Preparation of payment documents

It is important to know how, from 01.05.2021, two details of the recipient of funds (Federal Treasury body) should be filled in in payment orders for transfers to the budget:

- in field 15 - the account number of the recipient's bank (number of the bank account included in the single treasury account - UTS). Until 01/01/2021 this field was left empty;

- in field 17 - the new account number of the territorial body of the Federal Treasury (TOFK), recommended from 01/01/2021, mandatory from 05/01/2021.

By Order of the Ministry of Finance dated September 14, 2020 No. 199n, the procedure for entering information about an individual taxpayer has been changed from January 1, 2021. If you do not have a TIN and UIN, it is enough to enter the series and number of your passport or SNILS. This applies to individuals without individual entrepreneur status. The procedure for filling out a payment request for personal income tax for individual entrepreneurs has not changed - the entrepreneur indicates the TIN assigned to him.

In addition, from October 1, 2021, an updated list of payment grounds for repaying debts for past periods will apply (fields 106 and 108). In addition, changes affected the rules for filling out field 101.

Use free instructions from ConsultantPlus experts to correctly calculate and pay personal income tax.

Advance payments for income tax: payment deadlines in 2022

The timing of payment of advances on income tax depends on which calculation method the company uses. There are 3 of them in total:

- Quarterly.

Paid by the 28th day of the month following the reporting quarter.

- Monthly with additional payment.

For each month of the quarter, advances are paid before the 28th day of the current month, additional payment based on the results of the quarter is made no later than the 28th day of the month following the previous quarter. For example, for the 1st quarter of 2020, advances must be paid for March - before 03/30/2020 (03/28 falls on a Saturday), for April - before 04/28/2020, for May - before 05/28/2020. Additional payment for the 1st quarter must be made before 04/28/2020.

- Monthly based on actual profit.

Transferred no later than the 28th day of the month following the reporting period.

You can learn more about the deadlines for making advance payments of income tax in 2022 in this article.

If the deadline for payment of the advance payment falls on a weekend or holiday, it is postponed to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Let's look at how to fill out a payment order for an advance payment of income tax in 2022.

Filling rules

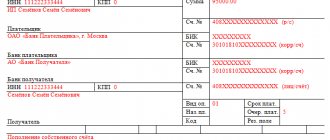

The payment order is divided into fields, each of which has a number. Unique numbers are fixed in position 762-P. Let's look at the personal income tax payment form in 2022 and the rules for filling out the values of the main fields of this document, which most often raise questions.

By fields:

- field No. 16. Enter the name of the recipient. When the payment is intended for the Federal Tax Service, then, in addition to the name of the branch or department of the regulatory body, the abbreviated name of the Federal Treasury body should be indicated;

- field No. 18. The type of operation is indicated - in the case of payments, the operation means the transfer of money on the basis of an order, and the code “01” is always entered;

- fields No. 19, No. 20 and No. 23. The value of the details is not indicated if the bank does not have special requirements for filling out;

- field No. 21. Here you should indicate the order of payment in accordance with the provisions of Art. 855 of the Civil Code of the Russian Federation. When paying personal income tax, code 5 “Other payments not specified in the paragraphs above” is entered;

- field No. 22. Designed to indicate the UIP code. It is almost always set to “0”. You will have to fill in a specific digital value only if the Federal Tax Service specifies the UIP in its request for the transfer of taxes;

- field No. 24 - purpose of payment; in case of personal income tax debt, the period for which the debt arose is written in it;

- field No. 101. Characterizes the status of the payer. When paying personal income tax, the following is used: “02” - if the tax is paid by an organization as a tax agent; “13” - if the individual entrepreneur pays tax for himself;

- field No. 102. Payer checkpoint. Organizations that have separate divisions list the calculated and withheld amounts of personal income tax both at their location and at the location of each of their separate divisions (clause 7 of Article 226 of the Tax Code of the Russian Federation). Federal Tax Service specialists (letter dated October 14, 2016 No. BS-4-11/ [email protected] ) note that if each separate division of an organization is assigned a separate checkpoint, a payment order for the payment of personal income tax indicating this code is issued for each such separate division. Moreover, this procedure also applies in the case when the registration of several separate divisions is carried out in accordance with clause 4 of Art. 83 of the Tax Code of the Russian Federation, at the location of one of them;

- field No. 104. BCC is indicated. Approach this field with special attention, because if you make an error in the code, taxes (penalties and fines) will be credited to a completely different type of payment. You will need the KBK code 18210102010 011000110 - the main details of personal income tax for employees in 2022. It is uniform for paying tax on income not exceeding 5 million rubles;

- field No. 105. The value of the code assigned to the territory of the municipal formation (inter-settlement territory) is indicated in accordance with the All-Russian Classifier of Territories of Municipal Formations (OKTMO). If the payment is made on the basis of a declaration, you can take the code directly from it;

- field No. 106. Basis of payment. The full list of possible designations is specified in clause 7 of Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107N with amendments that entered into force on October 1, 2021;

- field No. 107. As required by the rules for filling out personal income tax bills, formulated by the Ministry of Finance in a letter dated June 11, 2019, in this field the company indicates the period for which taxes are paid, and the current month is entered. The full list of possible designations is specified in clause 8 of Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107N. If it is impossible to determine the period, “0” is set. The taxpayer will have to generate several separate settlement documents with different indicators of the tax period, in a situation where the legislation on taxes and fees provides for more than one deadline for payment of tax payments and specific tax payment dates are established for each deadline. For example, in accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the following payment deadlines are established for personal income tax: no later than the last day of the month in which payments were made, when paying the taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay to an employee;

- no later than the day following the day of payment of income to the taxpayer - when paying all other income, including wages to employees, income in kind. The LLC transfers the payment no later than the day following the day of transfer of dividends;

Sample payment document for personal income tax transfer:

In the absence of a chief accountant in the organization, only the manager signs the payment slip.

When to pay

Tax payment is made no later than one working day following the day the income is issued (Clause 6, Article 226 of the Tax Code of the Russian Federation). An exception is made for vacation pay and sick leave: tax on them must be paid no later than the last day of the month in which the employee was given the appropriate funds.

Therefore, if on the same day you transfer personal income tax from the salary for the previous month and from vacation pay for the current month, then fill out separate payment orders for both salary and vacation pay (letter of the Federal Tax Service No. ZN-4-1 / [email protected] dated 12.07 .2016 ).

Filling out a payment form when paying penalties

Let's consider filling out a payment slip for personal income tax penalties with KBK in 2022 upon receipt of a request from the tax authority. The procedure for completing the document is different. We indicate in field 104 KBK 182 1 01 02010 01 2100 110 for tax taxed at a rate of 13%. For penalties accrued on taxes taxed at a rate of 15%, BCC 182 100 110 is used.

In field 106, according to the new rules, the ZD code is indicated, which means repayment of the debt, and the type of this debt can be determined by field 108, where a letter code is placed before the document number:

- “TR0000000000000” - number of the Federal Tax Service’s request for payment of taxes, fees, and insurance contributions;

- “PR0000000000000” - number of the decision to suspend collection;

- “AP0000000000000” - number of the decision to prosecute for a tax offense or to refuse to prosecute;

- “AR0000000000000” - number of the executive document or enforcement proceedings.

In field 107 we write down the period during which the debt arose.

In field 109 the date of the corresponding document is entered. If the date is unknown, set it to 0.

In field No. 22, enter the UIN value specified in the request. If there is no UIN code, enter 0 in the field. In field 24, write a detailed purpose of payment indicating the details of the Federal Tax Service request or indicate that repayment of the debt is voluntary.

| Penalties for personal income tax based on the request of the tax authority dated ______ No. ___. |

What to write on the pay slip when dismissing an employee?

There are often cases when, after dismissal, former employees of a particular enterprise go to court with a claim to protect their own rights.

This is because they were violated during the dismissal process. This is directly related to the procedure for terminating the contract. Very often, going to court is possible because the bosses incorrectly carried out the calculation, and during this, funds were illegally withheld from the former subordinate.

It must be remembered that a correctly stated purpose of payment in the appropriate order when dismissing a person from his position is a guarantee that there will be no further legal proceedings with the ex-subordinate.

Correctly filling out the document allows for high-quality accounting. Few people know that at the legislative level there are no strict requirements and rules regarding the information that must be entered in the “Purpose of payment” section.

There are several generally accepted options that the responsible person can use when filling out the document in question, as a rule, these are:

- the exact number, as well as the date when the document was written;

- The full name of the services offered by a particular company must be written down. Various products may be listed here, as well as types of work performed;

- you can write any information related to this document;

- then the exact purpose of the payment must be written down;

- the name of the tax, as well as the deadlines for its mandatory payment.

We must not forget that the number of characters that can be used by the responsible person when filling out the last paragraph is significantly limited. The employee needs to enter the name of the payment in only two hundred and ten characters. It is for this reason that it is allowed to indicate generalized information without distorting the purpose for which the money transfer is carried out.

The “payment purpose” field may differ slightly in meaning depending on different filling methods:

- The purpose of the money transfer indicates what type of transaction was carried out. Consequently, the company transfers the amount. This can be not only payment for labor, but also payment for a specific service;

- Using the payment purpose, the exact details of the document are written down, on the basis of which a detailed calculation is made. It is required to indicate the paper number, as well as the date of its preparation. We must not forget that, if necessary, the responsible person (in this case the employer) has the right to indicate detailed information about the document, which will confirm that the translation was carried out correctly;

- the name of the work performed, services provided or goods sold can indicate both a complete list of names and its general name;

- As a type of payment, it is often specified which funds are transferred. For example, this could be an advance payment, an additional payment;

- the exact amount of tax, which is calculated depending on the total amount of funds transferred. If this payment is not taxed, then this fact must be reflected in the document being drawn up;

- other mandatory information that may be required to verify the money transfer. For example, the time period for which the employee is entitled to this amount.

When filling out a payment order for the total amount with the register, the responsible person must write a link to the register. You also need to indicate all the other orders that are in it.

When drawing up a document, the employer must adhere to all the basic rules and requirements provided for by current legislation for the preparation of this paper.

If the payment form is filled out due to the need to transfer wages to employees’ bank cards, then the following information must be indicated:

- name and address of the bank. We are talking about the financial institution in which employees have bank accounts;

- the amount of money that a particular enterprise must transfer to an employee before immediate dismissal;

- It is necessary to indicate the purpose for which the money transfer is made. It is necessary to provide a reference to the date and exact number of the relevant register.

If a company or enterprise makes a payment to only one person, for example in the case of immediate dismissal, then in the “Recipient” field it is important to enter his last name, first name and patronymic. But in the field of paper called “Account” you must indicate the exact bank account number of the payee.

Budget Classification Codes (BCC)

A new BCC has been introduced for transferring tax on the income of an employee or founder if it exceeds 5 million rubles during the year.

| Payment Description | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| Income tax for individual entrepreneurs “for oneself” | 182 1 0100 110 |

| Payment by an individual (not an individual entrepreneur) | 182 1 0100 110 |

| Penalties for personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| Penalties paid by individual entrepreneurs “for themselves” | 182 1 0100 110 |

| Penalties paid by an individual (not an individual entrepreneur) | 182 1 0100 110 |

| Fines for non-payment of personal income tax by a tax agent | 182 1 0100 110 |

| Fine for personal income tax (individual entrepreneur “for oneself”) | 182 1 0100 110 |

| Personal income tax fine for an individual (not an individual entrepreneur) | 182 1 0100 110 |

By Order of the Ministry of Finance No. 236n dated 10/12/2020, new budget classification codes were introduced from 01/01/2021. They apply to personal income tax, calculated at an increased rate of 15%, on income exceeding 5 million rubles per year. This tax must be paid separately.

| Payment | KBK |

| Personal income tax at an increased rate of 15% | 182 1 0100 110 |

| Tax penalties at an increased rate of 15% | 182 1 0100 110 |

| Tax penalties at an increased rate of 15% | 182 1 0100 110 |

Separate BCCs are provided for the payment of personal income tax on dividends.

| Who transfers the tax to the budget | KBK |

| Tax agent | 182 1 0100 110 |

| Individual, recipient of dividends | 182 1 0100 110 |

The purpose of the payment must indicate that the tax is transferred from income in the form of dividends.

Errors in personal income tax payment orders

Please fill out the payment order details very carefully. If you make a mistake in them, your tax will be considered unpaid. You may have to re-transmit the tax amount to the budget and pay penalties for personal income tax (if you discover the error after the deadline for payment).

But this does not mean that the amounts paid will be lost. Although sometimes legal entities and individual entrepreneurs with staff as a safety net have to re-transmit the required amount in order to avoid a dispute with the Federal Tax Service.

The most important details include (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation):

- Federal Treasury account number;

- name of the recipient's bank.

Errors in other details are not critical, since the money will still go to the budget. The error is corrected by clarifying the payment (Clause 7, Article 45 of the Tax Code of the Russian Federation).