General rules for filling out a balance sheet in 2021

When preparing financial statements, the following changes should be taken into account.

Amendments to PBU

With the reporting for 2022, amendments to PBU 18/02, PBU 16/02, PBU 13/2000, PBU 22/2010, PBU 1/2008 came into force. They must be taken into account when preparing reports for 2022. According to the new edition of PBU 16/02, information about long-term assets for sale must be disclosed in accounting reports. The new FSBU 25/2018 “Lease Accounting” was also approved. The new standard is mandatory for reporting for 2022.

Financial reporting format

All organizations are required to provide financial statements for 2020 and an audit report only in electronic form. The procedure for submitting a legal copy of reporting was approved by order of the Federal Tax Service dated November 13, 2019 No. ММВ-7-1/ [email protected] , electronic formats - by order of the Federal Tax Service dated November 13, 2019 No. ММВ-7-1/ [email protected] The tax office will not accept accounting on paper.

Inventory

Before submitting annual accounting reports, an inventory is always carried out. But due to coronavirus restrictions, it is allowed to use alternative methods of inventory, for example, using video or photographic recording.

Transfer of assets from DAP to fixed assets

Assets that the organization no longer plans to use and intends to sell are transferred to non-current assets available for sale. But in some cases such an asset will have to be transferred back to fixed assets:

- the asset was transferred to DAP by mistake;

- new circumstances have arisen in which the property must be returned to fixed assets.

In the first case, the correction of the error must be reflected in the accounting; in the second case, such a translation is not an error. But the circumstances that have arisen must be confirmed by documents.

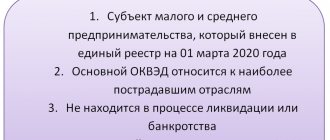

Loans to maintain employment and government assistance for coronavirus measures

Some organizations and individual entrepreneurs affected by coronavirus in 2020 received preferential loans to maintain employment. They are taken into account in the general manner according to the rules of PBU 15/2008. If the loan debt is written off, the amount of the written off debt should be reflected as part of other income (PBU 9/99). Federal and regional subsidies for financing certain expenses are generally taken into account as state aid according to the rules of PBU 13/2000.

PBU 18/02

As of reporting for 2022, amendments to PBU 18/02 are in effect. Now the organization can choose a method for determining differences: the balance sheet method or according to accounting data. The organization reflects the decision made in its accounting policies. An organization may change its accounting policies regarding the method used to determine current income taxes. Changes are reflected in section 2 “Adjustments due to changes in accounting policies and corrections of errors” of the statement of changes in equity.

Write-off of income tax for the second quarter

Some organizations were exempt from making advance payments of income tax for the second quarter of 2022. The amount saved by the organization is included in the reduction of income tax expense. In the financial results report, the value of the indicator reflected on line 2410 of the report is reduced by this amount (clause 7 of the Ministry of Finance information dated July 15, 2020 No. PZ-14/2020).

What form should I use to prepare financial statements for 2020?

The annual financial statements consist of a balance sheet, a statement of financial results and appendices thereto. The appendices include a statement of changes in equity, a statement of cash flows and explanatory notes drawn up in text and/or tabular form.

These reporting forms are used if federal and industry standards do not provide for other forms - such as, for example, for insurance companies and non-state pension funds.

The balance sheet for 2022 is compiled according to the form from the order of the Ministry of Finance dated July 2, 2010 No. 66n (as amended by the order of the Ministry of Finance dated April 19, 2019 No. 61n). Simplified financial statements include:

- simplified balance sheet;

- simplified financial statements;

- simplified report on the intended use of funds (for NPOs).

Organizations that conduct accounting in a general manner fill out a balance sheet in the form given in Appendix 1 to Order of the Ministry of Finance dated July 2, 2010 No. 66n. Organizations that have the right to use simplified accounting methods submit a balance sheet in a simplified form given in Appendix 5 to the order, or in a general form (Appendix 1 to the order).

Why is an organization's balance sheet compiled?

An organization's commodity balance can be compiled, in particular, to analyze the volumes of goods (products) received, the volumes of their sales and the availability of remaining goods (products) at the beginning and end of the period, identifying losses and surpluses of goods (products).

The definition of the concept of “commodity balance” is not enshrined in regulatory documents. The commodity balance, as a rule, is the ratio of the cost of goods sold (products sold) and the cost of goods received (products released) for a certain period of time.

The commodity balance is compiled for any time period, usually a month, but such a period can be a quarter, a week, a decade, or a day.

Thus, in retail trade, the balance of goods can be presented in the form of the following formula, based on the indicators of which the turnover for the sale of a particular product can be determined (clause 9.22 of the Methodological Recommendations approved by the Letter of Roskomtorg dated July 10, 1996 N 1-794/32- 5):

ZN + P = R + V + ZK,

- where ZN is the balance of goods at the beginning of the period;

- P - receipt of goods for the period;

- P - sales of goods for the period;

- B - other disposal of goods for the period (shortages, damage, markdowns, etc.);

- ZK - balance of goods at the end of the period. Thus, the commodity balance of a trading organization shows the relationship between the balances of goods at the beginning and end of the period, receipts, sales and other disposals of goods.

Also, along with the receipt of goods for the period, identified surpluses can be shown separately.

In addition to retail trade organizations, the commodity balance can be used, in particular, in the sphere of turnover of petroleum products and gas, coal processing (clause 6.5 of the Rules, approved by the Ministry of Fuel and Energy of Russia on August 17, 1995, section 12 of the Instructions for the accounting of petroleum products on main petroleum product pipelines (RD 153- 39-011-97), approved by the Ministry of Fuel and Energy of Russia on January 23, 1997, clause 4.8 of Methodological Recommendations RD 153-39.0-071-01, approved by Order of the Ministry of Energy of Russia dated 04.04.2001 N 100 (hereinafter referred to as RD 153-39.0-071- 01), paragraphs 26.3, 27 Instructions for determining and rationing losses of coal (shale) during processing (RD 03-306-99), approved by Resolution of the State Mining and Technical Supervision of Russia dated 08/11/1999 N 62).

Also, drawing up a commodity balance may be appropriate for other organizations. Thus, the commodity balance of a production organization can demonstrate the relationship between the balances of finished products at the beginning and end of the period, manufactured products, surpluses, other product losses and sold products.

The universal form of commodity balance is not approved at the legislative level, but examples of commodity balance forms are found in the above documents, in particular in RD 153-39.0-071-01. In this regard, each organization can independently develop a form of commodity balance that is convenient for itself and, if necessary, consolidate it at the level of internal documents.

The product balance can be compiled using various groupings, for example: organization, supplier, item, item property, time period.

In economic analysis, you can find models built on the basis of the commodity balance.

A commodity balance can be compiled for the following purposes, in particular:

- analysis of the volumes of received goods (products produced), the volumes of their sales and the availability of remaining goods (finished products) at the beginning and end of the period;

- assessing the implementation of planned indicators and deviations from them;

- identifying losses or surpluses of goods (products);

- identifying measures to improve internal processes in the organization.

We also note that the analysis and reconstruction of an organization’s commodity balance can be carried out by tax authorities as part of tax control measures (Letter of the Federal Tax Service of Russia dated October 31, 2017 N ED-4-9 / [email protected] ).

V.V. Gryazeva Listik and Partners LLC

What has changed in the presentation of the balance sheet?

In connection with changes in the Federal Law “On Accounting”, from January 1, 2022, the “one window” principle was introduced: accounting reports are no longer submitted to Rosstat. The second important change is that tax authorities accept accounting reports only in electronic form through electronic document management operators. All reporting is prepared only in thousands of rubles. On the first page they indicate whether the statements are subject to mandatory audit, and the name of the audit organization that conducted the audit of the statements.

Task No. 6 Using the balance method, create a product balance

| Random page | VOLUME-1 | VOLUME-2 | VOLUME-3 Architecture | Biology | Geography | Other | Foreign languages |

| Computer science | Story | Culture | Literature | Mathematics |

| Medicine | Mechanics | Education | Occupational Safety and Health | Pedagogy |

| Policy | Right | Programming | Psychology | Religion |

| Sociology | Sport | Construction | Physics | Philosophy |

| Finance | Chemistry | Ecology | Economy | Electronics |

Types of communication. | Indicators by the nature of their connection. Establish the type of connection between the resultant and factor indicators, create a calculation formula taking into account the sequence of factor indicators. | Task No. 3 Indicate the type of dependence of the following indicators (in this case, highlight factor and performance indicators). | Group the identified reserves of marketable products by type of resources used (a simple moment of the labor process). Determine the amount of the complex reserve. |

How to draw up a balance sheet: filling procedure

The new accounting forms look like tax returns. The forms have a cover page. On each sheet you need to put down your tax identification number, checkpoint and page number.

The balance sheet in its general form has six columns. The first is reserved for the number of explanations. If any indicator requires clarification, the number is indicated here, and the explanation is indicated in the detail sheet of individual balance sheet indicators. Small companies include in the balance sheet only indicators for groups of items (without detailing the items), and in the appendices to the balance sheet and financial statements they provide only the most important information, in the absence of which it is impossible to assess the financial position of the company or the financial results of its activities.

The second column contains the names of the indicators, and the third column contains the line codes. And the remaining columns should contain the following indicators:

- as of the reporting date;

- as of December 31 of the previous year;

- as of December 31 of the year preceding the previous one.

The balance sheet consists of two parts - assets and liabilities, which must be equal to each other. The asset reflects non-current and current assets, and the liability - the amount of equity capital and borrowed funds, as well as accounts payable.

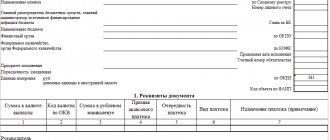

Title page

If the balance is primary, 0 is entered in the first cell in the “Adjustment number” field. In the updated balance, the adjustment number is entered in the field, for example, “1—”, “2—”, etc.

In the “Reporting period” field, code 34 is entered. This means that the balance sheet was compiled for the year. Next, indicate the full name of the company, OKVED, OKPO, OKOPF and OKFS codes and location address.

If the financial statements are subject to mandatory audit, indicate code 1 and then enter the name of the audit firm. Those who do not have to attach an auditor's report to the financial statements will enter code 0.

Indicate the number of pages in the accounting statements and documents attached to them. If the balance sheet and financial results report are submitted by the head of the organization, put 1 in the corresponding cell, and if a representative - 2. When submitting reports by the head, indicate his full name, signature and date. If the reporting is submitted by a representative, indicate his full name or name and details of the power of attorney.

Section I. Non-current assets

Intangible assets

The residual value of intangible assets is reflected on line 1110. To include an object in intangible assets, the following conditions must be met (clause 3 of PBU 14/2007):

- the object is capable of generating economic benefits in the future, and the organization has the right to receive them;

- the object can be separated or separated from other assets;

- the object is intended for use for a long time, that is, its useful life exceeds 12 months;

- it is possible to reliably determine the actual cost of the object;

- the object lacks a material form.

Intangible assets include exclusive rights to works of science, literature and art, programs for electronic computers, inventions, utility models, selection achievements, production secrets (know-how), trademarks and service marks.

Intangible assets do not include expenses associated with the formation of a legal entity, the intellectual and business qualities of the organization’s personnel, their qualifications and ability to work (clause 4 of PBU 14/2007).

Research and development results

Research and development expenses recorded on account 04 “Intangible assets” are reflected on line 1120.

Intangible and tangible search assets

These two indicators are given in lines numbered 1130 and 1140. They reflect information on the costs of developing natural resources (PBU 24/2011 from Order of the Ministry of Finance dated October 6, 2011 No. 125n).

Fixed assets

For depreciable objects, the residual value of fixed assets is recorded in line 1150. For non-depreciable property, the line indicates its original cost.

Objects must be owned by the organization or have the right of operational management or economic management. As part of fixed assets, the lessee can also indicate the property that is included on its balance sheet.

Real estate and land, the rights to which must be registered, are reflected in fixed assets from the moment the assets are received and put into operation. The cost of unfinished objects that the company builds independently is also reflected in line 1150 “Fixed assets” (clause 20 of PBU 4/99 from the order of the Ministry of Finance dated 07/06/1999 No. 43n) or in the sheet “Detailing of individual balance sheet indicators” is called deciphered line 1151 “ Construction in progress” and record these expenses in it.

Profitable investments in material assets

This data is indicated in line 1160. This is the residual value of the property intended for rent (leasing) and accounted for on account 03. If the company first used the property for production and management needs, but later leased it out, then the property must be reflected on a separate sub-account of account 01 as part of fixed assets.

Financial investments

For long-term financial investments, that is, with a circulation period of more than a year, line 1170 is allocated (for short-term ones - line 1240 of section II “Current assets”). Investments in subsidiaries, affiliates and other companies are also shown here. Financial investments are taken into account in the amount spent on their acquisition. The value of own shares purchased from shareholders for resale or cancellation, and interest-free loans issued to employees are not considered financial investments. Purchased own shares are reflected in line 1320 of the balance sheet liability. And interest-free loans to employees are included in assets as part of accounts receivable, namely: long-term loans - on line 1190, short-term loans - on line 1230.

Deferred tax assets

Line 1180 is filled in by income tax payers. Firms using the simplified tax system put dashes in it.

Other noncurrent assets

Line 1190 shows non-current assets that are not reflected in other lines of section I of the balance sheet asset.

Section II. Current assets

Reserves

The cost of inventories is reflected on line 1210. If necessary, decoding lines can be added in the “Detailing of individual balance sheet indicators” sheet.

Value added tax on purchased assets

Simplified people can fill out this line with code 1220 if, according to the accounting policy, they reflect the amounts of input VAT on account 19 “Value added tax on acquired assets.” Simplified workers are not VAT payers, so they can take into account input tax in the cost of goods, materials, work or services.

Accounts receivable

Line 1230 is intended for short-term receivables, that is, repayment of which is expected within 12 months after the reporting date. Financial investments (except for cash equivalents) For these assets, line 1240 is provided, which shows loans provided by the organization for a period of less than 12 months.

Cash and cash equivalents

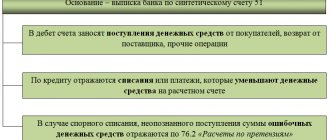

In line 1250, the cost of cash equivalents (the balance of the corresponding subaccounts of account 58) and the balances of the accounts in which funds are accounted for are summed up (50 “Cash”, 51 “Settlement accounts”, 52 “Currency accounts”, 55 “Special accounts in banks” and 57 “Translations on the way”). Cash equivalents include, for example, demand deposits opened with credit institutions (PBU 23/2011 from Order of the Ministry of Finance dated 02.02.2011 No. 11n).

Other current assets

Line 1260 indicates data on current assets that were not included in other lines of section II of the balance sheet asset.

Section III. Capital and reserves

Authorized capital (share capital, authorized capital, contributions of partners)

Line 1310 of the balance sheet reflects the amount of the authorized capital. It must coincide with the amount of the authorized capital, which is recorded in the constituent documents.

Own shares purchased from shareholders

If the company bought its own shares in the authorized capital not for sale, then their value is entered in line 1320. Such shares are supposed to be canceled, which automatically leads to a decrease in the authorized capital, therefore the line indicator as a negative value is given in parentheses. Shares that the company bought back and resold are considered an asset, and their value is included in line 1260 “Other current assets.”

Revaluation of non-current assets

Line 1340 shows the revaluation of fixed assets and intangible assets, which was taken into account in account 83 “Additional capital”.

Additional capital (without revaluation).

The amounts of additional capital are reflected in line 1350. The indicator for this line is taken without taking into account the revaluation amounts, which are reflected in the line above.

Reserve capital

The balance of the reserve fund is indicated on line 1360. This reflects both reserves formed as required by law and reserves created in accordance with the constituent documents. Decoding is required only if the indicators are significant.

Retained earnings (uncovered loss)

Retained earnings accumulated for all years, including the reporting one, are shown in line 1370. It also reflects the uncovered loss, the amount of which is enclosed in brackets

The components of the indicator for the reporting year and (or) for previous periods can be written down in additional lines, that is, a breakdown can be made based on the financial results obtained (profit/loss), as well as for all years of the company’s activity.

Section III “Targeted Financing” is filled out by non-profit companies instead of the “Capital and Reserves” section. Commercial companies put dashes in this section.

Section IV. long term duties

Borrowed funds

Line 1410 indicates the organization's debt for long-term (with a repayment period of more than 12 months) loans and credits (line 1510 is provided for short-term loans and credits).

Deferred tax liabilities

Line 1420 is filled in by income tax payers. Simplified people are not included in their number, so they put a dash.

Estimated liabilities

The specified line 1430 is filled out by companies that take into account estimated liabilities in accordance with PBU 8/2010 from Order of the Ministry of Finance dated December 13, 2010 No. 167n. Small firms may not apply this PBU.

Other obligations

Line 1450 indicates other long-term liabilities that were not reflected in other lines of Section IV of the balance sheet.

Section V. Current liabilities

Borrowed funds

Line 1510 indicates debt on short-term loans and borrowings taken out for a period of no more than 12 months. In this case, the amount should be reflected taking into account interest due at the end of the reporting period.

Accounts payable

The total amount of accounts payable is recorded in line 1520. This includes debts to employees for wages, to the budget for taxes, etc.

revenue of the future periods

Line 1530 is filled in when the accounting regulations provide for the recognition of this accounting object. For example, if a company receives budget funds or amounts of targeted financing. Such funds are taken into account as part of deferred income in accounts 98 “Deferred Income” and 86 “Targeted Financing” (clauses 9 and 20 of PBU 13/2000 from Order of the Ministry of Finance dated October 16, 2000 No. 92n).

Estimated liabilities

Line 1540 is filled out if the company recognizes estimated liabilities in its accounting. Only line 1430 reflects long-term liabilities, and line 1540 - short-term liabilities.

Other obligations

Line 1550 shows other short-term liabilities that were not reflected in other lines of Section V of the balance sheet.

After filling out the balance sheet, it is recommended to check the indicators using the following formulas (the debit and credit balances of the accounting accounts are designated Dt and Kt, respectively):

Line 1110 “Intangible assets” = Dt 04 (without R&D expenses) – Kt 05.

Line 1120 “Results of research and development” = Dt 04 (analytical account for accounting for R&D expenses).

Line 1130 “Intangible search assets” = Dt 08 (analytical account for accounting for expenses for intangible search costs).

Line 1140 “Material search assets” = Dt 08 (analytical account for accounting expenses for material search costs).

Line 1150 “Fixed assets” = Dt 01 – Kt 02 (analytical account for accounting for depreciation of fixed assets) + Dt 08 (analytical account for accounting for expenses for construction in progress).

Line 1160 “Profitable investments in material assets” = Dt 03 – Kt 02 (analytical account for accounting for depreciation of profitable investments).

Line 1170 “Financial investments” = Dt 58 + Dt 55 subaccount “Deposit accounts” + Dt 73 subaccount “Calculations for loans provided” (analytical accounts for accounting for long-term financial investments) – Kt 59 (analytical account for accounting for reserves for long-term financial investments).

Line 1180 “Deferred tax asset” = Dt 09.

Line 1190 “Other non-current assets” = the cost of non-current assets not taken into account in other indicators of Section I of the balance sheet.

Line 1100 “Total for Section I” = sum of indicators in lines 1110-1190.

Line 1210 “Inventories” = sum of debit balances of accounts 10, 11, 43.45, 20, 21, 23, 28, 29, 44 + Dt 41 – Kt 42 + Dt 15 + Dt 16 – Kt 16 – Kt 14 + Dt 97 (analytical expense account with a write-off period of less than 12 months).

Line 1220 “VAT on purchased assets” = Dt 19.

Line 1230 “Receivables” = Dt 62 + Dt 60 + Dt 68+ Dt 69 + Dt 70 + Dt 71 + Dt 73 (except interest-bearing loans) + Dt 75+ Dt 76 – Kt 63.

Line 1240 “Financial investments (except for cash equivalents)” = Dt 58 + Dt 55 subaccount “Deposit accounts” + Dt 73 subaccount “Settlements for loans granted” (analytical accounts for accounting for short-term financial investments) – Kt 59 (analytical account for accounting for reserves for short-term financial investments).

Line 1250 “Cash and cash equivalents” = Dt 50 + Dt 51 + Dt 52 + Dt 55 + Dt 57 – Dt 55 subaccount “Deposit accounts” (analytical accounts for accounting for financial investments).

Line 1260 “Other current assets” = the cost of current assets not included in other indicators in Section II of the balance sheet.

Line 1200 “Total for Section II” = sum of indicators in lines 1210-1260.

Line 1600 “Balance” = line indicator 1100 + line indicator 1200. The indicator from this line must match the balance line indicator 1700.

Line 1310 “Authorized capital” = Kt 80.

Line 1320 “Own shares purchased from shareholders” = Dt 81.

Line 1340 “Revaluation of non-current assets” = Kt 83 (analytical account for accounting for the amounts of revaluation of fixed assets and intangible assets).

Line 1350 “Additional capital (without revaluation)” = Kt 83 (except for the amounts of revaluation of fixed assets and intangible assets).

Line 1360 “Reserve capital” = Kt 82.

Line 1370 “Retained earnings (uncovered loss)” = Kt 84 (Dt 84). With a debit balance, the indicator is negative. It denotes the loss that the company has received.

Line 1300 “Total for Section III” = sum of indicators in lines 1310-1370. If the result is negative (if there are negative indicators on lines 1320 and 1370), it is shown in parentheses.

Line 1410 “Borrowed funds” = Kt 67. In this case, accrued interest, the repayment period of which as of the reporting date is less than 12 months, should be excluded and reflected on line 1510 (preferably with an explanation).

Line 1420 “Deferred tax liabilities” = Kt 77.

Line 1430 “Estimated liabilities” = Kt 96 (only estimated liabilities with a maturity period of more than 12 months after the reporting date).

Line 1450 “Other liabilities” = long-term debt that is not included in other indicators in Section IV of the balance sheet.

Line 1400 “Total for Section IV” = sum of indicators in lines 1410-1450.

Line 1510 “Borrowed funds” = Kt 66 + Kt 67 (in terms of accrued interest, the repayment period of which as of the reporting date is no more than 12 months).

Line 1520 “Accounts payable” = Kt 60 + Kt 62 + Kt 76 + Kt 68 + Kt 69 + Kt 70 + Kt 71 + Kt 73 + Kt 75. In this case, only short-term debt is taken into account.

Line 1530 “Deferred income” = Kt 98 + Kt 86 in terms of targeted budget financing, grants, technical assistance, etc.

Line 1540 “Estimated liabilities” = Kt 96 (only estimated liabilities with a maturity date of no more than 12 months after the reporting date).

Line 1550 “Other liabilities” = amounts of debt on short-term liabilities not taken into account when determining other indicators of section V of the balance sheet.

Line 1500 “Total for Section V” = sum of indicators in lines 1510-1550.

Line 1700 “Balance” = sum of line indicators 1300 + 1400 +1500.

If all transactions are reflected correctly and correctly transferred to the balance sheet, the indicators of lines 1600 and 1700 will coincide. If they do not match, it means there was an error somewhere. The data needs to be checked and recalculated.

What determines the procedure for compiling a report?

The procedure for drawing up a product report is influenced by the form of its form - unified TORG-29 or developed by the organization.

For a self-developed form, you need to describe the filling procedure. This is especially important when the form differs significantly from the standard form of a commodity report: new columns, tables, indicators, etc. have been added.

If an organization uses TORG-29, it can use the following filling rules:

The cost indicators reflected in the report reveal the structure of the commodity balance:

Balance of goods at the beginning + Receipt = Expense + Balance of goods at the end.

The commodity report must be received by the accounting department within the period established by the document flow schedule. We will tell you further how they work with a product report in accounting.

How to fill out a balance sheet using a simplified form

First, fill out the title page. It is the same as in regular reporting, but there are no fields for information about mandatory audit.

A simplified balance sheet will have six columns. The first is reserved for the number of explanations. The second column contains the names of the indicators, and the third column contains the line code. The remaining columns provide aggregated indicators:

- as of the reporting date;

- as of December 31 of the previous year;

- as of December 31 of the year preceding the previous one.

A simplified balance sheet also consists of an asset and a liability. Section totals are calculated in lines with codes 1600 and 1700. These lines must be equal. The codes for the remaining lines indicate the indicator that has the largest share in the aggregated indicator. For example, the line “Tangible non-current assets” includes fixed assets, as well as unfinished capital investments in fixed assets.

The assets of the simplified balance sheet reflect the amount of non-current and current assets, and the liabilities - the amount of equity capital and borrowed funds, as well as accounts payable.

Submit your balance sheet in accordance with the new requirements through the Astral Report 5.0 service. A smart report editor will tell you how to fill out each field in the form - even if you are filling it out for the first time, you will not make mistakes.