Companies that practice paying salaries in cash from the cash register may face cases of employees not receiving them. This happens due to various reasons, for example, due to illness, being on a business trip, etc. Since the period for issuing wages is strictly limited and cannot last more than five working days (including the day of receiving cash from the bank), the enterprise needs to close the payroll records for which the payment was made, depositing all unclaimed amounts (clause 6.5 of the Instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). Let's look at the mechanism of this operation and its accounting.

What is salary escrow?

Personnel records, employee reports, automatic calculation of salaries, benefits, travel allowances and deductions in a convenient accounting web service

Get free access for 14 days

The Labor Code requires employees to be paid twice a month. Payment terms are set by the manager and reflected in the company’s internal documents. Before paying wages, the company receives the required amount from the bank and draws up an expense sheet, where the payroll accountant enters data for each employee: name, accrued amount. The salary payment period lasts no more than five days (including the day of receipt of funds from the bank account), and this is the only time when funds in excess of the cash limit can be kept in the company's cash desk.

If one of the employees did not manage to receive their salary within the allotted time, then these funds will have to be deposited - that is, returned to the bank. This is the responsibility of the company, at the request of the Central Bank of the Russian Federation (Instruction dated March 11, 2014 No. 3210-U). To which accounting accounts should funds be deposited when returning to the bank, how to recognize amounts when calculating income tax, is it necessary to charge insurance premiums from them and withhold personal income tax? - read on.

Deposit transactions

The following entries are used to account for funds:

- receiving cash for payment - Dt 50 Kt 51;

- issuing wages to employees - Dt 70 Kt 50;

- wages deposited (posting) - Dt 70 Kt 76.04;

- contribution to the current account of money in excess of the limit - Dt 51 Kt 50.

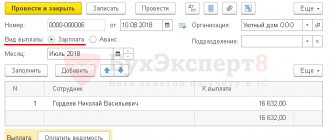

The final document for calculating wages can be considered a payroll, which indicates the amount of payments due to the employee minus the deductions made.

When paying for labor from the cash register, the payroll is handed over to the cashier, who determines whether there is enough cash to pay the salary and, if there is not enough, then orders the missing amount from the bank.

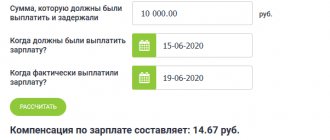

The entry for the deposit of wages (Dt 70 Kt 76.04) is made only in cases where the salary is paid in cash and is not received for a good reason. Failure to pay earned money through the fault of the employer is a violation of the law with mandatory payment of compensation for the delay.

There can be no escrow when transferring money from a checking account to an employee's bank account.

How to deposit your salary: step-by-step algorithm

When the deadline for paying wages expires, the cashier must check the payroll, recalculate the amounts paid and find out the amount of the balance. In column 23, opposite the names of employees who did not manage to receive the money, the entry “Deposited” is made or the same stamp is affixed. At the end of the statement the amounts are written down. Important: The totals of amounts paid and amounts to be deposited must be equal to the final amount on the statement.

The salary to be deposited must be submitted to the bank the next day after the end of the salary payment period. Record the deposit in the register. There is no unified form for the register of depositors; it can be compiled in free form. The register must contain the following details:

- company name or full name of the individual entrepreneur;

- date of registration of the register;

- period of occurrence of deposited funds;

- payroll number;

- Full name and personnel number (if any) of the employee who did not receive the money;

- amount of unpaid salary;

- total amount for unpaid salary;

- cashier's signature with transcript.

You can also include other details that are important to the company in the register. Transfer the data from the register to the ledger for recording deposited amounts. The book form can also be created independently or taken as a basis for forms for budgetary organizations. Document the accounting of salary deposit operations by posting:

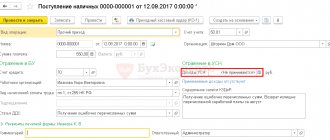

Dt 70 Kt 76-4 - deposited salary not received by employees; Dt 51 Kt 50-1 - deposited salary deposited into the current account.

When an employee who has not received a salary applies for it, the amount will need to be given upon first request, written or oral. There is no deadline for issuing the deposited salary. You need to receive the salary amount from the bank, draw up a cash order in the name of the employee, and reflect the date and number of the order in the book of accounting for deposited amounts.

The issuance of the salary must be recorded in the register of deposited amounts, a note about the amounts received must be placed next to the employee’s name and the date must be indicated. You need to keep salary deposit registers for five years. Record the accounting of the transaction for issuing deposited salary by posting:

Dt 50-1 Kt 51 - money received from the bank to pay the deposited salary; Dt 76-4 Kt 50-1 - the employee was given a deposited salary.

How to deposit your salary correctly

Depositing funds differs from simple storage in the presence of an established procedure. The procedure is described in the Instructions of the Bank of Russia dated March 11, 2014 No. 3210-U and is as follows:

- On the last day of issuing money, the cashier makes an entry “deposited” in the payroll opposite the names of the employees who did not receive the money.

- After this, the cashier calculates the total amount of wages paid and deferred funds.

- In the final line of the payroll, the cashier indicates the amounts issued and deferred.

- The cashier checks the total amounts of paid and deposited salaries with the total amount on the payroll and signs if they agree.

- Next, the cashier passes the signed pay slip to his supervisor.

- The deposited wage amounts are recorded in the accounting entry Dt 70 Kt 76.04.

Only enterprises that issue wages to employees in cash through a cash register are faced with the deposit of funds intended for wages.

What to do with unclaimed wages?

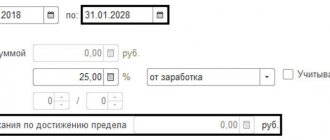

The employee has three years to receive his deposited salary. The countdown begins from the next day after the date on which the company should have issued the salary. If the employee or his representative has not applied for a deposited salary within three years, the following actions must be taken.

In accounting, write off the amount as other income. To calculate the tax, include it in non-operating income. Prepare an inventory report, an accounting certificate and an order from the head of the organization to write off accounts payable.

Never miss a thing in payroll

“Accounting is a convenient program. Thanks to the developers. I have been working with Kontur for a long time. And it’s convenient to manage personnel; you’ll never miss anything in payroll. All reports reach the recipient on time. Everything is updated with the times. I really like it, everything is convenient. And when something is unclear, you can call - and they will always come to your aid. Thanks again to the developers."

Natalia Abbasova, accountant, senior Veshenskaya, Rostov region.

Write-off of deposited wages

The employee has the right to demand unpaid wages returned to the company’s account within 3 years. After this period from the moment of depositing, the funds can no longer be paid (clause 1 of Article 196 of the Civil Code of the Russian Federation) - they become the income of the company, since accounts payable will be written off on a general basis.

In the company's accounting, this is reflected as part of other income by posting D/t 76/4 K/t 91/1. The write-off of deposited amounts is recorded in the reporting period when the statute of limitations for them has expired. The limitation period for deposited wages begins on the next day after deposit.

For example, if (based on the conditions of our example) wage deposits are not paid within 3 years, entries reflecting the receipt of other income from writing off deposit debt to employees will be generated in the company’s accounting in the 1st quarter of 2022:

D/t 76/4 K/t 91/1 in the amount of 50,400 rubles.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to generate income tax?

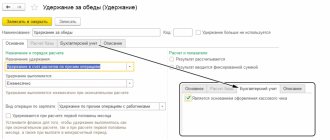

The procedure for writing off amounts of deposited salary in tax accounting depends on the method by which the company calculates income tax.

- With the accrual method, the deposited salary is included in expenses in the same month when it was accrued.

- With the cash method, the amount of the deposited salary is included in expenses only at the time of its payment. Then, in the month the salary is accrued, a deductible temporary difference arises and a deferred tax asset is created, which will be written off after the salary is issued.

Today, most companies have salary project agreements with banks with the transfer of money to employee cards, and salary deposit transactions rarely occur.

Kontur.Accounting is a web service in which you can easily conduct accounting, calculate salaries (and arrange salary deposits), and submit reports. Get to know the service's capabilities for free for 14 days!

Try for free

Salary deposit: what is it and why?

The reasons for an employee’s absence can be very different:

- Business trip;

- Vacation;

- Sick leave, etc.

If the employer is the culprit for non-payment of wages, then this is not a deposit of earnings, but an unlawful violation of labor laws.

The concept of wage deposit applies only to cash payments through the company's cash desk. Thus, if the accrued salary was not received by the employee within three days, then it must be returned back to the bank account. This procedure for cash discipline is regulated by the relevant provision, which states that the amount of funds received, which has a target direction (payment of wages), cannot be in the cash register of the enterprise for more than three days.

Payment of unearned wages

An employee has the right to request previously deposited wages for payment immediately after returning from forced absence. It must be paid using a cash receipt and recorded as an accounting entry.

Deposited wages were issued from the cash register, posting:

Dt 76-4 Kt 50.

Sample cash settlement for payment of deposited salary

If the employee never receives the deposited amount, then after three years it should be written off and reflected in the company’s income. Three years is the standard limitation period established by Article 196 of the Civil Code of the Russian Federation. The write-off is carried out based on the results of the inventory on the basis of the order of the head of the organization and is recorded as follows:

The amount for which previously unpaid wages were previously deposited is written off to income, posting:

Dt 76-4 Kt 91.

How to receive deposited salary

The accountant's procedure for depositing wages and issuing it at the employee's request is clearly defined. If the employee does not come to collect his earnings at the cash desk within the established time frame, the statement is closed. Opposite the surname of such an employee the entry “deposited” is placed.

If the amount is not large and does not exceed the limit established by the head of the enterprise and agreed upon with the bank, then, depending on the circumstances, at the discretion of the chief accountant, it may not be handed over to the bank, but stored in the cash desk until required.

For example, if the deadline for paying salaries is Friday, but it is known for sure that the employee will return from a business trip on Tuesday. If the amount of his earnings is small, then you can keep it in the cash register until the employee returns from a business trip and begins his professional duties.

If the deposited salary exceeds the established limit, the cashier deposits the money into the current account.

The employer is obliged to release unearned earnings to the depositor upon his oral or written application. If the funds are deposited at the bank, it will take a day to make a preliminary reservation and receive this amount from the current account to the cashier. The employee, if he is satisfied with this, can receive the deposited salary on the day of receiving the next advance.

The company may set a special day for the release of deposited amounts. The procedure for issuing such funds should be fixed in the accounting policy. The payment of the deposited salary to the employee is formalized by a cash receipt order.