“Of course, they feel good there in Europe, the attitude is humane, the roads are smooth - they have them! Taxes are almost 50% of salary! They can demand what they want. That's a lot of money! And we only pay 13%. So you can be patient,” how often have you heard such reasoning? Or maybe they told themselves this while bouncing the car on the next pit?

But wait, let's carefully calculate how much we pay in taxes using the example of our very real employee, hamster and financial consultant Zhora Kapustin.

So, Zhora Kapustin has been working with us not so long ago. It's not a dusty job - advising on financial issues, broadcasting and telling jokes. We like Zhora, so we pay him 50,000 rubles. Of course, Zhora deserves more! But let's make allowances for the fact that he is a hamster.

Zhora has a middle-class transport wheel and a small two-room cage. Zhora also likes to eat well, drink a little good wine and dress in mid-level brand stores. Look how fashionably he is dressed. A sight for sore eyes. Well, Zhora, let’s decide whether someone really doesn’t have enough money to clean up after you, and at the same time we’ll add some spice and take one thing from you, the cost of which is equal to tax deductions.

Personal income tax

Personal income tax. This is the main tax. We all know about him, he is well known. In our country it is 13%. It is paid on any income. Be it working in an organization, teaching, renting or selling real estate or a vehicle, winning the lottery, and so on. Yes, yes, Zhora, “I came in a couple of times just to broadcast” is also taxable.

So in order to pay you 50,000 rubles, the company adds 5,600 rubles on top. So much for your fancy hat. Let's move on.

Tax burden calculation

The tax burden (TN) can be calculated:

- in absolute terms - by calculating the exact amount of tax charges. This value is not informative enough; it is needed mainly by company analysts;

- in relative terms – by determining the percentage of funds allocated to pay off tax liabilities (TIT) in relation to the company’s revenue for the year, according to the formula:

CIT = CH (tax amount) / B (total revenue for the year, including non-operating income) x 100%.

The relative burden indicates how much of the company's income is contributed to the budget.

The procedure for calculating the Federal Tax Service was specified in order No. MM-3-06/ [email protected] When calculating the taxable income, you should:

- take into account only revenue “cleared” of VAT and excise taxes;

- take into account the personal income tax paid;

- do not include insurance premiums in the calculation.

When calculating Tax Tax for enterprises operating on OSNO, the amount of accrued tax should take into account:

- taxes accrued for payment - on profit, VAT, others specified in the relevant declarations;

- revenue reflected in the income statement (excluding VAT).

Example

At the end of 2022, the construction company calculated the tax burden based on the information in the accounting and tax reporting:

- revenue according to the financial results report excluding VAT – RUB 20,000,000;

- taxes accrued:

- VAT – 300,000 rubles;

- NNP (income tax) – RUB 1,800,000;

- transport tax – 20,000 rubles;

- transferred personal income tax – 350,000 rubles.

Absolute size of NN = 300,000 + 1,800,000 + 20,000 + 350,000 = 2,470,000 rubles.

Relative size of NN = 2,470,000 / 20,000,000 x 100% = 12.35%.

The industry average tax burden coefficient for construction enterprises, according to Appendix 3 to the Concept, is 10.4%. The calculated value of the company’s tax return is 12.35%, i.e., it is greater than the average value, which means that for now the risk of a visit from inspectors from the Federal Tax Service can be considered minimal.

If the tax burden calculated by the enterprise is lower than the industry average tax burden, then you will have to analyze the reasons that led to such results.

Pension Fund

Contributions to the pension fund are perhaps the largest. After all, after retirement, the state will have to support you for quite a long time. Or hasn't it been long enough? In general, to provide you with a decent old age. The guarantee of a good pension is a regular salary and a long work history, well, or a separate bank account, as Zhora did, because with his stressful work it is not at all a fact that he will last until retirement. Government agencies persistently urge workers not to accept salaries in envelopes, otherwise all they can provide you with is nothing. So your employer sends 22% of everything there - for the benefit of society, and Zhora says goodbye to 11,000 rubles and her brand new belt.

FSS

Another major tax is the Social Security Fund tax. It is this fund that takes on the bulk of our good life. Maternity benefits, ensuring economic stability and well-being of citizens, developing social services, eliminating the consequences of natural disasters and much more. But at the same time, of all taxes, it is one of the smallest! Only 2.9% in the piggy bank for your own well-being. Zhora is outraged. After all, if the cat knocks his cage off the table, there is a high probability that he will have to pick it up himself. Nevertheless, your magnificent pants for 1,440 rubles are also leaving you.

The budget is based on several regions

- Almost half of all tax collections in 2022 were provided by five regions. According to calculations by FinExpertiza analysts, based on data from the Federal Tax Service, 47.7% of all taxes were collected in Moscow, Khanty-Mansiysk and Yamalo-Nenets Autonomous Okrug, St. Petersburg and the Moscow region .

- The most taxes were collected in Moscow - 4.78 trillion rubles. (16.8% of all revenues), then comes Khanty-Mansi Autonomous Okrug - 4.1 trillion rubles. (14.4%) and Yamalo-Nenets Autonomous Okrug (6.7%) . St. Petersburg brought 5% of the total collections, the Moscow region - 4%, Tatarstan - 3.9%, Samara region - 2.9%, Krasnoyarsk and Perm territories - 2.8% and 2.2%, respectively.

- The least taxes were collected in Ingushetia - 5.9 billion rubles, or 0.02% of all-Russian collections, as well as in Tuva - 8.3 billion rubles. (0.03%) and the Jewish Autonomous Region - 7.4 billion rubles. (0.03%).

- However, out of the top five leading regions in tax collection, three regions - Moscow, St. Petersburg and the Moscow Region - collected more tax contributions to their own budgets. So, for example, out of the 4.78 trillion rubles that it collected, Moscow transferred only 1.87 trillion to the federal budgets , and the rest of the funds went to the city budget.

- For comparison: Khanty-Mansi Autonomous Okrug collected 4.1 trillion rubles and gave away 3.75 trillion. The Yamal-Nenets Autonomous Okrug contributed 1.62 trillion rubles to the federal budget, and Tatarstan – 0.78 trillion rubles. , or almost half of the proceeds from Moscow. FinExpertiza Global President Elena Trubnikova explains that the regions receive only income tax and personal income tax from all taxes collected. They must transfer the mineral extraction tax and VAT to the federal budget.

Property tax

Here everything is very individual for everyone. We have an article in which we tell you how to find out your tax, so we won’t quote it here. Let's just say that a tax of 0.1% is paid on the cadastral value. Zhora bought himself a beautiful two-room cage in a new building and pays 5,000 rubles a year for it. So what if she has a mortgage? Zhora, it's time for a tie.

Everything has changed: how to calculate property taxes in 2020?

Real Estate Taxes

Citizens of Russia who own an apartment, house, room, dacha or garage pay property tax. This type of taxation is calculated from the cadastral value of the property and the tax rate, which cannot exceed 0.1%.

For example, an individual owns an apartment worth 2,500,750 rubles. Property tax will be 2,501 rubles per year. If a citizen owns a house, he also pays land tax. The land tax rate for residential buildings is not higher than 0.3%, but in each region it is determined by local authorities.

In addition, each owner pays for major repairs of an apartment building. The amount of payment is determined based on the square meters of the apartment.

When selling real estate worth less than 1,000,000 rubles or owning an apartment for more than 5 years, no tax is paid. In other cases, a person who sells real estate at a higher price than he bought it for is required to pay a 13% income tax on the difference.

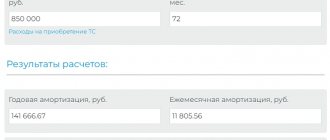

Transport tax

We also remember that Zhora has a very good transport wheel. Nothing special, but air conditioning, stabilizer and soft ride. In general, this is an average wheel at an average price. For car owners there is a special calculator where you can calculate the cost of your tax. For Zhora this is 4,000 rubles. And this left Zhora shirtless. And this is where the questions begin. Transport tax goes towards road construction. Attention, question. Where are the roads?

Tax burden - what is it?

Tax burden is the percentage of total revenue that a company pays in taxes. At the end of the year, the Federal Tax Service calculates its average value for each industry. This indicator becomes one of the conditions in the selection of applicants for on-site inspection. The fact is that the Federal Tax Service has radically changed its approach to organizing control over the activities of enterprises and the completeness of tax collection. Now, instead of conducting total audits, tax officials analyze the company’s indicators, correlating them with the criteria for the risk of committing tax violations (underpayment of taxes).

Such a transition is regulated by the Concept of planning on-site inspections, approved by Order of the Federal Tax Service No. MM-3-06/333 dated May 30, 2007 (as amended on May 10, 2012), according to the provisions of which planning inspections has become an open process built on the selection of payers for on-site control. according to risk criteria. Not the only one, but the most significant (criterion No. 1) of them is the amount of the tax burden on the company (section 4 of the Concept). An enterprise can calculate its indicator independently and then compare it with the industry average calculated by tax authorities. An enterprise whose tax burden stands out (turns out to be lower) from the general range of average indicators is more likely to be audited.

Thus, the tax burden is an important indicator not only for the Federal Tax Service, but also for a specific payer. Its analysis allows the company to choose the most appropriate taxation system and predict the tax authorities’ assessment of the financial statements. That is, the Federal Tax Service encourages companies to independently clarify their obligations, analyze them, minimize and eliminate violations.

There are several algorithms for calculating the total tax burden for a company, but for tax analysis it is calculated by the ratio of the share of taxes accrued for payment to the amount of income received in a certain period.

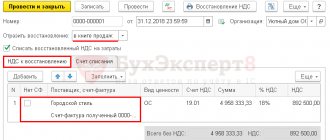

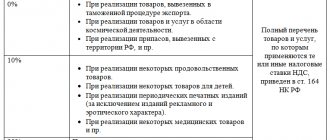

VAT in stores

Value added tax is imposed on all goods, works and services. The basic rate is 20%. There is another 10% - for medicines, for example, and 0% - but this is rare and certain documents are needed. So dinner in a cafe or food at the market - absolutely everything is subject to VAT. There is an option to shop at duty free, but it is quite inconvenient. So about 4,000 rubles a month and your favorite socks leave us.

Calculation of the tax burden by types of taxes and tax regimes

The letter of the Federal Tax Service dated July 25, 2017 No. ED-4-15 / [email protected] demonstrates the formulas for calculating tax income for specific taxes and types of regimes used in activities:

- For income tax - the ratio of accrued income tax to the amount of income from sales and non-operating income according to the tax return. When calculating the tax burden on the tax burden, it is necessary to remember that the tax burden for a manufacturing enterprise will be considered low in the amount of 3%, and for a retail enterprise - 1%;

- For VAT, NN can be calculated by the ratio of the VAT accrued for payment under the VAT declaration to the tax base determined according to the 3rd section of the declaration. If the company operated not only in the Russian Federation, but also exported products, then the tax base of the 4th section is added to the data of the 3rd section. In addition, the share of tax deductions in the total amount is also taken into account - it should not be more than 89%;

- Individual entrepreneurs on OSNO calculate the personal income tax burden by the ratio of accrued tax to income according to the personal income tax return;

- Under the simplified tax system, the burden is determined by the ratio of the amount of the single tax under the simplified tax system accrued according to the declaration to the declared income;

- For Unified Agricultural Tax payers, the burden is considered the ratio of the Unified Agricultural Tax tax calculated for payment to the income according to the Unified Agricultural Tax declaration.

If companies (regardless of the taxation regime) pay various taxes (water, land, transportation, mineral extraction tax, etc.), then the accruals for them are also taken into account when determining the total tax burden.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.