The concept of marriage and its types A detailed description of marriage can be taken from the Methodological Recommendations for

Formation of the cost of goods The concept of the cost of goods for the “simplified” in Chapter. 26.2 of the Tax Code of the Russian Federation does not

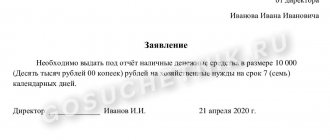

How to correctly issue accountable amounts to employees The procedure for issuing accountable amounts to employees consists of stages: Employee

The declaration is filled out in the following sequence: first, the annexes to the declaration corresponding to those operations that

One of the most controversial and complex types of taxation is VAT, that is, a tax on

On September 29, 2011, the Law “On the National Payment System” came into force, which introduced

Who should draw up a waybill? A waybill is a document for accounting and control

The patent tax system is the only special regime available only to individual entrepreneurs. Often

How to transfer losses: basic rules If a company received a loss based on the results of previous periods,

Cash transactions are operations related to the receipt, issuance, storage of cash and registration