Despite the fact that making a profit is not the priority of non-profit organizations (NPOs), they are also recognized as tax payers, albeit not the most important “fillers” of the budget. A number of taxes and fees are levied on NPOs, but the specific features of their activities are taken into account, which provide some tax benefits.

Let us consider issues related to the taxation procedure for NPOs according to the federal taxes and fees due to them.

Legislative regulation of NPOs as a subject of tax law

Even if profit is not the main goal of non-profit structures, its presence is possible in most cases. The main thing is that its receipt pursues the stated objectives of the organization, and is not used as a cover for the purpose of tax benefits. To control the use of NPO profits for their intended purpose, there are provisions of the Federal Law of January 12, 1996 No. 7-FZ (as amended on December 31, 2014) “On Non-Profit Organizations”.

The Tax Code of the Russian Federation recognizes the obligation of non-profit organizations to pay taxes on profits, since such organizations may have them (Article 246 of the Tax Code of the Russian Federation), and to provide declarations based on accounting according to general requirements.

Taxation of NPOs according to the tax code of the Russian Federation

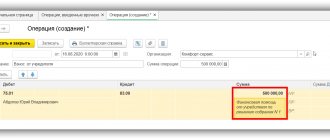

The Tax Code of the Russian Federation clearly states: non-profit organizations are required to submit declarations, which include calculations for taxes and fees to budgets of all levels. Also, NPOs are assigned the obligation to maintain accounting records and submit financial statements. These requirements are specified in the current legislation, and in the financial statements it is necessary to indicate information related to both commercial activities and statutory work. In this case, separate accounting is maintained. Even if there is no commercial activity, filing VAT, Profit or simplified taxation tax returns is still required. The income statement and the simplified taxation system (STS) declaration have sheets indicating information about targeted financing that must be filled out. Even if there was no revenue, these declarations will not be completely zero, this is important.

If there is no commercial activity, then such an NPO is exempt from the obligation to provide certain documents, but still the minimum reporting is provided to the Federal Tax Service, Pension Fund, Social Insurance Fund, Rosstat and the Ministry of Justice. As a result, a minimum of 35 reports are collected throughout the year. If an NPO is financed from the budget, then it is obliged to provide a full report on the expenditure of these funds with supporting documents, a report on the intended use of the funds received. The information is entered into the report form, and then it is included in the financial statements.

Type of NPO and taxation procedure

Non-profit organizations are usually divided into several types according to the source of funding:

- municipal (state) - they are financed by the state budget;

- public (non-state) - exist at the expense of their own profit and public contributions;

- autonomous - finance themselves.

IMPORTANT! The procedure and amount of taxes for non-profit organizations are directly related to whether the NPO conducts business activities.

As a rule, non-profit structures are not registered as entrepreneurs, but in the course of their operation they often have to provide services or perform work for the benefit of others in order to earn funds to finance the organization, thereby generating taxable profit.

General rules for taxation of NPOs

They are due to the characteristics of these structures, namely:

- profit is not their main goal;

- they are not entrepreneurs, and they need licenses to permit certain types of activities;

- NPOs can receive income in the form of voluntary contributions, donations and other gratuitous income.

These specific properties of NPOs are the basis for the general principles by which their taxation is carried out:

- All profits received by NPOs in the course of their activities are subject to appropriate tax (Article 246 of the Tax Code of the Russian Federation).

- Certain types of profit of NPOs are not included in the base for this tax (Article 251 of the Tax Code of the Russian Federation), namely, the profit that is received free of charge to ensure statutory activities. The list of non-taxable profits of non-profit organizations is contained in the orders of the Ministry of Finance of the Russian Federation.

Myths and misconceptions related to the simplified tax system in NPOs.

Let's start by debunking the myths that are attributed to the simplified tax system in general, and the simplified tax system in NPOs in particular. And then we will analyze each of the answers in detail.

- Having switched to the simplified tax system, you will still submit reports quarterly, plus monthly reports to the Pension Fund.

- If a non-profit organization has no revenue, the simplified tax return is not zero!

- In NPOs, in most cases, the simplified tax system increases the taxes payable. The simplified tax system does not save!

Special rules for levying income tax

As noted above, not all profits of NPOs are eligible to be taxed. A legal reduction in the income tax base can only be applied if a number of conditions are met:

- Accounting for targeted and non-targeted income in NPOs should be kept separately; only then can targeted income be excluded from taxation on the basis of benefits for non-profit organizations. Naturally, these funds must be used exclusively for their intended purpose, which must be confirmed by a report.

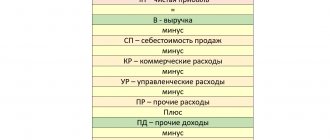

- Non-targeted income must be taken into account among “other”; these are two types of income:

- sales - income from performing work, providing services (for example, selling company brochures, selling educational literature, organizing seminars, trainings, etc.);

- non-operating - those whose source does not have a direct connection with the activities of the NPO, for example, fines for non-payment of the membership fee, late fees, interest from a bank account, money for rented real estate - the property of an NPO member, etc.

Non-targeted revenues of NPOs (both groups of income), according to the Tax Code of the Russian Federation, constitute the income tax base.

REFERENCE! The income tax rate for NPOs is the same as for commercial structures: 24%, of which 6.5% will go to the federal budget, and 17.5% to the budget of the constituent entity of the Russian Federation to which the non-profit organization belongs. The last part can be reduced at the initiative of local authorities, into whose budget it is intended.

Regulatory framework governing the taxation of non-profit organizations

In accordance with Article 246 of the Tax Code of the Russian Federation, the income of NPOs is subject to taxation. But Article 251 of this code allows not to charge taxes on funds transferred free of charge (for conducting activities in accordance with the charter).

In addition, the Tax Code of the Russian Federation establishes a special calculation of income tax in a situation where an NPO receives a grant - special-purpose financing.

Most often, non-profit organizations choose the general tax system (OSNO) to conduct their activities. The simplified taxation system (STS) can also be used in non-profit organizations.

A necessary condition for switching to the simplified tax system is an income limit of 60 million rubles. The amount of total income does not include funds received by organizations for targeted programs in the form of grants.

The relevance of taxation issues for non-profit organizations remains significant in 2022: legislation is constantly changing, the areas of activity and forms of NPOs are numerous, and the sources of financial revenue are also variable.

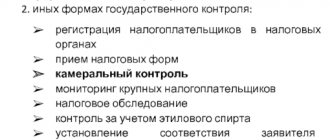

The diagram below shows clarifications from the Ministry of Finance and the Federal Tax Service of the Russian Federation, legal regulations that will allow you to determine which current explanatory materials and regulatory documents relate to the activities of non-profit organizations.

Top 3 articles that will be useful to every manager:

- Accounting services for companies: all the subtleties and nuances

- What to choose LLC or individual entrepreneur: pros and cons of different forms of ownership

- How to open a current account for an individual entrepreneur: choosing the best bank

Specifics of VAT taxation of non-profit structures

If a non-profit organization provides any services or sells goods, it cannot avoid paying value added tax if the activity does not qualify for exemption from it. The list of preferential activities without VAT is presented in Chapter. 21 Tax Code of the Russian Federation. For example, it includes the following activities:

- looking after the elderly in nursing homes;

- work in social protection centers;

- activities with children in free clubs;

- medical services of private physicians;

- sale of goods made by disabled people (or organizations where at least half of them are disabled);

- charitable cultural events, etc.

Requirements for the types of activities of NPOs for VAT exemption:

- social significance as the main goal according to Ch. 25 of the Tax Code of the Russian Federation is the main condition;

- a license to engage in this type of activity;

- the service provided must meet certain requirements (most often these are the conditions of time and place).

In case of payment, VAT is calculated according to the same principles as for commercial organizations.

Advantages of using the simplified tax system in a non-profit organization. Do I even need her?

Real benefits for NPOs from the simplified tax system:

- The number of reports provided during the year decreases from 41 to 34.

- From 2022, digital signature is mandatory for everyone, but it can be issued on the simplified tax system a little later.

- Salaries more than 50 thousand rubles. per month, subject to the conditions of Article NK Art. 427 Tax Code of the Russian Federation, paragraph 1, paragraphs 7.8

- There are special cases when the simplified tax system is very beneficial for non-profit organizations. We will examine almost all of these cases in detail below.

!Important. Many people switch to the simplified tax system, because... They are terrified of VAT. Let me immediately note that non-profit contributions and donations are not subject to VAT and INCOME TAX. The tax calculation sections on these returns will be blank. And most importantly, there is an alternative. According to Article 145 of the Tax Code of the Russian Federation, if your revenue was less than 2 million rubles over the last three months, you have the right to voluntarily refuse to be a VAT payer. Those. in fact, you will only submit an income tax return, and your revenue, as well as under the simplified tax system, is not subject to VAT. You also consider income minus expenses, and no minimum tax on revenue in the amount of 1% on the simplified tax system of 15%. And since the goal of an NPO is not to make a profit, you can always work at a loss, without paying taxes to the budget at all.

Practical advice: in order not to irritate the automatic selections of the Federal Tax Service, try to charge a few rubles of income tax payable, and still not show losses.

What form of non-commercial organization of the simplified tax system is really necessary? When the simplified tax system is really beneficial.

I will list the situations when the simplified tax system makes sense to apply.

- If the NPO is absolutely zero, and will remain zero for more than a year. Then you can go into “freezing”, realizing that when the time comes, it will be necessary to carry out a two-month procedure for resuscitating the NPO and reconciling with the Federal Tax Service and funds to determine whether all submitted reports have been correctly accepted. Even if you submit reports live, this does not guarantee their acceptance. A received stamp is placed in the window; if an error was made in the report, it will be checked later and will not be accepted. You will most likely find out about this in the form of a fine.

- NPOs that generate their income through income-generating activities with revenues of more than 2 million per month. At the same time, the profit from this activity is high. It is beneficial to use the simplified tax system of 6%, and, having paid 6% of the proceeds, transfer the net profit to finance your non-profit programs as targeted income.

- If salaries take up more than 30% of expenses or more than 50 thousand rubles. per month. A socially oriented non-profit organization, using the simplified tax system of 15%, receives a benefit on insurance premiums for employees. She pays 20% of insurance premiums, instead of 30%. The main directions are activities in the field of science, education, healthcare, culture, art, sports, social services, and charitable activities. Even if there is an income-generating activity, savings on insurance premiums exceed the minimum tax of 1% with a simplified tax system of 15%. It is important to say that 70% of NGOs work without salaries. The reasons for this are a separate article “Salaries in NPOs”.

Other federal taxes for NPOs

In addition to the main fiscal contributions (income tax and VAT), non-profit organizations also pay other taxes and fees:

- State duty. If NPOs turn to government agencies to carry out legal actions, they pay a fee on the same basis as other individuals or legal entities. Certain NPOs and their types of activities may be exempt from state duty, namely:

- financed by the federal budget - logical, because the duty is sent there anyway;

- state and municipal repositories of cultural property (archives, museums, galleries, exhibition halls, libraries, etc.) - they may not pay state duty for the export of valuables;

- Non-profit organizations of disabled people – state fees in courts and notaries are abolished for them;

- special institutions for children with socially dangerous behavior - they are allowed not to pay a fee to collect parental debt;

- Customs duty. But this payment “does not look at individuals”, but exclusively at goods, therefore it is not exempted from it on the basis of the status of an NPO, but only if the goods are included in the corresponding list.

How to register an NPO

Unlike ordinary commercial organizations, the Ministry of Justice is responsible for registering NPOs, with some exceptions. Its competence does not include the registration of consumer cooperatives and partnerships of real estate owners (HOA, SNT and others); documents for them must be submitted to the Federal Tax Service.

The preliminary preparation stage is very important - defining goals, drawing up a charter, choosing a name.

The step-by-step registration of an NPO looks like this:

- To choose the right form of an NPO, you need to decide for what purposes it is being created and select the appropriate OKVED codes.

- Establish a legal address, this is the location of the executive body, which, like an LLC, can be sole or collegial. The Ministry of Justice has the right to check the legal address of a non-profit organization. Prepare yourself in advance with a letter of guarantee from the owner, it indicates that he owns the premises on such and such grounds and is ready to provide an address for placing an NPO there. A copy of the title document is attached.

- There is one peculiarity with the name - it should indicate the specific form of the NPO and the direction of its activity. For example: the Zvezdochka Charitable Foundation for Assistance to Large Families or the Dolgostroy Homeowners Association. A link to a specific region may also be reflected (Regional public organization "Beekeepers of the Urals"). Do not use foreign words or the word “party” in the name (unless, of course, you intend to register a political party, which is unlikely). Using the words Moscow or Russia and their derivatives will require special permission, so avoid them if possible.

Achtung! Check the name in the register; if such an organization is already registered, you will be denied.

- Next, we prepare the charter. It must include all basic information: name, location, management procedure, procedure for entry and exit of founders, convening a meeting, sources of property and rules for disposing of them, procedure for making changes or liquidation, as well as other information.

- We fill out the application for registration. The form is the same as for LLC - P11001. The application must be accompanied by the decision (protocol) on creation in two copies, a document confirming payment of the state duty, the charter of the NPO in 3 copies. You can add a letter of guarantee about the address mentioned above, but this is not a required document.

- As for the state duty, its size is 4,000 rubles, as when registering other companies. There are some exceptions. For example, for microfinance organizations the fee is only 1,500 rubles.

- We submit the documents to the Ministry of Justice and wait 14 days. Then, if all is well, the documents from the Ministry are transferred to the Federal Tax Service and it enters the NPO into the register (another 5 days), the Federal Tax Service informs the Ministry of Justice about inclusion in the register (1 day), and it issues a certificate of registration (3 days). All deadlines are indicated in working days.

Religious organizations may be subject to religious examination and the process will be delayed; political parties also undergo a more thorough examination. When registering directly with the Federal Tax Service (for example, for a homeowners’ association), the period will be much shorter.

Regional taxation of NPOs

Local authorities establish the procedure for such taxation and rates, as well as benefits, including for non-profit organizations.

Property tax

Even if an organization has a benefit for this tax, it is still required to report to regulatory authorities in its tax return. The basis for accounting is the residual value of funds according to the data in the accounting records. The generally accepted rate of this tax is 2.2%, unless the regional authorities deem it necessary to reduce it, to which they have the right. Local structures also have the power to expand the list of non-profit organizations recognized as beneficiaries.

For different types of NPOs, the procedure for collecting property tax and benefits for it differs:

- Unconditional perpetual benefits for this tax on the basis of the law are provided for a number of non-profit organizations, such as:

- organizations of a religious nature and those serving them;

- scientific government agencies;

- criminal-executive departments;

- organizations that own cultural and historical monuments.

- Property tax benefits are provided to NPOs whose membership is made up of more than 50% (one type of benefit) or 80% disabled people.

- Autonomous NPOs, various foundations other than public ones, as well as non-profit partnerships do not receive property tax benefits.

Land tax

If NPOs have land plots in their ownership, perpetual use or inheritance, they are required to pay land tax. It is 1.5% of the cadastral value of the land plot. Some NPOs are completely exempt from this tax:

- societies of disabled people consisting of at least 80% (if the site is owned exclusively by them);

- penal system of the Ministry of Justice of the Russian Federation;

- religious structures.

FOR YOUR INFORMATION! Discounts on land tax for other types of non-profit organizations can be provided by local authorities.

Transport tax

If vehicles that belong to the organization on the right of ownership, management, or economic management are registered with an NPO, they are subject to transport tax on a general basis.

USN and single tax for NPOs

Who benefits from the transition to a simplified taxation system? First of all, a non-profit organization engaged in the sale of goods, provision of paid services and performance of paid work, most often it is an Autonomous Non-Profit Organization (ANO). If an NPO has movable or immovable property on its balance sheet, then switching to the simplified tax system will also be beneficial and economically justifiable for it. A non-profit organization can switch to the simplified tax system if it meets a number of conditions:

The NPO is not engaged in the production of excisable goods.

The residual value of fixed assets is no more than 150 million rubles.

NPOs do not have branches.

The average number of employees is no more than 100 people.

The profit is less than 112.5 million rubles (for 9 months of the current year).

To switch to the simplified tax system next year, you must notify the Federal Tax Service of your intention by December 31. At the same time, the residual value of fixed assets and the amount of profit received before October 1 of the current year (for 9 months) are indicated. If the NPO is “fresh”, that is, just created, then it can switch to a simplified form within a calendar month from the date of registration with the Federal Tax Service.

General mode or simplified tax system

NPOs have the right to choose whether to be on the general taxation system or switch to a “simplified” one. NPOs - payers of the simplified tax system are limited to a single tax, without paying:

- income tax;

- property tax;

- VAT.

As you know, for applying the simplified tax system there is an income limit of 45 million rubles. for the last 9 months of work. For non-profit organizations, this amount does not include receipts for targeted needs (grants, donations, subsidies, contributions from founders and members, etc.).

ATTENTION! The benefit on the tax rate on employee salaries for non-profit organizations when applying the simplified tax system is no longer valid.

General taxation system for NPOs

This tax regime is applicable to non-profit organizations by default; the main tax is “organizational income tax”, the amount of which is 20% of the income received. If it provides paid services in the amount of less than 2 million rubles per quarter, then it has the right to receive an exemption from VAT, in accordance with Article 145 of the Tax Code of the Russian Federation. But for this you need to submit an application! Because NPOs do not have the goal of making a profit; income tax may be minimal or completely absent. Sometimes the general taxation system is not economically profitable, so it is worth thinking about switching to a simplified one. This needs to be done, if only because a timely and prompt transition to the simplified tax system will relieve NPOs from the need to pay taxes on profits, property and value added. This important decision should definitely be made together with an accountant or an expert in the field of non-profit organizations.

Which simplified tax system to choose, income 6% or income minus expenses 15%?

In most cases, non-profit organizations choose the Simplified Taxation System, income minus expenses, abbreviated as simplified tax system 15% . Even if there is income-generating activity (revenue), a non-profit organization does not have the goal of making a profit. Profit is not distributed in the form of dividends; there are no beneficiaries (founders-owners). There is basically no point in making a profit.

Often, non-profit organizations, when providing social services, try to make it as accessible as possible, almost completely eliminating mark-ups. As a result, income almost equals expenses.

For this reason, they choose the simplified tax system of 15% and pay a minimum of 1% from the proceeds. There is no point in paying 6% to an NPO without profit.

Practical advice: Often, chief accountants choose the simplified tax system of 6% in non-profit organizations due to their own illiteracy or the desire to save their time at the expense of the manager’s money to pay extra taxes.

Important! A book of income and expenses, maintaining a 1C database and documenting expenses must be done on any simplified tax system. An NPO is not an individual entrepreneur, it is obliged to maintain full accounting records, even if it uses the simplified tax system (USN) 6%!

a simplified tax system of 6% if the services provided have a high profitability and generate a profit of more than 30%, which is used to finance non-profit programs, in accordance with the statutory goals.