Accounting for workwear and special equipment. inventory is strictly regulated by the legislation of the Russian Federation. Based on these standards, records are kept in the 1C Accounting 8.3 program.

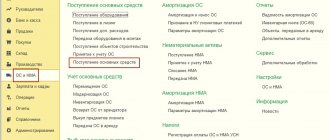

In order to reflect the transfer of such materials and other low-value materials into operation, there is a document of the same name, which is located in the “Warehouse” section. Please note that materials must be received at the warehouse before they can be written off. This can be reflected in different ways, for example, by registering the purchase of documents “Receipt (Act, invoice)”.

Workwear

First of all, let's fill out the header of the document. In it we will indicate the organization Roga LLC, the warehouse and the division where the materials are located.

Please note that this document allows you to transfer into operation at the same time special clothing, special equipment, as well as equipment and household supplies. In our case, the details for all groups of materials will be the same, so the data will be contained in the same document, only on different tabs.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Let's consider the example of the commissioning of seven safety helmets and five jackets for construction workers. We will issue them to our employee Gennady Sergeevich Abramov. In the future, it is he who they will be listed as. These materials are special clothing, so we will indicate them on the first tab of the same name in the document.

Please note that both safety helmets and jackets for construction workers are workwear, which must be indicated in the item data cards.

To correctly reflect these materials in accounting, it is very important to correctly indicate the purpose of use in the corresponding column of the tabular section. The data here is selected from a special directory of the same name, which you can fill out yourself.

In our example, the intended use of safety helmets is “Helmets for construction workers”. We filled out all the data ourselves. In our example, the cost of safety helmets will be repaid on a straight-line basis over the entire useful life. It is 11 months.

We will reflect this type of expense on account 25. Depending on the work regulations at your enterprise, the invoice may be different.

Please note that in accordance with current legislation, workwear with a useful life of less than a year can be written off at a time. In our example, the terms for safety helmets and jackets for construction workers are less than 12 months.

After entering all the necessary data into the document, it can be processed. The resulting wiring in our example is shown in the figure below.

Transferring materials into operation in 1C 8.3 - step-by-step instructions

Let's consider the sequence of writing off inventories in the accounting of an enterprise when using the software solution - “1C: Accounting”.

You need to start by issuing materials in the “Transfer to Operation” section, the section is located in the “Warehouse-Workwear and Equipment” menu.

Items of the MPZ category are reflected in special account 10.10 designated as “Working clothing and special equipment in the warehouse.” After creating the balance sheet, it is easy to note that the balance sheet shows reflective vests in the amount of 10 pieces and insulated suits in the amount of 15 pieces.

The next step is to reflect the transfer of items into operation. To do this, create a document of the same name by pressing the “Create” button in the document log.

First, fill out the header of the document and enter basic data - location of materials, organization and warehouse where the transfer is made. The selection button allows you to add items. After which the number of items and the responsible person are indicated, the purpose of operation is filled out. The next step is to contribute funds to cover the cost and reflect expenses. The period of active use, calculated in months, must be indicated.

The service life of the company's materials is regulated by the Labor Code. The duration of operation is determined depending on the specialty of the employee, the activities of the organization, and climatic conditions. Thus, a jacket and trousers with special inserts, such as membranes reinforced with an insulated lining, are used for at least three years. After which the protective clothing is replaced. Winter boots are issued for up to four years. Clothing without membranes, reinforced with lining, must be replaced every two years. When issued, the boots have a two and a half year shelf life.

In accordance with the cost parameters and basic service life of workwear, which is necessarily taken into account in the MPZ, items are conditionally divided into categories:

The first group includes items with a period of active use of up to 12 months. The write-off operation is performed at a time, and the cost does not play a decisive role;

The second group takes into account goods with a useful life of more than one year. These positions are not included in working capital due to the cost criterion; for this reason, repayment of the cost is required in accordance with the terms of use in a straight-line manner.

It is important to take these features into account when entering information about the intended use. For example, a reflective vest has been in use for less than 12 months, which requires write-off in accordance with the rules of the first group.

The cost of items from the second group is written off proportionally over the entire period of use. At the same time, a one-time write-off is made in the accounting system, causing the emergence of a temporary difference.

There is another suppression option, used exclusively in relation to special equipment. In this case, they proceed from the volume of products or work done or services provided in equal proportions. When using this method, monthly data entry into the “Material Development” document is required.

In this case, the item “Method of reflecting expenses” shows the accounting settings.

Then you can proceed to posting the document. You can check the generated transactions by clicking on the menu item “Show transactions and other movements on the document.” From this document it is possible to print out the “Issue Statement”, and, if necessary, the “Requirements-Invoice”.

In this way, transactions will be generated for two balance sheet accounts: 10.11 and 10.10 and the debit of off-balance sheet accounts used to record valuables. And the cost of the reflective vest will be repaid upon commissioning.

In this case, the repayment of the cost of workwear in accordance with the method of reflection will be made only in tax accounting. For this reason, a temporary difference will appear between accounting and tax data.

The temporary difference is noted in the first month of repayment of the book value of workwear and is subsequently written off, i.e. will be repaid during the entire period of use of the material.

Special equipment

Special equipment includes special equipment, tools and devices. The features of its accounting and the rules for classifying materials into this group are strictly regulated and approved by order of the Ministry of Finance of the Russian Federation No. 135n dated December 26, 2002.

In this example, we need to put into operation a mold for casting chocolate Santa Clauses. We will enter this data into the previously created document, since both the transfer date and the rest of the header details will match.

In the tabular section on the “Special equipment” tab, almost the same data is indicated as in the case of special clothing. In this case, only the transfer count 10.11.2 will differ. The program will fill in some data automatically. To do this, it is important to indicate in the nomenclature card that the “Santa Claus” uniform is special equipment.

The document will generate movements similar to the case with workwear, only in this situation the off-balance sheet account MTs.03 is also used.

Function of the acceptance certificate

The transfer and acceptance certificate is formed for the following purposes:

- recording the state of the transferred instrument;

- confirmation of the fact that the buyer and seller (landlord and tenant) have no claims against each other;

- confirmation that the transfer of the object has been completed;

- the act serves as the basis document for making relevant entries in the organization’s balance sheet.

Attention! The deed and the contract must be used and stored only together. Separately, these documents have no legal force. Also, all payment and accompanying papers for the instrument must be kept with the contract.

Inventory and household items accessories

The last tab will reflect the commissioning of the office organizer. We took it to the inventory and household items. accessories. Filling out the tab is similar to the previous examples.

In this situation, in the way of reflecting expenses, we indicated that repayment of the organizer will occur when it is put into operation. We will attribute the costs for it to general business expenses in account 26. You can use another account for accounting.

It is especially important to correctly fill out and configure the methods for reflecting expenses in 1C 8.3.

The document formed only two movements to transfer the office organizer as equipment into operation. In this case, the off-balance sheet account MTs.04 is used.

Postings for commissioning

- “Pass” button ;

- Button “Result of document posting” .

Rice. 132

| Attention | |

|

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Documenting

Document the release (transfer) of materials into operation (production) with the following documents:

- limit intake card (form No. M-8) is used for the systematic use of materials, when standards and plans for their consumption have been approved;

- an invoice for the release of materials to the third party (Form No. M-15) is used in cases where materials are transferred to a geographically remote unit;

- the demand invoice (Form No. M-11) or warehouse registration card (Form No. M-17) is used in other cases.

Such rules are established by paragraphs 100, 109 and 126 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Advice : standard forms of documents that are in albums of unified forms and approved by resolutions of the State Statistics Committee of Russia are not necessary to use. Therefore, organizations have the right to develop a single act for the write-off of materials. It can indicate only mandatory details and those that are important for the organization based on the specifics of the activity.

Use the same documents to write off property worth up to 40,000 rubles. (another limit established in the accounting policy), which in other respects corresponds to fixed assets. This is explained by the fact that in accounting its value is written off similarly to materials (paragraph 4, paragraph 5 of PBU 6/01, letter of the Ministry of Finance of Russia dated May 30, 2006 No. 03-03-04/4/98).

Use of materials

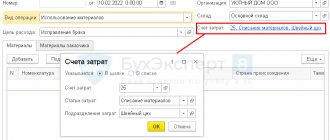

The document Consumption of materials with the type of operation Use of materials is used to account for materials used in production and for the organization’s own needs, as well as to account for operations for processing customer-supplied raw materials. Own materials are indicated on the Materials tab, and customer-supplied raw materials are indicated on the Customer Materials tab.

Setting up methods for specifying cost accounts is performed in the Cost Accounts form, which can be accessed by following the hyperlink located in the document header next to the Cost Accounts text (Fig. 1).

Rice. 1. Use of materials

If the switch is specified to be set to:

- In the header, then in the Cost Accounts form, you can specify the accounting account and cost analytics simultaneously for all materials used;

- In the list, accounting accounts and cost analytics are indicated in the tabular part of the document separately for each item.

Cost accounts are specified only for own materials; this setting does not apply to customer-supplied raw materials.

When posting a document, entries are generated for the debit of cost accounting accounts in correspondence with the material assets accounting accounts.