A gift certificate is a document certifying the right of its owner (holder) to purchase from the person who issued the certificate goods, work or services in an amount equal to the nominal value of this certificate (Letter of the Ministry of Finance of Russia dated April 25, 2011 N 03-03-06/1/ 268; Federal Tax Service of Russia for Moscow dated October 22, 2009 N 17-15/110609).

Upon receipt of the certificate, the employee has the right to choose the goods (work, services) he likes without payment.

Therefore, the transfer of a certificate to an employee represents a gratuitous transfer of property rights to goods, works, and services that have already been paid for, but have not yet been selected.

Typically, a gift certificate has the following features:

- has a limited validity period;

- not bought back;

- is not restored as a result of loss;

- withdrawn at the time of use;

- the negative difference between the cost of the selected goods, works or services and the face value of the certificate is not compensated to the buyer;

- the positive difference between the cost of the selected goods, works or services and the face value of the certificate is subject to additional payment by the buyer.

Let's consider how the costs of purchasing gift certificates, as well as transactions for their transfer to employees of the Organization, are reflected in tax and accounting records.

Application of PBU 18/02

The cost of purchasing gift certificates, as well as VAT accrued upon their transfer to employees, are recognized as expenses in accounting, but are not taken into account when forming the tax base for income tax.

Consequently, a permanent difference arises for this amount, leading to the reflection of a permanent tax liability (PNO) (clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19 .2002 N 114n).

The accounting records reflected the permanent tax liability with the following entry:

Debit 99, subaccount “Permanent tax liability”, Credit 68, subaccount “Calculations for income tax” - a permanent tax liability has been accrued.

Tax calculation for various types of remuneration

Let's look at how to account for gift cards in tax accounting.

Remunerations related to work activities are subject to personal income tax, insurance premiums are charged on them, and expenses associated with the acquisition of certificates are included in the tax base for calculating income tax.

Remunerations not related to work activities (anniversaries, birthdays, New Year and other holidays) are subject to personal income tax, insurance premiums are not charged and are not included in the income tax base.

The cost of gifts given to one person per year, including an employee, is not subject to personal income tax to the extent not exceeding 4,000 rubles (including VAT).

Personal income tax must be withheld from the value of gifts over 4,000 rubles. Personal income tax is withheld at the time of presentation of the certificate and is transferred to the budget no later than the next day.

Insurance premiums are calculated on the value of the certificate transferred:

- employee of the organization. A written gift agreement must be concluded with the employee. If a gift is given to an employee for the performance of work duties, then insurance premiums are charged for compulsory pension provision, social, medical insurance and accident insurance,

- If a person is not an employee of an organization and does not have an employment relationship with this organization, then insurance premiums are not charged.

VAT

The transfer of ownership of goods, the results of work performed, the provision of services free of charge is recognized as a sale and, accordingly, is subject to VAT (Subclause 1, Clause 1, Article 146 of the Tax Code of the Russian Federation).

Nothing is said about the gratuitous transfer of property rights directly to the Tax Code (Resolution of the FAS ZSO dated November 12, 2010 N A46-4140/2010).

Controlling authorities believe that the transfer of property rights (whether on a paid or gratuitous basis) is recognized as an object of VAT taxation (Paragraph 1, paragraph 1, clause 1, Article 146 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia for Moscow dated February 24, 2005 N 19 -11/11038).

The tax base in this case will be the price of purchasing the certificate (Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 15, 2006 N KA-A40/97-06).

Thus, when presenting a gift certificate to an employee, VAT must be calculated at a rate of 18% based on the face value of the certificate excluding VAT.

In this case, the invoice is drawn up in one copy in order to be reflected in the sales book.

If the Organization has an invoice for the purchased certificates and the Organization paid for the certificates by non-cash means, then “input” VAT can be deducted. Thus, there will be no losses on VAT: as much as was accepted for deduction, so much was accrued.

VAT and income tax

VAT is not charged on the cost of gifts if

- they are issued in cash, including in the form of a certificate,

- if the donor company uses a simplified taxation system.

Features of income tax calculation:

- if employee remuneration in the form of gifts is provided for in the collective agreement and is of an incentive nature, then these costs are taken into account when calculating income tax,

- if the gift is not related to the performance of work duties, then it cannot be taken into account when calculating income tax and when calculating the simplified tax system.

A gift agreement is drawn up if the value of the gift exceeds 3,000 rubles. When drawing up a gift agreement, calculations of the value of the gift are made without taking into account the employee’s salary, his position and his work achievements.

A gift for labor achievements is part of the salary, and the transfer of the gift occurs on the basis of an employment contract.

Personal income tax

The certificate gives the employee the right to receive goods (work, services) in the amount determined by its face value.

This right is transferred free of charge.

That is, the employee has income and a taxable base for personal income tax (Clause 1, Article 210 of the Tax Code of the Russian Federation).

The value of gifts received by an employee during a calendar year is not subject to personal income tax if their amount does not exceed 4,000 rubles. (Clause 28 of Article 217 of the Tax Code of the Russian Federation.).

If the denomination of the certificate is more than 4,000 rubles, then the excess amount is subject to personal income tax at a rate of 13% (for resident employees) or 30% (for non-residents).

Accordingly, the organization in relation to the specified income will be a tax agent (Letters of the Ministry of Finance of Russia dated 09/07/2012 N 03-04-06/6-274, dated 07/02/2012 N 03-04-05/9-809).

The calculated amount of personal income tax will need to be withheld directly from the employee’s cash income upon their actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation).

For example, when paying the next salary. In this case, the withheld tax amount cannot exceed 50% of the payment amount (Article 138 of the Labor Code of the Russian Federation).

If the value of the gift (in this case, a gift certificate) exceeds 3,000 rubles, then it is necessary to draw up a gift agreement in writing (Clause 2 of Article 574 of the Civil Code of the Russian Federation).

However, it is better to have a written agreement in any case.

The agreement is useful in order to confirm the exemption of the value of the gift from personal income tax (when the amount of the certificate does not exceed 4,000 rubles) and to avoid the accrual of insurance premiums.

What documents are used to document the purchase of gift certificates?

The following types of agreements between legal entities can be used for registration:

- agreement for the transfer of a gift certificate between legal entities,

- agency agreement - with instructions to search, purchase and transfer a gift certificate to individuals by order of the client,

- agency agreement with the addition of the function of a tax agent for the payment of personal income tax.

The client receives closing documents along with the contract:

- if an agreement on the transfer of certificates is used, then this is a universal transfer document or an act of acceptance and transfer of certificates,

- if any type of agency agreement, then it is the agent's report.

Insurance premiums

Payments and other remuneration made within the framework of civil contracts, the subject of which is the transfer of ownership or other property rights, are not subject to insurance premiums (Part 3 of Article 7 of the Law of July 24, 2009 N 212-FZ).

And a gift agreement is just such an agreement (Article 574 of the Civil Code of the Russian Federation).

Thus, in the case of transfer of a certificate to an employee under a gift agreement, the object of taxation with insurance premiums does not arise (Letter of the Ministry of Health and Social Development of Russia dated 03/05/2010 N 473-19).

Accounting for gift certificates from the seller

Although from the point of view of civil law relations, payment for a certificate is an acceptance of the conditions proposed by the seller, for the purposes of accounting and tax accounting of gift certificates, their sale should be considered as an advance from the buyer. This opinion was expressed by the Supreme Court in its ruling dated December 25, 2014 in case No. 305-KG14-1498. Financiers adhere to a similar position (letters from the Ministry of Finance dated 04/25/2011 No. 03-03-06/1/268, dated 02/08/2019 No. 03-03-06/3/7605).

In this regard, when organizing the accounting of gift certificates, it is advisable to proceed from this point of view.

For the seller, accounting for gift certificates will include several stages:

- Certificate production. In this case, the forms can be produced by a third party or in-house.

- Selling a certificate.

- Sale of goods (works, services) in exchange for a certificate and redemption of unused certificates.

Let us examine in detail the accounting procedure at each stage.

Costs for producing gift certificates

Expenses for issuing gift cards are aimed at generating income and are recognized as expenses for ordinary activities (clause 5 of PBU 10/99). Such expenses are reflected in account 44 “Sales expenses” in the period of occurrence. If contractors are involved, account 44 corresponds with account 60 or 76. When producing on one’s own, with cost accounts that collect expenses incurred for issuing certificates (materials, wages). At the end of the month, account 44 is closed to account 90 in the usual manner.

To control the movement of finished cards, off-balance sheet account 006 “Strict reporting forms” is used. The valuation is determined by the accounting policy of the enterprise and can be conditional, for example 1 ruble, or correspond to the real costs of production.

See how the acceptance of gift certificates for accounting is reflected in postings:

The same approach is used when calculating income tax: manufacturing costs are indirect costs that reduce the tax base (clause 1 of Article 252, subclause 49, clause 1 of Article 264 of the Tax Code of the Russian Federation). Firms using the simplified tax system (with the object “income minus expenses”) can take into account the costs incurred after they have been paid as part of material expenses (subclause 5, clause 1, article 346.16, subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

The right to deduct input VAT arises at the moment card issuance services are accepted for accounting.

1C does not provide special functionality for accounting for the costs of issuing cards. Services of third-party organizations are registered with the document “Receipts (acts, invoices)”:

Costs for own production are formed through payroll, invoice requirements, etc.

The posting of forms to an off-balance sheet account is carried out manually:

Selling gift certificates: accounting and taxes

As mentioned above, the sale of gift certificates in accounting should be qualified as receipt of an advance payment and reflected in the credit of account 62. At the same time, the forms are written off from the off-balance sheet account.

Since advances received are not taken into account when calculating taxable profit (subclause 1, clause 1, article 251 of the Tax Code of the Russian Federation), money received for cards does not increase profit. But these amounts are included in the VAT tax base. VAT is calculated at the rate of 20/120.

Enterprises using the cash method, including payers on the simplified tax system, must take into account the payment received for gift cards as part of their income (clause 1 of article 346.17 of the Tax Code of the Russian Federation).

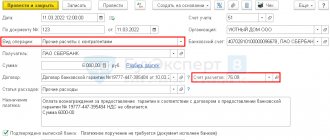

Let's look at how gift certificates are accounted for in 1C Accounting 8.3 at the stage of their sale.

If you keep records of gift certificates in UT 10.3 or 11 with subsequent uploading of data to 1C: Accounting, the procedure may be different; it is not discussed in this article. To set up gift card accounting in 1C: Trade Management, use the video at the beginning of the article.

Selling gift certificates in 1C

First of all, you need to make the necessary program settings:

In the “Trade” section we find the “Retail” subsection and “Gift Certificates”

Now you can start recording certificate sales. To do this, use the “Retail Sales Report” from the “Sales” section:

In the report, go to the “Certificate Sales” tab and click “Add”:

We create a new type of payment. We use an impersonal retail buyer as a counterparty, tying a virtual “Retail Sales” agreement to him:

We insert the created certificate into the tabular part of the report and indicate the total amount of sales. In our example, 5 cards with a nominal value of 5,000 rubles were sold. in the amount of 25,000 rubles.

We carry out the document. The program generated the necessary wiring:

At the same time, you need to make a manual operation to write off 006 sold certificates from account.

VAT payers, based on the generated retail sales report, generate an advance invoice:

Payment for goods with gift certificates

At the time of sale of goods in exchange for a gift card, it is necessary to reflect the revenue, charge VAT on sales, write off the cost of goods as expenses, offset the prepayment and submit for deduction the previously paid VAT on advances.

At this step of accounting for gift certificates in retail trade, the postings will be as follows:

Tax accounting in companies on OSNO is identical to accounting: income includes the proceeds received in the amount of the sale price of the product (excluding VAT), and expenses include its cost.

The tax base in organizations using the simplified tax system is formed differently:

When organizing the accounting of gift certificates in 1C 8.3, you will have to use the “Retail Sales Report” document again. On the “Products” tab, enter information about the product sold:

Fill in the “Non-cash payments” tab with the information about the presented gift certificate:

In our example, the buyer bought a printer for 9,000 rubles, 5,000 rubles. paid with a certificate, the remaining 4,000 rubles. paid extra in cash. "1C" generated all the necessary postings:

If the denomination of the certificate exceeds the purchase price, then the purchase price is entered in the “Amount” column on the “Non-cash payments” tab:

The program will reflect the deduction of VAT on advances on certificates offset against payment in accounting at the end of the month through the “Creating a purchase book” document. To do this, you need to fill out the “Advances received” tab.

In our example, certificates were used to pay for goods worth 9,000 rubles. (5,000 rubles for a printer and 4,000 rubles for a mixer), including VAT - 1,500 rubles. VAT is accepted for deduction:

Redemption of unused gift certificates: accounting

Typically, the terms of sale of gift cards provide that if the purchase price is less than the face value of the certificate or it is not purchased within the validity period, the unused amount will not be returned to the buyer. In such a situation, the “burnt” amount is recognized as the seller’s income and is reflected in account 91.

Art. 171, 172 of the Tax Code of the Russian Federation do not allow VAT to be deducted from written-off advance payments, since in this case there is no return of the advance payment to the buyer in connection with a change or termination of the contract, nor shipment of goods against the advance payment. Therefore, VAT relating to an unsold gift card is expensed at the time of redemption.

The write-off of debt on a “burnt” certificate is reflected by the following entries:

Redeeming Unused Gift Certificates: Taxes

Clause 18 Art. 250 of the Tax Code of the Russian Federation obliges income tax payers to include written off debt in non-operating income. For enterprises using the simplified tax system, the amount written off does not increase the tax base, since the cost of the certificate was fully included in income when it was sold.

It was already mentioned above that VAT on written off “burnt” certificates cannot be deducted. At the same time, according to the Ministry of Finance (letter dated December 7, 2012 No. 03-03-06/1/635), sub. 14 clause 1 art. 265 and paragraph 19 of Art. 270 of the Tax Code of the Russian Federation makes it impossible to reduce taxable profit by the amount of VAT on written-off advances.

That is, financiers believe that VAT paid on the sale of certificates can neither be returned from the budget nor taken into account as expenses when taxing profits.

But there are alternative points of view:

- The Ministry of Finance does not say anything about including in income the amount of VAT on written-off advances. At the same time sub. 2 p. 1 art. 248 of the Tax Code of the Russian Federation establishes that taxes presented to the buyer are not included in income. This allows us to conclude that when calculating income tax, VAT on written-off advances is not taken into account either in income or expenses.

- The courts have repeatedly confirmed the right of taxpayers to take into account VAT on written-off advances in expenses, if the tax was taken into account in income when writing off (resolution of the Central District Administrative Court dated March 19, 2015 No. F10-343/2015, resolution of the Far Eastern District Administrative Board dated March 4, 2015 No. F03-518/ 2015, etc.).

It is up to the organization to decide whether to adhere to the position of the Ministry of Finance or risk disputes with inspectors.

Redemption of unused gift certificates in 1C

In 1C, to write off a debt, the “Debt Adjustment” document is used:

In the appropriate fields we indicate that we want to write off the advance received; select a virtual retail buyer and click the “Fill in” button:

The program will automatically enter into the form all existing debt to the selected counterparty. In our case, we want to write off the value of the certificate (1,000 rubles) unused by the mixer buyer, so we correct the amount manually.

Fill out the “Write-off account” tab:

After posting the document, the following transactions will be generated in accounting:

VAT is written off using the document of the same name from the “VAT Regulatory Operations” section:

When you click the “Fill” button on the “Advances received” tab, the table will be filled in automatically:

Next, you need to fill out the “Write-off account” tab:

After posting the document, the program will generate the necessary transactions:

Purchasing a certificate

An analysis of the applied scheme for the circulation of gift certificates allows us to conclude that for tax purposes, the purchase of gift certificates should be considered as an advance payment for the purchase of goods in the future.

The buyer of the certificates issues funds to the seller and, as payment, receives not the goods, but a document certifying the right of its bearer to offset the face value of the certificate in the purchase price.

A similar approach to the qualification of this operation was expressed by the Ministry of Finance of Russia (letter of the Ministry of Finance of Russia dated April 25, 2011 No. 03-03-06/1/268), and is also found in judicial practice (post. FAS UO dated March 3, 2008 No. F09-883/ 08-S1).

Accordingly, the purchase of a gift certificate with a nominal value of 1000 rubles is reflected in the organization’s accounting as an advance payment:

DEBIT 76 CREDIT 51 (50, 71)

– 1000 rub. — a gift certificate was purchased.