When are Forms 3, 4 and 6 of the balance sheet prepared?

Forms 3, 4 and 6 of the balance sheet are included in the annual financial statements and are appendices to its main forms (balance sheet and income statement):

- Form 3 - statement of changes in capital;

- Form 4 - cash flow statement;

- Form 6 - report on the intended use of funds.

The application forms, as well as the main forms of accounting, are approved by the order of the Ministry of Finance of Russia “On Forms of Accounting Reports of Organizations” dated July 2, 2010 No. 66n (as amended on April 19, 2019). The same document contains a rule establishing that in a simplified version of reporting, the required forms are a balance sheet, a report on financial results and a report on the intended use of funds, and explanations for them should be drawn up only if absolutely necessary (clause 6).

IMPORTANT! When preparing reports for 2022, keep in mind that accounting forms have changed since 2019. Key differences: reporting can only be prepared in thousands of rubles; millions can no longer be used as a unit of measurement. OKVED has been replaced by OKVED 2. For other changes, see here.

Read more about existing balance sheet options in the article “Balance Sheet (Assets and Liabilities, Sections, Types).”

Since the report on the intended use of funds (Form 6) is intended for use when there is a movement of funds for a very specific purpose, it is not always used. Thus, Forms 3, 4 and 6 may not be prepared by persons reporting under the simplified form.

For information about who can use simplified reporting, read the material “Simplified reporting for small businesses” .

But the set of reports generated according to its full version will include forms 3 and 4. In this case, Form 6 and other explanations will be issued if necessary.

ConsultantPlus experts provided step-by-step instructions for filling out appendices to financial statements. Get trial access to the K+ system and proceed to the 2021 accounting manual.

Read about the principles that serve as the basis for the formation of accounting records in the article “What requirements should accounting records satisfy?” .

What is this?

Unified Form 4 is a kind of questionnaire, which is an official document filled out by an applicant when applying for employment at an enterprise to fill a vacancy related to access to any prohibited information related to state secrets.

Normative base

An enterprise related to state secrets is obliged to employ job seekers in accordance with the instructions developed by Government Resolution No. 63. It is worth noting that state secrets include information protected by it. Such information may be relevant to the following areas of activity:

- Political.

- Economic.

- Intelligence.

- Military.

- Other areas of activity that, if disseminated, could pose a threat to the security of the state.

Citizens and officials receive access to secrets at their own request. However, in the absence of such permission, the applicant will not be able to find employment in such an enterprise. In order to get the desired vacancy, a person must personally fill out a questionnaire (on form No. 4) and sign it, and after studying it by an employee of the security department, receive encouragement.

When and what to use?

Today there are many institutions in which employees are confronted with classified information related to state secrets. At the same time, this may be potentially important information, or not so much. A future employee of a security enterprise, by filling out such a questionnaire, certifies that he can be trusted with such information. To do this, he must personally fill out this document, and only manually, writing down all the data about himself in detail, according to the sample presented below. Naturally, such a document will be carefully checked by the relevant departments.

When filling out the questionnaire, it is recommended to follow the established guidelines. The form must include a photo of the applicant, size (6x4). The document must be signed by the candidate for the position and sealed with the seal of management.

To help you fill out this form, appropriate instructions are provided.

Form 3 balance sheet

Form 3 of the balance sheet is the statement of changes in equity. It contains information about the equity capital of the organization, which includes (clause 66 of the PBU on accounting and accounting, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n):

- authorized (share) capital;

- Extra capital;

- Reserve capital;

- retained earnings;

- other reserves.

In addition, the report reflects information on own shares purchased from shareholders.

Form 3 consists of three sections:

1. Capital movement

This is a table that shows the change in the organization’s capital over 2 years (reporting and previous). It shows how the capital has changed (whether it has increased or decreased) and why the changes have occurred.

It's easy to fill out this section. First you need to indicate the balances as of December 31 of the year preceding the previous one. Then fill in the indicators for the previous year and display the capital balance as of December 31 of the previous year. Next, you need to reflect the movement and balance of capital at the end of the reporting year. Indicators are reflected in the corresponding columns and rows. For example, if there was an increase in additional capital due to a revaluation of property, the amount of the revaluation is reflected in the line “Revaluation of property” (column “Additional capital”).

2. Adjustments due to changes in accounting policies and correction of errors

The title of the section speaks for itself: it contains information about adjustments to the amount of capital caused by changes in accounting policies or associated with the correction of significant errors of previous years identified after the approval of last year’s financial statements. It is advisable to fill it out before section 1, since its data is used to determine the indicators of the first section.

3. Net assets

This contains information about the organization’s net assets for 3 years (the reporting year and the previous 2). The procedure for their calculation is determined by order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n.

Read more about this procedure in the material “A new procedure for calculating net assets has been approved .

Form 3 can be found on our website using the link below:

Who makes the ID

The procedure for booking, receiving and issuing relevant documents to employees of organizations responsible for military registration work, and to those liable for military service themselves, is prescribed in the Resolution of the Interdepartmental Commission on the Reservation of Citizens in the Reserves dated 02/03/2015 No. 664c. Here are the forms that will be mentioned in our text.

The main paper for confirming the reservation is Form F-4. Its form can be downloaded below to familiarize yourself with it.

But if you need blank forms to register and book new employees, then simply filling it out is not enough. The required number of forms must be received by the person responsible in the organization for maintaining military records and reservations at the military commissariat against signature (form No. 10). This is done to record the documents issued.

Forms are filled out on the basis of military IDs, including the part called “notification”. The responsible person must indicate:

- the name of the military commissariat (department) that issued the form;

- FULL NAME. the booked employee, his year of birth;

- military specialty number (MS): for officers - 6 digits, and for privates - 3 digits;

- military rank;

- name and address (legal) of the organization where the reserved person works, as well as his position (profession);

- the basis on which the citizen was booked (for example, if his specialty is included in the relevant list);

- duration of military deferment. It cannot exceed 6 months from the date of mobilization announcement. In this case, the deferment period must be indicated in writing, and not in the form of a number.

An example of filling out the F-4 form (all information is fictitious, only the part that is filled out by an employee of the organization is shown)

After filling out the document, it must be signed by the organization’s management and taken to the commissariat of your district. Additionally, you need to attach a list of employees who are being booked, their military ID cards and personal cards. At the commissariat, the certificates are signed by authorized persons, after which all documents can be collected.

Please note that confirmation of booking for a specific employee must be issued within 10 days after hiring or the end of the probationary period, if one has been established.

Form 4 balance sheet

A Form 4 balance sheet is the common name for the cash flow statement. It contains information about the organization's cash flows for the reporting and previous years. Cash flows are detailed in the context of current, investment and financial transactions. For each type of activity, the receipt and expenditure of funds are shown.

At the same time, current operations include operations related to the implementation of ordinary activities. For example, receipts include sales proceeds and rental payments, while payments include payments to suppliers and wages. Investment transactions are those related to the acquisition, creation or disposal of non-current assets.

As cash flows from financial transactions, flows from operations related to attracting financing on a debt or equity basis, leading to a change in the size and structure of the capital and borrowed funds of the organization (credits, borrowings, deposits, etc.) are classified.

The procedure for filling out the report is described in detail in PBU 23/2011 “Cash Flow Report” (approved by Order of the Ministry of Finance of the Russian Federation dated 02.02.2011 No. 11n).

You can also download the form on our website using the link below:

A sample of filling out a cash flow statement was prepared by ConsultantPlus experts. Get trial access to the K+ system and download the document for free:

Basic rules for filling out form M-4

Since 2013, this form has not been strictly mandatory for use, however, it is still widely used in enterprises and organizations.

The receipt order has two sides and contains all the necessary information regarding the supplier, consumer and the product itself: its name, grade, size, quantity, cost, etc. (it should be noted that some cells can be left empty). If the inventory contains precious metals or stones, then this document must indicate information from the accompanying technical passport.

When filling out an order, you should avoid mistakes and omissions, and if there are any inaccuracies, it is better to fill out a new form.

According to the rules, the form can be filled out either by hand or on a computer, but in any case, the document must necessarily contain “live” signatures of the supplier’s representative and the consumer.

After registration, the number of the receipt order must be registered in the materials accounting card and transferred for storage to the accounting department of the enterprise, where it, like other primary documents, must be stored for at least five years.

The document is issued exactly on the day the goods are received and reflects the actual receipt. A receipt order is drawn up in one copy, and if there are several deliveries from the same supplier within one day, they can all be entered into one document.

Form 6 balance sheet

The sixth form of balance sheet is a report on the intended use of funds, which is compiled by non-profit organizations (NPOs) and legal entities receiving any targeted funding.

For NPOs, this report is essentially the main one. In this report they disclose information about the intended use of funds received to support statutory activities. It shows the balance of targeted financing at the beginning of the reporting year, the receipt and expenditure of such funds during the reporting period and their balance at the end of the year.

Form 6, as well as the main reporting forms (balance sheet and financial results report), has 2 design options: full (Appendix 1 to Order No. 66n) and simplified (Appendix 5 to Order No. 66n). The latter may be made up of organizations that have the right to use simplified methods of accounting when preparing reports in a simplified form.

You can download both versions of Form 6 on our website using the links below:

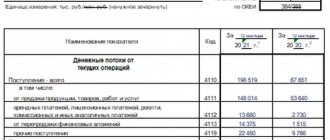

Cash Flow Statement: Example

As an example, consider Finist LLC, which is engaged in the wholesale trade of cars.

Here are the main indicators that served as data sources for filling out the lines of the DDS report for 2022:

| Index | Amount, thousand rubles | Line, amount thousand rubles. | Reflected amount, thousand rubles. |

| Current Operations | |||

| Revenue from the sale of cars, incl. VAT 20% | 150 000 | 4111 | 125 000 |

| Receiving funds from renting out property, incl. VAT 20% | 600 | 4112 | 500 |

| Payment to suppliers, incl. VAT 20% | 90 000 | 4121 | 75 000 |

| VAT (shown collapsed) | Outgoing: (150,000 + 600) x 20 / 120 = 25,100; Incoming: 90,000 x 20 / 120 = 15,000 | 4119 | 10 100, because outgoing VAT is greater than incoming VAT: 25,100 – 15,000 = 10,100 |

| Salary | 18 200 | 4122 | 18 200 |

| Income tax | 6 800 | 4124 | 6 800 |

| Other taxes (property tax) | 250 | 4125 (added by Finist LLC independently) | 250 |

| Receipt total | X | 4110 | 135 600 (125 000 + 500 + 10 100) |

| Payment summary | X | 4120 | 100 250 (75 000 + 18 200 + 6 800 + 250) |

| Balance by block of transactions | X | 4100 | 35 350 (135 600 – 100 250) |

| Investment operations | |||

| The loan issued in 2022 was returned to the company | 5 000 | 4213 | 5 000 |

| Dividends received from participation in other organizations | 1 200 | 4214 | 1 200 |

| A new building was purchased, payment includes VAT 20% | 12 000 | 4221 | 10 000 |

| Shares of a third-party organization were purchased | 2 000 | 4222 | 2 000 |

| VAT on the purchased building is reflected | 2 000 | 4229 | 2 000 |

| Receipt total | X | 4210 | 6 200 (5 000 + 1 200) |

| Payment summary | X | 4220 | 14 000 (12 000 + 2 000) |

| Balance by block of transactions | X | 4200 | (7 800) (6 200 – 14 000) |

| Financial operations | |||

| A contribution to the authorized capital of a new participant was received | 200 | 4312 | 200 |

| Dividends paid to founders | 13 000 | 4322 | 13 000 |

| Receipt total | X | 4310 | 200 |

| Payment summary | X | 4320 | 13 000 |

| Balance by block of transactions | X | 4300 | (12 800) (200 – 13 000) |

In the example under consideration of filling out a cash flow statement for 2022, Finist LLC looks like a completely successful enterprise: a positive result from current activities allows the company to purchase a new building and pay off the owners, i.e. cover the negative balance on investment and financial transactions.

The DDS report ends with the lines:

- 4400 – total balance for the year: 35,350 – 7,800 – 12,800 = 14,750;

- 4450 – balance of cash and cash equivalents at the beginning of the year: 9,870;

- 4500 – balance of cash and cash equivalents at the end of the year: 9,870 + 14,750 = 24,620.

As of December 31, 2020, at the cash desk and in the accounts of Finist LLC - 24,620 thousand rubles.

Results

Forms 3, 4 and 6 are appendices to 2 main accounting reporting documents: the balance sheet and the financial results report. Forms 3 (statement of changes in capital) and 4 (statement of cash flows) are mandatory if the main reports are created in their full form. Form 6 (report on the targeted use of funds) is drawn up only if the reporting entity has funds for targeted financing. Just like the 2 main reporting forms, Form 6 can be prepared in a simplified version by an organization that has the right to maintain simplified accounting.

Sources:

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is the F-4 form, when and who needs it

A certificate of reservation in form F-4 is a document confirming a deferment from conscription, which is issued to an employee who is in the reserve and subject to reservation. Typically, the decision about who is subject to reservation is made taking into account territorial lists of professions and positions. However, organizations may request personal deferments for individual employees if their activities are necessary for the smooth operation of the enterprise in wartime. But the final decision on this matter is made at the level of interdepartmental commissions on reservation issues.

Who is required to submit reports in Form P-4

Most legal entities involved in medium and large businesses must report to the state using this form. Moreover, if any company has representative offices and branches, then a separate form must be filled out for each of the separate divisions.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

It is worth noting that some enterprises and organizations are exempt from the need to submit form P-4 to the statistical accounting service. In particular, organizations engaged in small businesses, as well as public organizations and various cooperatives have the right not to transfer it. However, it should be remembered that such a possibility must be agreed upon and approved by the state statistical agency.

Individual entrepreneurs are also not required to submit this type of statistical reporting by law.

Form 4: form and sample filling

Form 4, filled out when obtaining access to state secrets, is called the “Questionnaire”. The questionnaire form is attached to the Instructions, approved. Government Decree No. 63 dated 02/06/2010.

Form 4 in Word can be found here.

As we noted above, the questionnaire is filled out by the person himself by hand. A photograph measuring 4x6 cm is attached to the form.

The questionnaire must be filled out no earlier than a month before it is sent to the security authority (paragraph “b”, paragraph 33 of the Instructions, approved by Government Decree No. 63 of 02/06/2010). The form 4 questionnaire is signed by an employee of the personnel department and certified by the seal of the organization or personnel department (if there is a seal) (clause 30 of the Instructions, approved by Government Decree No. 63 of 02/06/2010).

An example of filling out the form 4 form is given here.

INFORMATION

on changing the registration data of citizens staying

in reserve, working in __________________________________________

(name of company)

| № p/p | Last name, first name, surname | Year birth | changes | Note: desire |

_____________________ _________________ ___________________

(head of organization) (signature) (initials, surname)

M.P.

"____"______________ 200__

Explanation of the form

The organization, within 2 weeks, is obliged to provide information to the military commissariats at the place of residence about citizens who are in the reserve and subject to conscription for military service, hired or dismissed from work (expelled from educational institutions), as well as information about changes in position, qualifications, military specialty, military rank, composition, profile, marital status, address of residence and extension of deferment.

P A P K A No. 5

Documents on maintaining military records and reservations

citizens in reserve

1. Log of checks on the status of military registration and reservation of citizens in the reserve.

2. Book on recording special military registration forms.

3. Book of registration of transfer of special military registration forms, military IDs and personal cards.

4. Sample receipt.

5. Reservation restrictions.

6. Temporary standards for reservations.

7. Sample form of certificate and notice in form 4.

8. Journal of personal cards of form T-2 (T-2GS).

9. Sample of a personal card form T-2 (VUR).

10. The procedure for filling out section II “Information on military registration” of personal cards of forms T-2 and T-2GS.

11. Extract from the Decree of the Government of the Russian Federation No. 1541 of December 25, 1998 “On approval of the regulations on military registration.”

12. Extract from the Code of the Russian Federation on Administrative Offences.