Why is account 08 needed?

08 account is used to account for the company’s expenses on property, which will subsequently be taken into account as a fixed asset or intangible asset. In agriculture, account 08 takes into account the costs of forming a herd of productive and working livestock.

Account 08 is active. An increase in the cost of commissioning the acquired property is charged to debit. For example, when purchasing a machine, debit 08 of the account will write off not only the cost of the asset, but also the costs of delivery, installation and commissioning. When an object is accepted for accounting, its value is written off against the loan.

The procedure for using account 08 is fixed in PBU 6/01 and PBU 17/20.

What is an investment in non-current assets?

Investments are expenses of a company that are necessary to create or obtain fixed assets or intangible assets.

Costs on account 08 do not participate in the formation of the financial result in the period in which they are taken into account. Expenses incurred are usually attributed to the cost of land, acquired or constructed real estate, natural objects, and farm animals.

In the future, these costs are written off as expenses through depreciation of fixed assets and intangible assets.

For example, a company bought premises for 10,000,000 rubles in 2020. You cannot accept the entire amount as expenses. When the company puts the facility into operation, it will write off acquisition costs from credit 08 to debit 01, and then it will begin to depreciate this property. Let's say the useful life is 25 years. Then the annual expenses will include:

10,000,000 rub. / 25 years = 400,000 rubles.

That is, 400,000 rubles will be written off as expenses annually.

What are off-balance sheet accounts?

Off-balance sheet accounts are intended to account for funds located at the enterprise, but not belonging to it, as well as guarantees received and issued, and bad debts of debtors.

They have a three-digit code - 001, 002, ... 011. Their list is included in the standard counting plan.

Off-balance sheet accounts are not subject to the double entry rule. That is, the transaction amount is reflected only once - either as a debit or as a credit.

EXAMPLE:

The fixed asset is leased, its cost is 100,000.

Leased fixed assets are reflected in off-balance sheet account 001.

The lease of fixed assets is not reflected in the balance sheet accounts, only an entry is made to account 001 - the transaction amount of 100,000 is entered into debit 001 ( Dt 001 ).

When transferring the leased asset back to the owner, the organization removes the object from off-balance sheet accounting, and an entry is made for loan 001 in the amount of 100,000 ( Kt 001 ).

According to their structure, off-balance sheet accounts can be classified as active - when property is received, conditional rights and obligations arise, the amount is reflected in debit, when temporary rights and obligations are disposed of and terminated - in credit.

The standard accounting plan has 8 sections devoted to balance sheet accounts. Off-balance sheet accounts are located at the end of the Plan outside the main sections. This once again emphasizes that these accounts do not belong to the main ones, are not included in the balance sheet, but are only auxiliary for accounting for third-party property, temporary rights and obligations.

When preparing annual financial statements, their indicators are not taken into account.

The standard unified Plan provides for 11 off-balance sheet accounts.

Brief table

001 - Leased fixed assets

Off-balance sheet account 001 shows information about fixed assets taken for temporary use, reflected at the valuation amount specified in the lease agreement.

- Debit 001 - reflects the receipt of fixed assets taken for use for a limited period, according to the valuation amount specified in the lease agreement,

- Credit 001 – shows the disposal of leased fixed assets when they are returned to the lessor.

002 — inventory items accepted for safekeeping

Account 002 is used by purchasing companies to account for inventory items taken for temporary storage.

- Debit 002 - reflects the receipt of inventory items for safekeeping,

- Credit 002 – return of goods and materials taken for safekeeping to the owner.

003 — Materials accepted for processing

Off-balance sheet account 003 is necessary for accounting for the so-called customer-supplied raw materials - data is shown on the customer’s raw materials and materials accepted for processing; the company does not pay for such raw materials, but returns them to the owner as part of the finished product.

- Debit 003 - reflects the receipt of customer-supplied raw materials at the price specified in the contract (processing costs are included in the cost of work and services of the organization,

- Credit 003 – write-off of customer-supplied raw materials as part of finished products.

004 — Goods accepted for commission

Off-balance sheet account 004 - used by commission agent organizations that reflect goods accepted under a commission agreement from the principal.

- Debit 004 - reflects the receipt of goods for commission at the price specified in the acceptance certificates,

- Credit 004 – shipment of goods to customers.

005 – Equipment accepted for installation

Off-balance sheet account 005 is used by contractor organizations performing work.

- Debit 005 - equipment accepted for installation is reflected at the price specified in the customer’s accompanying documents,

- Credit 005 – disposal of installed equipment and transfer to the customer.

006 – Strict reporting forms

Account 006 – the movement of the BSO is taken into account.

- Debit 006 reflects the receipt of BSO according to the conditional valuation,

- Credit 006 – BSO expense (issue).

007 – Debt of insolvent debtors written off at a loss

Account 007 – accounts receivable that is not returned by debtors and written off at a loss (debts that are not realistic for collection, as well as for which the statute of limitations has expired), such bad debt is taken into account on the balance sheet for 5 years to monitor the possibility of its collection, if the financial situation of the debtor will change.

- Debit 007 - reflects written-off receivables not returned by debtors,

- Credit 007 - reflects either the repayment of the debt by the debtor, or a record of the removal of the debt from accounting due to the liquidation of the debtor’s organization, or upon expiration of the 5-year period for recording such information.

008 – Security for obligations and payments received

Off-balance sheet account 008 - takes into account the amount of guarantees received from other organizations to ensure the fulfillment of any obligations (payment for goods received, repayment of a loan), as well as to ensure payment for goods sold to customers. Account 008 are usually used by pawn shops to account for property received as collateral.

- Debit 008 - reflects the amount of the guarantee received from another organization,

- Loan 008 – writing off the guarantee amount after fulfilling the obligation for which the guarantee was received (for example, paying for the goods received, repaying the loan).

009 – Security for obligations and payments issued

Account 009 – the amounts of guarantees issued for the fulfillment of any obligations are taken into account - pledges, sureties, deposits.

- Debit 009 - takes into account the amount of guarantees issued to another person to ensure the fulfillment of obligations by a third-party organization (payment for goods received by it, repayment of a loan, etc.),

- Loan 009 – write-off of these guarantees as obligations are fulfilled.

010 – Depreciation of fixed assets

Off-balance sheet account 010 - shows the amounts of depreciation for housing facilities, external improvements, forestry and road management, etc.

- Debit 010 - depreciation is reflected,

- Credit 010 – write-off of depreciation upon disposal of objects.

011 – Fixed assets leased

Account 011 – data on fixed assets transferred for temporary use is reflected in cases where these objects must be taken into account on the tenant’s balance sheet.

- Debit 011 - fixed assets transferred for use to other persons for a limited period are reflected at the price shown in the lease agreement,

- Credit 011 - the return of these fixed assets is reflected.

We also recommend reading:

⇒ What are balance sheet accounts?

⇒ Chart of accounts table with explanation for beginners.

What subaccounts are opened for account 08

The chart of accounts suggests opening the following subaccounts for account 08, which we have collected in the table.

| Subaccount | We use it for accounting |

| 08.1 | Here we collect all the costs associated with the purchase of a land plot: from the cost of its acquisition to registration fees. |

| 08.2 | Here we summarize all the costs associated with the purchase of environmental management facilities. |

| 08.3 | Here we accumulate all the costs associated with creating an OS yourself. For example, these are the costs of constructing buildings and installing equipment. |

| 08.4 | We take into account all costs associated with the purchase of machines and equipment that do not require installation. |

| 08.5 | Here we reflect the cost of purchased intangible assets. These could be licenses for computer programs, trademarks, and so on. |

| 08.6 | Here we record all the costs incurred by the company for raising young animals. |

| 08.7 | Here we reflect the cost of purchased adult animals, including their delivery. |

| 08.8 | Here we reflect the company's R&D costs. For example, the creation of a new technology or prototype. |

How analytical accounting is carried out on account 08

On account 08, detailed analytical accounting is kept for each object on which costs are incurred. For example, on account 08 the following is kept:

- costs for each individual asset under construction or acquisition;

- costs for each type of design and survey work;

- costs for the acquisition of each intangible asset;

- costs of forming a herd for each type of animal;

- R&D costs by type of work or contracts if R&D is carried out to order.

In addition, costs should be broken down into groups. For example, costs of construction, reconstruction, installation, design and survey work, and so on.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Postings for budgetary institutions

Funds received from a credit institution (bank) allocated for execution must be reflected in the accounting of a budgetary institution with the following entries:

| Debit | Credit | Operation description |

| 2.201.11.510 | 2.205.41.660 | Funds received into the personal account of a budgetary institution (payment to the beneficiary of the amount for which the bank guarantee was issued) |

| 2.205.41.560 | 2.401.10.140 | Accrual of income in the amount of security under a bank guarantee in the event of its receipt at the disposal of a budgetary institution |

Which accounts does account 08 correspond to?

Account 08 corresponds with most of the accounts by debit. The list of accounts with which he corresponds on the loan is much smaller. For convenience, we have collected all the accounts in a table.

| Account 08 corresponds by debit with | Account 08 corresponds for the loan with |

| 02 “Depreciation of fixed assets” 05 “Depreciation of intangible assets” 07 “Equipment for installation” 10 “Materials” 11 “Animals for growing and fattening” 16 “Deviation in the cost of material assets” 19 “VAT on acquired assets” 23 “Auxiliary production” 26 “General business expenses” 60 “Settlements with suppliers and contractors” 66 “Settlements for short-term loans and borrowings” 67 “Settlements for long-term loans and borrowings” 68 “Settlements for taxes and fees” 69 “Settlements for social insurance and security” 70 “ Settlements with personnel for wages" 71 "Settlements with accountable persons" 75 "Settlements with founders" 76 "Settlements with various debtors and creditors" 79 "Intra-business settlements" 80 "Authorized capital" 86 "Targeted financing" 91 "Other income and expenses » 94 “Shortages and losses from damage to valuables” 96 “Reserves for future expenses” 97 “Deferred expenses” 98 “Deferred income” | 01 “Fixed assets” 03 “Income-earning investments in tangible assets” 04 “Intangible assets” 76 “Settlements with various debtors and creditors” 79 “Intra-business settlements” 80 “Authorized capital” 91 “Other income and expenses” 94 “Shortages and losses from damage to valuables" 99 "Profits and losses" |

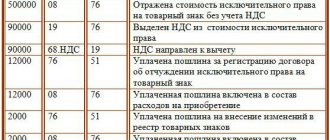

Basic postings with account 08

The table contains the main typical transactions with account 08 that every accountant encounters.

| Debit | Credit | The essence of wiring |

| 08 | 02 | We charged depreciation on equipment involved in the creation of a new non-current asset. |

| 08 | 05 | We calculated depreciation of intangible assets involved in the creation of a new asset. |

| 08 | 10 | The cost of materials used to create a non-current asset was written off. |

| 08 | 23 | The cost of auxiliary production services was written off to the cost of the asset. |

| 08 | 26 | We wrote off part of the general business expenses associated with the creation of the asset. |

| 08 | 60 | Purchased OS or intangible assets. |

| 08 | 66 / 67 | Interest on the loan was included in the value of the asset. |

| 08 | 70 | We paid wages to employees involved in the creation of the asset. |

| 08 | 69 | Insurance premiums were calculated from the salaries of employees involved in the creation of a non-current asset. |

| 08 | 75 | We received intangible assets as a contribution to the authorized capital. |

| 08 | 98 | Received a non-current asset free of charge. |

| 01 | 08 | The non-current asset was taken into account as fixed assets. |

| 03 | 08 | The non-current asset was taken into account as fixed assets for subsequent rental on a reimbursable basis. |

| 04 | 08 | The non-current asset was taken into account as an intangible asset. |

| 91 | 08 | The cost of a non-current asset sold or disposed of for another reason was written off. |

We recommend you the cloud service Kontur.Accounting. In our program, you will easily master the accounting of non-current assets and set up all the necessary analytics. You will also be able to keep records, calculate salaries, submit reports and use other accounting tools. We give all newbies a free trial period of 14 days.

Example of transactions with a beneficiary: receipt and write-off of a guarantee

For commercial and non-profit organizations, it is necessary to use corresponding postings. Let’s imagine that LLC “Ideal Customer” purchased products from LLC “Ideal Supplier” in the amount of 500,000.00 rubles. The table shows how to reflect the collateral provided by the bank in the beneficiary's accounting records.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 008 | — | 500 000,00 | Accounting for the received guarantee |

| 62 | 90 | 500 000,00 | Delivery of products to the customer |

Let's say the buyer is late in payment, and the supplier contacts the bank with a demand to pay the principal's debt in the amount specified in the guarantee. The accounting entries will be as follows:

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 51 | 76 | 500 000,00 | Receiving funds from the guarantor |

| 76 | 62 | 500 000,00 | Debt offset |

| — | 008 | 500 000,00 | Write-off of payment security from off-balance sheet |

If payment is made on time, the beneficiary does not need to contact the guarantor for debt reimbursement. Accounting records will be generated for the receipt and subsequent write-off of collateral on the 008 off-balance sheet account.