A facsimile signature is a mechanical copy of an individual's personal signature on a paper document. It is reproduced in the form of a seal or stamp.

Fax stamps are available from many companies. They are designed to solve organizational problems. After all, an employee with the right to sign cannot always sign it himself. For example, due to temporary absence from work. We decided to figure out in what cases the use of facsimiles is acceptable, that is, it will not entail consequences unfavorable for the company. For this purpose, we analyzed the legislation.

Please note that in state standards for document preparation, the “signature” attribute implies its handwritten execution. However, such GOSTs are advisory in nature (see table).

GOST standards for documentation

| Source of definition | The term "signature" | |

| Definition | Localization at source | |

| GOST R 7.0.8-2013. National standard of the Russian Federation. System of standards on information, librarianship and publishing. Record keeping and archiving. Terms and definitions (approved by order of Rosstandart dated October 17, 2013 No. 1185-st) | Signature – a detail containing a handwritten signature of an official or individual | Paragraph 3.2.1.58 |

| GOST R 6.30-2003. State standard of the Russian Federation. Unified documentation systems. Unified system of organizational and administrative documentation. Requirements for the preparation of documents (adopted and put into effect by Decree of the State Standard of the Russian Federation dated 03.03.2003 No. 65-st) | The “Signature” detail includes: the title of the position of the person who signed the document; personal signature; full name | Clause 3.22 |

| Organizational and administrative documentation. Documentation requirements. Methodological recommendations for the implementation of GOST R 6.30-2003 (approved by Rosarkhiv) | Signature is a document requisite, which is a handwritten signature of an official | Section 2 |

| Unified system of design documentation. Basic inscriptions. GOST 2.104-2006 (introduced by order of Rostekhregulirovanie dated June 22, 2006 No. 118-st) | Signature is a document requisite, which is a handwritten signature of an authorized official | Clause 3.1.4 |

Civil transactions

Paragraph 2 of Article 160 of the Civil Code of the Russian Federation characterizes a facsimile as a means of mechanical copying, and facsimile reproduction of a signature as an analogue of a handwritten signature. There are no other definitions of a facsimile signature in other federal laws. Therefore, these definitions are universal.

However, this was to be expected. After all, through a facsimile signature, a citizen exercises personal rights and acquires responsibilities. The purpose of an analogue (from the Greek “analogos” - corresponding) is to replace the original. Therefore, it is logical to expect that an analogue of a handwritten signature replaces it. It must perform the same functions as a personal signature, including identifying the signatory.

Meanwhile, it is not always permissible to use an analogue of a handwritten signature. Thus, documents drawn up by a notary are signed in person in the presence of a notary (Article 44 of the “Fundamentals of the Legislation of the Russian Federation on Notaries”).

The Civil Code (clause 2 of Article 160) states: when making transactions, the use of a facsimile signature is permitted by agreement of the parties.

At first glance, it seems that the condition on the use of a facsimile should be fixed in an agreement signed by the persons entering into the transaction (clause 1 of Article 160 of the Civil Code). However, based on paragraphs 1 and 3 of Article 434 of the Civil Code, an agreement can be concluded through the exchange of documents.

Let's assume you have received an invoice for payment that uses a facsimile signature. Such a document is recognized as an offer. If you paid this invoice, then you made an acceptance, which unconditionally confirmed your acceptance of all the terms of the invoice (clauses 1, 3 of Article 438 of the Civil Code of the Russian Federation), including consent to the further use of a facsimile signature in contractual relations.

It is possible that a different point of view will have to be defended in court.

Well, accountants are primarily concerned with tax legal relations.

The Ministry of Finance of the Russian Federation and the Tax Service are against the use of facsimiles

The financial department still insists that the use of a facsimile when signing an invoice is a violation of the rules for drawing up this document. Consequently, VAT deduction on such an invoice should not be provided (letters of the Ministry of Finance of the Russian Federation dated 01.06.10 No. 03-07-09/33, dated 17.09.09 No. 03-07-09.48, dated 17.06.09 No. 03-07 -09/31). To substantiate its point of view, the Ministry of Finance of the Russian Federation indicates that an invoice drawn up on paper is signed by the head and chief accountant of the organization or other authorized persons (clause 6 of Article 169 of the Tax Code of the Russian Federation). Since the possibility of using a facsimile is not provided for by tax legislation, it turns out that the invoice must be signed by the official in his own hand. Failure to comply with this requirement will result in refusal to deduct VAT on such invoice. The Federal Tax Service adheres to a similar opinion (Letters of the Federal Tax Service of the Russian Federation dated October 19, 2005 No. MM-6-03 / [email protected] , dated May 17, 2005 No. MM-6-03 / [email protected] ).

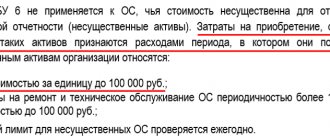

Primary accounting documents

Having agreed with the counterparty on the use of a facsimile signature, you will receive documents confirming the execution of the transaction with such a signature - acts, invoices and other reporting forms (unless the contract specifically stipulates the use of handwritten signatures). For an accountant, these are primary accounting documents. The question is: are they properly signed?

The Federal Law “On Accounting” (clauses 6, 7, part 2, article 9), as part of the mandatory details of the primary accounting document, provides for the signatures of the persons who made the transaction and are responsible for its execution. The wording “signatures of persons” is not equivalent to the requirement to use a personal, that is, hand-written, signature. According to the author, responsible persons have the right to independently choose the acceptable signing option.

When analyzing arbitration practice, pay attention to which of the laws “On Accounting” – “old” (No. 129-FZ) or “new” (No. 402-FZ) – is referred to by the court. The fact is that on January 1, 2013, the legislator liberalized the signature requirements, but this nuance was not properly appreciated. So, before January 1, 2013, according to the terminology of Law No. 129-FZ, the mandatory details of the primary accounting document included “personal signatures of persons responsible for the execution of a business transaction and the correctness of its execution.” Starting from January 1, 2013, in accordance with the requirements of Law No. 402-FZ - “signatures of the persons who completed the transaction, operation and those responsible for its execution.”

Some experts continue to believe “in the old fashioned way” that “stamping” signatures on the “primary document” is unacceptable. We invite you to speculate.

Whatever the signature on the document, the fact of economic life is obvious. After all, the completed transaction had an impact on the financial position of the company, the financial result of its activities and (or) cash flow (Clause 8, Article 3 of the Federal Law “On Accounting”). And PBU 1/2008 “Accounting Policy of an Organization” establishes the priority of content over form. This requirement means: in accounting, facts of economic activity must be reflected based not so much on their legal form, but on their economic content and business conditions. The bearer of the legal form is the supporting document. Due to the above requirements for accounting policy, deficiencies in document execution cannot serve as a basis for not reflecting the fact of economic life in accounting. Therefore, we conclude: a facsimile signature is not a fundamental obstacle to the acceptance of documents for accounting.

Moreover, Part 1 of Article 9 of the Federal Law “On Accounting” establishes the only basis for refusing to accept documents for accounting - when they document facts of economic life that have not taken place, including those underlying imaginary and sham transactions.

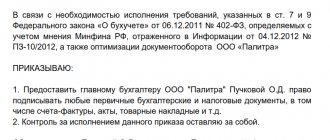

An order on the procedure for storing and using facsimiles will also help you prevent disputes with inspectors. As a rule, such decisions are included in the standards of an economic entity (Part 11, Article 21 of the Federal Law “On Accounting”).

At the same time, the manager’s signature on the financial statements must be handwritten (Part 8, Article 13 of the Federal Law “On Accounting”). After all, reporting users are an unlimited number of people. It is impossible to “agree” with them on the use of a facsimile signature.

Read also “Regulations on accounting: what has changed”

Facsimile - saving time or risk?

As you know, time is money. In modern conditions, businessmen have to save every minute, so facsimiles are becoming increasingly popular in companies with a high volume of document flow.

Typically, an organization will order facsimiles from a plate manufacturer. The use of facsimiles is entrusted to the responsible employee. Thus, in the absence of the person authorized to sign the documents, this employee puts a fax stamp on the documents. As a result, management time is saved. But is the game worth the candle?

Reference

| Facsimile - (lat. fac simile - “do something like this”) a seal, a cliche, with the help of which a person’s handwritten signature is reproduced. A facsimile is equivalent to a handwritten signature; Facsimile documents, as a rule, have legal force1. |

Legal basis

The concept of facsimile is not defined by law, however, the Civil Code of the Russian Federation establishes the following:

Document fragment

| Civil Code of the Russian Federation, Article 160 “Written form of a transaction” 2. The use of a facsimile reproduction of a signature using mechanical or other copying means, an electronic digital signature or another analogue of a handwritten signature when making transactions is permitted in cases and in the manner prescribed by law and other legal acts or by agreement of the parties. |

Examples of legislative acts that establish cases of using facsimiles in civil relations are also some international conventions to which Russia is a party. Thus, the Budapest Convention on the Contract for the Carriage of Goods by Inland Waterways (CNG) dated June 22, 2001, establishes that the shipper’s signature on a transport document can be affixed by hand, in the form of a facsimile seal, punched or stamped, affixed in the form of symbols or applied by any other mechanical or electronic means, unless prohibited by the laws of the state where the transport document is issued.

When can you use a facsimile?

It seems most reasonable to use a facsimile on documents that do not imply significant financial or other liability, since the main difference between a facsimile and a handwritten signature is the inability to assert that the corresponding document expresses the will of the person whose signature is reproduced. Consequently, the use of an analogue of a handwritten signature is possible only if there is an effective mechanism for establishing the authenticity of documents signed using a facsimile of the signature of the relevant person.

Using facsimiles when concluding contracts

From paragraph 2 of Art. 160 of the Civil Code of the Russian Federation it follows that if the counterparty agrees to accept the facsimile as a signature, then the document will have the same legal force as with a regular signature. In this case, counterparties can reflect in the text of the contract a condition on the use of facsimiles or enter into a separate agreement on the possibility of signing documents between companies in this way. Otherwise, if a dispute arises related to the fulfillment of obligations under the agreement, the court may declare such an agreement invalid. Even a bona fide counterparty can lose the case, since in accordance with paragraph 1 of Art. 160 of the Civil Code of the Russian Federation will not comply with the written form of the transaction. At the same time, the courts, guided by paragraph 1 of Art. 162 of the Civil Code of the Russian Federation, apply the consequences of non-compliance with the simple written form of the transaction:

Document fragment

| Civil Code of the Russian Federation, Article 162 “Consequences of failure to comply with the simple written form of a transaction” 1. Failure to comply with the simple written form of a transaction deprives the parties of the right in the event of a dispute to refer to witness testimony in support of the transaction and its terms, but does not deprive them of the right to provide written and other evidence. |

Judicial and arbitration practice

| Resolution of the Federal Arbitration Court of the Volga District dated May 26, 2008 in case No. A55-16332/2007 The applicant of the cassation appeal was CJSC Dairy Farm 3. The complaint was filed against the decision of the Arbitration Court of the Samara Region and the decision of the Eleventh Arbitration Court of Appeal on the claim of Kommunarskoye Peasant Farm LLC against Dairy Farm 3 CJSC for the collection of the amount of debt under the purchase and sale agreement. At the same time, by the decision of the Arbitration Court, the demands of Kommunarskoye Peasant Farm LLC were partially satisfied in terms of collecting the unpaid debt under the above agreement. The appellate court left this decision unchanged. In the cassation appeal, CJSC "Dairy Farm 3" asked to cancel the judicial acts that had taken place due to the court's violation of procedural and substantive law. The applicant of the cassation appeal indicated that there was no agreement between the parties on the possibility of using facsimile reproduction of the signature, while the court indicated the transfer and acceptance certificate signed by facsimile as proper evidence of the existence of a disputed debt. As a result, the cassation court satisfied the demands of Dairy Farm 3 CJSC, citing the lack of adequate evidence of the existence of contractual legal relations. |

A similar position is set out in the ruling of the Supreme Arbitration Court of the Russian Federation dated 02/07/2008 in case No. 653/08, which, by virtue of the rules of Art. 16 of the Arbitration Procedural Code of the Russian Federation is mandatory when the cassation authority checks the legality of the appealed judicial acts.

This situation can also be illustrated with the following example.

Example 1

| Romashka LLC leased non-residential premises to Argo LLC. At the same time, a lease agreement was signed between the parties, and a transfer and acceptance certificate for the premises was drawn up. When the contract expired, the parties decided to extend it, and an additional agreement was concluded to increase the rent rate. Argo LLC entered into this agreement by affixing a facsimile (however, the agreement did not provide for the use of a facsimile) and continued to pay rent at the old rate. Due to the fact that the terms of the contract were violated, Romashka LLC filed a lawsuit against the tenant, demanding collection of the unpaid portion of the rent. However, the landlord's demands were not satisfied due to the lack of the tenant's original signature. The court declared the additional agreement to establish a higher rental rate not concluded due to failure to comply with the written form of the transaction. |

Cases of courts making the opposite decision do occur, but this is only a rare exception to the rule. Thus, some courts believe that if an agreement is received, signed by facsimile, and the counterparty unconditionally accepted it (that is, fulfilled certain counter-obligations), then this means his consent to the affixing of the facsimile and to all the terms of this agreement. In addition, if neither party claims the contract is invalid due to the use of a facsimile, then this should mean that agreement has been reached on this issue, although there is no written agreement. Consequently, the contract is concluded and entails legal consequences.

Judicial and arbitration practice

| Resolution of the Federal Antimonopoly Service of the Moscow District dated June 25, 2007 in case No. KG-A40/5478-07 The arbitrators pointed to paragraph 160 of the Civil Code, according to which the use of a facsimile reproduction of a signature using mechanical or other copying means, an electronic digital analogue of a handwritten signature when making transactions, is permitted in cases and in the manner provided for by law, other legal acts or agreement of the parties. And if the facsimile signature placed on the acts and invoices does not raise any objections from the customer, the problem is removed. In addition, it is necessary to take into account the specifics of the relationship between counterparties. Resolution of the Federal Antimonopoly Service of 05/03/2007, 04/25/2007 No. F03-A51/07-2/893 in case No. A51-13268/2006-24-417 On the disputed documents there was a signature of the seller, made by facsimile, which, as the court emphasized, in accordance with paragraph 2 of Art. 160 of the Civil Code of the Russian Federation is an analogue of a handwritten signature and the use of which is permitted in cases and in the manner provided for by law, other regulations or agreement of the parties. In this regard, the court explained that in the case under consideration, the use of a facsimile signature was due to the specifics of the parties to the contract fulfilling its terms, incl. and the geographical remoteness of the parties to the transaction, which, according to the court, did not contradict the said norm of the Civil Code of the Russian Federation |

Using facsimiles when making other transactions

The above conditions for the use of facsimiles apply to contracts concluded in writing. But what about other transactions?

Guided by the same article of the Civil Code of the Russian Federation, the use of facsimiles is possible only if it is expressly provided for in the law or other regulatory act. Thus, you cannot use a facsimile when issuing a power of attorney. According to paragraph 1 of Art. 185 of the Civil Code of the Russian Federation, a power of attorney is a written authority issued by one person to another person for representation before third parties. At the same time, the Civil Code of the Russian Federation does not provide for the possibility of using a facsimile when issuing a power of attorney. This point of view is confirmed by arbitration practice (resolution of the FAS of the Volga-Vyatka District dated April 29, 2005 in case No. A11-1742/2003-K1-10/164).

In addition, paragraph 5 of the same article of the Civil Code of the Russian Federation states that a power of attorney on behalf of a legal entity is issued signed by its head or another person authorized to do so by its constituent documents, with the seal of this organization attached, which in itself obliges the power of attorney to be signed personally leader.

So, if the legal position is reflected more clearly about the use of facsimiles in civil law relations, then nothing is directly said about its use in relations not regulated by civil law.

After all, according to paragraph 3 of Art. 2 of the Civil Code of the Russian Federation, civil legislation does not apply to property relations based on administrative or other power subordination of one party to the other, including tax and other financial and administrative relations, unless otherwise provided by law.

At the same time, it is possible to act within the framework of the law, guided by the generally accepted principle “everything that is not prohibited is permitted,” without allowing for a broad interpretation of legal norms. In this case, regulatory legal acts often provide a direct indication of the content of the personal signatures of the responsible persons in the document.

So, according to paragraph 2 of Art. 9 of the Law “On Accounting”, primary accounting documents are accepted for accounting only if they contain personal signatures of persons responsible for carrying out business transactions and if their execution is correct. Such documents include invoices, invoices, waybills and other supporting documents on the basis of which accounting is carried out.

The Tax Service provides the following clarifications on this issue in letter dated 04/01/2004 No. 18-0-09/000042. It says that facsimiles are not allowed to be used on powers of attorney, payment documents, or other documents that have financial implications . A similar position is set out in letter No. 03-01-10/8-404 of the Ministry of Finance of the Russian Federation dated October 26, 2005.

Judicial practice on this issue is quite contradictory.

Judicial and arbitration practice

| In the resolution of the Federal Antimonopoly Service of North Caucasus of April 23, 2008 No. F08-2039/2008, the following is stated: the presence of a facsimile imprint of the signature of the head of the supplier organization in the invoice does not violate clause 6 of Art. 169 of the Tax Code of the Russian Federation and subject to other conditions of Art. Art. 171, 172 of the Tax Code of the Russian Federation cannot serve as a basis for refusing a tax deduction for VAT. However, the FAS DO in its resolution dated 02.21.2007, 02.14.2007 No. F03-A73/06-2/5431 in case No. A73-2444/2006-16 takes the opposite position: as the court explained, the current legislation does not it is possible to use facsimiles on powers of attorney, payment documents, and other documents with financial implications. Such documents include invoices, since they are primary documents confirming the validity of the application of a tax deduction. FAS ZSO in its resolution dated January 29, 2007 No. F04-8449/2006 (29482-A46-33) in case No. 23-1356/05 takes a roughly similar position. At the same time, the court found that some of the images of the signatures of the heads of some legal entities on the invoices were applied using letterpress clichés (facsimiles). Referring, in particular, to Art. 160, as well as on paragraph 3 of Art. 2 of the Civil Code of the Russian Federation, the court explained that the legislation on accounting, as well as the legislation on taxes and fees, does not provide for the use of facsimile reproduction of the signature of the manager when preparing primary documents and invoices. In the ruling of the Supreme Arbitration Court of the Russian Federation dated June 2, 2008 No. 6600/08, the court gives the following explanations regarding the fact of signing a tax return using a facsimile: reproducing the signature on a tax return using a facsimile does not confirm the information specified in it. The taxpayer (his representative), by signing a tax return, confirms the accuracy and completeness of the information specified in the tax return, causing by this action the corresponding legal consequences. Interpretation of paragraph. 2 clause 5 art. 80 of the Tax Code of the Russian Federation in the sense that it allows signing a tax return by affixing a facsimile stamp of the original signature, would lead to the emergence in tax relations of unjustifiably high risks of confirmation of the completeness and accuracy of the information specified in tax returns by improper persons. Moreover, negative property consequences in this regard could arise both for the state and for the taxpayers themselves. |

In addition, you cannot use a facsimile when concluding an employment contract. This conclusion follows from Art. 67 Labor Code. The manager also issues orders for hiring personnel. The use of facsimile reproduction of a signature in administrative documents automatically makes these papers invalid, since among the details that give the order legal force is the personal signature of the manager, and the facsimile reproduction of a signature is not his personal signature.

According to established norms of Russian legislation, as well as in accordance with judicial practice, facsimiles cannot be placed on a bill of exchange. This norm is established by paragraph 75 of the Regulations on bills of exchange and promissory notes, put into effect by Resolution of the Central Executive Committee and Council of People's Commissars of the USSR dated 08/07/1937 No. 104/1341, according to which the signature of the drawer is a mandatory requisite of the bill of exchange. The Recommendations on the use of bills of exchange in business transactions (Letter of the Central Bank of the Russian Federation dated 09.09.1991 No. 14-3/30) establish that, in contrast to the text of the bill of exchange, the signature of the drawer must be affixed to the bill in his own hand and, moreover, in handwriting.

The presence of a facsimile on a bill of exchange instead of a personal signature deprives the document of the force of a bill of exchange. Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18 draws attention to the fact that although civil law allows this method of reproducing a signature (Clause 2 of Article 160 of the Civil Code of the Russian Federation), but in the normative order it is different, Apart from handwritten, the method of signing a bill of exchange has not been established.

Fulfillment of any bill of exchange requisites (including signature) in a manner not expressly provided for by bill of exchange legislation is regarded as the absence of the corresponding requisites.

The absence of the signature of the person issuing the bill on the bill of exchange is a violation of paragraph 1 of the above provision, which contains requirements for the form of the bill of exchange obligation, due to a defect in the form of the bill of exchange.

Legal acts that define the procedure for holding competitions, auctions, and tenders, as a rule, contain a direct prohibition on the use of a facsimile signature. For example, the requirements established by the order of the Moscow City Department for Competition Policy dated July 13, 2007 No. 70-01-167/7 “On approval of standard documentation for placing a state order of the city of Moscow” state that when preparing an application for participation in a competition and documents included in such an application, the use of facsimile signatures is not permitted.

And in the documentation requirements established by the order of the Federal Agency for Education dated July 2, 2007 No. 1182 “On approval of standard forms of notification for an open auction for the supply of goods, documentation for an open auction for the supply of goods and the Regulations on the Auction Commission of the Federal Agency for Education,” there was the following wording: “When signing an application for participation in an auction, the use of a facsimile reproduction of a signature using mechanical or other copying means, or any other analogue of a handwritten signature is not permitted. Failure to comply with this requirement entails recognition of an application for participation in an auction for a lot as not meeting the requirements of the auction documentation and refusal to admit the participant who submitted such an application to participate in the auction for the corresponding lot.”

Instruction of the Bank of Russia dated September 14, 2006 No. 28-I “On opening and closing bank accounts, deposit accounts,” allowing the use of analogues of a handwritten signature by a client representative or a person authorized to manage funds in the account, as well as by persons entitled to the first or second signature, this rule does not apply to a bank card. Following the previously effective instruction of the Bank of Russia dated June 21, 2003 No. 1297-U “On the procedure for issuing a card with specimen signatures and a seal imprint,” the Instruction prohibits the use of such an analogue of a handwritten signature as a facsimile signature. Clause 7.2 of the Instructions states that the card is filled out using a typewriter or electronic computer in black font or with a pen with black, blue or purple paste (ink). The use of a facsimile signature to fill out the fields of the card is not allowed. The ban is quite justified, since in cases where funds are written off using a false payment order, it will be extremely difficult to conduct a handwriting examination.

Applications submitted by individuals and legal entities to state and local government bodies also cannot be affixed with facsimile signatures. For example, the Administrative Regulations of the Cheboksary City Administration for the provision of municipal (approved by Decree of the Cheboksary City Administration dated December 19, 2007 No. 296) states that when preparing an application submitted to the department for working with citizens’ appeals of the Cheboksary City Administration or the records management department of the Cheboksary City Administration , the use of facsimile signatures is not permitted.

Thus, we can say that the scope of application of the facsimile is limited only to civil law relations. In the field of other legal relations, there is currently no legislative basis for the use of facsimile signatures.

How to avoid adverse consequences

Theoretically, a company can have as many facsimiles as it has employees authorized to sign documents. But how advisable it is to produce them in such quantities, management must decide based on specific circumstances.

As for the issue of storing a facsimile, here we must proceed from the fact that this is an integral attribute of the person whose signature it contains. But since the facsimile is made by order of an enterprise for use in its activities, such a person is understood not as an individual in the broad sense of the word (as a citizen), but as an individual as an employee of the enterprise and its representative. In this case, although the facsimile is an attribute of the corresponding employee, it is not his property - it belongs to the enterprise. Therefore, it is up to the company management to decide where and how to store facsimiles.

For example, a company order may establish that the facsimile during working hours is located at the employee’s workplace, where it must be ensured that other persons cannot access it, and during non-working hours it is stored in a safe.

To protect yourself from possible problems with the recognition of documents signed using facsimiles, you should develop instructions indicating the list of documents that are allowed to be visaed using facsimiles; a list of persons who can do this and a facsimile of whose signatures must be made; facsimile storage procedure; the procedure for its destruction (for example, in the event of dismissal of an employee) and other significant points. The instructions should be approved by order of the enterprise.

Responsibility and control over compliance with the storage procedure and the legality of using facsimiles rests with enterprise managers. Along with other seals and stamps, the receipt and transmission of facsimiles to the responsible person can be recorded in the journal for recording and issuing seals and stamps. An entry is made in the accounting log about each such acceptance and transfer. Every year, a commission appointed by the head of the enterprise checks the availability of facsimiles. Worn out facsimiles that are subject to disposal should be destroyed by creating a commission at the enterprise for their destruction. At the same time, the composition of this commission and the fact of destruction of the facsimile are approved by order of the enterprise. In the event of theft or loss of a facsimile, enterprise managers must immediately notify the internal affairs authorities and take measures to find them.

Based on the above, we can conclude that when using a facsimile signature, an enterprise incurs significant legal risks, since there are large gaps in the legislation of the Russian Federation in this part, and judicial practice is quite contradictory. However, facsimiles must be used with extreme caution. In addition, it is possible that attackers could use the facsimile to their advantage.

The best alternative to using a facsimile of the signature of an authorized person of the organization is to issue a power of attorney to perform the relevant actions (signing the necessary documents) to one or more employees of the organization.

Opinion

| Elena Yusipova, deputy head of the legal department, head of the contract department of a pharmaceutical company, member of the Guild of Documentation Managers: If the company's management decides to sign documents using a facsimile, then the list of documents that can be affixed with a facsimile must be approved. You should always remember that if controversial issues arise, you will have to defend your point of view on the possibility of using a facsimile on a document in court. Letters sent to higher-level organizations, federal executive bodies and government bodies of the constituent entities of the federation, and other government bodies should not be signed with a facsimile signature. Based on personal experience of many years of working with documents in large companies, I can say that the need to sign orders or instructions with a facsimile signature practically does not arise, because During the absence of the manager, an employee is always appointed to perform his duties. In addition, a facsimile, as a rule, is made for signing a large number of similar documents. Therefore, the question of signing orders and instructions with a facsimile signature should not arise. In many organizations, fax signatures are affixed only to copies of sent documents. In this case, the following provisions may be stated in the Office Work Instructions or in the Regulations for organizing work with facsimiles:

From the above examples it is clear that in order to avoid abuse of the use of a fax signature in correspondence, many organizations impose strict restrictions. We can recommend that readers use such restrictions in their organization, enshrining them in local regulations. But exceptions can be made to the general rules. It all depends on the specifics of the activity. Thus, when conducting large and constant correspondence between organizations, in order to quickly resolve issues, it can be recommended to use a facsimile signature for a certain type of document by signing:

These documents (agreement or order) in one form or another should be in every organization, because they document the fact that the parties agree to use a facsimile. For important documents this can be a significant point. But at the moment, many organizations simply do not have such documents. The procedure for using a facsimile signature is often not defined not only in the organization’s external contacts, but also in internal regulatory documents. Often, each manager decides for himself which documents can be affixed with his facsimile signature and which are not, not always remembering the legal requirements. If this procedure is not established in your organization, then you need to be especially vigilant when assessing the possibility of using facsimiles for signing letters. After all, some letters may turn out to be an invitation (offer) or consent to conclude a deal (acceptance). Remember that we are talking about concluding a contract! To avoid problems with these documents, you can establish a rule according to which a facsimile will be affixed to a letter only after it has been endorsed by a lawyer or other specialist responsible for concluding such agreements. This will remove the burden of responsibility from the person who was entrusted with affixing the facsimile in the absence of the manager (for example, from his personal assistant or the head of the preschool educational institution service). |

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

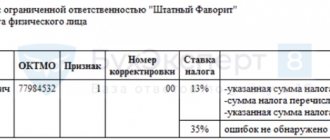

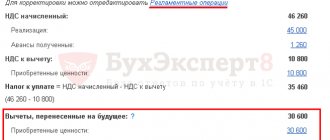

Value added tax

VAT deductions are applied after goods (work, services) are registered in the presence of primary documents and relevant invoices (clause 1 of Article 172 of the Tax Code of the Russian Federation).

We explained above that “distrust” of a facsimile signature in a document certifying the execution of a transaction does not prevent the registration of what was received under this transaction. This means there is no reason not to recognize the existence of primary documents.

However, inspectors are categorically against invoices with a facsimile signature (letter of the Ministry of Finance of Russia dated August 27, 2015 No. 03-07-09/49478). Why tax inspectors take this position is not difficult to understand. The fact is that the legislator directly stipulated that a facsimile signature is intended for use when making transactions. That is, the agreement of the parties to use a facsimile signature is exclusively of a civil nature. An invoice is a document of tax legislation. Civil law agreements do not apply to the rules for issuing invoices (Clause 2, Article 2 of the Civil Code of the Russian Federation).

Generally speaking, in arbitration practice there are decisions that justify the use of facsimiles for invoices. However, the arguments presented by the courts do not seem convincing to us, so we did not refer to them.

Read also “An invoice signed in facsimile does not give the VAT payer the right to deduct”

About the possibility of negative consequences

Let’s assume that a purchase and sale agreement or another civil law agreement is signed with a facsimile signature, but the parties did not enter into an agreement on the use of a facsimile. The court may recognize the following agreement:

- not concluded (Resolutions of the Federal Antimonopoly Service of the North Caucasus dated 09.08.11 No. A32-13609/2010, Ural Districts dated 06.10.09 No. F09-7622/09-C5 and Far Eastern Districts dated 08.13.09 No. F03-3794/2009);

- invalid due to non-compliance with the form of the agreement (FAS of the West Siberian District dated January 27, 2010 No. A02-413/2009).

At the same time, courts often reject claims to recognize such an agreement as invalid or unconcluded if the person whose facsimile was used subsequently approved this transaction or confirmed that he himself put a facsimile signature on the agreement, since he could not sign it personally, for example, because for injuries to the right hand (decrees of the Volgo-Vyatka Federal Antimonopoly Service dated 08.18.11 No. A43-18585/2010 and Ural District No. F09-10031/09-C5 dated 12.14.09). Direct subsequent approval of a transaction, in particular, can be understood as full or partial payment for goods, work or services, their acceptance for use, recognition of the counterparty’s claim, payment of a penalty, interest on the principal debt or other amounts, exercise of other rights and obligations under this transaction ( clause 5 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 23, 2000 No. 57).

Taxation of profits

According to the Ministry of Finance of Russia (letter No. 03-03-06/20808 dated April 13, 2015), documents with financial consequences with a facsimile reproduction of the manager’s signature are not supporting documents for income tax accounting purposes. True, the said letter related to the recognition of expenses. But amounts related to expenses for one party to the contract usually form income for the opposite party. Following the logic of the ministry, according to bilateral documents with a facsimile signature, tax inspectors will have to not recognize not only the expenses of one side, but also the income of the other. Meanwhile, practice does not remember such a precedent.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation (clause 1 of Article 252 of the Tax Code of the Russian Federation). So why do regulatory authorities and even sometimes courts refuse to recognize documents drawn up in full compliance with civil law? Tax accounting data is confirmed by primary accounting documents (Article 313 of the Tax Code of the Russian Federation). And the legislation on accounting, as we found out above, does not prohibit the acceptance of documents signed by facsimile for accounting. Finally, the lack of execution of the primary document can be corrected with a certificate from an accountant.

We will not analyze the controversial arbitration practice in cases involving the use of facsimile signatures. After all, the specific position of a particular court is unpredictable. Let's approach the issue of expense recognition from a global perspective.

Courts recognize expenses when they are real. At the same time, minor shortcomings in the preparation of primary documentation are not taken into account (resolution of the Seventh Arbitration Court of Appeal dated February 27, 2009 No. 07AP-233/09 in case No. A45-12409/2008-17/366). In addition, taxes are collected based on the taxpayer’s actual ability to pay them (Clause 1, Article 3 of the Tax Code of the Russian Federation). For this reason, courts reject refusals to recognize expenses on formal grounds.

We believe that such arguments will sway the inspectors in your favor.

We are not at all calling for everyone to switch to facsimile. Sometimes it is more expedient to issue a power of attorney to another employee who can replace the signatory. Our goal is to support the reader in a tax dispute.

There is no common point of view in arbitration courts

Some courts have agreed that no deduction is allowed for an invoice that is certified by a facsimile signature. However, until recently, most courts came to the opposite conclusion and allowed VAT to be deducted on such invoices. At the same time, the arbitrators noted that a facsimile signature is not a copy of the signature of an individual. It is only one way to perform an original personal signature. Therefore, the use of a facsimile does not indicate a violation of the requirements for signing an invoice established in the Tax Code of the Russian Federation. In addition, the courts indicated that tax legislation does not contain rules that would establish acceptable methods for signing invoices. The Tax Code of the Russian Federation does not contain a prohibition on signing the head of an organization or its chief accountant by affixing a facsimile stamp. Thus, the presence of a facsimile imprint of an official’s personal signature on an invoice cannot be a basis for refusing to deduct VAT on it. According to some arbitration courts, the use of a facsimile when signing an invoice is allowed only if it is provided for in a contract or other agreement between the supplier and the buyer.

Labor Relations

Is it permissible to use facsimiles in the field of labor legislation?

Article 5 of the Labor Code does not imply the applicability of civil legislation to labor relations. At the same time, it states that labor relations are regulated by collective agreements, agreements and local regulations.

An analysis of the text of the Labor Code shows that the phrase “personal signature” is not used in it. On this basis, we believe that the legality of facsimile reproduction of a signature can be established by a collective agreement, agreement or local regulation (in particular, the relevant order of the head of the company).

In addition, a facsimile, although provided for by civil law, is made personally for the employee, which means that it is actually within the framework of labor relations. A seal is used to identify a legal entity. Consequently, facsimile reproduction of the employee’s signature certifies the fulfillment of his labor function. This means that the statement that facsimiles are unacceptable in labor relations is untrue. After all, the employee does not independently participate in civil legal relations.

The opposite point of view is that the use of facsimiles by the employer is unacceptable. And she has supporters. In our opinion, it is advisable to take the “look to the root” position here. The use of a facsimile will entail adverse consequences for the employee or the employer if it was used in bad faith, by an inappropriate person, or in excess of his official powers. With equal success, the signature of a manager can be forged; no one is immune from this.

Facsimiles are contraindicated for tax returns and calculations

By signing a tax return or calculation, the taxpayer or his representative thereby confirms the accuracy and completeness of the information specified therein (paragraph 2, paragraph 5, article 80 of the Tax Code of the Russian Federation). The instructions on the procedure for filling out declarations for most taxes indicate that the head of the organization puts a personal signature on the declaration, the date of its signing and certifies his signature with the seal of the organization. It turns out that only the personal signature of the manager or other authorized person on the declaration serves as confirmation of the information contained in it. According to the Ministry of Finance of Russia, replacing a personal signature with its facsimile reproduction cannot be adequate confirmation of this information (letter dated October 26, 2005 No. 03-01-10/8-404). The courts also note that the declaration, certified by the facsimile signature of the head of the organization, does not comply with the requirements of the tax legislation of the Russian Federation (resolution of the Federal Antimonopoly Service of the North-West dated November 2, 2011 No. A56-66090/2010 and Volgo-Vyatsky dated April 11, 2008 No. A11-2499/2007- K2-24/126 districts). Therefore, the inspectorate is not obliged to accept it. As a result, the tax authority may consider that the taxpayer did not submit a declaration or calculation in a timely manner, and fine him at least 1,000 rubles. (clause 1 of article 119 of the Tax Code of the Russian Federation). In general, the penalty for this violation is 5% of the unpaid amount of tax subject to payment or additional payment on the basis of the declaration, for each full or partial month from the day established for its submission. In this case, the amount of the fine cannot exceed 30% of the specified amount. In addition, administrative liability is also provided for violation of the deadlines for submitting a declaration to the inspectorate. An administrative fine in the amount of 300 to 500 rubles may be imposed on taxpayer officials. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

Abuse Prevention

Since facsimile reproduction of a signature gives rise to rights, obligations and responsibilities (both of the employee-signer and the employing organization), the facsimile requires proper storage. Storage conditions must prevent abuse of the print and its unauthorized use.

As a rule, a facsimile is issued to an authorized (trusted) person who is responsible for its use.

In fact, the transfer of a facsimile can be equated to the issuance of a power of attorney to another employee to carry out transactions related to the responsibilities of the signatory. In this case, the terms of reference of the person entrusted with the facsimile must be clearly outlined.

Tatyana Korobeynikova,

accounting and taxation expert