How can a taxpayer calculate the share of VAT deductions?

To avoid falling under the control of inspectors, make sure that the share of deductions in the VAT return does not exceed the maximum amount.

For each region, the fiscal service calculates a safe VAT tax deduction on a quarterly basis. This information is published in open sources - on government websites. If a taxpayer’s safe deductions for VAT in 2022 when declaring exceeded the maximum deduction for VAT 2021 established by the fiscal authorities, then you should prepare for a call to a commission or an audit.

To avoid this, calculate the percentage of VAT deductions yourself in 2022 (in each quarter) and compare with the maximum share of VAT deductions established by the fiscal authorities in 2022 in your region. How to calculate the safe percentage of VAT deductions?

To determine a safe VAT deduction in 2020-2021, take data from declarations for the last four quarters. Sum up the total values of accrued VAT and deductions from all declarations. How to calculate the share of VAT deductions further? Divide the total value of deductions by the amount of the entire accrued tax and multiply by 100%.

What is the tax burden

This term refers to the share of revenue that, on average, accounts for the payment of taxes and mandatory contributions to the budget. Based on the size of this share, banks and the Federal Tax Service determine whether your business shows signs of tax evasion and money laundering.

The so-called safe share is considered depending on the goals. If you want to find out whether the bank will have any claims, you need to calculate the net interest. If you want to predict tax claims, calculate the coefficient using the Federal Tax Service formulas and compare them with the published values of average and safe coefficients.

If your tax burden is less than the provided safe values, banks and the tax office may consider the company unscrupulous. They will ask for documents confirming the legality of your financial transactions.

Formula for calculating the safe percentage of deductions

How to determine the share of VAT deductions - the formula will provide invaluable help. So, let's find out how to calculate the share of VAT deductions using the formula.

Formula for calculating the safe share of VAT deductions:

DVnds = (BB1 + BB2 + BB3 + BB4) / (Nnds1 + Nnds2 + Nnds3 + Nnds4) × 100%,

Where:

DVNDs - the share of VAT deduction in the 1st quarter of 2022 (for example, let’s take the tax period - 2nd quarter of 2022);

BB1, BB2, BB3, BB4 - tax deduction for VAT in 2022 for the 1st quarter, in 2020 - for the 2nd, 3rd and 4th quarters;

Nnds1, Nnds2, Nnds3, Nnds4 - accrued VAT for the 1st quarter of 2021, for the 2nd, 3rd and 4th quarters of 2022.

When it’s time to submit a declaration for the following periods, how to calculate the safe share of VAT deductions using this formula? Example - how to calculate the share of VAT deduction in the 3rd quarter of 2022? Take the total values of deductions and accrued tax from the declarations for the first two quarters of 2021 and the last two quarters of 2020.

Before calculating the safe VAT deduction in the declaration for 2021, in addition to the data from the declarations for three quarters of this year, take also the values from the annual declaration for 2022.

If the share of deductions is exceeded

If the company’s figure is higher, you need to be prepared for the inspection to ask for clarification. They can be like this:

- you purchased a large volume of goods, sales of which will be in the next quarter;

- you purchased expensive production equipment;

- your customer refused to purchase a large batch of products when the necessary components for its production had already been purchased, etc.

All such circumstances must be described and documented. This can have a positive impact on the inspector's decision.

In addition, do not forget that in some cases it is possible to transfer VAT deductions to subsequent periods. That is, if necessary and if possible, you can regulate the amounts by which you reduce the VAT accrued for payment to the budget. To prevent exceeding “safe” indicators.

Let us remind you that tax authorities analyze the value of the share of deductions for a company for at least 12 months, and not for one quarter.

Share of safe deductions by region

VAT deduction coefficients in 2022 for the 4th quarter by region:

| Region | 4th quarter 2022,% |

| Belgorod region | 92,00 |

| Bryansk region | 93,80 |

| Vladimir region | 84,90 |

| Voronezh region | 92,90 |

| Ivanovo region | 91,30 |

| Kaluga region | 87,30 |

| Kostroma region | 85,20 |

| Kursk region | 93,5 |

| Lipetsk region | 104,20 |

| Moscow region | 88,50 |

| Oryol Region | 91,6 |

| Ryazan Oblast | 82,00 |

| Smolensk region | 92,80 |

| Tambov Region | 94,90 |

| Tver region | 88,70 |

| Tula region | 95,80 |

| Yaroslavl region | 86,70 |

| Moscow city | 88,90 |

| Republic of Karelia | 79,00 |

| Komi Republic | 78,40 |

| Arhangelsk region | 85,00 |

| Vologda Region | 98,70 |

| Kaliningrad region | 64,30 |

| Leningrad region | 88,40 |

| Murmansk region | 188,80 |

| Novgorod region | 96,60 |

| Pskov region | 89,70 |

| city of St. Petersburg | 87,90 |

| Nenets Autonomous Okrug | 149,20 |

| The Republic of Dagestan | 82,90 |

| The Republic of Ingushetia | 92,90 |

| Kabardino-Balkarian Republic | 90,70 |

| Karachay-Cherkess Republic | 90,10 |

| Republic of North Ossetia–Alania | 86,70 |

| Chechen Republic | 96,50 |

| Stavropol region | 90,00 |

| Republic of Adygea | 84,60 |

| Republic of Kalmykia | 79,50 |

| Republic of Crimea | 86,50 |

| Krasnodar region | 90,70 |

| Astrakhan region | 76,50 |

| Volgograd region | 91,60 |

| Rostov region | 92,70 |

| city of Sevastopol | 81,20 |

| Republic of Bashkortostan | 91,40 |

| Mari El Republic | 88,40 |

| The Republic of Mordovia | 89,10 |

| Republic of Tatarstan | 90,80 |

| Udmurt republic | 80,70 |

| Chuvash Republic | 83,60 |

| Kirov region | 88,30 |

| Nizhny Novgorod Region | 90,40 |

| Orenburg region | 74,30 |

| Penza region | 88,80 |

| Perm region | 86,90 |

| Samara Region | 84,00 |

| Saratov region | 84,60 |

| Ulyanovsk region | 88,50 |

| Kurgan region | 85,20 |

| Sverdlovsk region | 91,00 |

| Tyumen region | 84,60 |

| Chelyabinsk region | 90,00 |

| Khanty-Mansiysk Autonomous Okrug – Yugra | 67,00 |

| Yamalo-Nenets Autonomous Okrug | 72,40 |

| Altai Republic | 88,90 |

| Tyva Republic | 81,50 |

| The Republic of Khakassia | 87,00 |

| Altai region | 89,60 |

| Transbaikal region | 87,43 |

| Krasnoyarsk region | 76,50 |

| Irkutsk region | 78,40 |

| Kemerovo region | 94,10 |

| Novosibirsk region | 88,90 |

| Omsk region | 84,90 |

| Tomsk region | 80,60 |

| The Republic of Buryatia | 97,30 |

| The Republic of Sakha (Yakutia) | 94,40 |

| Primorsky Krai | 94,20 |

| Khabarovsk region | 90,40 |

| Amur region | 131,20 |

| Kamchatka Krai | 92,70 |

| Magadan Region | 103,00 |

| Sakhalin region | 95,00 |

| Jewish Autonomous Region | 82,70 |

| Chukotka Autonomous Okrug | 136,50 |

| Baikonur | 65,10 |

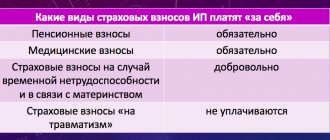

How to control your tax burden

When preparing scheduled audits, tax officials primarily include the following companies:

- working with negative profitability indicators;

- with a large share of deductions for personal income tax or VAT;

- with a reduced level of burden on basic contributions corresponding to the chosen taxation system;

- with tax debts;

- with reduced amounts of contributions to the budget compared to previous years;

- applying unjustified benefits for paying taxes.

All these factors lead to the fact that the fiscal service begins to doubt the “conscientiousness” of the enterprise and an official request is sent to the manager demanding an explanation for the discrepancies. If the answer is unclear or does not correspond to the real state of affairs, then verification cannot be avoided.

On the other hand, the analysis must also be carried out within the enterprise in order to timely detect problems with tax policy and identify its irrationality. In this case, it will be possible to carry out a number of measures that adjust the tax base while planning the tax burden. This can be done personally by the manager or chief accountant under the control of the business owner.

It will be necessary to carefully ensure that the tax burden is not less than 1% of the industry average. The coefficient may be higher than that specified by the Federal Tax Service, but this will mean that the company is overpaying taxes. To plan the burden of contributions to the budget, you need to:

- check the current required level of tax burden;

- plan the load for each type of tax and for the enterprise as a whole;

- determine the methods by which the intended result can be achieved;

- monitor the completion of the task and periodically make calculations independently.

- A timely change in tax policy will allow you to avoid an on-site audit by tax authorities.

Is there an average safe percentage of VAT deductions?

When selecting taxpayers for commission consideration, tax officials pay attention to those with a low tax burden. According to the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722, one of the signs of a suspiciously low tax burden is a value above 89%, defined as the safe limit for VAT deductions.

However, by letter of the Ministry of Finance dated March 21, 2017 No. ED-4-15/5183, the above-mentioned fiscal order was canceled. But tax authorities can use a formula to check whether your share of VAT deductions exceeds the safety percentage of 89. If so, then they will more carefully look for other signs of tax minimization.

To reduce all risks, before submitting a return, the taxpayer should both calculate the safe VAT deduction and compare it with the regional limit and 89%.

How to calculate the tax burden

First of all, you need to understand what exactly to take for calculation. According to the latest instructions from tax authorities:

- revenue is taken without excise duties and VAT;

- insurance premiums are excluded from the calculation;

- income is taken from line 2110 of the annual income statement;

- The amount of taxes includes the personal income tax paid.

The tax burden coefficient is calculated using the formula:

Tax burden = Amount of taxes paid / Income * 100.

Calculation example

From the tax return of the machine-building enterprise it follows that the company paid taxes in the amount of 850,000 rubles last year. At the same time, insurance premiums amounted to 330,000 rubles. The company's revenue is 9.5 million rubles. (without VAT). Let's calculate the existing tax burden:

850 000 / 9 500 000 * 100 = 8,94.

The burden of insurance premiums is equal to:

330 000 / 9 500 000 * 100 = 3,47.

Now we need to compare the obtained values with industry averages. For mechanical engineering, the total burden is 9.9, and for insurance premiums – 4.4. We can summarize that this company pays less taxes than the average company in this industry. Therefore, the business is under the close attention of the fiscal authorities - the enterprise may be included in the plan of on-site tax audits or an explanation from the Federal Tax Service will be required.

Calculation of tax burden for VAT

In the algorithm below for calculating the tax burden for VAT, we provide links to the declaration lines in relation to the current form, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

The algorithm for calculating the tax burden for VAT is based on the use of the following indicators from the VAT return.

1. BV – tax base for the domestic market – the sum of lines 010, 020, 030, 040, 050, 060, 070, column 3 of section 3.

2. BE – tax base for transactions with a rate of 0% – the sum of lines 020 for all transaction codes in section 4.

3. NU – the amount of VAT payable to the budget – the amount on line 040 of section 1.

The tax burden has two calculation formulas.

1. Regarding the tax base for the domestic market - as the ratio of the amount of tax accrued for payment to the budget to the tax base for the domestic market (in percentage).

The calculation formula in the above symbols:

NU/BV × 100.

2. Regarding the total tax base for transactions with a rate of 0% and in the domestic market - as the ratio of the amount of tax accrued for payment to the budget to the tax base calculated as the sum of the tax bases for transactions with a rate of 0% and in the domestic market (in percent ).

The calculation formula in the above symbols:

NU / (BE+BV) × 100.

Accordingly, if the indicator on line 040 of section 1 of the VAT return (the amount of tax payable to the budget) is missing, then the VAT tax burden indicator will be equal to 0.

The tax burden can be calculated either for one tax period or for a period of time covering several tax periods (usually a year). In the latter case, the relevant data on tax returns are summarized.