In what cases is a collection order issued?

A collection order is a payment document for debiting funds from the payer’s account without his additional consent (indisputably). The Civil Code regulates the procedure for applying collection payments (Articles 874-876 of the Civil Code of the Russian Federation).

Collection orders are submitted to the account:

1) tax authorities and extra-budgetary funds if the deadline for fulfilling the requirement has expired;

2) bailiffs if there is a writ of execution for collection;

3) counterparties of the enterprise or individual entrepreneur, if there is an agreement with the condition of payment in an indisputable manner;

4) a bank conducting settlements for an organization or individual entrepreneur - for counterparties on the basis of their application and a writ of execution issued in connection with a court decision.

In any case, the use of a collection order is based on the recipient’s right to collect a certain amount of money from the payer (clause 7.4 of the “Regulations on the rules for the transfer of funds” No. 383-P, approved by the Bank of Russia on June 19, 2012).

Unscrupulous bank

It is worth considering that with the chosen collection method there is a risk of dishonest actions by bank employees - they can notify the debtor about the received writ of execution before the funds are debited from the account. And here the priority mechanism provided for in Article 855 of the Civil Code of the Russian Federation comes into play: an informed debtor can direct the balance of money in the account to pay “salaries”, “bonuses” to employees or royalties in favor of third parties - such a transfer has a higher status than payments for executive orders. documents. In this simple way, the debtor is able to leave the potential creditor without proper satisfaction. It is possible to avoid this situation if you follow the path of initiating enforcement proceedings, however, this procedure also has a number of features that do not provide an absolute guarantee of recovery of the required amount. Let's see why this happens.

Difference from other payment documents

Let's look at how a collection order differs from other types of payment documents.

The payment order for the transfer of funds is filled out and presented to the bank for execution by the payer himself on a voluntary basis.

The payment request is made by the payee, but its presentation does not mean execution by the bank - the consent (acceptance) of the payer is often required to make the payment. If the payer disagrees, such a document will be returned to the recipient without execution. In certain cases, direct debiting of a payment request is also possible (by a court decision, on the grounds provided by law), incl. if the parties to the contract have agreed on this.

Read also: Payment with a bank mark

The collection order is filled out and presented by the recipient of the funds, having the unconditional right to do so. In this case, the payer’s consent is not required; money is transferred from the payer’s account by the bank if all the requirements for the document are met.

Who creates the order and when?

The participants in the process are:

- Principal – recipient of funds;

- Payer – from the account from which the funds are withdrawn;

- The remitting bank is the representative of the interests of the principal;

- Collection bank - any bank other than the remitting bank that receives a collection order;

- The presenting bank is usually the payer's bank.

The entire action is performed when the collecting bank receives an order from the principal.

Basic details

Such an order is very similar to a payment order, with the exception of the field for the purpose of payment:

- Day of exposure;

- Number and name of the order;

- Details of the location of the importer;

- Information about the person to whom the claim for payment is made;

- Name and order of the remitting bank;

- Name and order of the exporter;

- The amount to be recovered is indicated;

- Number of the principal's account with the remitting bank;

- List of accompanying documentation - commercial invoices or bills of exchange in a simple form.

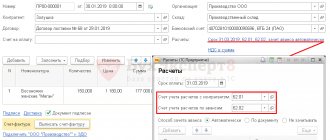

Sample of filling out a collection order.

Step-by-step filling steps

The document is generated in 5 copies, using the legally established form:

- 1st – signed for bank employees;

- The 2nd is intended for sending by mail when an explanation of the fact of non-payment is required;

- 3rd to send the original bill of lading;

- The 4th contains the signatures of authorized persons and seals, it is stored along with other necessary documents in the remitting bank;

- The 5th is given to the client on the day the documentation is submitted to the bank.

Important: in the case of an undisputed order, a reference to legislative acts is indicated.

Collection order form.

The order also contains instructions on its detailed application and calculation of the amount:

- Payment period and details;

- Filing claims in case of non-payment of the amount;

- Private Payment Options;

- How will the commission be paid?

- Features of interest collection.

Deadlines

Such an order is executed within a period of 3 to 30 days, depending on the type of request and the amount of funds in the payer’s account.

Mandatory details of a collection order

Today, the established form of collection order 0401071 is used (Appendix No. 4 to Regulation No. 383-P). In addition to the general requirements for all payment documents for non-cash payments (date, number, amount, name of the payer and his TIN, KPP, bank details - bank name, BIC and bank correspondent account, recipient and his TIN, KPP, bank details), There are additional requirements for collection:

- In the purpose of payment:

If collection is issued on the basis of an agreement, indicate its number, the clause on the indisputable write-off procedure, as well as the name of the goods, works, services for which payment is made.

- When a collection order is issued on the basis of the law (for example, when tax authorities collect a fine), the name of the collection, the date, number and article of the federal law justifying the collection, the number and date of the decision on collection are indicated.

- The document based on the writ of execution indicates: the authority that issued the document, the date of the writ of execution, the number of the court case or materials.

The bank checks both the form itself and the applications. Execution of a collection order is carried out only if all formal requirements for the document are fulfilled. If they are not observed, the executing bank notifies the originator so that they can eliminate the shortcomings. If the collector has not corrected the shortcomings, the bank returns the collection order without execution (clause 1 of Article 875 of the Civil Code of the Russian Federation; clause 3 of Appendix 13 of the Regulations of the Bank of Russia “On the payment system of the Bank of Russia” dated 07/06/2017 No. 595-P).

What is a collection order?

Collection is a form of payment with which you can make transactions on the accounts of third parties without obtaining the consent of the account manager.

The operation is carried out by generating a collection order to the bank. The document is generated by the recipient of the funds. This form of calculation is used if the account owner has an outstanding tax debt, according to other mandatory deductions, executive documents. Can be used as a means of settlement under supply contracts.

Kinds

There are 2 types of collection orders:

- Documentary . In order for the bank to carry out the transaction, supporting documents are attached to the order.

- Clean . Without documentary confirmation of the transaction, using checks and bills.

Collection orders from tax authorities

Most often, companies and individual entrepreneurs are faced with collection orders from tax authorities. In case of untimely payment of taxes and financial sanctions (fines, fines), the Federal Tax Service issues a demand to the debtor for payment, indicating the amount and date - by what date it must be fulfilled. If the taxpayer did not pay on time or did not challenge the legality of the claim (clause 3 of Article 46 of the Tax Code):

- no later than 2 months after the end of the period allotted for payment, a decision is made to recover funds;

- If more than 2 months have passed since the date specified in the request, a decision on collection can no longer be made, but the inspection has the right to go to court within six months.

Collection orders from tax authorities are usually received by the bank within 24 hours from the moment the decision on collection is made, and the amounts of money are written off without dispute. The Federal Tax Service must notify the taxpayer of the decision to collect payments within 6 days.

In addition to the collection order, tax officials usually send to the bank a decision to suspend transactions on the account for the same amount. In addition, in the presence of such restrictions, banks do not have the right to open a new current account for a taxpayer. Even if payment is made immediately, lifting the suspension may take a while.

Read also: Letter to the tax office about unblocking an account: sample

If there are insufficient funds in the account, the Federal Tax Service (and extra-budgetary funds) sends the bailiffs a decision to collect the amount due from the debtor’s property (Article of the Tax Code of the Russian Federation). Failure to comply with the bailiff's order within 5 days also entails the collection of an enforcement fee - 7% of the collection, but not less than 1,000 rubles from an individual entrepreneur and not less than 10,000 rubles from an organization (Article 112 of Law No. 229-FZ “On Enforcement Proceedings” dated 02.10 .2007).

Payments for collection

A collection order is a settlement document on the basis of which funds are written off from payers' accounts in an indisputable manner.

Collection orders are applied:

- in cases where an indisputable procedure for the collection of funds is established by law, including for the collection of funds by bodies performing control functions;

- for collection under enforcement documents;

- in cases provided for by the parties to the main agreement, subject to the provision of the bank servicing the payer with the right to write off funds from the payer’s account without his order.

The collection order is drawn up on form 0401071. COLLECTION OF MONEY IN AN UNCONDITIONAL ORDER

When collecting funds from accounts in an indisputable manner in cases established by law, in the collection order in the field “Purpose of payment” a reference must be made to the number of the law, the date of adoption and the corresponding article.

When collecting funds on the basis of enforcement documents, the collection order must contain a reference to the date of issue of the enforcement document, its number, the number of the case on which the decision subject to enforcement was made, as well as the name of the body that made such a decision.

If the enforcement fee is collected by a bailiff, the collection order must contain an indication of the collection of the enforcement fee, as well as a reference to the date and number of the enforcement document of the bailiff. Collection orders for the collection of funds from accounts issued on the basis of writs of execution are accepted by the recovering bank with the attachment of the original of the writ of execution or its duplicate.

Banks do not accept for execution collection orders to write off funds in an indisputable manner if the executive document attached to the collection order is presented after the deadline established by law.

Banks servicing debtors (executing banks) execute received collection orders with attached writs of execution, or in the absence or insufficiency of funds in the debtor’s account to satisfy the demands of the collector, make a note on the writ of execution about the complete or partial failure to fulfill the requirements specified in it, in connection with lack of funds in the debtor’s account and place the collection order, with the attached writ of execution, in the file “Settlement documents not paid on time.” Collection orders are executed as funds are received in the order established by law.

The undisputed procedure for writing off funds is applied for obligations in accordance with the terms of the main agreement, except for cases established by the Bank of Russia.

Write-off of funds in an indisputable manner in the cases provided for by the main agreement is carried out by the bank if there is a condition in the bank account agreement on the write-off of funds in an indisputable manner or on the basis of an additional agreement to the bank account agreement containing the corresponding condition. The payer is obliged to provide the servicing bank with information about the creditor (recipient of funds) who has the right to issue collection orders to write off funds in an indisputable manner, the obligation under which payments will be made, as well as about the main agreement (date, number and the corresponding clause providing for the right undisputed write-off).

The absence of a condition on writing off funds in an indisputable manner in the bank account agreement or an additional agreement to the bank account agreement, as well as the absence of information about the creditor (recipient of funds) and other above information is grounds for the bank to refuse to pay the collection order.

The collection order must contain a reference to the date, number of the main agreement and the corresponding clause providing for the right of undisputed write-off.

Banks do not consider the merits of payers’ objections to the debiting of funds from their accounts in an indisputable manner.

Banks suspend the write-off of funds indisputably in the following cases:

- by decision of the body exercising control functions in accordance with the law to suspend collection;

- if there is a judicial act on suspension of collection;

- on other grounds provided by law.

The document submitted to the bank indicates the details of the collection order, the collection of which must be suspended.

When the write-off of funds under a collection order is resumed, its execution is carried out while maintaining the priority group specified in it and the calendar order of receipt of the document within the group. The writ of execution, for which the collection of funds was not carried out (except for cases of termination of enforcement proceedings) or was carried out partially, is returned together with the collection order by the executing bank to the issuing bank for delivery to the recoverer personally against receipt of receipt or by registered mail with notification. In this case, the executing bank makes a note on the writ of execution on the date of return of the writ of execution indicating the amount collected if there was a partial payment for the document.

The writ of execution, the collection of funds for which has been made or terminated in accordance with the law, is returned by the executing bank by registered mail with notification to the court or other body that issued the writ of execution. In this case, the executing bank makes a note on the writ of execution indicating the date of its execution indicating the amount collected or the date of return indicating the grounds for termination of collection (number and date of the claimant’s application, court ruling (arbitration court) or other document) and the amount recovered if there was a partial payment for the document.

About the return of the writ of execution, a note is made in the bank's registration journal indicating the date of return, the amount (or the balance of the amount) and the reason for the return.

GENERAL PROVISIONS ABOUT COLLECTION SETTLEMENTS

When paying for collection

The bank (issuing bank) undertakes, on behalf of the client, to carry out actions at the client’s expense to receive payment from the payer and (or) acceptance of payment.

The issuing bank that has received the client’s order has the right to attract another bank (executing bank) to carry it out. In case of non-execution or improper execution of the client’s instructions, the issuing bank is liable to him.

If the non-execution or improper execution of the client’s order occurred in connection with a violation of the rules for performing settlement transactions by the executing bank, liability to the client may be assigned to this bank.

EXECUTION OF COLLECTION ORDERS

If any document is missing or the external appearance of the documents does not correspond to the collection order, the executing bank is obliged to immediately notify the person from whom the collection order was received. If these deficiencies are not eliminated, the bank has the right to return the documents without execution.

Documents are presented to the payer in the form in which they were received, with the exception of marks and inscriptions of banks necessary for processing the collection transaction.

If documents are payable at sight, the executing bank must make presentation for payment immediately upon receipt of the collection order.

If the documents are subject to payment at a different time, the executing bank must, in order to obtain the payer's acceptance, submit the documents for acceptance immediately upon receipt of the collection order, and the payment request must be made no later than the day the payment deadline specified in the document occurs.

Partial payments can be accepted in cases where this is established by banking rules, or with special permission in the collection order.

The received (collected) amounts must be immediately transferred by the executing bank to the issuing bank, which is obliged to credit these amounts to the client’s account. The executing bank has the right to withhold from the collected amounts the remuneration and reimbursement of expenses due to it.

NOTICE OF OPERATIONS PERFORMED

If payment and (or) acceptance have not been received, the executing bank is obliged to immediately notify the issuing bank of the reasons for non-payment or refusal to accept.

The issuing bank is obliged to immediately inform the client about this, asking him for instructions on further actions. If instructions on further actions are not received within the period established by the banking rules, or in its absence within a reasonable time, the executing bank has the right to return the documents to the issuing bank.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Settlements by collection orders between counterparties

There are two types of collection according to calculations:

- clean collection – a bill or check is presented for payment;

- documentary collection – to make payment, transaction documents are required: agreement, delivery note (act), invoice, etc.

An agreement may be concluded between suppliers (executors) and buyers (customers), providing for the right of the supplier to receive funds from the buyer’s current account without his consent under certain conditions (for example, completion of the delivery of goods). A copy of the agreement is transferred to the servicing financial institution. When submitting supporting documents, the recipient's bank verifies the legality of the claim and, if everything is in order, transfers the collection order and documents to the payer's bank. The payer is notified about the transfer of funds, and the recipient is notified about their crediting.

In what cases is this document required?

It cannot be said that the collection order is widespread. However, in some cases it occurs quite often, for example, in the practice of the tax inspectorate, when a collection order is sent to the tax debtor’s bank and debts are automatically written off from his accounts (such collection orders are subject to unconditional execution and cannot be contested). Or in the activities of public utilities, when an agreement is concluded between public utilities and the recipient of the service with the possibility of direct (i.e., not requiring the permission and participation of the direct payer) payments - in this case, the payment from the bank of the recipient of the service to the bank of the utility organization is also transferred by using a collection order.

Organizations sometimes also enter into similar agreements with each other, but this practice is not generally applicable, since it requires one hundred percent trust in relations between counterparties, as well as their indisputable solvency.

Collection order deadline

The bank is obliged to execute a collection order (Article 875 of the Civil Code):

- if the document must be paid “on sight” - immediately;

- with other deadlines, the bank sends a collection order immediately to accept the payer, and a payment request - no later than the day specified in the documents.

Partial payments are possible in case of special permission in the collection document or if this is established by banking rules.