Receipt of materials

FSBU 5/2019 “Inventories” does not contain the concept of “materials”. Typically, materials include:

- raw materials necessary for the production of semi-finished or finished products;

- auxiliary materials that are not included in the finished product, but are used to ensure the operability of the equipment, as well as any technological needs;

- fuels and lubricants;

- spare parts;

- container;

- purchased semi-finished products;

- waste production;

- others.

Materials belong to the company's reserves. The exception is when the materials:

- intended for the creation or modernization of non-current assets;

- obtained when disassembling the OS.

In an organization that has warehouses, the manager’s order approves a list of materially responsible persons (MRPs) responsible for the safety and maintenance of warehouse records of materials for each warehouse.

Inventory and materials received from suppliers have a set of shipping documentation, represented by an invoice (form TORG-12, M-15 or another accepted by the supplier), an invoice, a waybill, and a specification. Of these, the invoice serves as the basis for capitalization. In the absence of shipping documents, materials can also be capitalized.

Read about the rules for such posting in the article “How to post goods without accompanying documents.”

Upon acceptance, materials must be checked for compliance of the actual quantity, quality and assortment with the data stated in the supplier’s accompanying documents.

If no discrepancies were identified during the verification process, the MOL issues a receipt order in Form M-4. It is allowed to put a stamp on the supplier's documents instead of receipt orders. The stamp must reflect all M-4 details.

If, after the inspection, discrepancies are still identified, it is necessary to issue a statement of discrepancies in the TORG-2 form.

For the form and sample of filling out this form, see the material “Unified form TORG-2 - form and sample” .

Another way of receiving materials is their purchase by accountable persons at retail outlets. In this case, the primary source is invoices or sales receipts attached to the expense report.

ConsultantPlus draws your attention to the fact that starting from 2022, materials must be taken into account strictly in accordance with the new FSBU 5/2019 “Inventories”. The new rules were explained in detail by legal experts. To see the recommendations, get trial access to K+ for free and go to the ready-made solution.

Registration of a power of attorney to receive materials

Purpose and creation

An organization may issue a power of attorney to receive materials from a supplier to an authorized person. 1C provides such an opportunity by creating a Power of Attorney document.

The document does not generate postings, but with its help the process of registering issued powers of attorney and the generation of printed forms Power of Attorney in forms M-2, M-2a are automated.

The Power of Attorney document can be created:

- based on the document Invoice from supplier , using the Create based on – Power of Attorney button;

- by entering the document yourself in the section Purchases – Powers of Attorney – Create button.

Filling Features

Let's look at the features of filling out a document when purchasing materials. The header of the document states:

- Number - the serial number of the power of attorney, which is assigned automatically by the program;

- From - date of issue of the power of attorney;

- Validity period - the date until which the power of attorney will be valid;

- Counterparty – the name of the supplier from whom you plan to receive materials. Selected from the Contractors directory;

- Agreement – an agreement (invoice) under which it is planned to receive materials. Selected from the Contracts directory;

In the Contract , only those contracts that have the type contract With supplier .

- Bank account – the Organization’s account from which payment for these materials is made;

- Accountable person - selected from the directory Individuals , where passport data must be filled in, because This is a prerequisite for correctly filling out the printed power of attorney form.

The tabular part of the Power of Attorney indicates the name, quantity and unit of measurement of materials to be received. It can be filled in:

- automatically when entering the Power of Attorney based on the Invoice from Supplier ;

- using the Add ;

- using the Select .

Find out more about Methods for selecting items

On the Additional , specify the information for filling out the printed form:

- Received from - full name of the supplier from whom you plan to receive materials;

- According to the document - a document - the basis on which materials will be issued, for example, a work order, an invoice, a contract, an order, an agreement.

Documenting

An organization can develop its own power of attorney form in accordance with Art. 9 of Federal Law N 402-FZ. In 1C, a printed form of Power of Attorney in form M-2 (M-2a) is used.

The form can be printed by clicking the Print – Power of Attorney (M-2) button. PDF

If a power of attorney is issued for more than one purchase, then it is drawn up in form M-2a, print this form by clicking Print - Power of Attorney (M-2a).

Organization of warehouse accounting of materials

Accounting for inventory items in the accounting department and in the warehouse can be carried out using the quantitative-total and balance method.

When using the first option, both in warehouses and in accounting, inventory records are kept by quantity and amount simultaneously.

If the accounting policy has approved the balance method, then in the warehouse inventory items are taken into account by quantity, and in the accounting department - in total terms.

Keeping inventory records of materials is possible in two ways: batch and grade.

- Batch method.

In this case, each batch of inventory items is stored separately. A batch is a homogeneous material received according to one document. For each batch, MOL issues a batch card in two copies: 1st - for the warehouse, 2nd - for the accounting department. The form is approved by the company independently, depending on the type of inventory.

In the incoming part of the document, data is entered according to the primary document received from the supplier, in the outgoing part - data on the fact of write-off of materials. After the complete release of the entire batch of goods and materials, the batch card is closed, the MOL draws up an act of consumption of goods and materials and transfers the entire package of documents to the accounting department for verification.

- Varietal method.

Warehouse accounting of materials in this way is carried out by names and grades of goods and materials, regardless of the date of receipt and price. For each name of material, a materials accounting card (form M-17) is created, which is registered in a special accounting register. This card is maintained throughout the year.

When maintaining warehouse records using the sort method, warehouse space is used economically and material balances are easily managed. However, it is not possible to track the price of receipt of goods and materials, and the material is written off at the average cost using the FIFO method or at the unit price (clause 73 of order No. 119n).

Read more about the M-17 form in the article “Material Warehouse Card - Form and Sample.”

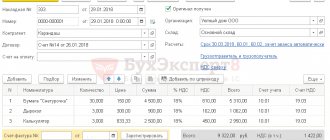

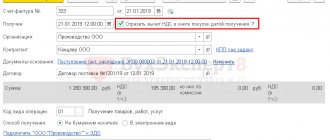

Registration of SF supplier

Register the supplier's invoice in 1C by indicating its number and date at the bottom of the Receipt document form (act, invoice) and click the Register .

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings

Wiring is generated:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

We looked at how to reflect the receipt of materials in 1C 8.3.

Test yourself! Take the test:

- Test No. 55. Purchasing materials with additional delivery costs

- Test No. 43. Purchasing materials using loan funds

- Test No. 38. Purchase and use of materials (household equipment) for non-production purposes

- Test No. 25. Write-off of materials for general business needs

- Test No. 15. Accounting and analytical accounting of materials: legislation and 1C

Intra-warehouse movement of goods and materials

Some accountants or merchandisers may ask, “What is movement?” In the course of business activities, an enterprise needs to move materials between warehouses or structural divisions. The primary document in this case is the demand invoice (form M-11). It is issued by the MOL of the sending party in 2 copies: the 1st remains with the transferring party and serves as the basis for writing off materials from the register, the 2nd is transferred to the MOL of the receiving party and is the basis for accepting the goods and materials for registration.

For information on filling out a demand invoice, read the material “Procedure for filling out form M-11 demand invoice.”

Inventory

In order to identify the actual availability of inventory items listed in accounting records, the organization conducts a warehouse inventory. It can be carried out as necessary by order of the manager, and also without fail in the following cases (clause 22 of order No. 119n):

- when selling materials;

- when changing MOL;

- when identifying cases of damage or theft of inventory items;

- in the 4th quarter before the preparation of annual accounting reports;

- in case of emergency (fire, flood, etc.);

- upon liquidation of the company.

The frequency of the audit may also be reflected in the accounting policy of the enterprise.

The audit procedure is regulated by methodological guidelines for inventory of property, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49.

First of all, the enterprise issues an order to conduct an inventory indicating the persons - members of the commission (at least 3 people) and is endorsed by the manager (INV-22 form). Such a commission has the right to conduct an audit only in full force in the presence of the MOL. Before carrying out the inspection, the MOL writes a receipt in any form stating that all inventory items have been taken into account and the documents have been transferred to the accounting department.

Inspectors check the actual availability of materials with a list called the inventory list (INV-3 form).

Read about the inventory list used when checking the availability of materials in the article “Unified form INV-3 - form and sample” .

Such a document contains a column with data on the amount of materials accounted for in accounting, and an empty column in which inspectors can reflect the actual presence of inventory items. After a complete recalculation of values, the commission signs this statement. The MOL records on the last page that the inspection was carried out in its presence and that there are no complaints against the commission.

If, as a result, discrepancies are identified between the accounting and actual quantities, a document is drawn up - a matching statement, in which all such discrepancies are recorded (form INV-18).

Read about the specifics of filling out this statement in the material “Unified Form INV-18 - Form and Sample” .

If a surplus is identified, it must be taken into account. It is considered the income of the enterprise and is recorded in the credit of the 91st account.

If misgrading of inventory items is detected, the result can be offset against each other. Such an offset is possible only for 1 MOL for 1 audited period and only for similar types of products in equal quantities (clause 32 of Order No. 119n).

If a shortage is identified, first of all it is necessary to find out whether there was a natural loss (for example, shrinkage, shrinkage). The shortfall within the limit is considered an expense of the enterprise and is written off as a debit to the 26th (44th) account; the excess limit and the actual shortfall must be reimbursed by the MOL. To reflect the identified discrepancies, the INV-26 form can be used.

For the procedure for filling out this form, see the article “Unified Form No. INV-26 - Form and Sample” .

ConsultantPlus experts spoke in detail about the nuances of conducting an inventory. Study the material by getting trial access to the K+ legal reference system for free.

Accounting for work in progress in 1C

For this type of accounting, 1C:Accounting provides a document “WIP Inventory”, designed to display the fact of the results of an inventory check of WIP at the production site, generated in the following cases:

- The release of products/works/services is carried out within a month, but it can be postponed to the next calendar month;

- The cycle is more than a month, there is no release within a month. Expenses should be taken into account as part of the work in progress and carried forward to the next month.

... and does not require formation when:

- The release of products/works/services is carried out within a month, at the end of the period there are no balances of work in progress (Accounts 20 and 23 are closed monthly).

When creating a document, you must fill in the following details:

- Cost account where you need to record the balance in the work in progress. You can select accounts 20.01 and 23 – Main and Auxiliary production, respectively;

- In the Division, if the “Keep cost records by division” checkbox is checked in the program settings, – Cost division, where you need to display the balance in the refinery;

- Nomenclature group – Types of finished products (works, services) for which the balance must be displayed in the refinery;

- Balance amount – total estimate of work in progress balances according to accounting data;

- The amount of the balance of invoices is the total estimate of the balances of work in progress according to tax accounting data.

When reflecting inventory facts, there may be cases when there is a total estimate in accounting, but not in tax accounting, and, conversely, when there is an estimate in tax accounting, it is not in accounting.

Fig.7 WIP inventory

When determining the cost of finished products, it may include the cost of the previous month's work in progress. It is important to remember that work in progress is products that have not passed all stages (phases) of production on a certain date. When accounting for work in progress, account 21 “Semi-finished products of own production” is also used.

Disposal of materials

The write-off of materials from the warehouse must be accompanied by one of the documents: a limit card (Form M-8), an invoice for the release of materials to the third party (Form M-15), a demand invoice (Form M-11) or a consignment note (Form TORG- 12).

- Limit-receipt card is a document intended for the release of one item of materials to another warehouse of the enterprise or to a third party. For example, baking bread requires flour. Form M-8 reflects the daily write-off of flour from the storage warehouse to production. This document is maintained for a month in 2 copies: one each for the releasing and receiving parties. The card contains data on the quantity of materials issued, which are endorsed by the signatures of the person who issued and accepted the MOL. At the end of the period, the cards are handed over to the accounting department.

- The demand invoice is issued once for each release of goods and materials in 2 copies: one for each of the parties.

- An invoice for the release of materials to a third party is issued as a result of the disposal of materials to a third-party legal entity (when selling or, for example, transferring materials as customer-supplied raw materials) or to a geographically remote division of the company. The document is issued in 2 copies. If the release was made to a third-party organization, a power of attorney from the recipient of the goods and materials must be attached to Form M-15.

The form M-15 can be found in the material “Unified form M-15 - form and sample” .

- When selling materials to a third party, an invoice is issued in the TORG-12 form in 2 copies: the 1st remains with the seller’s company, the 2nd is transferred to the buyer. If inventory items are transported by road, it is also necessary to draw up a TTN (Form 1-T).

For information about the documents drawn up during transportation, read the article “Confirmation of transportation expenses - with what documents.”

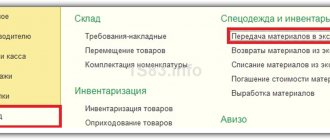

Write-off (disposal) of goods from the warehouse

The 1C program for warehouse accounting simplifies as much as possible the procedure for disposing of materials and goods from the warehouse. Next, let's look at an example of writing off materials for production. The write-off of material for production is documented in the “Requirement-invoice” document.

To register it, you need to go to the “Warehouse” section, then the “Warehouse” subsection, then find the line “Invoice requirements”.

Fig. 14 Requirements-invoices

In the window that opens, you can immediately select the warehouse from which you are going to write off materials for production. This function is active until you click the “Create” button.

Fig. 15 Warehouse selection

When you click the “Create” button, the warehouse name line is filled in automatically.

Fig. 16 Creating an invoice request

When filling out the necessary details, there is a “Warehouse” line on the right, which allows you to select from which warehouse the materials are written off for production. In our example, Warehouse No. 1 is Wholesale.

Fig.17 Completed document

So we will write off 350 kg of cement into production and form the remaining goods.

Fig. 18 Balance report

Note! We specifically entered the quantity of materials that exceeds the actual availability in the warehouse. The system allows you to write off materials in excess, since in the menu “Administration” - “Post documents” (Fig. 19) we have checked the box in the line “Allow write-off of inventories if there are no balances according to accounting data.”

Fig.19 Posting documents

Fig. 20 Allow write-off of inventories if there are no balances according to accounting data

If you uncheck this box, the program will prohibit posting a document for writing off materials. Below we will describe how the system controls negative balances.

Storage

An organization can create a warehouse designed to store materials from third-party organizations and receive a certain remuneration for storage services. This activity is regulated by Art. 909 of the Civil Code of the Russian Federation.

In this case, a public agreement is concluded between the counterparties. That is, anyone has the right to deposit their inventory items. Acceptance of materials based on quality, quantity and assortment is carried out by the storage warehouse's MOL. The depositor has the opportunity to inspect or check, as well as pick up his valuables at any time in the presence of the MOL.

The entire storage procedure is documented with primary documents. Let's look at the main ones.

Acceptance of goods and materials for storage is accompanied by an act of acceptance and transfer of goods and materials (form MX-1), which is issued in 2 copies: one for each party. The MOL records the receipt of inventory items for storage in a special journal (form MX-2).

Upon expiration of the storage period, as well as if the depositor wishes in writing, the storage warehouse returns the materials. This procedure is accompanied by a certificate of return of goods (form MX-3).

All data on the quantity and movement of inventory items are recorded by the MOL in special journals (MX-4, -5, -6, -7, -8).

Forms for forms MX-1 and MX-3 and the procedure for filling them out can be found in the materials:

- ,

- “Unified form No. MX-3 - form and sample”.

Transfer of payment to the supplier

Purpose and creation of a document

The fact of transfer of payment to the supplier, which was made according to the bank statement, is documented in the document Write-off from the current account transaction type Payment to the supplier .

The document Write-off from a current account can be created:

- based on the document Invoice from supplier , using the Create based button - Write-off from current account;

- based on the document Receipt (act, invoice) , using the Create based button - Write-off from the current account;

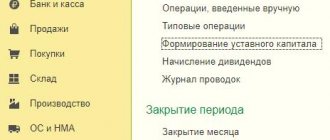

- by independently entering a document in the Bank and cash desk section – Bank – Bank statements – Receipt button – Goods (invoice).

Filling Features

If the document is filled out on the basis of the document Invoice from supplier or Receipt (act, invoice) , then it will be filled out automatically. The data must be verified with the bank statement and, if necessary, adjusted.

Features of filling out the document:

- Amount – amount of payment to the supplier, according to the bank statement;

- Recipient – name of the supplier. Selected from the Contractors directory;

- Agreement is the basis for settlements with the supplier, which may be an agreement, invoice, or other document. Selected from the Contracts directory.

In order for mutual settlements with the supplier to be correct, it is necessary to ensure that the counterparty and the agreement indicated in the Receipt document (act, invoice) and in the Write-off document from the current account coincide.

Otherwise, there will be an incorrect balance in settlements with the supplier and distortion of tax and accounting reporting.

Postings according to the document

In our example, materials were first received from the supplier, which resulted in accounts payable under Kt 60.01 “Settlements with suppliers and contractors.”

At the time of payment to the supplier, the debt is repaid and posting Dt 60.01 Kt is generated.

If an advance payment is made to the supplier, the advance payment to the supplier will be reflected by posting Dt 60.02 Kt, which will be offset against the subsequent delivery of materials from the supplier.

But regardless of how the payment was made to the supplier - in the form of prepayment or postpayment, the documents used and the procedure for filling them out to draw up a standard materials receipt scheme do not change.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Results

For efficient and uninterrupted operation of the company, it is necessary to properly organize the work of warehouses.

In order to track the movement of inventory and materials in warehouses, it is very important to issue accompanying and primary documents in a timely manner, the circulation of which should be recorded in the document flow schedule in the accounting policy of the enterprise. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Production accounting settings in 1C - step by step for dummies

Accounting policy according to accounting

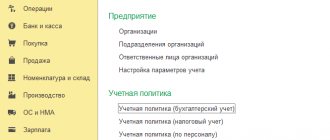

Setting up accounting policies for accounting purposes is set in the Main - Settings - Accounting Policies section.

During production, set the Product Output when setting up Activities, the costs of which are taken into account on account 20 “Main production” .

And also determine the settings for writing off general business expenses and using planned costs in 1C.

Setting the planned cost

If you do not pre-set planned prices for GP (or semi-finished products), set the price manually in the Shift Production Report document.

the type of planned prices in the section Administration - Program Settings - Accounting Parameters - link Type of planned prices.

Set the planned price using the document Setting item prices in the Warehouse - Prices - Setting item prices section.

- Setting the planned production price

- Setting item prices

Specification Definition

To automatically fill in materials for production in 1C, it is recommended to enter specifications for their write-off per unit of production.

Set the specification of the item in the item card using the Specifications in the section Directories – Goods and Services – Nomenclature.

Learn more Determination of specifications for the write-off of materials for production