Why are off-balance sheet accounts of MC needed (MC.01, MC.02, MC.03, MC.04) In the program’s chart of accounts

Notify employees and the employment office People need time to get a new job, so

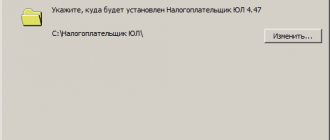

STAGE 3 Destination folder At this stage of installation, you are prompted to select the location where the

A work book is one of the most important documents for every person. It stores information about

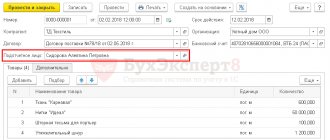

Receipt of materials FSBU 5/2019 “Inventories” does not contain the concept of “materials”. Typically, materials include:

For accounting purposes, balance sheet and off-balance sheet accounts are provided. The first ones are maintained to reflect cash and

How to account for property that is in gratuitous use? 06/28/2018 Question: At a municipal government agency in

The concept and types of advance payments Not only an accountant, but also any working person knows

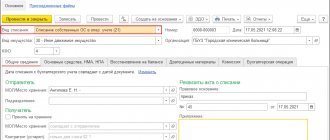

FSBU 27/2021 “Documents and document flow in accounting” comes into force on January 1, 2022

Who objects and what? Among the rights of tax authorities (under Article 31 of the Tax Code