Home → Articles → Is it necessary to issue a cash receipt when transferring payment to a bank account?

The seller must use cash register systems even if buyers transfer money for goods by bank transfer to a current account through a bank by creating a payment order. In other words, the cash does not arrive at the cash register, but you still need to punch the check. This vision of the situation, which coincides with the position of the Ministry of Finance of the Russian Federation, was outlined by Federal Tax Service specialists in a letter dated July 6, 2017 No. ED-3-20 / [email protected] Is it necessary to issue a cash receipt when the buyer, a legal entity or an individual, transfers payment to the seller’s bank account through the bank?

Find out details:

In accordance with paragraph 1 of Art. 1.2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) settlements using electronic means of payment” (hereinafter referred to as Law No. 54-FZ) by all organizations and individual entrepreneurs when carrying out They make payments on the territory of the Russian Federation without fail using cash register equipment (CCT), with the exception of certain cases listed in Art. 2 of this law. For the purposes of applying the provisions of Law No. 54-FZ, settlements mean the acceptance or payment of funds using cash and (or) electronic means of payment, in particular for goods sold, work performed, services provided (paragraph eighteen of Article 1.1 of Law No. 54-FZ ). According to paragraph 1 of Art. 4.3 of Law No. 54-FZ, cash register equipment, after its registration with the tax authority, is used at the place of settlement with the buyer (client) at the time of settlement by the same person who makes settlements with the buyer (client), with the exception of settlements made by electronic means payment on the Internet. Please note that cash register is not used when making payments using an electronic means of payment without its presentation between organizations and (or) individual entrepreneurs (clause 9 of article 2 of Law No. 54-FZ) (letter of the Federal Tax Service of Russia dated 02.02.2017 No. ED- 4-20/ [email protected] ). Law No. 54-FZ does not contain a definition of the concept of an electronic means of payment. According to paragraph 19 of Art. 3 of the Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System” (hereinafter referred to as Law No. 161-FZ), an electronic means of payment is a means and (or) method that allows a client of a money transfer operator to create, certify and transfer orders for the purpose of transferring funds within the framework of applicable forms of non-cash payments using information and communication technologies, electronic storage media, including payment cards, as well as other technical devices. Clause 1.9 of Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” (hereinafter referred to as Regulation No. 383-P) stipulates that money transfers are carried out by banks on the orders of clients, fund collectors, banks (senders of orders) in electronic form, including using electronic means of payment, or on paper. Clause 1.1 of Regulation No. 383-P provides for the transfer of funds within the framework of the following forms of non-cash payments: – settlements by payment orders; – settlements under a letter of credit; – settlements by collection orders; – payments by checks; – settlements in the form of transfer of funds at the request of the recipient of funds (direct debit); – settlements in the form of electronic money transfer.

Thus, the user (Organization or individual entrepreneur using cash register equipment when making payments (paragraph seventeen of Article 1.1 of Law No. 54-FZ).) is obliged to issue the buyer (client) a cash receipt or a strict reporting form if the payment is for goods (work, services) are carried out in cash or using electronic means of payment (letter of the Ministry of Finance of Russia dated July 5, 2017 No. 03-01-15/42408).

Consequently, when the buyer (client) uses forms of non-cash payments that do not involve the use of electronic means of payment to pay for goods (works, services), the user is not obliged to use cash register systems.

Payment using Internet banking.

In paragraph 4 of the letter of the Bank of Russia dated March 6, 2012 No. 08-17/950 in relation to remote banking systems, it is noted that, based on the totality of the norms of Law No. 161-FZ, remote banking systems that allow you to draw up, certify and transmit orders to for the purpose of transferring funds, are electronic means of payment.

Taking into account the definition of an electronic means of payment, which is contained in clause 19 of Art. 3 of Law No. 161-FZ, and the above explanations, we believe that the buyer’s payments for goods (work, services) through the Internet bank can be recognized as payments using electronic means of payment.

As representatives of the Ministry of Finance and the Federal Tax Service of Russia have repeatedly indicated, the obligation to use cash register systems arises for the selling organization (contractor, performer) from the moment of confirmation of the execution of the order for the transfer of electronic means of payment by the credit organization (see, for example, letters of the Ministry of Finance of Russia dated September 28, 2017 No. 03-01 -15/63180, dated 08/25/2017 No. 03-01-15/54800, dated 09/04/2017 No. 03-01-15/56675, dated 08/25/2017 No. 03-01-15/54800, dated 04/21/2017 No. 03 -01-15/24312, dated 03/16/2017 No. 03-01-15/15260, dated 01/25/2017 No. 03-01-15/3480, letter of the Federal Tax Service of Russia dated 02/02/2017 No. ED-4-20/ [email protected ] ).

Taking into account the stated position of the Ministry of Finance of Russia, when receiving payment from a buyer (client) by transferring funds using Internet banking, the seller organization (performer) is obliged to use cash register systems and issue such a buyer a cash receipt or a strict reporting form.

At the same time, we note the following. In the above explanations, the legal position on the need to use cash register systems when making payments is justified, in particular, by the rule of paragraph 5 of Art. 1.2 of Law No. 54-FZ. According to this standard, users, when making payments using electronic means of payment, exclude the possibility of direct interaction between the buyer (client) and the user or his authorized person, and the use of devices connected to the Internet and providing the possibility of remote interaction between the buyer (client) and the user or his authorized person when making these payments (settlements using electronic means of payment on the Internet), they are obliged to ensure that the buyer (client) receives a cash receipt or a strict reporting form in electronic form to the subscriber number or email address specified by the buyer (client) before making payments. In this case, the user does not print a cash receipt or a strict reporting form on paper.

Meanwhile, as follows from paragraph 1 of Art. 4.3 of Law No. 54-FZ, cash register equipment is used either on site and at the time of settlement with the buyer, that is, with direct interaction between the buyer and the seller (his representative) when making the payment, or in settlements that are carried out by electronic means of payment on the Internet.

Within the meaning of these provisions in their interrelation, in the case where settlements are made not through direct interaction between the buyer (client) and the seller (or his representative) at the place of settlement, but using electronic means of payment, the use of cash register is required provided that settlements are carried out with the use of devices connected to the Internet, which provide the possibility of remote interaction between the buyer (client) and the user or his authorized person when making these calculations. That is, a necessary condition for the use of cash register systems when paying for goods using electronic means of payment is the presence of remote interaction between the buyer and seller when making payments.

The law does not disclose the concept of such remote interaction. We did not find any corresponding explanations from the regulatory authorities. In our opinion, in the context of the provisions of Law No. 54-FZ, remote interaction between the buyer and the seller (his authorized person) when making payments using electronic means of payment occurs when devices connected to the Internet provide the seller with the opportunity to obtain information about the transaction by the buyer at the time of payment.

It seems that Internet banking as a system that allows you to draw up and electronically transmit client orders to the bank to transfer funds does not in itself provide the possibility of remote interaction between the buyer (client) and the seller (performer) at the time of payment for goods (work, service).

Therefore, we believe that the buyer’s use of Internet banking for settlements with the organization in the situation under consideration leads to the need for the organization to use cash register only if the settlements are made during remote interaction between the parties to the transaction via devices connected to the Internet. If there is no such interaction, the seller has no obligation to use CCP.

Please note that by virtue of Part 9 of Art. 7 of the Federal Law of July 3, 2016 No. 290-FZ “On amendments to the Federal Law “On the use of cash register equipment when making cash payments and (or) payments using payment cards” and certain legislative acts of the Russian Federation” (which introduced obligation to use online cash registers) (hereinafter referred to as Law No. 290-FZ) in the event that organizations or individual entrepreneurs in accordance with Law No. 54-FZ (as amended in force before the date of entry into force of the specified Federal Law) had the right not to apply control - cash register equipment, this right remains with them until July 1, 2022.

Previously, the current version of Law No. 54-FZ did not require the use of cash register systems in the case when an individual buyer makes a payment through an online bank.

Thus, until July 1, 2022, an organization has the right not to use cash registers when accepting funds for work performed from an individual’s bank account to the organization’s current account through an online bank.

Similar conclusions follow from letters of the Ministry of Finance of Russia dated October 12, 2017 No. 03-01-15/66780, dated October 11, 2017 No. 03-01-15/66395, dated October 5, 2017 No. 03-01-15/65053, dated September 28, 2017 No. 03-01-15/63145, dated 09.20.2017 No. 03-01-15/60820, dated 09.04.2017 No. 03-01-15/56675, dated 08.25.2017 No. 03-01-15/54800, dated 18.08 .2017 No. 03-01-15/53076, Federal Tax Service of Russia dated 08/31/2017 No. AS-4-20/ [email protected] , dated 03/21/2017 No. ED-3-20/1911, etc.

Some clarifications on the BCC for income tax

Personal income tax is calculated by subtracting documented expenses from the amount of income of individuals and taking a certain percentage of this amount (tax rate). Personal income tax is assessed separately for residents and non-residents of the Russian Federation, but this does not apply to employees. Some income specified in the legislative act is not subject to taxation (for example, inheritance, sale of real estate older than 3 years, gifts from close relatives, etc.) The income declaration gives individuals the right to certain tax deductions.

In a situation where the income is wages, the state takes the tax on it not from the employee after accrual, but from the tax agent - the employer, who will issue the employee a salary with taxes already paid to the budget.

Personal income tax on employee income

Paid by the tax agent monthly on payday, maximum the next day. In case of payment of sick leave and vacation benefits, the tax is transferred by the tax agent no later than the end of the month of their payment. It does not matter who the tax agent is - a legal entity or an individual, an LLC or an individual entrepreneur.

Vacation payments are also subject to personal income tax, because it is the same salary, only for the rest period. The tax must be paid before the end of the month in which the employee received his vacation pay.

NOTE! Personal income tax is not charged on the advance payment. An employer is prohibited from paying personal income tax from its own funds.

How is personal income tax calculated?

All taxes are calculated using the formula: tax base multiplied by the tax rate. The differences lie in what is taken as the basis and what interest rate is set.

For personal income tax, it matters whether the employee is a resident of the Russian Federation or not. If during the year he stayed in the country for more than 182 days, then personal income tax will be calculated at the resident rate of 13%. Non-residents must pay a rate almost three times higher - they are subject to a rate of 30%.

Current KBK

BCC for tax transferred by a tax agent – 182 1 01 02010 01 1000 110.

If there is a delay, you will have to pay penalties according to KBK 182 1 0100 110.

The imposed fine must be repaid according to KBK 182 1 0100 110.

Interest on this type of personal income tax is paid according to KBK 182 1 01 02010 01 2200 110.

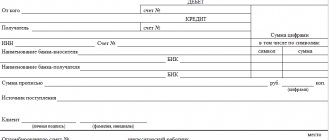

Making payments through a bank branch using a payment order

According to clause 5.1 of Regulation No. 383-P, when making payments by payment orders, the payer's bank undertakes to transfer funds through the payer's bank account or without opening a bank account of the payer - an individual to the recipient of the funds specified in the payer's order.

The payment order is drawn up, accepted for execution and executed electronically, on paper (clause 5.4 of Regulation No. 383-P).

An order to transfer funds can be transmitted, inter alia, using an electronic means of payment (clause 5.8 of Regulation No. 383-P). At the same time, for the purpose of transferring funds without opening a bank account, a credit institution may accept cash from a payer - an individual (clause 1.4 of Regulation No. 383-P).

In our opinion, the buyer (client) depositing cash into the bank's cash desk with the transfer of a payment order to the bank to transfer funds to the seller is not equivalent to a cash settlement carried out between the seller and the buyer. In the situation under consideration, cash is accepted not by the seller, but by the bank, and payment is made non-cash by crediting funds to the seller’s bank account. In this case, electronic means of payment are not used either, since the buyer contacts the bank in person and does not draw up an order for the transfer of funds using information and communication technologies, electronic storage media, including payment cards, as well as other technical devices.

In such circumstances, the seller has no obligation to use cash register when receiving payment from the buyer.

A similar conclusion can be reached with regard to such a payment method as a transfer from an individual’s bank account by personally contacting the bank serving the individual.

Additionally, we note that the letter of the Ministry of Finance of Russia dated August 25, 2017 No. 03-01-15/54800 states the following: the issue of using cash register systems when an individual buyer pays for goods by submitting an order (instruction) from the buyer of a credit organization on paper is currently being studied Ministry of Finance of Russia.

That is, at present, the Russian Ministry of Finance does not connect the buyer’s execution of a paper payment order to transfer funds to the seller by depositing money in a bank or disposing of funds in a bank account with the need for the seller to use cash register equipment.

At the same time, some letters from the Federal Tax Service of Russia, with reference to the position of the Ministry of Finance of Russia, emphasize that Law No. 54-FZ does not provide for exceptions regarding the need to use cash register systems when making payments by electronic means of payment through a credit institution, including by means of a payment order (letters from 08/30/2017 No. AS-4-20/17256, dated 07/06/2017 No. ED-3-20/ [email protected] ).

Moreover, the Ministry of Finance of Russia in its clarifications indicated that Law No. 54-FZ does not provide for special conditions (exceptions) regarding the use of cash register systems for the user (seller) when the buyer pays for goods through a payment order through a credit institution (letters dated August 15, 2017 No. 03 -01-15/52356, dated 04/28/2017 No. 03-01-15/26324).

In a letter dated 08/15/2017 No. 03-01-15/52356, representatives of the Russian Ministry of Finance noted, in particular, that cash register is used in the case of payment for goods (work, services) by buyers (clients) - individuals (subject to the exception specified in paragraph. 9 Article 2 of Law No. 54-FZ dated 22.05.2003) by submitting instructions (instructions) to a credit institution to transfer funds in favor of an organization (individual entrepreneur). In this case, the organization (individual entrepreneur) sends a cash receipt to the subscriber number or email address specified by the buyer before payment (hereinafter referred to as the buyer’s data), except in cases where the organization (individual entrepreneur) does not have the opportunity to receive the specified buyer data. In this case, the organization (individual entrepreneur) must take all measures to obtain the buyer’s data. One of such measures may be reaching an agreement with a credit institution to request the buyer’s data when the buyer (client) submits an order to the credit institution.

From these clarifications, it is not entirely clear whether financial department specialists consider it necessary to use cash registers by the seller in the event that the buyer (client) pays for goods (works, services) by issuing a payment order only using electronic means of payment or in any other situations.

It seems that when the buyer transfers funds through a bank with the preparation of a payment order in paper form, the seller does not have an obligation to use cash registers, since the scope of application of Law No. 54-FZ does not extend to non-cash payments, except those made using electronic means of payment.

However, we do not exclude the possibility of disputes with regulatory authorities if CCP is not used in such a situation.

Let us note that in their explanations, representatives of the Russian Ministry of Finance do not mention the possibility of not using cash registers in the case of depositing cash at the bank’s cash desk before July 1, 2022 (as, for example, in relation to the use of cash register systems when making payments via Internet banking). At the same time, if we accept the logic of the tax authorities and the Ministry of Finance of Russia, set out in the above letters, the obligation to use cash registers when depositing cash into the bank’s cash desk should arise no earlier than 07/01/2018, since the old version of Law No. 54-FZ did not require the use of cash registers in the event when the buyer - an individual deposits cash into the bank's cash desk to transfer funds to the current account of the seller organization (Part 9 of Article 7 of Law No. 290-FZ).

The answer was prepared by: Olga Tkach, expert of the Legal Consulting Service GARANT The answer passed quality control

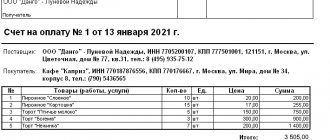

How to issue a payment order when paying tax for a company

The payment order must indicate the company for which the tax is paid.

Particular care must be taken to fill out the “TIN” field, which indicates the TIN of the person whose obligation to pay taxes is being fulfilled. When you pay for your company - company TIN.

In the “Payer” field, you must indicate information about the payer whose obligation to pay tax is being fulfilled: the name of the organization, if the tax is being transferred for it.

Sample

Tax payment for a company

Since 2022, the Federal Tax Service of Russia has launched the “Payment of taxes for third parties” service. It makes it possible to quickly and correctly prepare documents for paying tax for a third party and make it.

Also read:

How to register an online cash register with the tax office A reminder on working with online cash register systems What should organizations and individual entrepreneurs do to enter into an agreement with the OFD

Latest news of the digital economy on our Telegram channel

| Do you need to transfer fiscal data to the Federal Tax Service? The Electronic Express company is a fiscal data operator and is included in the register of OFD of the Federal Tax Service of Russia. Connect the cash register to the OFD >> |

| Do you need an electronic signature for EGAIS? All you have to do is leave a request. We will provide the required type of electronic signature certificate, tell you how to apply it and provide other additional services. Leave a request >> |