Tax 1447 in the Republic of Sakha / Yakutia / is a fairly popular tax office, with 10 registered

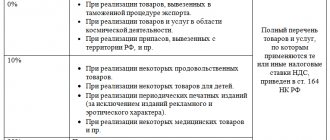

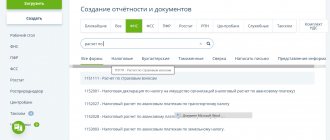

Among the variety of taxes and fees intended for mandatory calculation by business entities, VAT ranks

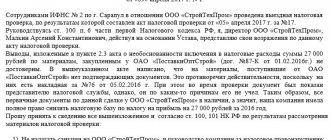

What exactly is an objection to a tax audit report used for? An objection drawn up on behalf of a company,

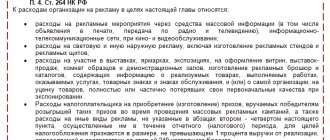

What is the difference between standardized and non-standardized advertising expenses Advertising expenses, which are taken into account for tax purposes, are divided

What should be considered low-value and wear-and-tear property For a long time, low-value and wear-and-tear items were taken into account

What is the size of the living wage in Russia in 2022? The size of the living wage (LM) for

Are you an employer with employees? In this case, you have to collaborate monthly with

WHO IS OBLIGED TO PAY INSURANCE PREMIUMS The calculation and payment of insurance premiums is regulated by the Tax Code of the Russian Federation

In Russia, assistance to low-income citizens is regulated at the level of federal and regional legislation. Average income

To simplify accounting and reduce the tax burden, entrepreneurs often choose special tax regimes