The vast majority of all existing companies, both large and small, cannot do their business without delivery workers (suppliers). The only exceptions are companies that are themselves large delivery companies or companies whose main activity is not production, etc. These may, for example, include companies whose main activity is aimed at generating income from a share of the authorized capital of other companies.

This article will give a definition of what an acceptance (hereinafter referred to as AK) is, consider the types of AK in accounting (hereinafter referred to as BU), types of transactions, accounts for settlements with suppliers, forms of primary documents for settlements with suppliers, transactions for accepting supplier invoices for received materials and examples.

What is AK?

Before we begin to describe the accounts associated with settlements with suppliers, we will give explanations to some concepts.

Many people do not understand the meaning of AK, which may appear in the BU. It does not appear often, but it can confuse accountants, especially beginners.

In general, this concept occurs quite often in everyday life and applies not only to BU. The word “accept” is translated from both English and Latin as “to accept.” Accepted means accepted. In the Russian Federation, the concept of AK refers to the unconditional and complete acceptance of any offer by the recipient.

In BU AK is considered acceptance of a service, work or ownership of any value. AK's business transaction must be taken into account before payment. Otherwise, such an operation is often defined as a reflection of the company’s debt. Therefore, if the supplier’s invoice is accepted for materials received at the warehouse, this means the appearance of accounts payable.

Is it possible to revoke an acceptance?

As follows from Article 439 of the Civil Code, revocation of acceptance is possible in two cases:

- The refusal of the transaction was received by the person before the response about its acceptance;

- Acceptance and refusal came simultaneously.

With the offer everything is a little different

. According to Article 435 of the Civil Code, it is considered not received only when the response was received earlier than the proposal or simultaneously with it. Otherwise, the offer is irrevocable (Article 436 of the Civil Code). In any case, the person has a deadline to accept the offer or refuse it.

Ways to express acceptance:

- In writing. Complex and expensive transactions require the parties to enter into an agreement.

- In a public form. Acceptance is carried out by an unlimited number of persons: by purchasing goods in a store, paying for the services of a swimming pool or gym, etc.

- Active action. To accept a transaction, a person can begin to execute it by fulfilling the agreed conditions. A variety is conclusive actions, expressed in paying a bill, ordering on a website, putting money into a vending machine (when a physical representative of the other party is absent).

Types of AK in used

The concept of AK relates more to banking and finance, and to a lesser extent to accounting. In our case, AK occurs only when making payments through a company’s bank account. The main types of such settlements are payment order (hereinafter referred to as PP) and payment request (hereinafter referred to as PT). The difference between them is that with the help of a PT, the deliverer demands payment from the payer for a product, service or work (issues an invoice), and with the help of a PT, the payer instructs the bank to pay from his account for a product, service or work from the delivery person.

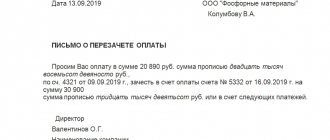

AK occurs when paying through PT, which comes in two types: with AK and without AK. PT with AK means that the payer must agree to this (accept the invoice) within three days before paying the invoice. After this period, if the payer has not accepted or refused to pay, the PO is considered accepted. PT without AK does not include the payer’s consent, and money is transferred from the payer’s account to the deliveryr’s account immediately. This type of payment (without AK) is possible only if it is specified in the agreement between the deliverer and the buyer (payer).

Transactions with transactions accepting the supplier's invoice for received materials are carried out on the basis of the acceptance type of PT. Refusal from AK (payment of invoice) can be complete or partial. In case of complete or partial refusal, the buyer must make a statement of refusal to his bank with a covering letter stating the reasons for the refusal and an indication of those clauses of the contract that were not fulfilled. The bank does not accept unfounded refusals by the payer, and the bank does not consider all possible disputes between the buyer and the delivery person.

There are also such concepts as preliminary and subsequent AK. In BU they are almost never used, but they can occur. These concepts relate more to the field of finance. Pre-AK is the type of AK described above. That is, the payer in this case must give prior consent before payment. Subsequent AK means the same procedure as an invoice without AK, when money is withdrawn from the payer’s account immediately, but at the same time the buyer retains the right to subsequently refuse AK after the withdrawal of funds. The subsequent AK has not been used in the Russian Federation since 1992.

Games with offer and acceptance at the everyday level

Philologists argue that the words “scam” and “offer” have different etymological origins. But do scammers know about this , who sometimes want to equate silence and

agreement? Often they send offers and demand compliance with the terms of the contract (read - payment), even if no expressed consent has been received.

Important! If you receive a letter with a service agreement in your mailbox

(for example, intercom service support), where it is stated that the agreement is concluded from the moment of sending, this does not comply with the law. In any transaction, participants must have a choice: accept the terms or refuse.

If such a scam offer is received, a person has the right to contact the supervisory authorities with a demand to bring the unscrupulous counterparty to justice. If money is written off unconditionally (for example, when services are imposed by a cellular operator), they can be returned in pre-trial or judicial proceedings.

Type of transaction with acceptance of the delivery provider's invoice

All business transactions in accounting are divided into 4 types:

- Active-active correspondence (active debit account, active credit account).

- Active-passive correspondence (active debit account, passive credit account).

- Passive-active correspondence (passive debit account, active credit account).

- Passive-passive correspondence (passive debit account, passive credit account).

Correspondence is a connection between accounting accounts when the same amount is reflected in two accounts at once. Two accounts in any transaction are called corresponding.

The first type of operation increases one active balance sheet item and decreases another active balance sheet item by one amount. The balance value remains unchanged. The second type increases two balance sheet items by one amount. The balance value increases by this amount. The third type reduces two balance sheet items by one amount. The balance value is reduced by this amount. The fourth type reduces one liability item on the balance sheet and increases another liability item. The balance value remains unchanged.

In our case, the active account “Materials” (materials received) and the active-passive account “Settlements with suppliers and contractors” (accounts payable increased) increase. That is, if the supplier’s invoice for received materials is accepted, the type of operation will be the second.

Invoices for settlements with suppliers

These accounts are account 50 “Cash”, account 51 “Settlement accounts”, account 52 “Currency accounts” and account 55 “Special accounts in banks”. In most cases, settlements with delivery providers are carried out using account 51, but sometimes money is issued in cash and in other ways using the accounts mentioned above.

There are no particular difficulties when paying with delivery providers using these accounts, with the exception of cash payments through account 50. There are many pitfalls in this situation that are worthy of coverage in a separate article. Here we will consider only the most basic points.

Issuing cash to the delivery person without any headaches and delays is possible only if the money is given personally to the head of the company, who is the delivery person (this could be an individual entrepreneur, for example). In all other cases, the representative from the delivery providers must be required to have an original power of attorney to receive money. It is even better if this form of payment is stipulated in advance in the agreement with the delivery person, and it is stated that cash payment is possible only if the delivery person’s representative has the original power of attorney.

Another problem when paying the delivery person in cash is that his representative must issue a receipt for the sale of the goods. To do this, he must have a mobile cash register on hand to issue a receipt at the time of unloading the goods. There is an option with a pre-prepared check, but it must be stamped on the same date as the day the goods were shipped.

If the supplier's invoice for received materials is accepted, this is reflected in accounting through account 60 “Settlements with suppliers and contractors” and in connection with the above-mentioned accounts. However, there are cases when the delivery person's invoice was accepted and paid before the goods were unloaded, and during unloading a discrepancy in the order amount was revealed that violated the contract or did not correspond to the delivery note. Here the score 60 will correspond to the score 76.2.

Games with offer and acceptance at a high level

Such simple and understandable conditions outlined by the Civil Code become a real weapon in the right hands. If the company was careless to make an offer on unfavorable terms

, counterparties can take advantage of this. How to advertise products in this case? How to deceive consumers and exaggerate the benefits of a product?

After all, proposals addressed to an unlimited number of persons are a public offer, as provided for in Article 437 of the Civil Code. The legislator noted that this requires a reservation. You may have seen it on websites and on the pages of magazines: “The information is not a public offer.” This means that if the seller refuses the deal on the terms specified in the advertisement, he will not receive anything for it

. At least from a potential client.

Forms of documents for settlements with suppliers

Before describing the transactions - supplier invoices for received materials are accepted, we provide a list of documents used in settlements with suppliers:

- Consignment note (TORG-12) – issued to the buyer by the delivery person. Upon issuance, the rights to the goods are automatically transferred to the buyer.

- Invoice (IF) – issued to the buyer by the delivery provider. Confirms two facts: shipment of goods and payment of the specified amounts of VAT for their further deduction. This document is drawn up by those suppliers who operate under VAT.

- Universal transfer document (UDD) - can replace both TORG-12 and SF. Introduced since 2013.

- Waybill (1-T) – issued to the buyer by the delivery provider if the goods are delivered using transport and through the intermediary company that delivered the goods.

Postings when accounting for VAT and payment to the supplier or contractor

The above entries will be sufficient if the deliverer or contractor is not a VAT payer.

The supplier's invoice for received materials has been accepted. The posting with VAT will be as follows: Dbt 19 Kdt 60. Next, you need to close account 19 with the following posting: Dbt 68 Kdt 19. These entries should go immediately after one of the postings from the sections above, that is, in this case (if the counterparty pays VAT) there will be three wiring. After this, payment is made to the delivery person or contractor using the following posting: Dbt 60 Kdt 50 (51, 52, 55).