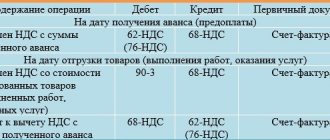

Recovered VAT - what is it? The question of VAT restoration arises in relation to the tax previously

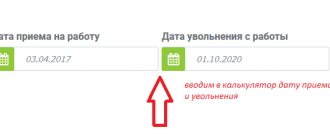

Regulatory regulation Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average

All company managers understand that an on-site tax audit is very serious. But many

Information disclosure rules Order of the Ministry of Finance No. 287n dated November 27, 2020 amended the provisions on

Nowadays, a situation where the tax authority requires a pensioner to pay property tax

Almost when running any business related to material assets, the entrepreneur has a need to use

Unified forms Article 91 of the Labor Code of the Russian Federation reflects the responsibilities imposed on the head of an institution for the organization

Invoice under the simplified tax system All organizations and individual entrepreneurs using the simplified system are not VAT payers, but

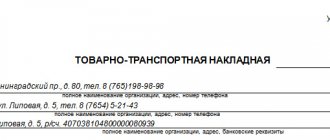

Who should draw up a bill of lading If transportation of inventory items occurs directly by the owner or seller

Let me remind you that clause 27 of the Regulations on accounting and financial reporting (approved by Order of the Ministry of Finance