Fulfilling the duties of a temporarily absent employee There are several ways to replace vacationers: Combination. The employee combines his

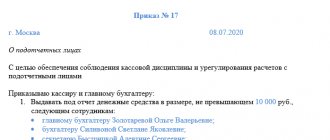

Who are called accountable persons? The order determines the list of employees who receive money from the organization’s cash desk

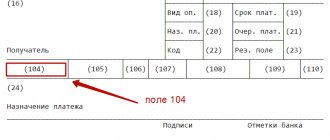

In 2022, the rules for filling out payment orders were updated. Some changes take effect immediately,

Registration of the issuance of financial assistance The package of documents for registration of the issuance of financial assistance is not defined by law,

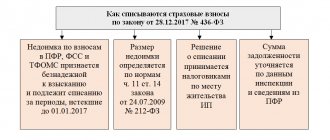

An individual entrepreneur decided to close his business. In order not to be disturbed by supervisors later

Why is a collection order necessary? The role of a collection order is simple: to pay for any services or

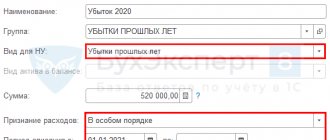

Tax base As a general rule, profit is income received minus expenses allowed by the Tax Code

Registration of payment documents It is important to know how, from 05/01/2021, two details of the recipient of funds should be filled in

Tax legislation obliges persons who own vehicles to annually accrue and pay tax. Frequency of this

Tax amnesty in 2022 for individuals In the Tax Code of the Russian Federation and the current legislation nowhere