Interconnection of reporting forms

A properly drafted document contains interconnections between balance sheet indicators and other forms of reporting. These include a statement of income and expenses, capital, cash flow, as well as explanatory notes to the document.

Key relationships, that is, the correspondence between indicators of two documents, include the following links:

| Balance line | Corresponding Document Line |

| Financial report | |

| 1250 | 4500, 4450, 4400 |

| Statement of capital | |

| 1310 | 3100, 3300, 3310, 3320 |

| Financial results report | |

| 1370 at the end of the year | 2600 for the current year |

| Profit report | |

| 1370 | 2400 |

| 1180 | 2450 |

In the online service Astral Report 5.0 you will quickly prepare electronic reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and other departments. The platform provides a package of capabilities for setting up productive work, including accounting:

- convenient document flow and VAT reconciliation with counterparties;

- reminders about deadlines for submitting financial statements;

- access of several users to a single database and documents.

What to check if an asset is not equal to a liability?

- Timeliness and correctness of accounting transactions entered into registers. Even in one working day, a discrepancy of minutes can disrupt the routine.

- Indicating each transaction performed and entering all documentation; if at least one document is missing somewhere, the balance will not balance.

- Inventory is a mandatory annual procedure at the end of each reporting period, carried out in accordance with local regulations and established legislation. All manipulations in the inventory process, except for the actual carrying out, must be recorded in the appropriate documents; perhaps this is where the error lies, check the inventory data.

- Having found any mistake, hiding it means dooming yourself to a balance that does not converge at the end of the year. All errors should be recorded in accounting, in accordance with routine procedures and legal norms.

- Closing the accounting accounts as of December 31 is called the reformation of the balance sheet - this is the final stage of its preparation, carried out upon completion of all operations of the company’s business activities for the reporting period.

It is in the last point that discrepancies most often lie when reconciling the balance, which means it is worth understanding it in more detail.

How to check your balance sheet

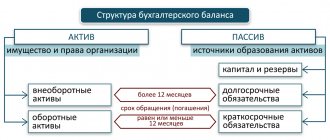

A balance sheet is a document that reflects information about the movement of property, the state of accounts, relationships with counterparties and, in general, the results of the financial and economic activities of the organization.

The correctness of the document and comparison of its indicators with other forms of reporting are extremely important. A deviation in the information line by 10% or more from the real figure entails liability and a fine under Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, and will also make it difficult for the company to obtain a positive opinion from the auditor.

In this article we will look at how to check the balance sheet and link its indicators with data from other types of reporting.