Organization of accounting of calculations for social contributions

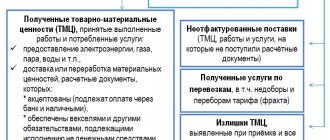

Organization of accounting of calculations regarding insurance deductions is the responsibility of all employers, regardless of the taxation system applied. The billing period is the calendar year, and the reporting period is the first quarter, six months, 9 months, and a year. According to the approved procedure, the employer must record:

- accrued, transferred social contributions, pennies, fines;

- excess insurance deductions, penalties, penalties subject to refund, including interest;

- settlements with Social Insurance for social insurance funds due to maternity and illness at the place of registration of the policyholder (including amounts from the Social Insurance Fund);

- insurance costs.

Cost accounting for deductions for insurance coverage carried out by the policyholder is represented by social cash benefits (for disability, when registering in early pregnancy, at the birth of a child, for child care (every month), etc.). This also includes cash payments in excess of the established amounts and in amounts taken into account when counting into the insurance period periods that are not subject to compulsory insurance (applies to cash assistance for temporary disability due to illness and due to maternity).

Accounting for the amounts of calculated payments is carried out based on the results of each month by the policyholders during the billing (reporting) period for all employees. The basis is the amount of cash payments and material incentives credited from the beginning of this period to the end of the month, as well as the rates of the insurance contributions themselves.

When the maximum amount is reached, accruals (Government Decree No. 974 of November 24, 2011) are terminated, with the exception of pension insurance. The calculation for the Pension Fund does not stop, but only the tariff is reduced. The policyholder can obtain background information on the status of settlements regarding contributions, penalties or fines through a request to the territorial fund authority within 5 days.

The payer prepares and submits a declaration on social contributions for pension insurance, as well as calculations of advance payments under the Unified Social Tax (for those who make cash payments to individuals). Reporting is prepared and submitted in accordance with forms 4-FSS and RSV-1 Pension Fund of the Russian Federation. Form 4-FSS has been filled out since 2016, taking into account the new rules established by FSS Order No. 59.

Insurance rates and basis for calculating premiums

For each individual, an organization or individual entrepreneur calculates contributions individually depending on the income received. The assessment base is calculated as a cumulative total during the calendar year. For some types of income, the tax base is limited. See the limits in force in 2016 here.

The final amount of contributions is the taxable base multiplied by the corresponding insurance tariff (rate).

| Taxable base | Pension Fund | FSS | FFOMS | Total |

| Does not exceed the established limit value, % | 22 | 2,9 | 5,1 | 30 |

| More than the established limit, % | 10 | 5,1 | 15,1 |

Tariffs for contributions “for injuries” depend on the occupational risk class assigned to the organization or enterprise.

What is account 69 in accounting

69 accounting account is a tool used to accumulate information on accruals and payments for all types of personnel insurance. It is located in Section VI “Calculations” of the Chart of Accounts for accounting of the financial and economic activities of the organization.

Extra-budgetary funds of the Russian Federation

In 2022, contributions to state funds are set in the following amounts (without benefits):

- FFOMS - 5.1%;

- PFR - 10% (above the maximum base of 1.1 5 million rubles) and 22% (up to the maximum base of 1.15 million rubles);

- FSS - 0% (above the maximum base of 865 thousand rubles) and 2.9% (below the maximum base of 865 thousand rubles).

Characteristics of account 69

On the account 69 reflects information not only on the accrual and payment of monthly payments to state funds, but also penalties and penalties imposed for late and non-payment.

Debit 69 of the account shows the amounts of paid contributions to compulsory medical insurance, the Pension Fund of the Russian Federation and the Social Insurance Fund, funds that are reimbursed to employees of the enterprise upon the occurrence of an insured event, as well as overpaid amounts that were returned by state funds. For loan 69, you can control the accrual of installments that are payable, as well as penalties and fines for late payments.

You can determine whether account 69 is active or passive after analyzing its balance at the beginning and end of the reporting period. Such a balance can show both an overpayment and arrears of payments, therefore it can be a credit or debit, respectively, defining account 69 as active-passive.

Scheme 69

The debit balance reflects the debt incurred by government agencies to the organization. It arises as a result of overpaid insurance premiums and is subject to refund. The emergence of a credit balance occurs as a result of the formation of amounts of accrued but not yet paid contributions. Due to the fact that balances are displayed in the context of subaccounts, you can immediately determine which payments have not been made.

The accounting department of the enterprise has the right to include all accrued contributions as indirect, direct or other costs, depending on the type of settlement with personnel on the basis of which the contributions were paid. Thus, the accrued amounts of payments reduce the taxable profit of the enterprise.

See also: What is ruble denomination in simple words and what are its goals

The amounts of insurance payments are accrued monthly when making settlements with personnel, and payment of accruals made is carried out until the 15th of the next month.

What does count 69 include?

Accounting, or more precisely, the transferred payments, together with the paid amounts for insurance fees, are displayed on account 69 “Calculations for social insurance and security” and subaccounts to it. Account 69 combines all information on insurance payments (applies to social, medical, and pensions).

| № | Subaccounts of the first order | № | Subaccounts of the second order |

| 69-1 | "Calculations for social insurance." | 69-1-1 | “Settlements with the Social Insurance Fund for insurance fees.” |

| 69-1-2 | “Settlements with the Social Insurance Fund for fees for social insurance against accidents and occupational diseases.” | ||

| 69-2 | "Calculations for pension provision." | 69-2-1 | “Calculations for the insurance part of the labor pension” (concludes, in turn, joint and several with the individual part); |

| 69-2-2 | “Calculations for the funded part of the labor pension.” | ||

| 69-3 | "Calculations for health insurance." |

As for vacation pay, they are recorded in account 96 “Reserves for future expenses.” To reflect deductions of funds from vacation pay, a subaccount is opened to the specified account. After the transfer of wages, postings display the money collected into extra-budgetary funds and for compulsory insurance against (occupational diseases) accidents at work.

Account 69 corresponds to the production cost accounts. On the credit of this account, correspondence with account 99 (profit and loss) shows the accrual of penalties for late payments. By debit, account 69 corresponds with the expense accounts (transferred funds and amounts paid through payments for medical, pension and social insurance).

Is count 69 active or passive?

To answer the question whether account 69 is active or passive, you must first understand what it is used for. In accounting, account 69 is used to display calculations for various types of compulsory social insurance:

- pension;

- medical;

- in case of occupational diseases/injuries at work;

- in case of temporary disability.

Account 69, as a rule, corresponds with cost accounts, and in the case of calculating benefits at the expense of the employer, with accounts related to the accrual and payment of wages. It also reflects penalties for late payments made to government funds through the tax office. The debit reflects payments made in the form of mandatory insurance contributions. Based on this, we can conclude that this accounting account is active-passive.

Posting examples

When calculating insurance premiums, they must be charged to the same cost account where the salary of the same employee is taken into account. The transfer of contributions to the budget is carried out by various payment orders indicating the BCC of the corresponding fund. Let's consider further examples of drawing up postings for dummies.

Calculation of insurance premiums

| Debit | Credit | Operation designation |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount “Pension insurance” | Contributions for employee pension insurance have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount "Medstrakh" | Contributions to the health insurance fund have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount "Social Insurance" | Contributions to the social insurance fund for temporary disability and maternity have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount “Injuries” | Contributions for insurance against accidents and injuries have been calculated |

Transfer of insurance premiums

| Debit | Credit | Operation designation |

| 69 subaccount “Pension insurance” | 51 | Employee pension insurance contributions transferred non-cash |

| 69 subaccount "Medstrakh" | 51 | Contributions to the health insurance fund were transferred non-cash |

| 69 subaccount "Social Insurance" | 51 | Contributions to the social insurance fund for temporary disability and maternity were transferred non-cash |

| 69 subaccount “Injuries” | 51 | Payments for insurance against accidents and injuries are transferred non-cash |

Other transactions with insurance premium funds

| Debit | Credit | Operation name |

| 69 subaccount “Injuries” | 70 | A payment was made from the fund due to a work-related injury. |

| 69 subaccount "Social Insurance" | 70 | Sick leave payments have been accrued |

| 99 | 69 subaccount “Pension insurance” | Reflects the accrual of penalties for late payment of employee pension insurance contributions |

| 99 | 69 subaccount "Medstrakh" | Reflects the accrual of penalties for late payment of contributions to the health insurance fund |

| 99 | 69 subaccount "Social Insurance" | Reflects the accrual of penalties for late payment of contributions to the social insurance fund for temporary disability and maternity |

| 99 | 69 subaccount “Injuries” | Reflects the accrual of penalties for late payment of accident and injury insurance premiums |

Existing subaccounts 69

Account 69, the sub-accounts of which reflect data in the context of state funds receiving payments, shows the accrued and paid amounts of contributions:

- 69-01 - an account for reflecting social insurance payments that are paid to the Social Insurance Fund.

- 69-02 - accounting for pension accruals in favor of the Russian Pension Fund. Depending on the activity of the enterprise, additional sections may be opened on this sub-account to reflect information on contributions for additional payments to certain categories of employees, for example, aviation workers, coal industry organizations, and those employed in work with harmful or difficult working conditions.

- 69-03 - accounting for payments for compulsory health insurance for employees. The subaccount is divided into payments to the Federal Compulsory Medical Insurance Fund and the territorial one.

- 69-07 - contributions to the funded part of the pension, made on the basis of the employee’s application.

- 69-08 - employer contributions for employees to private medical centers.

- 69-11 - an account for accrual (expense) of amounts for insurance against occupational diseases or industrial accidents in favor of the Social Insurance Fund.

Attention! If an enterprise has relationships with other extra-budgetary funds, then accounting provides for the possibility of opening other sub-accounts to simplify the accounting of transactions.

Changes in transactions on account 69 in 2016

Account 69 reflects many business transactions, and any legislative change in the rules for calculating payments must be taken into account by the auditor. Starting this year, the following requirements came into force:

- the amount paid to an employee upon dismissal is not subject to UST only if it does not exceed three times the average monthly income;

- social security deduction cancelled. payments from travel expenses;

- Transfers to the Pension Fund from the income of foreign workers have become mandatory.

If the rules are not followed, administrative penalties will be applied to the employer.

How to work with count 69

Account 69 - active-passive. Since the account balance can be either positive or negative, it is allowed to record amounts in both debit and credit. In this case, the credit side reflects the funds that must be transferred to each of the funds, and the debit side shows what has already been paid.

A separate sub-account must be opened for each type of contribution. If necessary, the accountant has the right to open the required number of additional sub-accounts. This point must be recorded in the company's accounting policies.

Table of typical transactions for account 69

The basis for calculating the amount of insurance premiums is the amount of remuneration that is paid to the employee according to the employment contract. The amount of accrual of contributions is carried out according to Kt 69, transfers to extra-budgetary funds are reflected in Dt 69. Also, according to Kt 69 the amount of receipts of contributions credited from extra-budgetary funds in favor of the organization can be carried out.

Basic transactions on account 69 are reflected in accounting with the following entries:

| Dt | CT | Description | Document |

| 69 | 51 | Insurance premiums are transferred to an extra-budgetary fund | Payment order |

| 20 | 69 | Insurance premiums accrued to an employee of the main production | Payroll |

| 44 | 69 | Insurance premiums have been accrued to the employee who ensures the process of selling goods | Payroll |

| 99 | 69 | Accrual of fines and penalties for insurance premium payments | Accounting certificate-calculation |

| 51 | 69 | Refund of funds overpaid to extra-budgetary funds | Bank statement |

Example of postings for account 69

On January 31, 2016, Start LLC made a payment to K.R. Sazonov, an employee of the economic department:

- salary - 41,300 rubles;

- sickness benefit - 7,500 rubles. (including for the first 2 days at the expense of the organization - 2,350 rubles).

See also: Balance sheet: what you need to know, how to fill it out and sample

When paying Sazonov’s salary, the accountant at Start LLC calculated the amount of insurance premiums:

- Pension Fund for the insurance part of the labor pension: 41,300 rubles. x 14.0% = RUB 5,782;

- Pension Fund for the funded part of the labor pension: 41,300 rubles. x 6.0% = 2478 rub.;

- FSS for insurance premiums: 41,300 rubles. x 2.9% = 1198 rub.;

- Social Insurance Fund for contributions to insurance against accidents and occupational diseases: 41,300 rubles. x 0.2% = 83 rub.;

- FFOMS: 41,300 rub. x 1.1% = 454 rubles;

- TFOMS: 41,300 rub. x 2.0% = 826 rub.

The accountant at Start LLC reflected the payment of wages to Sazonov and the accrual of insurance premiums with the following entries:

| Dt | CT | Description | Sum | Document |

| 91.2 | 70 | The salary of K.R. Sazonov has been accrued. | RUB 41,300 | Payroll |

| 91.2 | 70 | Sickness benefits accrued (at the expense of Start LLC) | RUB 2,350 | Payroll |

| 69.01 | 70 | Sickness benefit accrued (at the expense of the state) | RUB 5,150 | Payroll |

| 91.2 | 69.01 | The amount of insurance contributions to the Social Insurance Fund has been calculated | 1198 RUR | Payroll |

| 91.2 | 69.01 | The amount of insurance premiums accrued (accidents and occupational diseases) | 83 rub. | Payroll |

| 91.2 | 69.02.1 | The amount of insurance premiums has been calculated (the insurance part of the pension) | 5782 rub. | Payroll |

| 91.2 | 69.02.2 | The amount of insurance contributions has been accrued (the funded part of the pension) | 2478 rub. | Payroll |

| 91.2 | 69.03.1 | The amount of insurance premiums accrued (FFOMS) | 454 rub. | Payroll |

| 91.2 | 69.03.2 | The amount of insurance premiums accrued (TFIF) | 826 rub. | Payroll |

| 69.01 | 51 | The amount of insurance contributions (accidents and occupational diseases) was transferred to the extra-budgetary fund. | 83 rub. | Payment order |

| 69.02.1 | 51 | The amount of insurance contributions (the insurance part of the pension) was transferred to the extra-budgetary fund | 5782 rub. | Payment order |

| 69.02.2 | 51 | The amount of insurance contributions (the funded part of the pension) was transferred to the extra-budgetary fund. | 2478 rub. | Payment order |

| 69.03.1 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (FFOMS) | 454 rub. | Payment order |

| 69.03.2 | 51 | The amount of insurance contributions was transferred to the extra-budgetary fund (TFIF) | 826 rub. | Payment order |

By debit

| Debit | Credit | Content | Document |

| 69.01 | 51 | Transfer of funds from the organization's current account to pay off debts to the budget for insurance premiums in the part transferred to the Social Insurance Fund | Debiting from current account |

| 69.01 | 70 | Calculation of child care benefits from the Social Insurance Fund | Payroll |

| 69.01 | 70 | Calculation of benefits for temporary disability at the expense of the Social Insurance Fund | Payroll |

By loan

| Debit | Credit | Content | Document |

| 000 | 69.01 | Entering initial balances: insurance premiums in the part transferred to the Social Insurance Fund | Entering balances |

| 20.01 | 69.01 | Inclusion in the costs of main production of the amount of insurance premiums in the part transferred to the Social Insurance Fund | Payroll |

| 23 | 69.01 | Inclusion in the costs of auxiliary production of the amount of insurance premiums in the part transferred to the Social Insurance Fund | Payroll |

| 25 | 69.01 | Write-off of the amount of insurance premiums to general production expenses in the part transferred to the Social Insurance Fund | Payroll |

| 26 | 69.01 | Write-off for general business expenses the amount of insurance premiums in the part transferred to the Social Insurance Fund | Payroll |

| 29 | 69.01 | Write-off of the amount of insurance premiums to the expenses of service industries and farms in the part transferred to the Social Insurance Fund | Payroll |

| 44.01 | 69.01 | Inclusion in distribution costs of the amount of insurance premiums in the part transferred to the Social Insurance Fund in organizations engaged in trading activities | Payroll |

| 44.02 | 69.01 | Inclusion in business expenses of the amount of insurance premiums in the part transferred to the Social Insurance Fund in organizations engaged in industrial and other production activities | Payroll |

| 91.02 | 69.01 | Inclusion in other expenses not related to the main activities of the amount of insurance premiums in the part transferred to the Social Insurance Fund | Payroll |

| 96.01.2 | 69.01 | Write-off of the estimated liability (use of the reserve) for the cost of contributions in the part transferred to the Social Insurance Fund | Payroll |

| 96.01.2 | 69.01 | Write-off of the estimated liability (use of the reserve) for the cost of contributions in the part transferred to the Social Insurance Fund (accounting for wages in an external program) | Reflection of salaries in accounting |

Calculation of insurance premiums

| Debit | Credit | Operation designation |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount “Pension insurance” | Contributions for employee pension insurance have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount "Medstrakh" | Contributions to the health insurance fund have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount "Social Insurance" | Contributions to the social insurance fund for temporary disability and maternity have been calculated |

| 08, 20, 23, 25, 26, 29, 44, 91/2, 96, 97 | 69 subaccount “Injuries” | Contributions for insurance against accidents and injuries have been calculated |

Transfer of insurance premiums

| Debit | Credit | Operation designation |

| 69 subaccount “Pension insurance” | 51 | Employee pension insurance contributions transferred non-cash |

| 69 subaccount "Medstrakh" | 51 | Contributions to the health insurance fund were transferred non-cash |

| 69 subaccount "Social Insurance" | 51 | Contributions to the social insurance fund for temporary disability and maternity were transferred non-cash |

| 69 subaccount “Injuries” | 51 | Payments for insurance against accidents and injuries are transferred non-cash |

See also: Working capital turnover ratio

Other transactions with insurance premium funds

| Debit | Credit | Operation name |

| 69 subaccount “Injuries” | 70 | A payment was made from the fund due to a work-related injury. |

| 69 subaccount "Social Insurance" | 70 | Sick leave payments have been accrued |

| 99 | 69 subaccount “Pension insurance” | Reflects the accrual of penalties for late payment of employee pension insurance contributions |

| 99 | 69 subaccount "Medstrakh" | Reflects the accrual of penalties for late payment of contributions to the health insurance fund |

| 99 | 69 subaccount "Social Insurance" | Reflects the accrual of penalties for late payment of contributions to the social insurance fund for temporary disability and maternity |

| 99 | 69 subaccount “Injuries” | Reflects the accrual of penalties for late payment of accident and injury insurance premiums |

What does debit 69 credit 69 show?

Correspondence Dt 69 Kt 69 is reflected in the instructions.

In this case, the debit of account 69 shows:

- Accrued amounts of benefits, which is accompanied by the posting of debit 69 credit 70.

Example 1

The employee was on sick leave. After his illness, he submitted a certificate of incapacity for work. As a result, the following entries were reflected in the accounting for amounts compensated by the Social Insurance Fund:

- Dt 69 Kt 70 - temporary disability benefits accrued;

- Dt 70 Kt 51 - payment of benefits;

- Dt 51 Kt 69 - FSS reimbursed the benefits.

- Payment of insurance premiums, penalties, fines.

- Adjustments related to excessive assessment of insurance premiums or reimbursement of benefits by funds.

Credit account 69 is mainly found when calculating insurance premiums, penalties and fines on them. At the same time, we note that the moments of calculation of contributions and payments to employees coincide, and the correspondence of account 69 is similar to the cost account used to reflect the specified payment.

Example 2

The production organization paid wages to employees:

- production personnel RUB 570,000;

- management staff RUB 800,000;

- commercial department 650,000 rub.

Contribution rates for VNIM - 2.9%, for compulsory health insurance - 22%, compulsory medical insurance - 5.1%, for NS and PZ - 0.2%.

For insurance premium rates, see this article.

An example of accounting for insurance premiums for the purpose of calculating income tax from ConsultantPlus A trading organization accrued and paid a bonus to employees in June for the 20th anniversary of the company. The total amount of insurance premiums accrued for all employees is RUB 755,000. You can view the entire example in K+ by getting free trial access.

The accounting records reflect the following entries:

- Dt 20 Kt 70 - payroll for employees in production 570,000 rubles;

- Dt 20 Kt 69.01 - accrual of contributions from VNiM 16,530 rubles. (570,000 × 2.9%);

- Dt 20 Kt 69.02 - contributions to the mandatory insurance policy 125,400 rubles. (570,000 × 22%);

- Dt 20 Kt 69.03 - compulsory medical insurance contributions 29,070 rubles. (570,000 × 5.1%);

- Dt 20 Kt 69.11 - contributions from NS and PZ 1140 rubles. (570,000 × 0.2%);

- Dt 26 Kt 70 - salary calculation for management staff 800,000 rubles;

- Dt 26 Kt 69.01 - from VNiM 23,200 rub. (800,000 × 2.9%);

- Dt 26 Kt 69.02 - for OPS 176,000 rubles. (800,000 × 22%);

- Dt 26 Kt 69.03 - for compulsory medical insurance 40,800 rubles. (800,000 × 5.1%);

- Dt 26 Kt 69.11 - contributions from NS and PZ 1600 rubles. (800,000 × 0.2%);

- Dt 44 Kt 70 - salary of the commercial department 650,000 rubles;

- Dt 44 Kt 69.01 - from VNIM 18,850 rub. (650,000 × 2.9%);

- Dt 44 Kt 69.02 - for OPS 143,000 rubles. (650,000 × 22%);

- Dt 44 Kt 69.03 - for compulsory medical insurance 33,150 rubles. (650,000 × 5.1%);

- Dt 44 Kt 69.11 - contributions from NS and PZ 1300 rubles. (650,000 × 0.2%);

- Dt 69.01 Kt 51 - payment of contributions from VNiM 58,580 rubles;

- Dt 69.02 Kt 51 - payment of contributions to the OPS 444,400 rubles;

- Dt 69.03 Kt 51 - payment of contributions for compulsory medical insurance 103,020 rubles;

- Dt 69.11 Kt 51 - payment of contributions from NS and PZ 4040 rubles.

If an organization underestimates the amount of insurance premiums or pays them later than due, it will have to accrue and pay penalties and fines.

Important! Hint from ConsultantPlus Depending on the situation, entries for accrual of penalties can be made on the following dates (clause 16 of PBU 10/99): on the date of the decision...; on the date of demand...; Read more about the date of reflection of penalties on contributions in K+. Trial access is available for free.

Example 3

The organization paid insurance premiums from VNiM on September 25 instead of September 15, 2020, and therefore it was charged penalties for violating the payment deadlines. The amount of contributions from example 2.

Amount of penalty = 10 × 1/300 × 4.25% × 58,580 = 83 rubles,

Where:

10 — number of days of delay;

4.25% - refinancing rate;

Dt 91 Kt 69.01 - accrual of penalties 83 rubles.

Dt 69.01 Kt 51 - payment of penalties 83 rubles.

Our article will help you fill out payment forms.

Correspondence of account 69 with other accounts

Account 69 in most cases corresponds with the accounts on which the calculation of wages is reflected (in relation to deductions made from the enterprise’s funds). However, correspondence is also possible with accounts that record profits and losses, expenses and income of the enterprise. This is the count. 99, and correspondence with him reflects the accrual of fines issued and penalties incurred for late payments and non-payments.

Correspondence under debit 69 occurs with the following accounts:

- Section V “Cash” - 50, 51, 52, 55. In this case, the entries reflect transactions carried out with the company’s money in any form: cash and non-cash located on the company’s current, foreign currency or special accounts.

- Section VI “Calculations” - 70. This is the main corresponding account reflecting calculations for personnel wages.

Correspondence for loan 69 occurs with the following accounts:

- Section I “Non-current assets” - 08.

- Section III “Production Costs” - 20, 23, 25, 26, 28, 29. The accounts correspond to the calculation and payment of insurance premiums for workers of various types of production, depending on the specialization of the enterprise.

- Section IV “Finished products and goods” - 44 (for trade workers).

- Section V “Cash” - 51, 52. In this case, transactions carried out with non-cash funds in the current and foreign currency accounts of the enterprise are reflected.

- Section VI “Calculations” - 70, 73. These are the main corresponding accounts, reflecting calculations for wages and other transactions with personnel.

- Section VIII “Financial results” - 91, 96, 97, 99.

Main correspondence

Typical wiring

Account 69 can correspond with the following accounts.

From the debit of account 69 to the credit of accounts:

- Account 50 - used in certain cases when social benefits are issued from the cash register. Moreover, such an entry can only be made in situations where the benefit is not combined with salary payments and is calculated bypassing account 70. In addition, they should not be subject to taxes and other deductions.

- Account 51 - when transferring contributions from a current account;

- Account 52 - when transferring contributions from a foreign currency account. Despite the fact that such correspondence is directly indicated in the chart of accounts adopted by Order 94-N, it is unlikely in real life, since payments to the budget must be made in rubles.

- Account 55 - when transferring contributions to social funds from open special accounts;

- Account 70 - when calculating benefits to employees at the expense of social funds.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - when calculating contributions to employees involved in preparing capital investment objects for operation;

- Account 20 - when calculating contributions to employees engaged in the main production;

- Account 23 - when calculating contributions to employees engaged in auxiliary production;

- Account 25 - when calculating contributions to general production employees;

- Account 26 – when calculating contributions to administrative employees;

- Account 28 - when calculating contributions to employees involved in correcting a previously committed defect;

- Account 29 – when calculating contributions to employees employed in service industries and farms;

- Account 44 - when calculating contributions to employees involved in the sale of finished products or services;

- Account 51 - when crediting excess funds transferred to funds, compensation, etc. to the current account.

- Account 52 - When crediting money, compensations, etc., excessively transferred to funds to a foreign currency account. Despite the fact that such correspondence is directly indicated in the chart of accounts adopted by Order 94-N, it is unlikely in life, since budget payments must be made in rubles.

- Account 70 - When deducting from the employee part of the cost of sanatorium treatment allocated by the social insurance fund;

- Account 73 - when withholding penalties and fines issued by social funds from the guilty person;

- Account 91 - when calculating contributions to employees not directly involved in the production of products or provision of services;

- Account 96 - when accruing contributions for the amount of vacations, employees undergoing warranty repairs, at the expense of previously formed reserves;

- Account 97 - when accruing to amounts of wages that are paid in one period, but are recognized in accounting in the subsequent period.

- Account 99 - when reflecting contributions for wages paid in connection with the liquidation of the consequences of natural disasters. The same entry is drawn up when reflecting accrued fines and penalties for payments to social funds.

Reflection of payment of insurance premiums

Simple and convenient calculation of insurance premiums in the online service Kontur.Accounting! Get free access for 14 days

Paid contributions are reflected in the debit of subaccounts of account 69 “Calculations for social insurance and security” and the credit of account 51 “Current account”:

- Debit 69 sub-account “OPS” Credit 51 “Current account” - contributions to the insurance part of the pension have been paid;

- Debit 69 subaccount “Calculations for medical contributions” Credit 51 “Current account” - medical contributions have been paid;

- Debit 69 subaccount “Calculations for contributions in case of temporary disability and maternity” Credit 51 “Current account” - contributions in case of temporary disability and maternity have been paid;

- Debit 69 “Settlements with the Social Insurance Fund for contributions from accidents and occupational diseases” Credit 51 “Current account” - insurance premiums were paid to the Social Insurance Fund of the Russian Federation for accidents at work.

Rates and calculation procedure

The tax period for calculating insurance premiums is the calendar year. Social insurance payments are calculated separately for each employee. The basis for the calculation is all accruals to the employee accrued from the beginning of the year and related to the performance of his job duties.

Calculate the amount due monthly as follows:

Tariffs for fees to extra-budgetary funds are established by Article 426 of the Tax Code of the Russian Federation. For social contributions for pension insurance and in case of temporary disability, tax base limits have been established. They are reviewed annually and established by the Government of the Russian Federation. Above this, social insurance contributions are not paid, and pension contributions are paid at a reduced rate.

Insurance premium rates

| Insurance type | Tariff, % | Maximum base 2022 (Government Decree No. 1378 dated November 15, 2017) | Tariff for an amount exceeding the limit |

| SS in case of VNiM | 2,9 | 815 000 | No |

| OPS | 22 | 1 021 000 | 10 % |

| Compulsory medical insurance | 5,1 | There is no maximum base, payments are calculated from all income for the billing period | |

Tariffs for payments for social protection against industrial accidents and occupational diseases are established by the Social Insurance Fund depending on the type of activity of the company. To do this, it is necessary to annually confirm the main type of activity. The rate can vary from 0.2 to 8.5%. If you do not confirm the main type of activity by submitting an application in the form established by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55, then the Social Insurance Fund will set the maximum possible tariff based on the types of activities of the company listed in the Unified State Register of Legal Entities.

Tax accounting of insurance premiums

If you work for OSNO, then expenses in the form of insurance contributions for compulsory pension, social and health insurance are taken into account as part of other expenses. The same applies to contributions accrued for payments that are not included in the expenses for corporate income tax on OSNO. Organizations and entrepreneurs operate similarly using the simplified tax system “Income minus expenses” and the unified agricultural tax.

From 50% to 100% of insurance premiums are accepted to reduce the amount of tax paid in connection with the application of the special regime in the following cases:

- simplified tax system at a rate of 6%,

- Patent.

If you are an individual entrepreneur without employees, then you can reduce the tax by the entire amount of insurance premiums for yourself. Organizations and entrepreneurs with employees reduce the tax by only half. The cost of a patent and insurance premiums will also be reduced from 2022; for this, a special notification must be submitted to the tax office.