18.02.2019

The review was prepared on release 3.0.67.74, but for at least a year now the configuration has been calculating and paying salaries and personal income tax in exactly this way. Therefore, with the help of these secrets, I have already corrected several databases for 2022 in order to automatically generate 6-NDFL from 1C: Accounting 8, rev 3 in 2022 and manually check the prepared statements for 2022.

In 1C: Accounting 8, edition 3, the correct 6-NDFL report can be generated automatically.

If you don’t want to spend a lot of time creating 6-NDFL and then 2-NDFL, then prepare for this report every time you pay your salary, which is 2 times a month, in accordance with Russian legislation.

The recipe is simple. Follow the rules by which the personal income tax accounting subsystem works in 1C: Accounting 8, edition 3, and every time you pay a salary, check the “Preparation for 6-personal income tax” report. Each line of the report corresponds to a line in the regulated 6-NDFL report with a convenient addition-decoding for employees.

I have prepared summary rules on what to pay attention to when calculating and paying salaries so that the 6-NDFL report turns out correct.

Payment method

1. When paying interpayment accruals before the advance, vacations and sick leave. We indicate that the document is Payment of salaries for the current month and the Fill button should fill in the correct amount.

2.When paying vacation or sick pay after an advance payment, you must explicitly add an employee and remove the line associated with the payment of the advance payment.

3. Remember the sequence of conducting and filling out documents Accrual (salary, vacation, sick leave) - Statement for payment - Statement or cash settlement.

4. When paying in advance the entire amount accrued for the current month, we manually enter the payroll document and tax into the payment statement.

5. When simultaneously paying one employee for a month through a bank and a cash desk, the tax amounts must be adjusted manually, since the program will not see the correct distribution of amounts.

7. Do not copy payment documents, but create new ones.

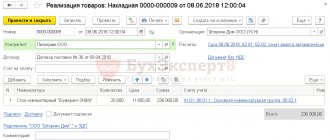

8. If in the document Payment of wages in advance the dot is on advance payment, but errors still appear, then move the dot to Payment of wages, remove the personal income tax (it should be withheld only when paying wages), remove the link to the payroll document and then return full stop on "advance".

9. First, the payment statement, then the Bank Statement or Cash Order. If you want to change it, cancel the write-off, then fill out the Payment Statement.

10. If you are correcting the previous period, cancel all payment documents up to today. And run consistently, even for the entire past year, a payment statement, a money write-off document, a payment statement, a money write-off document, etc.

11. The accrued personal income tax is formed by the salary accrual document and if everything has been calculated correctly, then there is no need to retransmit it when making corrections. Check how personal income tax is calculated on bonuses - if the bonus is calculated in two lines, adjust it so that it is one line.

12. Withheld personal income tax is generated using the document Statement for payment + Statement or cash settlement

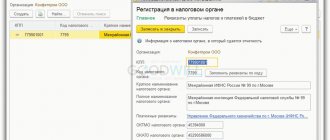

13. The transferred personal income tax is generated using the document Write-off from a current account with the transaction type Transfer tax and with the selected tax “Personal income tax when performing the duties of a tax agent”. This tax needs to be automatically installed in the program; you don’t need to create it yourself. Otherwise there will be errors. The picture below will show you how to find out that you are completing the Personal Income Tax Transfer correctly. In the document, you can manually indicate whose tax is being transferred or automatically when posting.

14. If no tax has been accrued, then when personal income tax is transferred to the budget, the distribution to employees will NOT automatically work. Correct manually via the “Split by Employee” hyperlink.

Filling out form 6-NDFL from 2022 in 1C ZUP 3.1

Content

What changed?

Since 2022, form 2-NDFL has been integrated into form 6-NDFL on the basis of a new federal law adopted on September 19, 2019, which approves amendments to the Tax Code. Law No. 325-FZ “On Amendments to Parts I and II of the Tax Code of the Russian Federation.”

By order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] , a new form 6-NDFL was approved and for the 1st quarter of 2022 it will be necessary to report on it.

Composition of the new form 6-NDFL

- Title page;

- Section 1 “Data on the obligations of the tax agent” The data is similar to Section 2 of the previous form.

- Section 2 “Calculation of calculated, withheld and transferred amounts of personal income tax” Data similar to section 1 of the previous form 6-NDFL.

- Appendix No. 1 “Certificate of income and tax amounts of an individual” These are migrated 2-NDFL certificates, filled out once a year when filling out annual reporting.

Review and filling out 6-NDFL in 1C

A new form in the 1C Salary and Personnel Management configuration appeared in release number 3.1.16.133 , to submit a report on the new form, check that your release matches this or is newer.

In order to view and fill out the new form, open it in the section Reporting, certificates - 1C-Reporting

In the window that opens, click on the Create , in the list that opens, open the folder Reporting for individuals and select 6- income tax (from 2022) , double-click on the line.

A window for selecting a reporting period will open in front of us; let’s try to fill out the 6-NDFL report for the 1st quarter of 2022.

Click on the Create , a report form will open in front of us.

Click the Fill to try to generate a report.

Filling out the first section of 6-NDFL

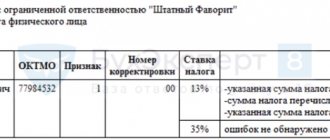

Section 1 is similar to Section 2 of the previous version of the report, the main difference is the appearance of the KBK code, according to which the listed personal income tax is filled out; when transferring personal income tax at a 15% rate, the report is generated according to two KBK, KBK 18210102010011000110 for a rate of 13% and KBK 18210102080011000110 for a rate of 15%

Field 020 shows the amount of personal income tax withheld for the last three months of the reporting period, individuals

In field 021 , fill in the date no later than which the withheld personal income tax must be paid. The planned date of personal income tax transfer is indicated.

Field 022 indicates the amount to be transferred on the specified date.

Field 030 indicates the amount of personal income tax returned by the organization to individuals in accordance with Art. 231 Tax Code of the Russian Federation. Personal income tax returns are now reflected only in Section 1 of the new form 6-NDFL.

Field 031 indicates the tax refund date in accordance with Art. 231 Tax Code of the Russian Federation

Field 032 indicates the amount of tax returned to individuals.

Filling out the second section 6-NDFL

Appendix No. 1 must be filled out when drawing up 6-NDFL for the calendar year and completely copies the currently used 2-NDFL .

The new form is applied from the submission of the 6-NDFL calculation for the first quarter of 2022.

Zero reporting for 6-NDFL

The procedure for filling out form 6-NDFL implies that it is necessary to submit it only when the taxpayer accrues income in favor of an individual.

If an organization or individual entrepreneur does not accrue income in favor of individuals, they are not tax agents, and, therefore, they do not have the obligation to submit “zero” tax reporting in Form 6-NDFL.

More details on the tax website.

What to look for in pictures

Listed personal income tax

Statement for payment and withheld personal income tax

Formation of 6-NDFL in “1C: ZUP” (“Salaries and personnel management”)

1C developer specialists quickly responded to changes in legislation and supplemented the releases with a new reporting form. Like all other tax reporting forms in 1C, after the reporting period, 6-NDFL can be filled out automatically using software. Let's consider this process using the example of “1C: ZUP” (3.0).

To generate 6-NDFL in 1C: ZUP in the main menu “Reporting. Certificates" you should select "1C - Reporting", then the "Create" item and in the drop-down menu "6-NDFL".

In the window that appears, to fill out 6-NDFL, you must select an organization and indicate the period for which the report is generated.

NOTE! Under the fields to be filled in in the 6-NDFL window you will see information about the edition of the form that the program will fill out. In the future, in case of changes, in order to create a correct report, you will need to track the correct edition of the form.

Press Enter and you will be taken to the form page. We check the data (in addition to information about the organization and period, the type of report (primary or corrective), date of signing, etc. will also be visible). Then click “Fill”, and “1C” transfers the data from the personal income tax accrual registers for the reporting period to the form. The draft report is ready!

It remains to check it. This can be done manually by generating a payslip for the same period in the same “1C”. If the report is filled out correctly, the indicators in lines 110 “Amount of accrued income” and 140 “Amount of calculated tax” in 6-NDFL must coincide with the totals in the columns “Total accrued” and “Total withheld” in the payroll statements for the same period.

Correcting errors for generating 6-personal income tax is a separate, extensive issue. In this article we will not dwell on it in detail. We only note that if discrepancies are found during reconciliation with the payroll sheet, then the 6-NDFL project has a line decoding function available. To do this, place the cursor on the desired line (for example, 110) and either double-click on it with the left mouse button, or press the right mouse button once and select “Decrypt” from the drop-down menu. It is convenient to check the resulting decoding with the payroll sheet to identify differences.

For information on sending a report to the Federal Tax Service via electronic communication channels, read the article “Is it possible to fill out form 6-NDFL online?” .

When it's not a mistake

“Non-salary” income accounted for by the date of payment, such as vacations, sick leave, bonuses, may not be included in the report because they relate not to the period when they were accrued, but to the period when they were paid.

For example, a temporary disability benefit accrued in September but paid in October is included in 6-NDFL on the date of receipt of income, which refers to October, i.e. to the reporting period “year”, not “9 months”. Therefore, this benefit will not be included in the 9-month report, and this is not an error!

To make the example clearer, let’s assume that in Buttercup LLC, accruals for 9 months were made only in September and only to one employee, L.L. Tyulpanova.

The accrued salary and sick leave payments for September were paid in full on October 5:

When generating a 6-NDFL report for 9 months, in Section 1, line 020 includes only salary payments, the amount of accruals for sick leave will be included in the annual report, because the date of receipt of income refers to October:

Salaries for December were issued in January 2022

This is the salary calculated for 2022:

- In section 1, do not show - in December you did not withhold personal income tax from her.

- In Section 2, include fields 110, 112, 115, 130, 140, and 142 in the indicators, but do not show on line 160 (the tax has not yet been withheld) and line 170 (you will withhold it next month).

Please note that, according to the latest clarifications of the Federal Tax Service, wages should not be included in 6-NDFL (including income certificates) if it has not yet been paid on the date of submission of the calculation. Therefore, it is better to report after the employer’s deadline for paying wages for the last month of the reporting period. Otherwise, clarification will be required.

In 6-NDFL for the 1st quarter of 2022, reflect the salary for December issued in January and the personal income tax from it:

- in section 1 in fields 020, 021, 022; in this case, in field 021, indicate the working day following the day of salary payment;

- in section 2 - only in field 160.

This procedure was confirmed by the Federal Tax Service in a letter dated 02/11/2022 No. BS-3-11/ [email protected]

Just last week the campaign for submitting annual reports for 2015 ended, but the regulatory authorities are not asleep. From the 1st quarter of 2016, a lot of interesting things await us in this direction. I will not consider what changes have affected reports that are already familiar to us, for example, form 4-FSS. It is much more interesting to talk about completely new forms of reporting. Today I will try to tell you about filling out 6-NDFL in the 1C ZUP 2.5 program.

For several days I tried to figure out where to start. I read articles on various websites, forums, and listened to webinars. And yesterday morning I decided to consider the most common situations that arise while working in the 1C ZUP 2.5 program.

In most cases, I read that in the 1C ZUP program, form 6-NDFL is filled out automatically, by clicking the “Fill” button. Well, let's see J

I won’t tell you what each line in form 6-NDFL means and bother you with links to articles of laws. You can read all this on the Internet. I will look at a small and specific example with the main documents for calculating payroll during the quarter. We will not consider a situation where salaries are calculated once at the end of the month, no one gets sick or goes on vacation, and receives the same salary every month. Everything really happens there by pressing the “Fill” button J

So, in the first quarter of 2016, the organization Inkom Plus LLC employed 10 people. People took out an interest-free loan, got sick, went on vacation and quit. What came of it?

First, let's look at the accounting settings that affect filling out form 6-NDFL.

To most accurately reflect the facts of payment of income to employees and the deadline for transferring personal income tax in the accounting settings, it is recommended to uncheck the “When calculating personal income tax, take the calculated tax into account as withheld”

What does this setting affect? In accordance with paragraph 4 of Art. 226 Tax Code of the Russian Federation

The accrued amount of personal income tax must be withheld directly from the taxpayer’s income at the time of payment. If the checkbox in the setting is SET, then personal income tax is withheld from income at the time of salary calculation, i.e. document “Calculation of wages to employees” and in 6-NDFL, section 2 will look like this:

However, as a rule, we calculate salaries on the last day of the month and pay them at the beginning of the next. Those. in fact, personal income tax must be withheld already in February and the deadline for transferring the tax should be different!

That is, of course, it’s up to you to decide whether to change this setting or not, but if the tax authorities impose penalties for each day of delay in paying personal income tax to the budget, then the date on line 120 is of great importance.

ATTENTION! If before this, in setting up your accounting parameters, the checkbox “When calculating personal income tax, take the calculated tax into account as withheld” was checked, and now you decide to remove it, then you will have to “re-post” all documents for accrual and payment of salaries for the 1st quarter. This must be done very carefully and carefully, because... re-processing of documents for salary payments has become problematic since release 101.2.

Well, now let’s look at filling out the 6-NDFL report for the 1st quarter of 2016. At the same time, in January one employee was sick, in February one employee quit and in March one employee was on vacation, and for the purity of the experiment, the salary for March was paid in full on March 3 J

Open form 6-NDFL. It is located in regulated reports in the section “Reporting for individuals”

Open the report and fill it out using the “Fill” button

Now let’s generate a personal income tax report for the 1st quarter of 2016 and compare the data with the completed section 1:

Having compared the indicators in the report with the completed section 1, I understand that everything is clear, understandable and correct. We now move on to the analysis of section 2:

So, in January everything is clear: line 130 includes the accrual for January without child care benefits plus income in kind:

483637,18-100+400,73=483937,91

I remind you that there was a sick leave. The person was ill from January 18 to January 24. The amount of sick leave is reflected in the summary of accruals and deductions:

Now let's look at February. For February, payments were made twice, which is reflected in section 2 of form 6-NDFL in two blocks. Let me remind you that in mid-February one employee was fired. On February 15, he was paid in full: compensation for vacation and days worked in February:

This is where I had questions J.

For February, a total amount of 526,662.12 was accrued, of which compensation for the dismissed employee amounted to 53,543.37. Through simple manipulations with the calculator, I come to the conclusion that for February in section 2, all lines 130 reflect the amount of income equal to only 498636.32 = 53543.37 + 445092.95.

What is this amount of income that is not included in section 2? Let's do the math:

526662,12-100+522,95-498636,32=28448,75

It turns out that this is the salary of a dismissed employee, which we paid on February 15:

After “playing” with the documents, I came to a disappointing conclusion: if the payment is made on February 29, then 6-NDFL will look like what we need:

But the person was fired in the middle of the month. And we must calculate it in full on the day of dismissal, and not on the last day of the month.

E-xxx. Let's look at March.

Well, at least there are no problems in March. But for the purity of the experiment, I still changed the employee’s vacation from March 21 to 14 days. Those. Full calculation of vacation pay and salary for the month must be made on March 18. I think you have already guessed that the result is the same as with the fired person. The vacation pay amounts are included in line 130, but the salary calculation is not L

That. I came to the conclusion that if the salary is paid on the last day of the month or at the beginning of the next, then all amounts of income fit well on lines 130, but if the statement for the payment of salaries for the current month is made earlier, then these incomes do not fall into the second section forms 6-NDFL in general.

To be fair, it is worth noting that I checked the report in different checking programs. And no errors were found anywhere. Those. it turns out that the sum of all lines 130 may be less than actually paid and this is not an error. But why then fill out this information at all?

As a result, I wrote a letter to the 1C company for help. Perhaps I'm missing something or doing something wrong. We will wait for an answer.

To be honest, I don’t even know how to fill out a report in the 1C Accounting program?

“I’ll play around” from Monday J

Thank you for reading to the end.

I will be glad if the article was useful.

Continue reading here.

| Head of care service Budanova Victoria |

Social buttons for Joomla

When it's a mistake

Sometimes there may be a “re-grading” of documents based on the reasons for the payment of wages. The reason for the appearance of such misgrading may be a manual adjustment in the statement of the total amount payable to the employee or a recalculation of accrual documents.

When paying wages for September to employee T.M. Tyulpanova. the inscription “incl. for August", when deciphering the amounts payable, it is clear that there has been a re-sorting of the basis documents, although the total amount for the lines for August is zero:

In the example under consideration, the “re-grading” occurred according to the documents Accrual of salaries and contributions , which accrued “salary” income and Bonus , which accrued the bonus, taken into account for personal income tax purposes on the date of payment. As a result of the statement, part of the income in the form of a bonus for personal income tax accounting purposes was attributed by the date of payment to October.

The amount of the bonus accrued in August is 3,500 rubles.

As a result, only part of the accrued premium will be included in 6-NDFL for 9 months, which is an error:

To eliminate such an error, you need to return to the original statement for August and refill it, or manually adjust the amounts payable according to the documents in order to eliminate the misgrading.

For a detailed answer, see the video:

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge