Due to the emergence of new forms of ownership, the complication of production processes and changes in economic policy, accounting methods are also expanding. Users require documents with varying degrees of detail. These requirements are met by registering accounts with both generalized and more specific information about business transactions at the enterprise.

For example, sometimes generalized information about certain types of accounting is sufficient for the director of a company. The warehouse manager or workshop manager will have enough information directly related to his field of activity. Sometimes you may need information about a specific supplier, subcontractor, or a specific debtor or creditor. Also, for example, there is a general accounting of salary arrears, and there is one for each employee. The double entry form is reflected in different accounting documents, but the final parameters in them are the same.

It turns out that identical information appears in accounting with varying degrees of detail. At the same time, for generalized synthetic information, only the monetary form of reporting is used, and the registration of analytical data can take place in physical equivalent. Each type of accounting has its own purpose, method of reflection in accounting and classification. According to the Accounting Law, accounts are usually divided according to the level of detail:

- Synthetic – contain generalized data.

- Analytical – reveal and specify general information in detail.

- Subaccounts (intermediate link) - simplifies the grouping of objects between generalized synthetic information and more detailed, that is, analytical.

Accordingly, documents are registered in two types. The dual method of reporting provides a complete final picture of accounting. Let's look at analytical and synthetic accounting accounts, examples of which you will find in the text.

The concepts of these types of accounting are given in the Accounting Law adopted in 1996. And although with the entry into force of the Federal Law of December 2011, the previous regulations no longer apply, the old definitions are still relevant today.

What is synthetic accounting

To have an idea of what we are talking about, let’s step back a little from the dry theory written in clerical language. Imagine a Russian nesting doll with several more hidden inside. It can be compared to accounting. The biggest nesting doll is the main one, we don’t know for sure what it’s filled with inside, we’re just guessing.

Likewise, generalized information contains a certain type of information about the company’s activities, determined by homogeneous economic characteristics, but does not disclose the details of the operation. Organizations are allowed to use the data presented in the Chart of Accounts. Without this manual, it is impossible to conduct accounting, since this book contains a list of all names, codes, explanations, and diagrams of the purpose of each of the synthetic accounts.

How else do synthetic accounts differ from other accounting documents? They necessarily have a two-digit number, which is inherent in each name, it cannot be changed, and in the world of numbers they use not account names, but their digital equivalent. Over time, those regularly used (i.e., the Work Plan) are remembered, and you don’t need to know everything.

Therefore, two numbers are indicated in the documents, and all accountants who will operate with them know that 01 is “Fixed assets; 10 – “Materials”; 41 – “Goods”; 60 – “Settlements with suppliers and contractors”, etc. Using the code, which is the same for all users, it will immediately be clear what exactly the report is related to. At the enterprise, according to the type of activity, they use part of the synthetic accounts. There are 99 of them in total, but not all farms need to keep records for each of them.

Conclusion: For all organizations, synthetic accounts are the same and do not depend on the profile of the enterprise. The data is reflected in the balance sheet, being its basis.

For complete control over all activities of an enterprise, (generalized) information alone is not enough. For example, this is what synthetic accounting looks like:

Account 10 “Materials”

| Initial balance | Revolutions | Final balance |

| 100 | + 40 – 85 | 55 |

The table shows income and expenses, but what kind of products they are is unknown. To study the content in detail, an additional, more understandable picture of reporting is needed. For this purpose, detailed invoices are used, which indicate the name of each type of material.

What is analytical accounting

Analytical accounts reveal the internal content of summarized data. They detail information about types of property, obligations, and business processes. Accounting based on them is called analytical. Units of measurement may vary. Various accounting units can be used as meters: cost; natural; labor Here they write, without encryption, full and specific names:

For example, using synthetic account 41 (Goods), we can find out the total total of their availability at the enterprise. But we don’t know exactly what is hidden under the numbers. What if the regulatory authorities come? Yes, they will tell the chief accountant named Khotbysha: “And what exactly goods did you ship, receive, and what is now in the warehouse?” And here analytical notes save us. We looked, checked, made sure that everything fits! Phew, we did it!

Thanks to such invoices, which specifically indicate that the boards are pine, planed, we have information about each type or group of goods: their specific location, structure, quantity, name, etc. This list is regulated by the company itself, based on its profile. Remembering the nesting doll, you can guess that the detailing of analytical accounts is multi-level.

For example, let's take account 60 (Payments with suppliers and contractors): we will see the total amount of debt. Here even the director will want to know: to whom and how much do we owe? Who can still wait, and who needs to be settled with as quickly as possible? Analytical data is needed again. Information in them will be reflected for each supplier, buyer or contractor separately. This information will say much more than a generalized version.

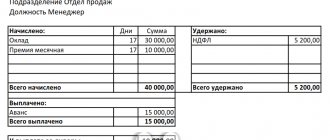

For example, account 70 (Settlements with personnel for wages) will show the total debt to employees, but who exactly needs to be paid and how much can only be found out thanks to analytical data. They provide information about everyone's salary.

The examples above show that analytical accounts are opened as a development of a synthetic separate account. That is, this is the internal content of the Main Matryoshka. Moreover, figuratively speaking, the weight of the large nesting doll and the weight of all the internal ones should match, penny for penny. Accordingly, the final debit and credit parts of these documents must be identical, as well as the balance.

Analytical accounting scheme: Account 10 “Materials”

| № | Name | Initial balance | Revolutions | Final balance | |

| Coming | Consumption | ||||

| 1 | Buttons | 60 | 20 | 45 | 35 |

| 2 | Buttons | 30 | 15 | 35 | 10 |

| 3 | Lightning | 10 | 5 | 5 | 10 |

| Total | 100 | 40 | 85 | 55 | |

Compare the readings of the synthetic (see table above) and analytical accounts: the final figures are the same. Analytical accounting information is always linked to a specific enterprise. How detailed the accounts will be kept depends on his career guidance.

Analytical accounting is usually carried out in warehouses or workshops where there is product turnover. Mostly synthetic accounting is kept in offices, but, for example, such an item as staff salaries is not done in warehouses. The foreman can assign a CTU to the employee, record his absenteeism, and the accountant will calculate the amount of earnings. He will also check that the overall final indicators coincide with the analytical ones.

Note: There are no differences in the method of maintaining both types of accounting. They are maintained in the same way: debit, credit, balance, the so-called “airplane”. Despite the fact that generalized synthetic information refers to accounts of the first order, the basis for them is analytical data created on the basis of primary documents. This is where the document flow begins.

Subaccounts and their meaning

Subaccounts are widely used by business entities to build an accounting system and group analytical accounting data, for the subsequent generation of financial, statistical, and management reporting of the company. Sub-accounts indicate the nature of the grouping and the sequence of formation of analytical accounting (third-order accounts).

As in synthetic accounting, entries in subaccounts are made only in monetary terms. Reflection of natural quantities, despite the individual features of analytical accounts inherent in them, is not provided. For some synthetic accounts, subaccounts are not provided. Based on the economic meaning of the reflected indicators, it is assumed that the use of the second level of accounts is unnecessary.

A subaccount included in the grouping of a specific synthetic account is active, passive or active-passive, depending on what the first-order account is in relation to the balance. In turn, third-order accounts, analytical, opened in development of the sub-account, in relation to the balance sheet, are the same as the sub-account that combines them.

What documents are analytical accounting registers ?

The total balance as of a certain date in the subaccounts of one synthetic account and the balance in this synthetic account itself are equal. A similar principle is observed in relation to turnover on sub-accounts in a certain period. Subaccounts for each synthetic account are reflected in the Accounting Chart - an official document of the Ministry of Finance.

Example. Account 41 “Goods”, according to the chart of accounts dated October 31, 2000, has 4 subaccounts, taking into account:

- 1 - commodity weight in the warehouse;

- 2 – commodity mass in retail trade;

- 3 – container;

- 4 – purchased products.

How to keep records when combining simplified taxation system and PSN using accounting subaccounts ?

Transactions with goods can be reflected in subaccounts as follows:

- Dt 41/1 Kt 60 – goods were received into the warehouse from the supplier, the supplier’s transport services for delivery are reflected;

- Dt 41/2 Kt 41/1 – goods transferred to retail sale;

- Dt 90/2 Kt 41/2 – the cost of the goods is reflected in expenses.

Account 90 “Sales” used in postings also has subaccounts: - 1 – revenue;

- 2 – cost of sales;

- 3 and 4 – VAT, excise taxes;

- 9 – profit, loss from sales.

Subaccount 2 takes into account the cost of goods for which revenue is recorded in subaccount 1. Subaccount 3 reflects the amount of VAT receivable from buyers, customers; on subaccount 4, the amount of excise taxes in the price of goods and products sold. Subaccount 9 reveals the financial result of work for the month. The use of subaccounts on account 90 allows you to obtain detailed information about income, sales expenses and the results of these sales.

By the way! In banking, a “sub-account” is an account opened for an organization in addition to an existing current account. Sub-accounts are opened for geographically remote divisions of the organization. The list of operations on them is limited.

Subaccounts and subcontos should not be confused. The latter relate to the field of analytical accounting, when using software in accounting. They are, in essence, a reference book that is used when working with several accounts and subaccounts. For example, in the 1C “Accounting” program, the “Organizations” subaccount is used when working with accounts 60, 62, opened in the context of subaccounts.

What is a subaccount

Subaccount is an intermediate link between analytical and synthetic accounts. It is used to account for objects of various types. This additional step will help group identical information into a second level of detail. For each group, analytical records are kept, in which the things of each group are called by their proper names. If this is not enough, they develop it in even more detail.

Sub-accounts can be maintained in both cost and physical units. Their purpose is clear in a simple diagram:

| Synthetic account | Subaccounts | Analytical accounts |

| 10 "Materials" | 10.1 Fuel | 10.1.1 Gasoline 10.1.2 Diesel fuel |

| 10.2 Containers and packaging materials | 10.2.1 Pallets 10.2.2 Cardboard |

Note: As a rule, a subaccount contains several analytical accounts, and a synthetic account may include several subaccounts. This accounting scheme is not mandatory if additional grouping is not necessary.

Interaction of synthetic and analytical accounting

Now that the essence of double accounting is clear, the connection between these concepts becomes obvious. To understand the specific content of the general account, which synthesizes a large amount of information, but does not reveal a natural and understandable view of accounting objects, analytical information is needed. Each report is based on primary documents. In one case, it’s, as they say, all in one bottle. Another lists each ingredient separately.

The main thing in reporting documentation is that everything comes together. Therefore, records in both reporting options are kept in parallel, otherwise, no matter the hour, everything will get confused, lost, forgotten. And verification and reconciliation of data may be required at the most unexpected moment.

Often, in order for the final indicators of both types of accounting to strictly coincide, in synthetic accounts the numbers are written down in pencil. After checking the analytical data, if everything is calculated correctly, you can make a note in ink with a firm hand.

From the above, it becomes clear how important both types of accounting are for each other. This scheme is required only for complex types of synthetic accounting, when a specific decoding of the content and confirmation of the correctness (correspondence to reality) of the testimony in the document is required. There are times when analytical data is not needed, and everything is clear. Such accounts are called simple.

What parameters will indicate that accounting is ideal? Criterion - the numbers in the final readings of both types of accounting must match. These accounting parameters include:

- opening balance;

- ending balance;

- revolutions (income, consumption).

Usually several analytical accounts are attached to one synthetic account. But options are possible. Let's remember about simple and complex accounts. The balance sheet may sometimes contain several types of generalized indications, which are confirmed by a minimum number of analytical documents. This depends on the profile orientation of the enterprise and its economic policy. That is, options are possible.

But we are analyzing the classic type of accounting. So, summing up the final detailed information, we compare it with the final figures of the generalized ones. Everything coincided. This means that the records are being kept correctly. Now is it clear what synthetic and analytical accounting is in accounting?

Note: The listed indicators of both types of accounting are identical. If the final totals do not match, then an error has been made. Thus, the relationship between synthetic and analytical accounts is a controlling tool for flawless accounting.

Industry use of subaccounts

In addition to the standard chart of accounts, others are also used. Special charts of accounts are used, for example, by banks and budget organizations with corresponding, different from others, numbering of accounts and subaccounts. The specifics of some industries are such that a standard chart of accounts is not enough for complete, comprehensive accounting.

Thus, on the basis of document No. 94n, agriculture has developed its own chart of accounts, which differs mainly in the composition and numbering of sub-accounts (Order of the Ministry of Agriculture No. 68 of 01/29/02). It reflects the complexity and need for detailed accounting data in the agricultural industry. Some subaccounts, except for agriculture, are not used anywhere else.

Example. Account 10 in the chart of accounts dated 10/31/2000 contains 11 subaccounts, and in the chart of accounts for agricultural enterprises dated 01/29/02 there are 12 subaccounts.

There are general subaccounts:

- raw materials and materials;

- spare parts;

- fuel;

- inventory and household supplies accessories, etc.

There are specific sub-accounts. For agricultural enterprises:

- fertilizers and plant and animal protection products;

- stern;

- seeds and planting material.

For commercial organizations:

- special equipment and clothing in the warehouse;

- special equipment and clothing in use.

Obviously: if an agricultural company regularly issues protective clothing to workers from a warehouse and accepts it into the warehouse, it will be necessary to enter a separate subaccount (subaccounts), which is not in Order No. 68, into the working chart of accounts, or, if the volume of transactions is small, reflect them on the subaccount “Other materials” .

Due to the introduction and exclusion of individual subaccounts from the accounting tables of accounts, the numbering of subaccounts also varies. For example, “fuel” in the agricultural version of the chart of accounts, as a subaccount of account 10, is numbered 4, and in the generally accepted version – 3.

Briefly

- Subaccounts are in the second position in the hierarchy of accounting accounts, occupying an intermediate position between synthetic and analytical accounts. In relation to the balance, they are in the same position as the synthetic accounts that group them. This property is transferred to analytical accounts opened on their basis.

- They are maintained only in value terms.

- In the chart of accounts, the list of subaccounts is open. Some synthetic accounts do not need to open subaccounts, or their subaccounts are not specifically named (they can be opened by type of data reflected).

- The chart of accounts and the presence of subaccounts in it can have variations, reflecting the characteristics of the industry of application or belonging to a certain market sector.

- Based on federal documents, organizations develop and approve a working chart of accounts that takes into account their specifics.