Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

The division of an organization's property is a complex legal process, which is often accompanied by a number of contradictions and problems. The division occurs in accordance with the requirements of the legislation of the Russian Federation and depends on the circumstances that caused the division. The most common circumstances are:

- liquidation of the organization;

- withdrawal from the founders of the LLC;

- divorce of spouses.

Division of property of a legal entity upon its liquidation

Liquidation of a legal entity is the termination of the organization’s activities in accordance with the legislation of the Russian Federation. A mandatory element of liquidation is the formation of a liquidation balance sheet. It reflects non-current and current assets, capital and reserves of the enterprise, as well as its liabilities.

The division of the organization's property occurs with the participation of the liquidation commission. This helps resolve disputes and avoid conflicts between participants and obtain a reliable assessment of LLC property.

During the liquidation of a company, its property passes to the founders, that is, to individuals. This procedure must be organized in accordance with the established procedure for distributing the property of a liquidated company among its founders. The distribution order includes two stages, and stage 2 without stage 1 is impossible, that is, the actions are performed one by one:

- payment of retained earnings to the founders of the Company;

- distribution of the Company's property between participants according to the size of the founders' shares in the authorized capital.

The division of the property of an enterprise upon liquidation is carried out in kind or in cash . When dividing in kind, property is distributed among the founders, taking into account the size of their shares in the authorized capital. In the cash form, the property of the company is first sold, then the proceeds are distributed among the founders in proportion to their shares in the authorized capital.

Liquidation of a commercial organization is a direct basis for a tax audit . According to statistics, most enterprises are not ready for this, so companies most often cease their business activities through reorganization. In this case, the distribution of the company's property according to the algorithm described above is impossible.

How to register the transfer of real estate to the founder if the legal entity is excluded from the Unified State Register of Legal Entities?

G.S. Akimova, author of the answer, legal consultant at Askon

QUESTION

The legal entity was liquidated on the basis of Article 21.1 of the Law on State Registration. At the time of making a record of its termination, the liquidated person had a registered right of ownership of real estate (non-residential premises). How to register the transfer of real estate to the founder of an organization?

ANSWER

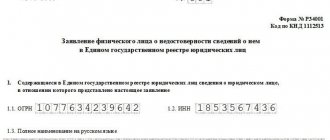

If a legal entity is excluded from the Unified State Register of Legal Entities,

and at the same time such a legal entity still has property, including real estate, it is possible to formalize the transfer of this property to the founder in court - by submitting an application to appoint a procedure for distributing the discovered property among persons entitled to it.

JUSTIFICATION

In accordance with Part 5.2. Article 64 of the Civil Code of the Russian Federation, in the event of discovery of the property of a liquidated legal entity excluded from the unified state register of legal entities, including as a result of declaring such a legal entity insolvent (bankrupt), an interested person or an authorized state body has the right to apply to the court to appoint a procedure distribution of discovered property among persons entitled to it. In this case, the court appoints an arbitration manager who is entrusted with the responsibility of distributing the discovered property of the liquidated legal entity.

An application for the appointment of a procedure for the distribution of discovered property of a liquidated legal entity may be submitted within five years from the date of entry into the unified state register of legal entities of information about the termination of the legal entity.

It should be noted that there is judicial practice on the recognition of ownership of discovered property, but all of it concerns money (Resolution of the AS ZSO dated 04/05/2018 N F04-3739/2017; Resolution of the Arbitration Court of the Central District dated 10/11/2016 N F10-4005/2016 on case No. A54-6664/2015). However, it was not possible to find similar judicial practice in real estate. In relation to real estate, on the contrary, judicial practice has developed with the refusal to satisfy demands for recognition of ownership rights (Resolution of the Arbitration Court of the North-Western District dated 04.04.2016 N F07-108/2016 in case N A56-17048/2015).

It is obvious that recognition of property rights must be preceded by a claim to establish a distribution procedure.

Thus, the thirteenth appellate arbitration court indicated: “ At the same time, the appellate court proceeds from the fact that the mere fact of exclusion of a legal entity from the Unified State Register of Legal Entities is not provided for by the Civil

Code of the Russian Federation or other laws as a basis for the emergence of the founders of a legal entity's ownership of what belonged to the excluded property to a legal entity.

from the provisions

of Article 63 of the Civil Code of the Russian Federation that participants in a company are automatically allocated the property of a given company excluded from the Unified State Register of Legal Entities.

At the same time, the plaintiff did not provide evidence of receipt of property as a result of any procedures related to the termination of the activities of a legal entity.

At the same time, the procedure for excluding an inactive legal entity from the Unified State Register of Legal Entities by decision of the registration authority is a special basis for the termination of a legal entity, not related to its liquidation.

In case of exclusion of an inactive legal entity from the Unified State Register of Legal Entities, the procedure established for the case of liquidation of a legal entity and aimed at identifying creditors and completing settlements with them does not apply.

Consequently, the satisfaction of the claim of the founder of the company for recognition of his ownership of the property owned by Snezhok LLC does not allow us to unequivocally state that the rights of other persons will not be violated. The procedure for distributing the discovered property of a liquidated legal entity is carried out according to the rules of the said Code on the Liquidation of Legal Entities .”

(Resolution of the Thirteenth Arbitration Court of Appeal dated 04/05/2018 No. 13AP-1412/2018 in case No. A56-68738/2017).

Division of property of a legal entity in case of withdrawal from the founders of the LLC

The division of the company's property when a participant leaves the founders takes place in accordance with the charter. The distribution occurs based on the established size of shares in the capital of the enterprise of each founder.

However, the actual and nominal value of shares may differ. With the actual value of the shares, this means the proportional value of the net assets, with the nominal value - only a part of the authorized capital of the Company.

When leaving the founders, the participant has grounds to receive the actual value of the share. Then the share is issued in the form of cash. It is also possible to receive property, but only with the consent of the remaining founders. Let us note that the material assets of the company do not belong to an individual participant, they are owned by all the founders, and it does not matter whether the contribution to the capital of the Company was made in the form of property or in cash.

If a participant disagrees with the actual value of the share, he has the right to file a claim with a judicial authority.

Property of a liquidated legal entity

Property after liquidation of a legal entity can also be distributed.

The general procedure for terminating activities and dividing property between participants (shareholders) of an organization is disclosed in Article 63 of the Civil Code of the Russian Federation. According to paragraph 1 of this article, the main body authorized to carry out liquidation is the liquidation commission. It is she who, by virtue of paragraph 4 of Article 62 and paragraph 1 of Article 63 of the Civil Code of the Russian Federation, manages the organization, takes measures to identify creditors and seeks ways to collect receivables.

However, the liquidation commission acts before an entry is made in the Unified State Register of Legal Entities about the liquidation of the company. But what to do if the company no longer exists, and an essentially absurd situation has arisen - there is property, but its owner is absent. More on this later.

In practice, there are situations when, after making an entry in the Unified State Register of Legal Entities, an organization may discover undistributed property that, for various reasons, was not included in the liquidation balance sheet. A similar situation may arise when a company is excluded from the Unified State Register of Legal Entities if it does not file reports on taxes and insurance contributions within 1 year, and also does not conduct banking transactions on its accounts, in accordance with the requirements of Articles 64.2 of the Civil Code of the Russian Federation, 21.1 of the Federal Law “On State ..." dated 08.08.2001 No. 129-FZ, or if the organization was liquidated due to bankruptcy.

The mechanism for the distribution of such property is established in clause 5.2 of Art. 64 Civil Code of the Russian Federation. It can be used by both creditors and participants of the liquidated company. An application for assignment of property distribution can be submitted within 5 years after the company is excluded from the Unified State Register of Legal Entities.

Important! Targeted payments and subsidies are not subject to distribution and are not included in the distributed property. Also, such property does not include things and property rights that have been terminated, for example, the right to lease under a contract that was not renewed in a timely manner.

You need to understand that the company will not be restored; this is not necessary for the distribution of property.

How does the procedure work?

After an application for appointment of distribution of the discovered property is submitted, an arbitration manager is appointed. The court does this. It is the arbitration manager who manages the distribution. The costs may be borne by the submitting creditor or a participant in the liquidated company.

The procedure itself follows the rules that are established for the liquidation of a company, but with certain specifics, because the property can be sold in order to then distribute the proceeds from its sale. The arbitration manager determines the list of creditors, the property is assessed to determine the market value, the assets are put up for auction, and the proceeds are distributed among the creditors in the order of priority, which is prescribed in Art. 64 of the Civil Code of the Russian Federation, in proportion to the size of the requirements.

If there are no creditors

If there are no creditors, then the property will be distributed among the participants of the liquidated company in proportions, according to shares or by virtue of an agreement between them. All disputes and issues of the distribution process are resolved by arbitration courts. Since there are no special distribution rules, the application is subject to consideration according to the general rules of claim proceedings.

How to distribute assets after liquidation of a business?

What is company property? First of all, we are talking about things, objects and money that are in one organization. Therefore, it is very important to know and be able to correctly distribute property immediately after the liquidation of a legal entity. Next we will also talk about how to pay taxes in such a situation.

What is the property of a liquidated company?

After the termination of the organization's activities, property remains; according to the law, it must be distributed among all participants. There is some procedure that allows shareholders to distribute assets. This is also enshrined in Art. 63 of the Civil Code of the Russian Federation. But here it is worth remembering that the liquidation commission is responsible for actions to liquidate the company. It is she who not only manages the processes at the time of liquidation, but also makes decisions on issues of closing debts with creditors. You can get acquainted with the information in more detail - clause 4 of Art. 62 and paragraph 1 of Art. 63 Civil Code of the Russian Federation.

The liquidation commission makes its decisions until the tax office makes an entry in the Unified State Register of Legal Entities about the liquidation of the legal entity. But different situations happen. For example, there is no physical or legal organization, but the property has not yet been distributed. At the same time, the owner himself is absent.

Even after making an entry in the federal information resource, the company may have undistributed assets. Such assets are usually not included in the liquidation balance sheet. If a company has not submitted documents on taxes and insurance within 360 days, it may be removed from the list of the federal information resource. This may also be due to the fact that the organization has not carried out financial transactions on its own accounts all this time. You can study the information - Art. 64.2 of the Civil Code of Russia, 21.1 of the Federal Law. This also includes the bankruptcy of a company.

Assets can be distributed not only among the participants of a closed company, but also among creditors. This is stated in clause 5.2 of Art. 64 Civil Code of Russia. Within 5 years after the removal of an enterprise from the federal information resource, an application for the distribution of a specific asset can be submitted.

But it is worth remembering that the distributed asset does not include payments from government bodies and property rights. In this case, we can give an example of renting under an invalid contract.

The company will not recover, so there is no need to distribute assets.

Asset distribution phasing

The company, represented by the commission, must submit to the department a document appointing the distribution of existing property. If everything is done correctly, an arbitration manager is appointed. The appointment takes place through the court. After this, all processes are managed by this manager. All costs are borne by either the creditor or the liquidation commission of the organization.

It is worth remembering that the stages of asset distribution take place strictly according to legal conditions. During the distribution of the company's assets, the assets can be sold, and then the income can be distributed among private owners. The responsibilities of the arbitration manager also include compiling a list of counterparties and an independent assessment of assets. This is the only way to subsequently determine the value of the property and list the assets on the trading platform. Proceeds from the sale are distributed evenly among all counterparties. You can view information on this topic in Art. 64 Civil Code of the Russian Federation.

Asset distribution without creditors

The managers of a liquidated enterprise can count on a proportional distribution of assets if there are no creditors. During the distribution, disputes and conflicts may arise. In this case, everything is resolved through an arbitration court. The claim is considered by the judge in accordance with the claim proceedings, based on general provisions.

Arbitrage practice

The counterparty can count on the distribution of assets through the courts for 5 years. This norm is spelled out in clause 5.2 of Article 64 of the Civil Code of Russia. In this case, assets can be both movable and immovable.

But here it is worth remembering that the court ruling is related to the absence of the defendant. Although this factor is unlikely to affect the overall consideration of office work. The judicial system in any case adheres to the general rules of procedure.

If the judge made a positive decision in the case in accordance with clause 5.2 of Article 64 of the Civil Code of Russia, then it is necessary to approve an arbitration manager, who in the future will deal with the distribution of the assets of the liquidated enterprise. The manager must adhere to the legal order and take into account the asset allocation process carried out previously. This is stated in paragraph. 3 clause 5.2 art. 64 Civil Code of Russia.

Comparison of the distribution of assets of a firm and a PJSC upon termination of operations

Depending on what form of management the company has, the order of actions is determined. Information can be found in paragraph 8 of Article 63 of the Civil Code of the Russian Federation.

Procedure for the company

Any company has the right to begin the process of asset distribution only after it has settled all matters with creditors. That is, it will pay off debts. This is stated in paragraph 1 of Art. 58 Federal Law No. 14. Only after this is it possible to count on the division of property between management. Asset Allocation Process:

- Distribution of profits among the company's management. This also applies to profits that have not yet been paid.

- Shared division of property between all participants.

But before distributing property, participants must pay off all debts and pay off all creditors. Also in paragraph 2 of Art. 58 Federal Law No. 14 states that participants must fully repay debts on unpaid profits. This can be done using money or other property of the liquidated company. After this, you can move on to the next stage if there is property. Proportional sharing of property is possible if the company does not have enough assets to calculate profit. The managers of the liquidated company can rely on undistributed assets after the payment of profits under the transfer deed. However, the document must be confirmed by the liquidation commission and everyone involved in the case.

Please note that calculations must be made before the company is included in the federal information resource. This is indicated in paragraph 9 of Art. 63 of the Civil Code of Russia. After all, it was from this time that the enterprise was liquidated. This means that the commission loses its rights to the further process of asset distribution.

Stages for PJSC

There are certain differences in the distribution of PJSC assets. First of all, you need to read Art. 23 Federal Law No. 208. In this case, the phasing of asset distribution occurs in three stages:

- The company must make payments on all available shares. These actions are prescribed in clause 1.1 of Art. 75 Fed. Law No. 2022.

- A PJSC must pay dividends on shares. This is noted in Art. 32 Fed. Law No. 208. Based on legal principle, shareholders do not have the right to participate in the liquidation of a PJSC, but can count on legal dividends.

- Shareholders must divide the remaining property among themselves.

The remaining assets are distributed only after the basic portion has been paid to shareholders. This is enshrined in paragraph 2 of Art. 23 Fed. Law No. 208.

Funds can be paid in non-cash form in accordance with clause 8 of Art. 42 Fed. Law No. 208. Also, property can be put up for auction; this issue is dealt with by an appointed commission (Clause 8 of Article 63 of the Civil Code of the Russian Federation). This way you can avoid problems in the future. It can also be noted that the process of property distribution must be completed before the company is included in the federal information resource. This note is in Art. 24 of Federal Law No. 208.

As a result, I would like to say that the distribution of assets should occur in accordance with Russian legislation.

Using legal methods, you can even resolve the issue of undistributed assets. Judicial practice shows a positive outcome of cases. all articles

Distribution of property upon liquidation of LLC and PJSC (comparative analysis)

The procedure for dividing the remaining property is determined by the organizational and legal form of the company (LLC, JSC, etc.) taking into account the provisions of paragraph 8 of Article 63 of the Civil Code of the Russian Federation and relevant Federal Laws (for example, “On Companies...” dated 02/08/1998 No. 14-FZ, “ About joint stock..." dated December 26, 1995 No. 208-FZ). As an example, consider this issue in relation to LLCs and PJSCs.

Distribution procedure for LLC

According to paragraph 1 of Article 58 of Federal Law No. 14, LLC has the right to begin distribution of property only after final settlement with creditors. After this condition is met, the property is subject to division between the participants, which involves 2 stages:

- Transfer of profits that have already been distributed but not yet paid.

- Division of the remaining property according to the shares of participants in the authorized capital of the company.

Paragraph 2 of Article 58 of Federal Law No. 14 obliges participants to first fully repay the debt on unpaid profits (both from cash and from other property of the LLC) and only then proceed to the second stage of dividing the remaining property (if any). If it is not enough even to make a full calculation of the profit, then the actual property must be distributed among the participants in proportion to their shares.

If, after payment of profits, there is undistributed property left, it is subject to transfer to the participants on the basis of a transfer act, which is signed on the one hand by the head of the liquidation commission, on the other - by the LLC participant (or by all participants, if there are several of them).

It is important to remember that all calculations must be completed before the entry on the liquidation of the organization is made in the Unified State Register of Legal Entities, since by virtue of paragraph 9 of Article 63 of the Civil Code of the Russian Federation, it is from this moment that the organization is considered liquidated, after which the liquidation commission loses its authority to sign any documents.

Distribution of property after liquidation of a legal entity - judicial practice

An example of resolving a situation similar to those described above can be found in the decision of the Moscow Arbitration Court dated December 14, 2015 in case No. A40-160054/15, which indicates the need to apply in this case the rules of paragraph 5.2 of Article 64 of the Civil Code of the Russian Federation. According to the designated norm, an interested person (creditor, founder) has the right to apply to the court within 5 years with a request to appoint a procedure for the distribution of discovered property. In this case, we can talk about both actual movable or immovable things, and about the rights of claim of the liquidated organization to other entities.

The peculiarity of such cases, as can be seen from the indicated arbitration decision, is the absence of a defendant. However, this fact does not affect the general procedure for considering the case, which is resolved according to the general rules of litigation.

In case of a positive decision, the court, by virtue of clause 5.2 of Article 64 of the Civil Code of the Russian Federation, must approve the proposed arbitration manager or appoint one, since all actions for the distribution of discovered property are exclusively within its competence. In this case, the distribution itself must take place in the order in which the division of the organization’s property was carried out earlier, as is expressly stated in paragraph 3 of clause 5.2 of Article 64 of the Civil Code of the Russian Federation.