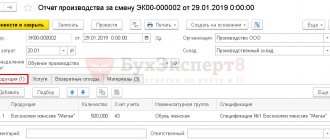

Operations in the report

The shift production report (hereinafter referred to as OPS) is intended to document the following types of enterprise activities:

- Release of goods, materials, finished products, semi-finished products - that is, release of any product produced by the enterprise;

- Services provided to the company's production units;

- Writing off materials as expenses;

- Release by production of returnable waste.

All these operations can be documented in the OPS document.

Registration in 1-C Accounting

The OPS document is located in the accounting program in the Production tab. If there is already at least one completed document of this type, then when you go to the OPS section, a list with previously completed production documents will open. In the open document you need to indicate the following information:

- The organization and its division in which the manufactured products were formed;

- Issue date;

- The warehouse where the finished products were received;

- List of manufactured products indicating quantity, planned price and accounting account;

- An account in which all costs for the production of a given batch of products will be taken into account. As a rule, this is 20 or 23 counts.

Accounting in production: where to start

In order to better understand the goals and objectives of accounting in production, let's imagine a certain hypothetical production that produces a PRODUCT. Our PRODUCT production process has several stages:

- Preliminary processing.

- Actually production.

- Final processing.

That is, in our production cycle there are at least three sections. At each site, the PRODUCT goes through its own technological cycle.

The production process in general can be represented as a diagram:

As we see in the diagram, raw materials enter production. In our case, raw materials go through three (in practice there may be more or less) stages of processing, and the output is a finished product.

In this regard, the accounting department of a manufacturing enterprise faces several important tasks:

- Determine the procedure for acceptance and accounting of raw materials.

- Establish the procedure and rules for accounting for materials at each stage of production, determine the frequency and form of material reports, take the form of primary documents on the basis of which material resources are released to the workshops and transferred from one technological site to another.

See how the warehouse accounting card and the materials warehouse accounting book are maintained and what transactions reflect the movement of materials in accounting.

Important! From 01/01/2021, materials accounting is carried out in accordance with the new FSBU 5/2019 “Inventories”, PBU 5/01 has become invalid. The Guide from ConsultantPlus will help you adapt to the new accounting rules. If you do not already have access to this legal system, trial access is available for free.

- Determine the nature of remuneration for production workers.

- Establish procedures and rules for accounting for finished products.

- Find out which structures of the enterprise are involved in the production process (departments of the chief mechanic, chief technologist, laboratory, quality control department, other support services - repairmen, equipment cleaning and adjustment, industrial premises cleaners, transporters). For each support service, it is necessary to determine a list of material costs and equipment used, the nature of remuneration, and introduce a procedure for accounting for material and technical resources.

There are many tasks - therefore, in the process of setting up production accounting, an accountant must be well versed in all the intricacies of the production process. And you need to start introducing accounting by studying the technology and features of those products that are obtained at each stage of production. At the same time, the main task of accounting at the production site is to accurately determine the actual costs per unit of production.

Result

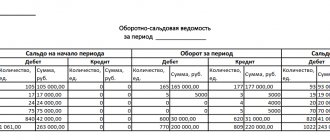

When creating and posting an OPS document in 1-C Accounting, the following transactions are generated:

Debit 41 (43) Credit 20.1 - finished products released,

Debit 20.1 Credit 10.1 - materials for the manufacture of these products are written off.

Let's look at an example for a more precise description of the postings.

Example 1.

From the production workshop of Reshenie LLC, the foreman handed over to the accountant a report that the workshop produced 100 kg of sausage. In this case, 60 kg of beef, 20 kg of pork, 10 liters of water, 10 kg of seasoning mixture were consumed. The accountant will draw up the OPS document, as a result of which the following transactions will be generated:

Debit 41 Credit 20.1 100 kg 30,000 rubles - products released

Debit 20.1 Credit 10.1 60 kg 12,000 rubles - beef written off

Debit 20.1 Credit 10.1 20 kg 4,000 rubles - pork written off

Debit 20.1 Credit 10.1 10 kg 1,000 rubles - water written off

Debit 20.1 Credit 10.1 10 kg 5,000 rubles - seasoning mixture written off

The write-off of materials does not always involve the execution of this document. In order for materials to be written off, when drawing up a production report, you need to put a mark indicating that the materials are written off using this document. If the mark is not marked, then you need to write off the materials using another document - the Request-invoice.

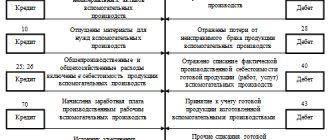

What is included in production costs

Production costs may include:

- material costs for main production: raw materials, components, semi-finished products purchased externally;

- energy costs for production: electricity, fuels and lubricants, thermal energy, etc.;

- human labor costs expressed in wages of main workers and workers in auxiliary production;

- costs of compulsory social insurance;

- depreciation of equipment used in the production process;

- labor costs of management personnel involved in production;

- cost of materials for auxiliary workshops;

- depreciation of equipment in auxiliary workshops.

Costs are grouped by elements in accordance with the requirements of clause 8 of PBU 10/99.

Find out more about reflecting main production in the balance sheet from our article.

At the same time, the costs of maintaining the main and auxiliary production facilities are of a general production nature. Such costs must be accumulated on the 25th account and attributed to cost using one of the methods for distributing indirect costs. The method is chosen by the enterprise based on economic feasibility and in accordance with industry instructions on the formation of product costs (for industry enterprises).

Thus, cost accounting is carried out by elements and items. Material accounting can be carried out in the context of workshops (sites), financially responsible persons, by types of finished products, varieties, etc.

More information about the classification of production costs can be found in the publication “Production cost accounting system and their classification.”

Read about the new rules for accounting for work in progress, which is included in inventories from 01/01/2021 (according to FSBU 5/2019 “Inventories”) in the Ready-made solution from ConsultantPlus. Trial access is available for free.

Specification

In order to be able to document the release of a product in one document and write off the materials that were spent on its production, it is necessary that a specification be drawn up for each type of product. A specification is a list of materials that are needed to produce one unit of product. To create a specification, you need to go to Directories, and then select the “Item Specifications” section. In this section, you need to document how much of what you need to spend from materials to create a unit of production, and so on for each type of product manufactured by the enterprise.

Important! If there is no specification for the manufactured product, the program will not be able to write off the materials spent on its production. In such a situation, you will have to formalize this operation with the “Demand-invoice” document.

Shift production report

In order to set up production accounting in the program, you must enable this option in the 1C settings. To do this, in the “Main” section, select “Settings” - “Functionality”.

Next, in the list that appears, select “Production” and check the corresponding box.

The release of products and their receipt at the enterprise warehouse is carried out by creating the document “Production Report for the Shift”. To do this, select: “Production” – “Production reports for the shift”.

A new document is opened by clicking the Create button in the document log.

The following must be filled in the header of the document:

- Warehouse where manufactured products will be received;

- Cost account – default 20.01 (Main production);

- Cost subdivision - for the correct distribution of costs during the Month Closing operation.

In the tabular section on the “Products” tab, by selecting from the “Nomenclature” directory, information about the products being manufactured is filled in. The quantity and planned price are entered. The amount is calculated automatically.

- Capitalization account for finished products – 43 (Finished products).

- The planned price is the cost of production according to the calculation (planned calculation), at which the products are delivered to the warehouse during the month.

The formation and calculation of the actual cost of production is carried out during the “Closing of the month” operation. To correctly calculate the cost when carrying out the “Month Closing” operation, it is also necessary to fill in the product group of manufactured products.

A product group is an analytical indicator for cost accounting and correct calculation of costs by type of product.

The Specification field allows you to fill out the Materials tab automatically in terms of the number of products produced.

If the “Specification” field is filled in on the “Products” tab, then on the “Materials” tab, click the “Fill” button, based on the selected specification, the program will automatically fill the tabular part with processed raw materials in terms of the quantity of products. Or you can fill out the tabular part manually by selecting materials from the “Nomenclature” directory.

By clicking the Dt/Kt button, you can see the document transactions generated by the program.

- Dt 43 Kt 20 – products produced;

- Dt 20.01 Dt 10.01 – materials written off for production.

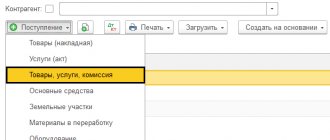

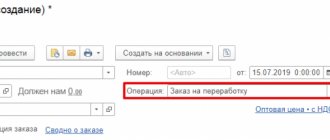

It is also possible to write off materials for production by creating a “Requirement-invoice” document based on the “Production Report for a Shift” document.

In this case, the “Materials” tab in the “Shift Production Report” is not filled in. By clicking the “Create” button, the document “Request-invoice” is entered on the basis.

The invoice requirement is automatically filled in with materials released into production if the “Specification” field is filled in in the document “Production Report for a Shift” on the “Products” tab. Or it can also be filled in manually by selecting items from the “Nomenclature” directory.

- accounting account – 10.01 (Materials).

- cost account – 20.01 (Main production).

The items “Cost division”, “Nomenclature group”, “Cost item” are required to be filled out for the correct formation of the cost when carrying out the “Month Closing” operation.

The “Production Report” document for the shift also has tabs “.

Services – to be filled in if the company has several divisions that can provide services to each other. For example, packaging of products, which is produced by a separate division of the organization for the production division.

Returnable waste - filled in if more materials were released into production than required for the manufacture of products and the remainder of these materials must be returned to the warehouse for use in the future.