Inventories represent one of the most important parts of financial statements. The decisive role is played by the correct assessment, in accordance with which they are recorded and subsequently reflected in the reporting.

In this regard, new approaches to determining the value of assets are emerging in international practice. One of them is the formation of appropriate reserves for reducing the cost of material assets. They are reflected in account 14 of accounting.

Using count 14

Account 14 “Reserves for reduction in the value of material assets” is used to summarize information about reserves for deviations in the cost of raw materials, supplies, and fuel resources from the actual market indicator.

This direction is also used to summarize information about reserves for reducing the cost of other assets - work in progress, finished products, commodity items, etc. The formation of the corresponding reserve is directly reflected in account 14. Here it is accounted for as a loan, and next to it in double entry there is usually a debit of 91, which means other deductions and receipts.

In the next reporting period, as the material assets for which the reserve was formed are written off, the amount is restored and a reverse entry is made Dt 14 Kt 91. Similarly, the operation is displayed in the case of an increased market value of material assets.

Analytical accounting within the operation is carried out separately for each of the reserves. When an enterprise records materials, goods, and finished products, this does not at all indicate the need to create a reserve. It does not occur in all cases, but only in the presence of certain factors.

Conventionally, these include the following areas:

- the fact of inventory obsolescence;

- significant damage;

- reduction in sales costs.

An important role in the accounting process is played by the costs of purchasing inventories, which include the following groups:

- cost at purchase prices;

- customs duties, payment of duties, etc.;

- remuneration to intermediaries;

- costs of preparation and delivery of inventories;

- transportation and procurement costs.

While inventories are not used by an organization, their actual market price may be subject to change. And if there is a decrease in it, the actual cost cannot be changed.

Calculation of the final balance for account 14

The formula for calculating the final balance on account 14 = Beginning balance on the loan + Turnover on the loan 14 - turnover on the debit 14.

Let's use the previous example and draw an airplane:

Balance at the end = Balance at the beginning CT + Credit turnover - debit turnover = 1000 + 200-100 = 1100 rubles. Debit turnover is shown (200 rubles) for the amount of reserves created for the period. Credit turnover (100 rubles) is the amount of the reserve written off. The closing balance (1100 rubles) shows how much reserves we have in account 14 at the end of the reporting period. 1100 rubles are not reflected in the balance sheet but are subtracted from the amount of INVENTORIES in the balance sheet asset. Let's say we have INVENTORIES in the amount of 10,000 rubles in the balance sheet on the INVENTORIES line there will be 8900 rubles (10000-1100)

Accounting Features

The net realizable value of inventories is subject to revision in each subsequent period. If the net realizable value of inventories that were previously marked down subsequently becomes greater, the amount that was previously written off is reversed to the extent of the initial markdown so that the new cost corresponds to the minimum actual cost.

At the end of the reporting year, in the process of writing off materials, the reserved value is restored, and the entry Dt 14 Kt 99 appears in accounting. As for the restoration of the reserve value in the process of disposal of inventories, it is reflected through the operation Dt 14 Kt 90.

Which accounts does account 10 correspond to?

Account 10 can correspond with the following accounts:

From the debit of account 10 to the credit of accounts:

- Account 10 - when transferring materials between warehouses;

- Account 15 - when purchasing materials using accounts 15, 16 in accounting;

- Account 20 - when registering materials from the main production;

- Account 23 - when registering materials from auxiliary production;

- Account 25 - when recording materials that arose during the implementation of general production expenses;

- Account 26 - when recording materials that arose during the implementation of general business expenses;

- Cch. 28 – when registering irreparable defects as materials;

- sch. 29 - when receiving materials from service farms;

- sch. 40 - when adjusting the actual cost;

- sch. 41 - when converting goods purchased for resale into materials;

- sch. 43 - when converting finished products into materials;

- sch. 44 - when recording material that arose when incurring sales expenses;

- sch. 60 - upon receipt of materials from suppliers;

- sch. 66 - upon receipt of materials in the form of short-term trade credits or loans;

- sch. 67 - upon receipt of materials in the form of long-term trade credits or loans;

- sch. 68 - regarding fees or taxes attributable to the cost of materials;

- sch. 71 - upon receipt of materials from accountable persons;

- sch. 75 - when the founders contribute shares with materials;

- sch. 76 - upon receipt of materials from other suppliers, inclusion of the cost of services in the price of materials, etc.

- sch. 79 - upon receipt of materials from branches or head offices;

- sch. 80 - when making contributions from partnership participants in materials;

- sch. 86 - upon receipt of materials as targeted funding;

- sch. 91 - upon receipt of materials during the disassembly of OS objects;

- sch. 97 - adjustment of the cost of materials charged to deferred expenses;

- sch. 99 - when registering materials arising due to emergency circumstances.

You might be interested in:

Account 60 “Settlements with suppliers and contractors” in accounting: what it is intended for, characteristics, postings

According to the credit of the account, it corresponds with the debit of the following accounts:

- sch. 08 - when writing off materials for preparation for operation of non-current assets, capital construction, etc.;

- sch. 10 - when transferring materials between warehouses;

- sch. 20 - when releasing materials to main production;

- sch. 23 - when releasing materials to auxiliary production;

- sch. 25 - when releasing materials for general production needs;

- sch. 26 - when releasing materials for general business needs;

- sch. 28 - when releasing materials to correct defects;

- sch. 29 - when releasing materials to subsidiary farms;

- sch. 44 - when releasing materials for sales expenses;

- sch. 45 - for the amount of shipped materials, the revenue for which has not yet been recognized in accounting;

- sch. 76 - upon disposal of materials to another counterparty;

- sch. 79 - when transferring materials to branches or head offices;

- sch. 80 - when paying off a partner’s share with materials;

- sch. 91 - when writing off the cost of materials upon their disposal;

- sch. 94 - when a shortage of materials is detected;

- sch. 97 - when assigning the cost of materials to future expenses;

- sch. 99 - when writing off materials for emergency circumstances.

Postings with examples

The creation of reserve points is traditionally carried out before drawing up the annual balance sheet. The amount is usually calculated for each item number or name, and sometimes for groups of similar values.

Reserve amount = (US - TS) * CMC, where

US – accounting value indicator, TC – current value, KMC – number of material assets.

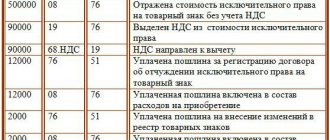

Reserves are not created if the actual cost is high at the reporting date. The account is active-passive. The formation of the reserve is subject to reflection on the credit of the account. Below are the main transactions for this account:

- Dt 91 Kt 14 – formation of a reserve. The basis for regulation is an accounting certificate and an order from the manager.

- Dt 14 Kt 91. The invoice is generated on the basis of the same types of documentation. The operation means writing off and restoring the reserve amount for inventories.

- Dt 60 Kt 41 – acceptance of commodity items for accounting. Actions are carried out on the basis of the consignment note.

- Dt 91 Kt 14 – creation of a reserve. It is carried out on the basis of the manager’s order and certificate.

- Dt 99 Kt 68. Permanent tax liability.

- Dt 62 Kt 90 – reflection of revenue received during the sale of commodity items.

- Dt 90 Kt 68. The operation is traditionally regulated by an invoice and involves the accrual of VAT on sales.

- Dt 90 Kt 41. Interim operation, which reflects the write-off of cost. The consignment note serves as an indicative regulatory document.

- Dt 14 Kt 91 – the reserve amount is written off.

- Dt 68 Kt 99 – introduction of a tax asset on an ongoing basis.

What is account 10 used for in accounting “materials”

The chart of accounts establishes that account 10 takes into account objects that are defined in accounting in accordance with PBU 5 as materials.

Materials include material assets that are used in the form of inventory, raw materials for the production of finished products, provision of services, performance of work, for resale if necessary, for the implementation of the management process of a business entity.

If material assets are acquired for the purpose of resale on an ongoing basis, then they are goods and a different account is used to account for them.

Materials are accounted for on account 10 at the actual costs incurred for their acquisition or at accounting prices, depending on the methods chosen in the organization’s accounting policy.

Accounting can be maintained for each unit of materials, batch, or group. The company independently determines how to record them based on the characteristics of its activities, as well as in order to ensure control over their availability and movement.

Attention! Materials located in the company may not belong to it by right of ownership, then they are recorded on off-balance sheet accounts (002 and 003).

Creating a reserve with an example

The reserve, as already noted, represents the difference between the actual cost and the market price. If the second parameter in relation to a product created from materials is greater than or equal to the physical cost, a reserve is not formed, as stated in the relevant Guidelines for accounting for inventories.

Accounting for the fact of creating a reserve is carried out according to Kt 14. Let's consider the process of its formation step by step using practical examples and using existing transactions.

The organization Fomich LLC has homogeneous materials in its calculation - pigment. Starting price – 600,000 rubles, including 100,000 rubles. – VAT. At the end of the reporting period, an inventory process took place, and in the end it was found that the market price had decreased and was equal to 300,000 rubles. The company decided to create a reserve.

This operation will be recorded as follows (to simplify accounting):

600,000 – 100,000 = 500,000 rub.

Dt 19 Kt 60 = 100,000 rub. – input parameter of value added tax in the process of receipt of materials.

Dt 10 Kt 60 = 500,000 rub. – direct receipt of materials to the warehouse.

Dt 91 Kt 14 = 300,000 rub. – acceptance of input VAT for deduction.

What subaccounts are used?

The following subaccounts can be created for account 10:

- 10/1 “Raw materials and supplies” - it records raw materials and the main types of materials that form the basis for the production of main products. Here you can also keep records of materials for auxiliary and technological purposes, as well as agricultural products intended for processing.

- 10/2 “Purchased semi-finished products and components, structures and parts” - this takes into account the cost of semi-finished products and components that are purchased for the production of products and require further refinement.

- 10/3 “Fuel” - this takes into account the availability and movement of fuel and lubricants for the company’s vehicles and equipment.

- 10/4 “Containers and packaging materials” - here all types of containers are recorded, as well as materials for their manufacture or repair.

- 10/5 “Spare parts” - here the accounting of spare parts intended for the repair of existing equipment, vehicles and other mechanical means is made;

- 10/6 “Other materials” - production waste, trimmings, shavings, etc. are taken into account here. Materials that were formed during the liquidation of the OS can also be taken into account here. The main thing is that the materials accounted for in this subaccount are not used as basic materials, fuel, spare parts, etc.

- 10/7 “Materials transferred for processing to third parties” - this takes into account materials that were transferred to third parties for the manufacture of products from them;

- 10/8 “Building materials” - the subaccount is used in developer organizations to account for materials used during construction and installation;

- 10/9 “Inventory and household supplies” - the account records the cost of tools, inventory, and household supplies;

- 10/10 “Special equipment and special clothing in the warehouse” - is intended to account for special equipment, equipment, special clothing, etc., which are stored in the warehouse.

- 10/11 “Special equipment and special clothing in operation, etc.” — designed to account for special equipment, equipment, workwear, etc., which are used in production.

Attention! An organization can open other sub-accounts necessary for proper accounting. Analytical accounting can be carried out by types, types, sizes, grades of materials, etc.

Regulatory acts

In the process of regulating management activities for reserves, various types and forms of documentation are used. It is divided into several levels.

- Decrees, orders adopted by the President of the Russian Federation, as well as regional government bodies.

- Local regulations of the enterprise.

- Methodical instructions.

- Accounting documents (invoices, delivery notes, accounting certificates, etc.).

- Other forms of documentation that are relevant in the process of accounting activities.

Thus, account 14 in accounting is relevant and is used quite often. The creation of reserves is necessary in a large number of practical situations, since not only the convenience of accounting operations, but also the transparency of transactions depends on it.

It is necessary to achieve competent preparation of transactions in all directions and signing of correct and rational amounts for them, since the fact of fulfillment of obligations depends on them.

about the author

Grigory Znayko Journalist, entrepreneur. I run my own business and know first-hand the problems and difficulties that individual entrepreneurs and LLCs face.

The concept of raw materials and supplies in accounting

Materials are recognized as objects of human activity that are used mainly in one production process and fully transfer their value to the manufactured object.

Their useful life is less than one year. In accordance with the law, they are included in the working capital of the enterprise.

Raw materials are objects that are products of the mining industry or agriculture. They undergo a processing process and are fully used in the manufacture of finished products.

Materials are a product of the manufacturing industry, which is subsequently used to produce products, provide services, and perform work.

Materials are divided into the following groups:

- Raw materials and basic materials are the basis for the manufacture of finished products

- Semi-finished products of own production are an integral part of work in progress; they are not taken into account in account 10.

- Purchased semi-finished products are materials that have undergone pre-processing at other enterprises.

- Auxiliary materials - lubricants, containers, returnable waste, etc.

- Fuel is used as one of the sources of energy in economic activities.

- Spare parts are used for timely repair of equipment and other fixed assets.

- Construction materials - used in construction work and repair of buildings and structures.

- Household inventory - objects used in several production processes or in the management of an organization, classified as materials due to cost or short lifespan.

Using account 15 in accounting

Often in their activities, organizations prefer to account for received inventories at accounting prices. The procedure for their determination, which also needs to be reflected in the accounting policies indicating the level of their materiality, may be as follows:

- the supplier's price is taken as the accounting price;

- Inventory items are accounted for at the cost of previous periods;

- the accepted fixed value is used as the accounting price.

If there is a significant deviation of accounting prices from the level of market indicators (usually more than 10%), then they are subject to revision.

The use of accounting prices when determining the cost of inventories involves the use of account 15 in accounting, which collects all information about the real cost of the purchase.

Dt 15 - Kt 60 - purchase of materials from the supplier (purchase cost).

Dt 19 - Kt 60 - reflected input VAT.

Dt 68 - Kt 19 - acceptance of tax for deduction.

Dt 60 - Kt 51 - materials paid for.

Dt 10 - Kt 15 - purchased goods have arrived at the warehouse.

The debit of account 15 reflects data on the actual cost of inventories. An idea of the accounting prices of a certain group of materials gives account credit 15.

To record the deviation of the accounting price from the actual costs incurred, account 16 is used.

Dt 15 - Kt 16 - posting shows the amount of excess of the accepted accounting price from the actual one.

In the opposite situation, when the accounting price is less than the actual acquisition costs, the following entry is made:

Dt 16 - Kt 15.

Accounting entries for the account

With a score of 10 the following entries can be made:

| Debit | Credit | Description |

| Materials receipt transactions | ||

| 10 | 10 | Transfer of materials from warehouse to warehouse |

| 10 | 15 | Materials accepted at discount prices |

| 10 | 20 | Accepted materials manufactured by the main production facilities |

| 10 | 20 | Return of unused materials to the warehouse |

| 10 | 23 | Materials manufactured by auxiliary production forces have been accepted into the warehouse |

| 10 | 28 | Accepted irreparable marriage |

| 10 | 29 | Materials produced by subsidiary farms have been accepted for accounting |

| 10 | 41 | Goods purchased for resale are used as materials |

| 10 | 43 | Finished products are transferred to the warehouse for use as materials |

| 10 | 44 | Return of materials issued for sales support |

| 10 | 60 | Receipt of materials from the supplier to the warehouse |

| 10 | 66 | Receipt of materials for short-term trade credit or loan |

| 10 | 67 | Receipt of materials for long-term trade credit or loan |

| 10 | 71 | Receipt of materials from an accountable person |

| 10 | 73 | Receipt of materials from personnel |

| 10 | 76 | Receipt of materials from other creditors |

| 10 | 79 | Receipt of materials from the head office or branch |

| 10 | 75 | Receipt of materials as a contribution to the authorized capital |

| 10 | 86 | Receipt of materials in the form of targeted financing |

| 10 | 97 | Receipt of materials from deferred expenses funds |

| 10 | 99 | Receipt of materials due to emergency or force majeure circumstances |

| 10 | 91 | Additional valuation of materials, proceeds from the sale or dismantling of an asset |

| Material write-off operations | ||

| 08 | 10 | Write-off of materials for preparing non-current assets for operation |

| 14 | 10 | Materials have been marked down |

| 20 | 10 | Materials transferred to main production |

| 23 | 10 | Materials transferred to auxiliary production |

| 28 | 10 | Materials transferred for correction of defects |

| 29 | 10 | Materials were donated to the needs of subsidiary farms |

| 44 | 10 | Materials were transferred for the needs of preparing main products for sale |

| 79 | 10 | Materials transferred to the head office or branch |

| 91 | 10 | Write-off of the cost of materials upon disposal or sale |

| 94 | 10 | Shortage of materials identified |

| 97 | 10 | The cost of materials is charged to deferred expenses. |

| 99 | 10 | Loss of materials written off due to emergency or force majeure circumstances |