Concept and types of advance payments

Not only an accountant, but also any working person knows what an advance payment is.

Both in labor and economic relations, the essence of the concept is similar: a certain part of the cost of a product, work, service is transferred in favor of the counterparty in advance, that is, provided that the work, product or service has not yet been delivered or provided. A similar method of calculation is provided for paying taxes and fees. For example, taxpayers applying a simplified taxation regime are required to pay advances under the simplified tax system. Companies using OSNO pay advance payments for VAT and income tax.

Types of advances:

- According to wages.

- Under contracts, supplies, services. Including state and municipal procurement.

- When taxing.

- When issuing money, he will report.

- Other categories of advances.

Each type of advance has special rules and restrictions.

It is important not to confuse the concepts of “advance” and “deposit”. The advance tranche is credited towards future supplies or towards the repayment of tax debt. But the deposit is the amount of money provided as a guarantee that the assumed obligations will be fulfilled.

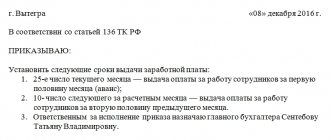

Advance on wages

The transfer of earnings for the first half of the month is regulated by the Labor Code, namely Article 136. The employer undertakes to pay wages to all employees working under employment contracts at least twice a month: every 15 days.

The exact amount of salary advance has not been established. But the Ministry of Labor provided several clarifications for employers. In Letters of the Ministry of Labor dated 03/20/2019 No. 14-1/B-177, dated 09/18/2018 No. 14-1/B-765 it is determined that the amount is determined in proportion to the time worked in the first half of the month.

When calculating the salary advance, include the official salary or rate, as well as bonuses and additional payments calculated for time worked. But do not take into account bonuses and incentive payments calculated for results or based on work results.

The purpose of payment “advance on wages” in payment orders is used less and less. The Ministry of Labor recommended replacing the outdated wording with a more current one: “salary for the first half of the month.”

Example of a salary payment order

Payment order for salary to card

The transfer is executed by payment order, the details of filling which are discussed in our publication. It is important to take into account the fact that the payment day is usually considered the day the funds are credited to the card, and this day should not be later than the deadlines established by tax legislation. In order to prevent delays in salary payments, it is necessary to take into account the time period that the bank allocates for crediting money to accounts.

A payment order for the transfer of salaries to staff is a document whose execution is not difficult, but it is worth taking into account the nuances of filling out the details. To ensure normal payment processing, they are filled out in accordance with the following requirements:

- in the “Payment recipient” field indicate the bank institution that has the company’s salary project under the concluded agreement and the account number to which the transfer is made;

- in the “Payment amount” column, the transfer amount is recorded, which is similar to the calculated amount to be issued in person in the company’s accounting records - an advance payment or final payment for the month;

- in the “Purpose of payment” field they must reflect for what period the transfer is being made. For example, when transferring an advance, it is formulated as follows: “Payment of wages for the 1st half of the month according to register No. _ dated _._.2018.” A mandatory attachment to the payment order for the transfer of salary amounts is a register indicating the payments due to each employee of the company.

Sample payment slip for transferring salary to a card:

Advance on agreements and contracts

Registration of the purchase of goods, works, services involves the conclusion of an agreement. The agreement specifies all essential terms of cooperation, including the payment procedure. It is possible to provide for an advance payment procedure. For example, when the buyer transfers part of the delivery cost in advance, before the actual shipment of goods to the warehouse or provision of services.

The amount of advance payment under contracts is determined by agreement of the parties: partners must agree in advance on the payment system and write down the agreements reached in the agreement.

More stringent frameworks are provided for state and municipal procurement. In general, the advance payment should not exceed 30% of the contract amount (clause 18 of Regulation No. 1496). But there may be exceptions. For example, when making payments using federal budget funds, the following restrictions are established:

- 30-80% - for the development of R&D for import substitution;

- 30-90% - in the presence of treasury support during settlements;

- up to 100% - for communication services, purchasing periodicals, paying for courses, professional retraining, purchasing travel tickets, insurance, etc.;

- up to 30% with the possibility of increasing to 70% - for construction and major repairs of state property in Russia, with treasury support for settlements.

To pay for services and supplies from regional or local budgets, other advance limits may be provided. For example, Moscow City Decree No. 1229 “On Advance Payments” (as amended) provides for certain restrictions on the assignment of advance payments in contracts executed at the expense of the Moscow city budget. The standard advance amount in Moscow is 20%. But there are exceptions (clause 1 of Moscow Government Decree No. 1229-PP dated December 30, 2008 (as amended on December 25, 2017)).

Example of a payment order for the supply of goods

Reasons for refusal to transfer funds

It happens that a legal entity or individual entrepreneur, when transferring money to an individual to a current account or card, receives a bank refusal to carry out the operation. This usually happens for the following reasons:

- There is not enough money in the current account. In this case, indicate a smaller amount that will be enough to complete the operation. Or top up your account and only then repeat sending the payment order.

- Blocking of accounts . If an account is frozen or blocked, bank customers will not be able to make transactions using funds from the current account until the decision is reversed. To do this, you need to deal with the bailiffs or the tax authority, which ordered the bank to seize the accounts. The client will have to prove that there were no illegal actions. If this succeeds, the bank, by order of the judicial authorities or tax authorities, will unblock the accounts, after which operations can be carried out.

- Technical difficulites . In this situation, it may be sufficient to restart the page, system, or check the Internet connection. If a transaction cannot be completed and confirmed due to technical work on the site, you will have to wait until it is completed.

- Incorrect information entered into the form. Before sending a payment order to the bank for verification, check the data in all fields of the form. If you find an error, correct it and try sending the document again. Even rearranging two digits or inaccurate wording of the payment purpose will result in bank employees returning the payment order for adjustment.

After filling out all the fields of the payment order, it should be signed. Use an SMS code or electronic signature.

Useful links:

- Instructions for transferring to a card from the official Sberbank website.

Give your rating

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

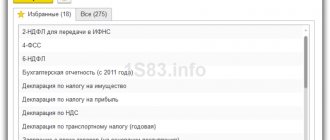

Advance payment for taxation

The advance payment system is provided for several types of tax burden at once. For example, when calculating income tax, simplified tax system, VAT, as well as transport, property, land taxes and other types of fees.

The frequency and rules for calculating advance payments for taxes and fees are enshrined in the Tax Code of the Russian Federation, and can also be regulated by regional and local executive authorities.

In essence, a tax advance is a transfer of funds for obligations to the budget that have not yet arisen. For example, calculations according to the simplified tax system. For simplicity, the tax period is a calendar year. The obligation to pay the simplified tax system arises only after a year. But taxpayers are required to calculate and pay periodic tranches to the Federal Tax Service on a quarterly basis.

Application features and calculation methods

| Advance calculation principle | Budget classification code | Examples of payment slips |

| Calculation of advance payments for income tax | KBK for income tax | Sample payment order for payment of income tax |

| Calculation of advance payments under the simplified tax system | KBK on single income tax with simplification | Sample payment order when applying the simplified tax system |

| Tax and reporting period for VAT | KBK for VAT 2020 | Filling out a payment order |

Please note that some individual entrepreneurs are required to pay advance payments for personal income tax. The Federal Tax Service will calculate the tranche amounts independently based on the 3-NDFL declaration for the previous year. If an entrepreneur believes that this year’s payments are significantly lower than last year’s calculations, the inspectorate should be notified. To adjust the personal income tax advance, the merchant must send a declaration to the Tax Service in form 4-NDFL.

Transfer of funds through Sberbank Business Online

In the Sberbank Business Online system, you can transfer money from the current account of an individual entrepreneur or legal entity to an individual’s card opened in Sberbank if an agreement has been concluded for a salary project:

- Log in to Sberbank Business Online.

- Find the item “Salary project”.

- Specify “New payment”.

- Fill out the form that appears on the screen. In the “Type of accruals” item, indicate “Other payments” if you are sending money to a personal card.

- Click the “Add” button and enter your plastic card number.

- Save the payment order, sign it with the code from SMS or with an electronic signature. Send the confirmed document to the bank.

For regular transfers, it is more convenient to create a template so that all fields are filled in automatically.

RKO in Sberbank

| Service | 0Р |

| % on balance | 0 |

| Replenishment | 0,15% |

| Payment | 100 rub. |

| Translation | 0 rub. |

| Overdraft | Commission 1.2% |

Information about the date of signing the contract for the salary project and the document number is stored in the “Issue of salary cards” section. There you can also find information on all issued cards if the money goes to several employees.

Advances to report

Issuance of money on account is one of the types of advances used by organizations. Funds can be given out for various purposes. This could include travel expenses, purchasing materials for business needs, and settlements with suppliers. Other goals set by management may also be identified.

Accountable funds can only be issued to an employee of the company. Moreover, the manager should fix the list of employees who are accountable persons. In addition, the organization should approve limits on advances of accountable amounts, reporting deadlines and additional payment rules.

Accountable funds are issued based on the employee’s application or the manager’s order. The amount can be transferred to cards or issued in cash from the cash register.

Material on the topic Accountable funds: procedure for issuance and return

In the payment order “Issue of non-cash funds on account” the purpose of the payment will be formulated, for example, like this:

Transfer of advance payment for travel expenses to the employee’s bank card.

Sample payment order for travel allowances

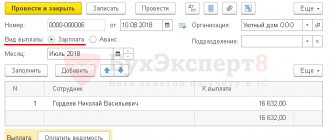

Salary payment

Payment for the supply of goods

Payment to cards

The following statements are provided for crediting cards:

- To the bank - to work within the project;

- To accounts – for maintaining personnel accounts outside the project, i.e. open on your own.

The system provides for uploading each statement into a separate file for subsequent transfer to the bank.

Fig.12 Uploading the statement file

The data is transmitted to the bank in the form of a register, which contains a list of employees and their accounts.

Fig. 13 Register of transfers

In addition, for “Statements to the Bank” documents, it is possible to combine several statements paid with one payment order and upload them as one file.

Free expert consultation

Tamara Baeva

1C consultant

Thank you for your request!

A 1C specialist will contact you within 15 minutes.