When does an increased personal income tax rate apply?

From 2022, an increased personal income tax rate applies under the following conditions:

- the amount of income per year exceeded 5 million rubles;

- income is included in the list approved by law dated November 23, 2020 No. 372-FZ.

These lists are different for tax residents and non-residents. In general, tax residents of the Russian Federation include those who stayed in the country for more than 183 calendar days within 12 months (clause 2 of Article 207 of the Tax Code of the Russian Federation).

In 2022, the coronavirus pandemic made moving across state borders much more difficult than usual. Therefore, the limit for recognizing an individual as a tax resident of the Russian Federation in 2020 was reduced to 90 days (clause 2.2 of Article 207 of the Tax Code of the Russian Federation). It is possible that this will be extended to 2022, but so far there is no such information.

Payers of progressive personal income tax rates

Due to the entry into force of Federal Law No. 372-FZ of November 23, 2020, which introduced innovations into the tax “encyclopedia” (Chapter 23 of the Tax Code of the Russian Federation), the procedure for calculating personal income tax has changed dramatically. Taxpayers, depending on the total amount of taxable income received since the beginning of the reporting year, are required to apply two rates to withhold personal income tax (clause 1 of Article 224 of the Tax Code of the Russian Federation):

- 13% - if income in monetary terms is within 5 million rubles.

- 650 thousand rubles (5,000,000 X 0.13) and 15% - from a tax base exceeding 5 million rubles.

The following categories of taxpayers are required to calculate, withhold payments at the source and transfer personal income tax to the budget on a progressive scale (clause 1 of Article 226 of the Tax Code of the Russian Federation):

- Russian legal entities and separate divisions of foreign companies when calculating wages to hired personnel and equivalent taxable income

- individuals - individual entrepreneurs who have chosen the general taxation system when receiving income from their activities

- lawyers and notaries when receiving funds from consumers of services as a result of private practice

- citizens without entrepreneurial status who are required to declare income received and calculate tax independently or pay an additional amount in accordance with notifications received from the tax authority

When determining the threshold, tax agents must take into account only income paid by them personally. There is no need to collect certificates and monitor payments received by individuals from other sources.

What income is taxed at a rate of 15%

From income up to 5 million rubles. you must pay the standard rate of 13%. The increased rate applies only to income above this limit.

For residents, income includes salary, bonuses, sick leave, as well as income from the following operations:

- from equity participation;

- in the form of winnings received from participation in gambling and lotteries;

- on various transactions with securities and derivative financial instruments;

- from participation in an investment partnership;

- in the form of profits of a controlled foreign company.

For non-residents of the Russian Federation, income includes (clause 3 of Article 224 of the Tax Code of the Russian Federation) the following types:

- income of foreigners who work under a patent;

- income of highly qualified foreign specialists;

- income of participants in the state program for the resettlement of compatriots;

- income of crew members of ships flying the state flag of the Russian Federation;

- income of foreigners recognized as refugees or granted temporary asylum in the Russian Federation.

What income is not subject to the increased rate?

For residents of the Russian Federation, the limit is 5 million rubles. income does not include:

- from the sale of property, except securities;

- from the value of gifts, also excluding securities;

- from insurance and pension payments.

That is, for such income the rate will always be 13% regardless of the amount (clause 1.1 of Article 224 of the Tax Code of the Russian Federation as amended by Law No. 372-FZ).

Also, special personal income tax rates for certain types of income will continue to apply to residents of the Russian Federation.

- 35% on income in the form of winnings and prizes received as part of promotions, as well as in the form of interest.

- 30% for certain types of income from securities.

- 9% on income from mortgage-backed bonds.

And finally, for non-residents the following rates are maintained, provided for in paragraph 3 of Art. 224 of the Tax Code of the Russian Federation, regardless of the amount of income:

- 15% for dividends received;

- 30% for all other income, except dividends and income of non-residents, taxed at the rate of 13% (15%) from the list given in the previous section.

What is personal income tax

Personal income tax stands for personal income tax.

Income tax (outdated name personal income tax) is one of the types of direct taxes that are levied on the income of a private individual. It is calculated as a percentage of taxable income. In simple words, personal income tax is a personal income tax that is forcibly collected and sent to the budget to finance government spending. There is no separate law on personal income tax; it is regulated, as mentioned above, by Chapter. 23 Tax Code of the Russian Federation. It describes in detail what the object and subject of taxation is, how individual income tax is calculated and paid, in which cases taxes on the income of individuals are not levied, and other aspects related to the taxation of income of individuals are discussed. We will talk about the most important of them below.

How to calculate personal income tax taking into account the increased rate

As long as the amount of payments to an employee from the beginning of the year does not exceed 5 million rubles, the employer must charge personal income tax in the usual manner at a rate of 13%.

If the employee’s annual income has become more than 5 million rubles, then personal income tax should be calculated as the amount of 650 thousand rubles. from 5 million rubles. and 15% of the excess amount.

Example 1.

The employee's annual income was 7 million rubles. The amount exceeding the threshold of 5 million rubles, after which the rate changes:

PR = 7 - 5 = 2 million rubles.

Personal income tax for the year will be equal to:

Personal income tax = 650 thousand rubles. 2 million rubles. X 15% = 950 thousand rubles.

What to do if an individual has several sources of income

A person can have several employers. It may happen that at each place of work the income is less than 5 million rubles, but in total it is more. In such cases, each employer charges personal income tax at the usual rate of 13%.

Tax officials will collect all information about an individual’s income for the year and if it turns out that the total amount of income exceeded 5 million rubles, they will send a notification to the individual. The taxpayer himself will have to pay the missing amount before December 1 of the next year (clause 6 of Article 228 of the Tax Code of the Russian Federation as amended by Law No. 372-FZ).

The form of notification and the procedure for sending it have not yet been approved. But there is still time for this: complete information on the income of individuals for 2022 will appear to tax authorities no earlier than April 30, 2022, when the deadline for submitting tax agent reports and 3-NDFL returns expires.

Examples of calculating personal income tax on interest on deposits in 2022 and 2022

The tax calculation method concerns only accrued interest; the amount of the deposit itself is recognized as a person’s property and is not subject to taxation. Please note: there is no need to split deposits, since the income received is summed up.

Example

A citizen has 3 deposits opened in different banks. Interest is paid at the end of the deposit terms.

Let's calculate personal income tax on interest received by a citizen for two cases:

- if the deposit expiration date is 04/10/2020;

- if the deposit expiration date is December 31, 2021.

The refinancing rate of the Central Bank of the Russian Federation as of 04/10/2020 is 6%, and we do not yet know the rate as of 01/01/2021, but let’s assume it will be 6.25%.

1. Calculate the total amount of interest on three deposits:

| Indicators | Deposit in bank No. 1 | Deposit in bank No. 2 | Deposit in bank No. 3 |

| Amount, rub. | 500 000 | 700 000 | 1 100 000 |

| Rate, % per annum | 5 | 7 | 9 |

| Deposit term, months | 12 | 24 | 36 |

| Amount of income (interest), rub. | 25 000 | 98 000 | 297 000 |

| Total income, rub. | 420 000 | ||

2. Let’s compare how personal income tax is calculated according to the current procedure and in a new way:

| Index | 2020 | 2021 |

| Amount of income, rub. | 420 000 | |

| Refinancing rate, % (we use 2020 values) | 6 | 6,25 |

| Valid at the time of receipt of income | Valid as of January 1 of the year in which the depositor received interest | |

| Non-taxable amount of income, rub. | 500 000 * 11% + 700,000 * 11% * 2 (years) + 1,100,000 * 11% * 3 (years) = 572,000 Note: 11% = 6% + 5% | 1 000 000 * 6,25% = 62 500 |

| Tax base, rub. | 420 000 — 572 000 = -152 000 | 420 000 — 62 500 = 357 500 |

| Personal income tax amount, rub. | — | 357 500 * 13% = 46 475 |

The calculation results show that the tax burden using the new calculation methodology will increase significantly. But the idea of innovation meets the principle of tax fairness: more tax is paid on more income.

How to apply personal income tax deductions now

In general, from 2022, personal income tax deductions can be applied separately for each income category.

Income from transactions with securities and derivative financial instruments can be reduced by:

- investment deductions (Article 219.1 of the Tax Code of the Russian Federation);

- previously received losses from such operations carried forward to the future (Article 220.1 of the Tax Code of the Russian Federation).

The income of participants in an investment partnership can be reduced by losses from previous years (Article 220.2 of the Tax Code of the Russian Federation).

The main tax base can be reduced by the amount of standard, social, property and professional tax deductions (Articles 218, 219, 220, 221 of the Tax Code of the Russian Federation).

If the amount of standard, social and property deductions for the year exceeds the main tax base, then they can be used to reduce the following types of income (clause 6 of Article 210 of the Tax Code of the Russian Federation as amended by Law No. 372-FZ):

- from the sale or receipt of property as a gift, except for securities;

- from insurance and pension payments.

Reporting and tax payment deadlines

The tax period for personal income tax is the calendar year (Article 216 of the Tax Code of the Russian Federation). It is from the beginning of the tax period that income, on which the calculation of tax depends, is taken into account on an accrual basis. The procedure and deadline for paying personal income tax on wages are regulated by Art. 226 Tax Code of the Russian Federation. According to its provisions:

- personal income tax is transferred in respect of all taxpayer income, the source of which is the tax agent, with the offset of previously withheld amounts (part 2);

- the deadline for paying income tax in 2022 is no later than the day following the day the taxpayer pays income, the deadline for paying personal income tax in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay is no later than the last day the month in which payments were made (part 6);

- The amount of personal income tax calculated and withheld from the employee is paid to the budget at the place where the employer is registered with the tax authority (Part 7).

As a rule, in organizations and individual entrepreneurs that employ at least several employees, local software systems or online accounting systems are used for accounting and tax reporting, access to which is provided by service banks and companies specializing in online accounting. Within the framework of such complexes, automated calculation, withholding and payment of personal income tax is carried out, as well as the provision of tax reporting to the Federal Tax Service.

Features of personal income tax calculation and sanctions for violations in 2021-2022

To ensure that taxpayers get used to the new rules, there will be a transition period in 2021-2022. The limit of 5 million rubles will be applied not in general for all income of an individual, but for each type of income separately (Clause 3 of Article 2 of Law No. 372-FZ).

Example 2.

One of the founders of the company simultaneously holds the position of director. For 2022, he received a salary of 4 million rubles. and dividends in the amount of 2 million rubles. Despite exceeding the total amount of income by 6 million rubles. above the limit of 5 million rubles, all director’s income will be taxed at a rate of 13%.

If a tax agent makes a mistake in calculating personal income tax at a rate of 15% for the 1st quarter of 2022, he will not be fined provided that he independently finds the error and pays the missing amount before July 1, 2021 (Clause 4 of Article 2 of Law No. 372-FZ) .

Putin made the oligarchs laugh with the new personal income tax rate

Alexander Zhelenin Journalist, Rosbalt news agency

Vladimir Putin’s speech two days before the start of such an important vote on amendments to the Constitution once again showed that he always has trump cards up his sleeve for every taste. Do you want money? Here are the new and old manuals. Social justice? Have you been talking about a progressive income tax for a long time? No question, get it! Now the rich will start dancing - we are raising personal income tax for those who receive 5 million rubles a year and above from 13% to (no joke!) 15%. In general, “Eat pineapples, chew hazel grouse, your last day comes bourgeois”...

Few doubted that Putin would promise to shower his fellow citizens with a new portion of child benefits. It’s always been like this before elections - they’ll throw something at the people. Of course, for families in which one or both parents have lost their jobs (and, according to Rosstat, there are now 4.5 million people in the country, and this is not counting those whose salaries have been greatly reduced), a monthly allowance of 5 thousand rubles for a child under three years old and for children from three to seven years old for families with incomes below the subsistence level will not make a difference. As well as a one-time payment of 10 thousand rubles for children under 16 years of age. However, “it’s not a big deal, but it’s nice.”

As for the increase in income tax, on the one hand, it was indeed somewhat unexpected, and on the other, if you think about it, it was laughter through tears...

As you know, there are no oligarchs in Russia. Well, there are a hundred dollar billionaires, but these, of course, are not oligarchs... And then I visually imagined the scene of the preparation of a “landmark” decision to increase the personal income tax rate by as much as 2% for rich and very rich Russians.

100336

The core of patriotism has cracked in Russia

...Vladimir Vladimirovich holds a meeting in a narrow circle of close “neoligarchs”. Announces the need to increase income tax from 13% to 15%. “What?!” one or several of them involuntarily burst out. “I realize this is not easy for you,” says the president, “but I think you will understand this decision, because this is for sick children, not for the sake of self-interest.” He looks into the eyes of his comrades, but does not detect much delight in them. “No, but how can we live?” our neo-oligarch friends persist.

“I know that this is really not easy, this has yet to be realized. But we will figure out something to compensate you for the “lost income” so that they... don’t fall out. Let's reduce some other tax by the same 2%. Well, you never know what else. We’ll come up with something…” says Putin. “Oh, well, that’s a different matter,” the worried moneybags sigh with relief.

Now let’s move on from the imaginary scene to harsh reality. Russia's transition to progressive taxation (if it really took place) could indeed be a step towards a more equitable society. However, the devil, as we know, is in the details. In the 1990s, we had some semblance of progressive taxation, but it was so complex and confusing that effectively “administering” it was almost impossible.

But, firstly, who made personal income tax so confusing? And secondly, who at that time followed any laws at all? It was the new Russian state that turned a blind eye to tax evasion. So he should make all the claims about this to himself...

202212

Anatomy of rumors: request for dispossession of elites

In 2001, Putin introduced a flat (for everyone) 13 percent income tax rate. Until now, including in his address to the people on June 23, he takes credit for the fact that “after the introduction of a flat personal income tax scale, tax collection increased.” It still wouldn’t increase! If before this you received something around zero, then an increase in fees by at least some positive value is always an increase, who would argue.

I don't want to be misunderstood. I am generally against taxes, if anything. I think that in the beautiful distance they will not exist at all.

But while we live in a society divided into billionaires, beggars and the vast majority of those who can barely make ends meet, the first must share with the second and third. Accordingly, income tax must be strictly differentiated. The rich became rich by pumping money one way or another not out of thin air, but out of society, and therefore are obliged to share with it.

Let's see how things stand with this in most developed countries.

In the US, the federal income tax rate ranges from 10% to 39.6%.

In Canada from 15% to 50%. In France from 5.5% to 75%. In Norway from 9.5% to 39%. The maximum rate for the largest fortunes in Sweden is 57%, in Denmark 55.6%, in Belgium 50%, in Portugal 48%, in Spain 45%.

169146

Putin has been challenged, but this is not an ultimatum yet

Of course, in Europe there are Lithuania and Hungary, where the income tax rate is 15%, and Romania (16%), but for developed social states today this is the exception rather than the rule.

Naturally, in different countries, there are different deductions that allow you to reduce your income tax rate. For example, if you are paying off a mortgage or supporting dependents.

Let us also note that almost all of these countries have a minimum income tax. In the USA, for example, at the federal level it ranges from 9 to 18 thousand dollars per year (depending on age, marital status and other factors). In other words, this is not just a progressive, but a differentiated tax.

Meanwhile, in such a “fairly” structured post-socialist state as modern Russia, as is known, there is no non-taxable minimum. Both the billionaire and the cleaning lady who receives 12 thousand rubles a month have 13% of their earnings taken into the treasury. Now, however, as the president promised us, millionaires and billionaires will be tightened up to 15%. However, it is obvious that it is much more difficult for a person receiving 12 thousand rubles to pay 13% (approximately 1500 rubles) of income from it than for someone who, say, from 120 million rubles a year transfers 15% (18 million rubles) to personal income tax. At the same time, they have slightly different problems - the children of a cleaning lady have thin soup, and the children of a millionaire have chalk pearls.

To summarize what has been said, the increase in income tax on wealthy and wealthy citizens by two percent, which Putin made the Russian people happy with the other day, does not even amount to pre-election PR. This is ridiculous.

Alexander Zhelenin

How to pay personal income tax at a rate of 15% and report on it

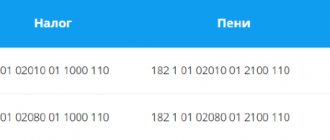

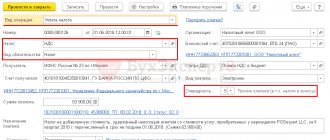

As before, depending on the situation, the tax agent must pay personal income tax at the place of its registration, the location of separate divisions or the location of its activities. But for that part of personal income tax that is taxed at a rate of 15%, separate BCCs have been established (Order of the Ministry of Finance of the Russian Federation dated 06/08/2020 No. 99n).

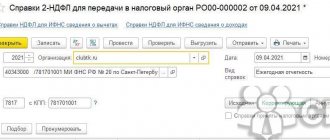

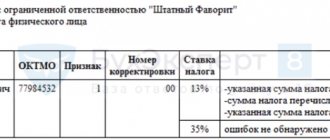

When filling out form 6-NDFL for rates of 13% and 15% for one type of income, you need to fill out sections 1 and 2 separately (letter of the Federal Tax Service of the Russian Federation dated December 1, 2020 No. BS-4-11/19702).

Where will the money from the tax at the new rate go?

According to Putin:

“This will give the budget about 60 billion rubles. I propose, as experts say, to “color” these funds, protect them from any other use and target them for the treatment of children with serious, rare diseases, for the purchase of expensive medicines, equipment and rehabilitation means, and for high-tech operations.”

Thus, the new law should also include indications of the targeted use of the additional 2% personal income tax that will be collected from citizens with high incomes.