To obtain a bank loan, register with an employment center, assign various benefits, and in some other cases, a citizen must confirm his income. If he works in a company, he can get a certificate from the accounting department. But for an individual entrepreneur this is a little more difficult. Let's figure out how an individual entrepreneur's income certificate is issued and when it is needed. We will also consider in detail what documents it is replaced with.

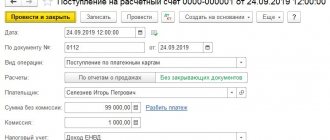

Free accounting services from 1C

About the certificate form

For working citizens, there is a special certificate about the income and tax amounts of an individual, which is prepared by an accountant. But an individual entrepreneur cannot issue such a certificate to himself in the approved form. It’s good if an entrepreneur works as an employee at the same time, his employer will help him. But where can I get a certificate of income for an individual entrepreneur if he is only engaged in business? The issue is easily resolved: the entrepreneur can write it out himself.

The certificate must be issued on the entrepreneur’s letterhead. If it is not there, the header should list basic information about the individual entrepreneur. This is INN, OGRNIP, address, contact phone number, email.

The text of such a certificate can be arbitrary, but certain information must be indicated, namely:

- name of the document and date of its signing;

- last name, first name, patronymic of the entrepreneur;

- the amount of income of the entrepreneur - in order to avoid mistakes, it is better to write it in numbers and words;

- position and full name of the persons signing the certificate. This is usually the entrepreneur himself, but if you have an accountant, you can also include him.

Income is confirmed for the period for which the certificate is required at the place of presentation. It should be included in the title of the document. That is, it may be called, for example, “Certificate of income of individual entrepreneurs for 2022.” The content of the document and its form can be free. The main thing is that the amount of income and the period are clearly clear from the text.

The right decision would be to provide a certificate of income when it is needed. This is especially true if you need to confirm income since the beginning of the current year.

How can an individual entrepreneur obtain a certificate of decreased income?

If the income of an individual worker decreases, it is necessary to issue a certificate of income, which indicates the decrease or lack of profitability.

In this case, the person is required to fill out a certificate of no receipts of funds, leaving the field reporting income zero. It would not hurt to officially certify the certificate with a signature and seal, as well as provide a tax return with zero income for a given period or a journal of income and expenses. Otherwise the design remains unchanged. After filling out the certificate, all that remains is to notify the authority that requested the documents and, if possible, receive a tax deduction or benefit. In the absence of a current account, the chance to get a loan remains possible; for this purpose, loan programs for small businesses are being studied (follow the latest financial news). For the most interesting and profitable options, applications are sent on the Internet to receive answers. It is convenient to use filters on aggregator sites for searching. To apply here you will need the following documents (minimum):

- financial statements, declarations, tax certificates, forms;

- certificate of tax registration from the Federal Tax Service, indicating the taxation system;

- civil passport of an individual;

- certificate of registration in the Unified State Register of Individual Entrepreneurs;

- permission for individual entrepreneurs to conduct business, if required.

Then it’s more complicated, and to confirm income, the type of document is determined by the specific tax regime:

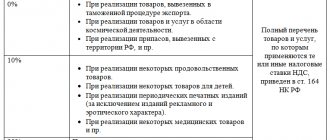

| Type of taxation | How to confirm |

| IP on a patent | Tax is paid regardless of the actual profitability of the entrepreneur, so you need to keep a log of actual taxes. |

| IP on UTII | The tax document for individual entrepreneurs on UTII is not attractive because it does not include information about imputed income or probable revenue. In this case, income is taken into account by the individual entrepreneur independently. Remember that IP on UTII is canceled from 01/01/2021. |

| Individual entrepreneur on a simplified taxation system and general regime | The real income of an individual entrepreneur is confirmed here by a certificate from the simplified taxation system for the past year or form 3-NDFL. When submitting a tax return for last year, a financial organization may require a certificate of current income. You will probably need accounting recording forms for the taxation system using the simplified tax system and a journal of income and expenses in the general mode. |

It turns out that the priority for the bank is individual entrepreneurs on the simplified taxation system or OSNO.

As can be seen from all that has been said, the main supporting document is a certificate in form 3-NDFL, but other documents may also be needed (which documents that confirm solvency should be provided is up to you to decide, choose them yourself). Entrepreneurs need to keep additional records of any income, tax deductions and store all documents and receipts, no matter what income is received.

In the article, we analyzed how an individual entrepreneur confirms his income, what information the authorities are interested in, told us what forms to fill out declarations and other papers, where to get a certificate of income of an individual entrepreneur both for obtaining a loan and for other needs. A variety of authorities can order information from a legal entity, however, firstly, this does not happen often, and secondly, now you know what forms to use to compile such documentation and will be able to prepare and submit it according to the necessary requirements using the method given in the article.

By the way, if you need to make a certificate for a working employee, it is enough to use a certificate in form 2-NDFL as a sample. It is necessary to draw up exactly the same way as a certificate for an individual entrepreneur, indicating the monthly salary and the employee’s total earnings for a period of 3-6 months. Certify with a seal or, if the individual entrepreneur works without a seal, sign.

How can an individual entrepreneur confirm his income?

In fact, an individual entrepreneur does not have to issue a certificate of income so often, since in most cases they can be confirmed differently. How exactly - it depends on what tax system the entrepreneur uses.

IP on OSNO

An entrepreneur in the main tax system pays personal income tax and reports on the 3-NDFL declaration. This form serves as confirmation of the individual entrepreneur's income for the previous full year.

However, sometimes you need to confirm income from the beginning of the year. In this case, the Income and Expense Accounting Book (KUDiR) will help, from which you need to make a copy. It is convenient to keep it on your computer, and then print it out and sign it.

Free tax consultation

IP on the simplified tax system

How does an individual entrepreneur confirm his income in a simplified tax system? A tax return under the simplified tax system, which he submits to the Federal Tax Service once a year, is suitable for this. By analogy with individual entrepreneurs on OSNO, in order to show income for a year that has not yet ended, you need to present a copy of the KUDiR.

Prepare a simplified taxation system declaration online

IP on PSN

Purchasing a patent frees the entrepreneur from any reporting. But he is obliged to keep records of income, because if it exceeds the established threshold, it will be impossible to work on a patent.

Accounting is carried out in the Individual Entrepreneur Income Accounting Book on the patent system. A copy of last year's book is proof of income for the past year. If you need to confirm income within the year, a copy of the current CUD is made.

IP on NPD

Professional income tax (PIT) is a new regime that can be applied by self-employed individuals and entrepreneurs without employees (if they meet a number of conditions, in particular, they do not hire employees or trade).

How can an individual entrepreneur confirm his income in this mode? Everything is very simple. All tax payers are registered in the “My Tax” system, through which they report information about their business to the Federal Tax Service and receive messages from there. The application is available for mobile devices and PCs. In it you can request a certificate of income, which will be provided in the form of an electronic document.

Certificate of income in the bank form for individual entrepreneurs on OSNO: how to confirm income for the bank, social security?

Certificate of income in the bank form for individual entrepreneurs on OSNO

If you need to confirm your profit for a banking institution, social security and other similar organizations, then instead of a document in form 2-NDFL you can provide a declaration in form 3-NDFL . This applies to private owners who pay personal income tax, that is, are on the general taxation system ( OSNO ). The Federal Tax Service will give you a copy of the income statement certified by the head of the tax authority. This document will indicate that the income has been confirmed and the declaration has been accepted by the Federal Tax Service.

Important: The declaration must be submitted in advance. After the tax officer accepts it, ask him to issue a 3-NDFL in several copies.

If such paper is available, a private businessman will not need a document on income 2-NDFL , since from a legal point of view, these are identical documents indicating the amount of funds received.

Help for social protection

Such a certificate is required to assign certain benefits, for example, as a guardian or a low-income family. In this case, the entrepreneur can also make a certificate of income himself. It must be issued for the previous 3 full months, that is, the month of registration is excluded.

A certificate of income for an individual entrepreneur to himself for the social protection authority may have some design features. In particular, territorial offices sometimes require you to indicate monthly income in the form of a table, as well as calculate the average monthly income. Otherwise, the certificate is issued in the same way as for other places of presentation.

Let's sum it up

We figured out how an individual entrepreneur can make a certificate of his income himself and confirm it with other documents.

A certificate confirming the income of an individual entrepreneur, which he issues to himself independently, is drawn up in any form. After all, there is no approved form for this document. It may be needed, for example, by social security authorities. But in most cases, it is necessary to confirm the income of an individual entrepreneur with tax returns and accounting registers. This is required, for example, by banks if an entrepreneur wants to take out a loan. Which document needs to be presented depends on the tax system and the period for which you need to confirm income.

In conclusion, we would like to add that you can sometimes obtain a certificate of income for an individual entrepreneur from the Federal Tax Service. This is not a generally accepted practice, but some tax inspectorates meet entrepreneurs halfway and issue such certificates based on the data they have.

Is it possible to request a certificate from the Federal Tax Service?

The Tax Code or the administrative regulations of the Federal Tax Service do not contain information about actions to certify the income of individual entrepreneurs by tax authorities. However, many regional inspectorates issue such certificates at the request of the taxpayer.

What is the procedure in this case:

- Draw up an application in any form for the issuance of an income certificate.

- Go to the operating room of the tax office, where declarations are submitted.

- One copy of the application remains with the tax office, the second with an acceptance mark is returned to the applicant.

- Within a month, you can receive either a certificate or an answer about the impossibility of issuing it.

- It will not be possible to appeal the actions of the inspectorate, since the issue is not regulated by law.

Sometimes a self-drafted certificate is also attached to the application, and the tax officer only verifies the data and certifies it with his signature and seal.