

For accountants, agriculture is considered the most complex industry, since a typical farm can involve several types of activities. Production of livestock and crop products, catering, transport and other types of services, trade - a typical set of services for one agricultural enterprise.

Especially a lot of paperwork piles up due to the constant change in assets, which, in addition to property and equipment, are considered to be animals. The typical farm accountant's job does not revolve around filling out reports in the office alone. The employee must also spend a lot of time on the farm and production, recording information on livestock numbers, analyzing the correctness of filling out documents and working closely with zoologists and ordinary farm employees.

Such bureaucratic workload leaves a certain imprint on the activities of an accountant, overwhelming the employee with a pile of paperwork. As the company grows and the number of livestock increases, additional employees may be required. And this, despite getting rid of one problem, can provoke new troubles.

If accounting is carried out by several employees on different media, then this creates an additional problem, because each specialist prepares reports in the way that is convenient for him.

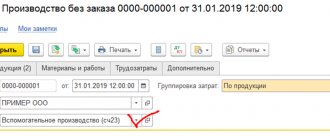

In order to avoid such situations and reduce costs, farms are implementing accounting automation systems that carry out calculations independently, which greatly simplifies the reporting process. All that is required of a specialist is to insert the data into the program and select the necessary values, and the program will carry out the necessary calculations itself.

This approach to organizing a farm helps generate reports for tax authorities, maintain statistics on milk yield and productivity, monitor the health of each individual, optimize feeding, improve the quality of production and improve the finished product.

Modern programs, such as “1C: Selection in animal husbandry. KRS" from the Matrix company include all the necessary modules for the optimal and efficient functioning of the farm.

Using the program it is possible to track:

- Breeding work;

- Veterinary activities;

- Quantitative and weight accounting;

- Feed consumption indicators;

- Livestock reproduction data;

- Number of milk yields.

This approach to work helps not to distract specialized specialists from their main work, giving them the opportunity to do what they love.

According to estimates of large livestock farms in Russia, such as Miratorg, Cherkizovo and RusAgro, with the help of automation of accounting in livestock farming, data entry time is halved, and errors in reporting are reduced by 99%.

Of course, the farmer will have to pay for the introduction of automation in his production, but in the long term, such a solution will pay off within 3-5 months and will allow the farm to save a lot by fully controlling its activities and making effective management decisions based on the data received.

Accounting: offspring

Reflect the receipt of animals as offspring using one of the following entries:

Debit 11 Credit 20

– reflects the cost of offspring of young productive and working livestock (animals, rabbits, chickens, ducklings, goslings, turkey poults), new bee colonies;

Debit 11 Credit 23 subaccount “Drawn transport”

– reflects the cost of the offspring of working livestock.

This procedure follows from the Methodological Recommendations approved by Order of the Ministry of Agriculture of Russia dated June 13, 2001 No. 654.

An example of reflecting the receipt of offspring of animals in accounting

CJSC Alfa has productive cattle, which are included in its fixed assets. These animals gave rise to offspring, which “Alpha” received on her birthday.

The cost of the offspring was determined to be 20,154 rubles.

Alpha's accountant made the following entries in accounting:

Debit 11 Credit 20 – 20,154 rub. – reflects the cost of offspring of young productive livestock.

Regardless of the method of receipt of animals, in accounting, write off the cost of productive, working, breeding livestock, recognized as fixed assets, as expenses through depreciation (clauses 5 and 17 of PBU 6/01).

The procedure for reflecting the receipt of animals when calculating taxes depends on the taxation system used by the agricultural organization.

Accounting for slaughter and mortality

Slaughter, cutting, death, death from the elements or loss of livestock is formalized by an act f. SP-54. It is compiled by a special commission. The received products are transferred to the organization's warehouse using an invoice.

The cost of slaughtered livestock not related to fixed assets is written off as follows:

Dt 20 Kt 11 - the cost of goals scored is written off.

Animals assigned to the organization's OS (productive, breeding, working) are written off after slaughter using the following records:

Dt 01 Kt 01 - shows the initial cost of livestock prepared for slaughter;

Dt 02 Kt 01 - depreciation of the animal is taken into account;

Dt 20 Kt 01 - animal carcass transferred for processing at residual value.

At the end of the month, the farm manager draws up a report f. SP-51. It reflects the movement of animals. The document is submitted to the accounting department along with the primary documentation.

If animals die due to the fault of an employee, he must reimburse their cost. It is established by revaluation to the market price and collected in the prescribed manner.

Example #2. Accounting for the reduction of cattle as a result of illness

At Rassvet LLC, cattle died as a result of an epidemic. The cost of livestock is 780,000 rubles, the cost of a veterinary report and burial amounted to 58,000 rubles. The accountant wrote off the losses as follows:

Dt 91 Kt 11,780,000 rubles—cattle that died from the epizootic were written off;

Dt 91 Kt 76 58,000 rub. — costs associated with mortality are taken into account.

Accounting for the purchase and sale of products

Accounting depends on the sources of livestock receipts. These include:

- For a fee from third parties;

- Gratuitous;

- In the form of an investment in the authorized capital;

- Own offspring.

Animals received from third-party organizations are accounted for by waybills, acts, invoices and breeding certificates. Accounting makes the following entries:

Dt 11 Kt 60 - purchased young animals are capitalized;

Dt 19 Kt 60 - VAT is reflected from the invoice.

When purchasing young animals from individuals, a purchase and sale agreement and a statement of form SP-40 are drawn up.

Animals received free of charge come with the same documents as when purchased. The accountant reflects the transaction as follows:

Dt 11 Kt 98 - young animals received as a gift were taken into account.

The cost of heads received as an investment in the authorized capital is determined by agreement between the founders. It can be increased by the amount of transportation costs.

When selling livestock externally, the company prepares documents similar to the purchase. The following wiring takes place:

Dt 62 Kt 90 - revenue is taken into account;

Dt 90 Kt 11 - the cost of sold livestock is written off;

Dt 90 Kt 68 - VAT charged.

Cattle accounting

Heads of the main herd are recognized as fixed assets, fattening and young cattle are considered working capital (see → Accounting for the receipt of fixed assets: documents, postings). The company forms its own herd from offspring, purchases, or animals donated by third-party enterprises.

Before the young animals move into the main stock, they are counted in groups:

- First-calf heifers for sale;

- Cows over 2 years old;

- Heifers up to 2 years of age;

- Bulls;

- Purchased young stock.

Purchased animals are received for rearing at actual costs, including contract costs, transportation and other costs, except VAT.

Example #1. Purchasing bulls from breeding stock I bought 7 breeding bulls from the breeding farm at a unit price of 44,000 rubles. (including VAT - 4,000 rubles). Transportation costs on our own are 3,200 rubles. The accountant will make the following entries:

Dt 11 subaccount “Purchased breeding stock” Kt 60 in the amount of 280,000 rubles. ((44,000 – 4,000) * 7)

— the cost of purchased bulls is reflected without VAT;

Dt 19 Kt 60 in the amount of 28,000 rubles. — VAT has been submitted for compensation;

Dt 11 Kt 23 in the amount of 3,200 rubles. — transportation costs are taken into account;

Dt 60 Kt 51 in the amount of 308,000 rubles. — money was transferred to the breeding farm.

The cost of obtaining 1 quintal of milk = (maintenance costs - costs of by-products): increase.

Key entries for accounting in livestock farming

Young animals purchased:

| Debit | Credit | Description |

| Dt 11 | Kt 60 | purchasing young animals from outside |

| Dt 11 | Kt 76 | acquisition of young animals from the population |

The purchase of animals from individuals is recorded by recording:

| Debit | Credit | Description |

| Dt 11 | Kt 60, 76 | young animals received from citizens were taken into account |

Receipt of adult livestock as a gift is formalized with the following entries:

| Debit | Credit | Description |

| Dt 08 | Kt 98-2 | the market value of animals received as a gift is taken into account |

| Dt 08 | Kt 23, 26, 70, 76 | expenses for receiving livestock for free are reflected |

| Dt 01 | Kt 08 | donated animals are accepted for registration |

| Dt 98-2 | Kt 91-1 | the market value of the donated animals is reflected |

The receipt of animals as an investment in the authorized capital is reflected as follows:

| Debit | Credit | Description |

| Dt 11 | Kt 75-1 | deposit received in the form of livestock |

The cost of animals killed due to the fault of an employee is reflected as damage to valuables:

| Debit | Credit | Description |

| Dt 94 | Kt 11 | death was discovered due to the fault of the employee |

| Dt 73 | Kt 94 | losses are written off to the account of the culprit |

If the culprit is not identified, wiring is done:

| Debit | Credit | Description |

| Dt 20 | Kt 94 | the cost of dead livestock was written off |

If animals died from an epidemic or natural disaster, they are written off as follows:

| Debit | Credit | Description |

| Dt 91 | Kt 11 | write-off of livestock that died from an epizootic |

| Dt 10 | Kt 91 | raw materials from livestock deaths are taken into account |

The accountant records the transactions of death of livestock for other reasons with records:

| Debit | Credit | Description |

| Dt 94 | Kt 11 | livestock deaths taken into account |

| Dt 20 | Kt 11 | the cost of slaughtered livestock has been written off |

| Dt 43 | Kt 20 | finished products received at the warehouse |