There are many programs for accounting - there are both paid multifunctional software and free programs with a limited set of capabilities. There are also online services that allow you to do accounting through a browser.

Let's look at the 10 best programs and services for accounting, from inexpensive or free solutions to complex products with extensive capabilities, and also figure out in which cases using one or another option is optimal.

Free software for accounting

Let's start the review with free accounting solutions.

Info-Enterprise

The developers offer to use a free version of a full-fledged licensed program. There are no restrictions on work: neither in time nor in the number of operations.

This is a completely suitable solution for individual entrepreneurs and small companies that do not have separate divisions, with a staff of no more than 100 employees. The application allows you to update reporting forms and algorithms without any restrictions.

If you need to work with the program for several users on a local network at once, you can purchase the “Standard” package. For large enterprises, it is advisable to choose the PROF version. All paid versions offer annual maintenance, including high-quality technical support.

The Info-Enterprise product is presented in two versions: as a desktop version and as a cloud solution that allows you to keep records on the Internet. The user, if necessary, can easily and simply switch from the desktop version of the program to the cloud version and back. In this case, the settings, as well as the appearance and functionality of the software, will be saved, even if the configuration has been modified.

Taxpayer legal entity

On the website of the Federal Tax Service of the Russian Federation, you can download for free a small utility “Legal Taxpayer”, which helps automate the process of preparing accounting and tax reporting for individuals and companies. After filling out the form, the program will issue a fully prepared form for submitting reports to the Federal Tax Service. The program allows you to run several businesses, has a simple interface and a function for identifying errors when filling out documents. The utility contains current document forms that are updated quarterly.

Own Technology

Another free program for accounting is “Own Technology”. The software is designed for entrepreneurs and small business owners. This is a network product, but the information is not stored in the cloud, but on your server or regular computer. At the same time, the database is available to several employees at the same time, for example, a director, an accountant, and managers. The free basic version supports up to 10 users.

To be able to work with advanced reports, connect retail equipment, or upload data to 1C, you can purchase the professional version of the program. Its cost is 1990 rubles per workplace. When switching to the paid version, all information is saved.

Paid accounting programs

1c accounting

“1C: Accounting 8” is the most popular domestic ERP/accounting system. Maintaining the 1C: Accounting program involves taking into account various types of financial and economic activities of enterprises in one program. The software is suitable for any business - from individual entrepreneurs to large corporations and holdings - and supports all taxation systems, however, not all companies use the full functionality of the program.

The advantages of the 1C:Accounting 8 system are flexible settings, the ability to modify the program code to suit the needs of a specific business, as well as a large number of configurations and additions. Reporting can be submitted with one click directly from the application: electronic reporting will be generated and sent to regulatory authorities using the special “1C-Reporting” service.

You can work with the program via the Internet; for this, the 1C-Fresh service is used. There is also a mobile version of the 1C: Mobile Accounting application with all the necessary functions for accounting.

SAIL-Enterprise

The "PARUS-Enterprise 7" system is a software product for automating accounting in small and medium-sized enterprises operating in such industries as services, trade, manufacturing, catering, tourism, etc. The program can work on one or more (up to 15 -20) PC on the local network.

The main features of the program include: the ability to add individual components to the system as needed, a simple administration process, integration with other applications, for example, with the Microsoft Office office suite.

For large commercial companies, the developers offer a comprehensive system for automating all operational and management, as well as financial and accounting tasks - “PARUS-Enterprise 8”.

Expensify

While Expensify is not a full-fledged accounting software for small businesses, it is amazing when it comes to business expenses.

This online accounting service is designed for solopreneurs and those teams who typically deal with a lot of invoices and receipts.

Because your Expensify credit card is linked to the mobile app, every time you make a payment using your card, a record is created in Expensify.

And as for receipts, all you have to do is use your phone's camera to scan them and add them to the relevant transactions.

The best part is that admins can create automatic approval flows, which means certain types of transactions (like food and drink orders under $10) are approved automatically. Full control over business processes!

Expensify also easily syncs with various accounting software options, meaning all business expenses from Expensify credit card accounts are automatically included in your bookkeeping.

Both teams and solopreneurs can get started for $4.99 per month per user, and the largest corporations can use a management plan with HR and ERP integration for $9 per month per user.

Ideal for: freelancers, self-employed, large enterprises.

Online services for accounting

When using cloud accounting, you will not be tied to your workplace. You can log into your personal account from any device: you only need an Internet connection. All forms and documents in such services are updated automatically immediately after changes in legislation occur, and the documents are stored on remote servers; you don’t even need to download them to your computer. In addition, using online accounting services is cheaper than popular accounting software.

1C: BusinessStart

Especially for individual entrepreneurs, small LLCs and self-employed citizens, it offers an easy-to-use cloud version of the program for maintaining accounting via the Internet.

The 1C:BusinessStart service will help you calculate your taxes and prepare all the necessary reporting. Most taxes can be paid in a few clicks. The program contains all the basic capabilities: issuing invoices, processing banking transactions, accepting payments, generating and submitting reports.

It’s very easy to understand the program, technical support by phone and chat is available around the clock, the service supports all tax regimes and reminds you about tax payment deadlines. The advantages also include fast updates, the ability to work with a fiscal registrar and a scanner.

The price of electronic delivery for one legal entity is 3,000 rubles; there are also “Start” and “Business” tariffs with an annual subscription. The developer gives you the opportunity to try out the service for a month for free.

VLSI Accounting and Accounting

The online program “SBIS Accounting and Accounting” is suitable for both beginners in accounting and professional accountants who will appreciate its convenient, carefully thought-out interface and rich set of tools.

The service adapts well to businesses of any size, provides easy generation of all types of reports (to Rosstat, Federal Tax Service, Social Insurance Fund and other authorities), and provides access to cloud storage where you can keep backup copies of your documentation.

A characteristic feature of the product is the simple entry of documents: you only need to link item items once, after which the service will compare them automatically. The process of preparation, analysis, and verification of reporting is also fully automated. Submission of reports occurs via the Internet.

There is a mobile version that allows you to issue invoices directly from your smartphone. The cost of the program depends on the tax regime you use and the functionality you need.

My business

The “My Business” online service is popular due to its simple interface, competent support service and wide functionality: you receive a full range of services, from electronic reporting to online consultations with professional accountants. The service is optimal for individual entrepreneurs, as well as small and medium-sized businesses on the simplified tax system, UTII or patent. In addition, it is possible to entrust accounting to the service team.

Prices for using the service are quite reasonable, and the developers offer a flexible tariff system and comprehensive solutions for retail/wholesale trade and online stores. To test the service, it is possible to get free trial access.

Elbe

Online accounting "Kontur.Elba" is user-friendly and, according to the developers, is suitable even for those who do not understand accounting and do not have special knowledge. The service is convenient for individual entrepreneurs and LLCs using the simplified tax system, UTII or patent system.

By paying one of four tariffs (“Economy”, “Business”, “Premium” or “Super Premium”), the user receives the following features:

- instant sending to counterparties of documents generated in this service through the application or web version;

- obtaining a free electronic digital signature, which can be used when sending reports and reconciling with the Federal Tax Service;

- 24/7 user support via chat, email or phone;

- automated entry of data on transactions from current accounts (for this you need to set up integration with the bank);

- the ability to use custom Elba templates or create your own;

- preparation of eight types of accounting and tax reporting;

- mobile application for invoicing, tracking receipts and communicating with support.

New users are offered a free 30-day trial to try out the service. The service will remind you about the time for submitting reports and paying taxes by mail or SMS.

Kontur.Accounting

Using the Kontur.Accounting service will be a good solution for small businesses. Like online accounting Elba, this product belongs to SKB Kontur, but here the developer offers broader opportunities. The service is convenient for accountants, directors and accounting firms. It is perfect for legal entities with up to 100 people who use the tax systems of the simplified tax system, OSNO or UTII.

The Kontur Accounting service takes on a wide range of tasks:

- maintaining accounting, tax and personnel records;

- makes payments for employees (salaries, sick leave, vacations, as well as taxes and contributions);

- production accounting, including registration of production, sales of products and calculation of their cost;

- the service will prepare and help submit tax reports to the Federal Tax Service, Pension Fund, Social Insurance Fund and Rosstat;

- will check counterparties according to the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs;

- will provide electronic document management;

- includes integration with leading Russian banks.

The free trial period is 14 days.

A user-friendly interface and wide functionality, round-the-clock technical support, multi-user mode and automatic updates make this service a profitable solution for small companies and individual entrepreneurs.

Xero

Xero is a modern, comprehensive cloud-based financial accounting software for small businesses.

But what makes her special is her passion for user experience and deep understanding of the accounting needs of small businesses.

With Xero, you don't just get the basics (like tracking income and expenses, cash flow reports, and the ability to send invoices) - you get all the tools you need to make good business decisions based on data, not guesswork.

Software features include third-party integration, bank reconciliation, inventory tracking, and contact lists, meaning you have everything you need to manage your business.

Moreover, since Xero offers partnership opportunities for accountants, chances are that the operating system is already familiar to your accountant.

You can get started with Xero for $20 per month and send up to 20 invoices and proposals every month.

Expense claims and project tracking add a few dollars to your monthly plan if you choose to use them.

Ideal for: Most small businesses.

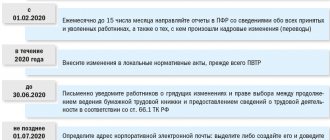

Which accounting software should you choose?

When choosing a program for accounting, the following factors should be taken into account: the organizational and legal form (individual entrepreneur, JSC, LLC), the taxation system used (USN, UTII, PSN, etc.), the number of employees on staff, the scale of the business, as well as the scope activities.

For example, for large companies with complex accounting and having their own production, the right choice would be the online service “SBIS Accounting and Accounting” or a professional accountant’s tool – the popular “1C: Accounting” program.

To run an individual enterprise, the capabilities of the 1C:BusinessStart program will be sufficient. Individual entrepreneurs without employees should pay attention to the “My Business” online service. The solutions "Kontur.Elba" and "Kontur.Accounting" are suitable for those businessmen who want to do their own accounting.

If you don’t want to invest in accounting yet, you should take a closer look at the free products – “Info-Enterprise” and “Own Technology”. Their capabilities, as a rule, are quite sufficient for small businesses.

Wave

Are you looking for accounting software that won't cost a million?

You should consider Wave - it's the best online accounting system for a sole trader or freelancer.

With Wave, it's completely free to track accounts payable and your business expenses. In fact, you can also create invoices and reports at no additional cost.

This is the best solution for those looking for a basic accounting service that will help you grow your business.

You only pay for payroll and payment processing when you need it, meaning you don't have to pay for services or features you don't use.

Wave Accounting charges a small payment processing fee and accepts all major credit cards and wire transfers as payment methods.

You can also use Wave for payroll to pay employees, contractors, and other third-party business partners in minutes.

Your employees can securely access their payroll and W-2 forms through Wave's proprietary portal, and update contact and banking information as needed.

Since Wave is essentially a free accounting service, if you have a small or growing business, Wave is a great fit for you.

Ideal for : Small business on a budget.