From our article you will learn:

In case of failure to submit or untimely submission of reports to the Pension Fund of the Russian Federation, fines are imposed on the employer as administrative measures. In particular, this applies to such reporting forms as SZV-M, SZV-STAZH and SZV-TD.

In the article, we will understand how fines are assigned, in which case the violator faces trial, and we will also find out how much late payment is fined and what responsibility is imposed on the employer for the incorrect form of reporting documents.

Penalty in the Pension Fund for a payment order sample for filling out a payment order 2020

In the established form RSV-1, in addition to the total amounts of transferred contributions to extra-budgetary funds, personal information is also indicated for each individual , exclusively those in whose favor the policyholders made appropriate payments and other monetary rewards (including contributions according to which experience is determined).

- “Ishd” – the original (original) form. Indicated upon initial reporting.

- “extra” is an additional form. It should be provided if necessary to supplement the initial report (for example, not all information is provided about the insured person).

- “cancel” is a form of cancellation (cancelling). A type of report that serves as a cancellation of previously submitted information about insured persons to the Federal Tax Service.

AutoJurist legal assistance

Menu Attention. This site is not an official source of information. When printing and paying a receipt, check that the details from official sources are filled out correctly.

Recipient of the payment: UFK for the Moscow region (GU - Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region.

) INN: 7703363868 KPP: 770301001 Account number: 40101810845250010102 in the bank: State Bank of Russia for the Central Federal District BIC: 044525000 KBK: 39211620010066000140 OKTMO: 46656101 Fine for failure to comply timely submission of the report SZV-M reg. No. 060-051-014447 PFR branch for the city.

Notice Payee: INN: KPP: Recipient's bank: account: BIC: corr/s: KBK: OKTMOOOKATO: Abbreviated name of the authority: Payer: Full name: Address: INN: Name of payment: Amount: Payer: (signature) Cashier On this page You can fill out and print the Receipt and payment details Fine for late submission of the report SZV-M reg. No. 060-051-014447 to the Pension Fund Branch for Moscow and the Moscow region Monetary penalties (fines) for violating the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) Municipalities of the Moscow Region Chekhov Municipal District Chekhov City using the form proposed above.

Payment order fine PFR 2022 sample filling

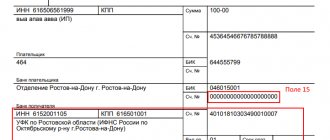

Explanation of the fields of the payment order for payment of contributions Next, we provide a description of the main fields of the payment order that must be filled out in order to transfer insurance premiums in 2022.

Field Filling Status of the payer, field 101 Payer of insurance premiums - “01” INN of the payer, field 60 INN of the organization KPP of the payer, field 102 KPP of the organization, separate division or real estate depending on the place of payment of contributions Payer, field 8 name of the organization or “separate” TIN and KPP of the recipient, fields 61 and 103 TIN and KPP of the Federal Tax Service, to which you submit the reports.

- 1 Introductory information: types of insurance premiums in 2022

- 2 Deadlines for payment of insurance premiums in 2022: dates

- 3 Explanation of the fields of the payment slip for payment of contributions

- 4 Where to send payments (recipient)

- 5 Codes for payer status in 2022

- 6 BCC for insurance premiums for 2022

- 7 Example of a payment order for contributions to compulsory pension insurance

- 8 Example of a payment order for contributions to compulsory social insurance

- 9 Example of a payment order for contributions to compulsory health insurance

- 10 Example of a payment order for contributions to “injuries”

How to fill out a payment order for fines (nuances)

- The “Purpose of payment” detail must contain the following information: type of payment and its basis.

- Details “Payment order” — 5.

- Props 101:

- when paying fines for yourself: 01 - for legal entities, 09 - for individual entrepreneurs;

- for payments made as a tax agent: 02.

- In detail 105, OKTMO is filled in - the code of the territory of the municipality where funds from paying fines are collected.

- Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, the letters TR are used (which means a requirement when the tax office issued this document under Article 69, 101.3 of the Tax Code of the Russian Federation).

- Props 107 (tax period) has a value of 0.

- Detail 108 indicates the requirement number; the symbol No. does not need to be inserted.

- Indicator 109 contains the date of the document, the number of which is reflected in detail 108, in the format “DD.MM.YYYY”.

How to pay financial sanctions to the Pension Fund through Sberbank online

Let us also remind you that you cannot make mistakes in the reporting method. If the number of employees is 25 or more, the company must submit information about them strictly in electronic form. And if in such a situation the accountant submits a paper report, the company faces a fine of 1,000 rubles. Even if you met the reporting deadlines (Part 4, Article 17 of the Federal Law of 04/01/96 No. 27-FZ).

A fine for late registration is assessed in the amount of 5 thousand rubles if a period not exceeding 90 days has passed from the date of mandatory registration. If the missed period is longer, the amount of the penalty increases and will be 10 thousand rubles.

It often happens that the violator has lost the collection notice. But in any case you will have to pay. What to do in this case? To do this, it is enough to know the organization that imposed the penalty. Next, go to the bank and inform the operator that you need to pay a mandatory payment and name the recipient. Next, the visitor is given a form to fill out. After this, payment is made at the cash desk and the client is given a receipt.

On the same page, you can add the operation to the list of templates, and then the next time, if you need to pay a contribution to the Pension Fund, all clicks on the links and filling in the details will be done automatically. You only need to adjust the payment amount (if necessary) and confirm payment via SMS.

Any of us can receive a fine for an administrative offense. Although this is not a serious penalty, and the amount to be paid is usually small, it is better to pay the fine as quickly as possible, because otherwise, other difficulties may arise in the form of an increase in the amount or even arrest. Today there are several payment methods, so let’s look at how to pay an administrative fine online using the order number, and also what to do if you don’t have a receipt.

Sample of filling out a payment order for a fine SZV-M 2021

Since January 2022, after changes to the Tax Code of the Russian Federation, Chapter. 34 “Insurance premiums”. From now on, payers of pension insurance contributions are required to make payments to the Federal Tax Service at the place of registration.

We decided to study in detail the payment order to the Pension Fund of Russia 2022 and are now ready to tell everything about it. First of all, let us clarify that companies and individual entrepreneurs report in 2022 to the Pension Fund of the Russian Federation in the SZV-M form by the 15th day of the month following the reporting month.

For late submission of the report, the Pension Fund will impose a fine.

The Pension Fund recalled the details for payment of penalties by companies and entrepreneurs in Moscow and the Moscow region for failure to submit (late submission) of information in the SZV-M form.

The BCC for both Moscow and Moscow region employers is the same - 392 1 1600 140.

As for other details, employers registered in Moscow fill out the “penalty” payment form as follows: INN 7703363868, KPP 770301001; Recipient of the Federal Financial Inspectorate for Moscow (for the State Pension Fund Branch for the city of Moscow)

The original SZV-M was sent by the policyholder in compliance with the deadline, and the supplementary form was submitted to the fund at the initiative of the company in connection with the latter’s independent identification of errors in the previously submitted information.

In addition, the district court cited a letter from the Pension Fund of December 14, 2004 No. KA-09-25/13379, which indicated the possibility of not applying financial sanctions provided for in Part 3 of Art.

17 of Law No. 27-FZ, if the policyholder independently identified the error and provided reliable information on personalized accounting.

Notice Payee: INN: KPP: Recipient's bank: account: BIC: corr/s: KBK: OKTMO OKATO: Abbreviated name of the authority: Payer: Full name: Address: INN: Name of payment: Amount: Payer: (signature) Cashier On On this page you can fill out and print out the Receipt and payment details. The fine for late submission of the report SZV-M reg. No. 060-051-014447 to the Pension Fund Branch for the city UIN is a Unique Accrual Identifier. This identifier is represented as a code that consists of 20 or 25 digits.

Thus, the last dates for submitting reports in the SZV-M form in 2022 are February 15, March 15, April 17, May 15, June 15, July 17, August 15, September 15, October 16, November 15, December 15, 15 January 2022.

Please note: if the number of employees exceeds 25 people, reporting must be submitted electronically with an enhanced qualified electronic signature.

Where to pay the fine for SZV-M in 2022: sample payment order Companies have a question about paying the fine for SZV-M: it is not clear where to pay the fine sent by the fund, for example, for late submission of SZV-M - to the fund's KBK or tax

The main details for paying the SZV-M fine are KBK - 392 1 16 20010 06 6000 140, where 392 is the code of the payment administrator, which is the Pension Fund.

Code" must be set to 0. If this field is not filled in, the payment will not go through. Necessary terms Payment order indicates a special form of non-cash payments. It represents an order from the depositor to the bank to transfer a certain amount to the recipient’s account.

(changes approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2022

No. 65n) About the KBK assigned to the Federal Tax Service of Russia Letters of the Federal Tax Service of the Russian Federation dated February 3, 2022 No. ZN-4-1/ and dated February 10, 2022 No. ZN-4-1/ On the statuses of insurance premium payers in payment orders Appendix 1 to the Regulations approved Bank of Russia dated June 19, 2022 No. 383-P Payment order details Appendix 3 to the Regulations approved by the Bank of Russia dated June 19, 2022.

Read about the possibility of paying contributions by third parties. Let's take a closer look at the innovations in the key details of the payment order for the transfer of insurance premiums to the Federal Tax Service. At the beginning of 2021, when filling out a payment order for the transfer of insurance premiums, the status number became the subject of numerous disputes and disagreements between payers and the Federal Tax Service.

Many companies and entrepreneurs have already encountered the fact that if they are “late” for submitting their SZV-M report, they can receive a fine. And the fine is not small - 500 rubles per employee. How to correctly make a payment order to pay a fine?

How did you come up with this amount of 7,500 rubles? If for each employee the fine is 500 rubles, then when multiplied by the number of employees we get 7,500 rubles. In our example, the company employs 15 people.

Every month, the 15th is the deadline for making payment of contributions; on this date, payment documents must be completed and sent, and money must be transferred. For insurance contributions to the Pension Fund from cash receipts of enterprise employees within the framework established for 2022. limit (876 thousand

RUB) the tariff is 22%, and for payments above this limit - 10%.

In 2022, big changes came into force regarding payment orders; from now on, control over payment and submission of reports on contributions to the Pension Fund belongs to the tax service, which means sending documents and money is now also carried out to the Federal Tax Service (at the place of registration of the entrepreneur or at the location of the LLC and separate departments). Already from January 1, 2017. obligatory contributions (including those paid for periods ending before this day) must be transferred with the designation in the payment slip of the tax authorities. Calculations (incl.

The Fund may fine you for errors in the SZV-M if you submit incomplete or unreliable information. A fine is also possible for late submission of SZV-M in 2022 and incorrect format. Everything about fines and how to pay them is in this article.

Fixed CB for compulsory pension insurance (insurance part) from the income of an entrepreneur who has exceeded the limit of 300,000 rubles 182 1 02 02140 06 1200 160 Fixed CB for compulsory pension insurance (insurance part) 182 1 02 02140 06 1110 160 Fixed CB for compulsory pension insurance (accumulative part) 182 1 0200 160 Payment order form to the Pension Fund Download How to fill out a payment order

Let’s assume that the organization is late in submitting the SZV-M report for January 2022. It had to be submitted no later than February 15th. However, in fact, the report was submitted to the Pension Fund only on February 22. A total of 105 people are listed in the report.

Therefore, the fine for late submission of SZV-M in 2022 will be 52,500 rubles (500 × 105). Below in the table we present the amount of fines for late submission of SZV-M in 2022.

As an example, we give fines from 1 to 25 individuals in the report (inclusive).

Organizations and individual entrepreneurs making payments and other remuneration to individuals are required to submit a report in the SZV-M form to the territorial divisions of the Pension Fund of Russia. This obligation is enshrined in 2021 in paragraph 2.2 of Article 11 of the Federal Law of 01.04.

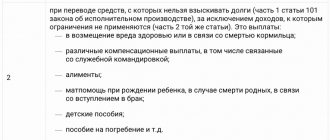

1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” The same law also provides for liability in the form of fines for late delivery of SZV-M.

Article 17 of the law states that failure by the policyholder to submit within the prescribed period or submission of incomplete and (or) false information will entail a fine of 500 rubles in relation to each insured person.

If there is an official decision on a fine, but you do not agree with it, you can challenge it in court. In particular, you can try to reduce the total size of the sanction. Although the legislation does not provide that the fine for late submission of SZV-M can be reduced due to mitigating circumstances. In principle, there is no mechanism for reducing the fine.

Now the fund practices the so-called mass impersonal mailing of letters with messages about a fine for SZV-M. Therefore, even a conscientious company that honestly submits all reports on time may accidentally receive such letters.

After all, there may not even be a sample as such. So, such letters are absolutely no reason to pay anything to the fund. If you are sure that you are right, then first of all contact representatives of your fund branch.

Perhaps, we repeat, the inspectors simply made a mistake, and you really don’t owe the state anything.

- Since January 2022, after changes to the Tax Code of the Russian Federation, Chapter. 34 “Insurance premiums”. From now on, payers of pension insurance contributions are required to make payments to the Federal Tax Service at the place of registration. We decided to study in detail the payment order to the Pension Fund 2021 and are now ready to tell everything about it. In Art. Article 17 of this law addresses issues of liability of both the Pension Fund itself and policyholders. In particular, para. 3 of this article provides for a fine for late delivery of SZV-M, which is imposed on the insured - a legal entity or individual entrepreneur:

- the period of delay is insignificant;

- the offense was committed for the first time;

- the report was not submitted on time due to illness or absence of the responsible employee, for example, the chief accountant was hospitalized;

- technical malfunctions and failures, for example, power outages, computer failure, software error.

Fines for violations in the field of personalized accounting are quite high. Usually a standard sanction is applied - 500 rubles for each person in the non-submitted report. Or 500 rubles for each employee whose information contains errors.

Payment fine to the Pension Fund for late submission of SZV-m in 2021 sample filling

If the deadline for submitting the monthly SZV_M is violated, then penalties on the Pension Fund of the Russian Federation cannot be avoided. You will have to pay a fine to the controllers. It is important to fill out the payment order correctly. If payment is not received by the fund, then controllers will apply additional penalties.

It is unacceptable to combine these amounts in one order. The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay.

Good night, dear forum members. For the first time, I was one day late in submitting my SZV-M report. The only thing that makes me happy is that I only have 3 employees. The pension fund sent a fine, but the letter does not contain details.

Tell me the new KBK for the fine for SZV-M.

And which OKTMO should be indicated: the company or the Pension Fund? What happens if there is an error in the budget classification code? How long does it take to pay the fine to the Pension Fund?

The purpose of the document is to provide personalized data about employees. The official submission deadline is set as the following date. If the deadline for submitting the SZV-M is violated, employers face sanctions.

What is the penalty provided for late submission in the year under SZV-M and is it possible to reduce the penalty? Let's look at the regulatory nuances. Both enterprises and entrepreneurs can be fined for late submission of a report.

The exception is individual entrepreneurs operating without hired personnel.

But it can be reduced many times. A clear position and justification will help you get more money back. Give as many arguments as possible and, if possible, provide evidence: confirmation of a failure from the provider, sick leave, etc.

In turn, the report on the RSV-1 form includes a title page and six sections: If we talk about the SZV-M reporting, then it is submitted with a mandatory indication of the type of form.

How did you come up with such a sum of rubles? If for each employee the fine is rubles, then when multiplied by the number of employees we get rubles. In our example, the company employs 15 people.

The protection of the rights of an enterprise is ensured by Section 3 of the Civil Code. Chapter 45 of the Bank Account can also be included here. The violating bank may be charged a penalty in the form of a penalty (Article 330 of the Civil Code of the Russian Federation). If you look from the other side, the bank employees can also be understood.

Since they report to regulatory authorities, one of which is the Central Bank. Even because of one lost explanatory note, the bank is liable and is obliged to pay a fine or eliminate the error on its own.

Current regulations Civil relations between business entities are regulated by relevant regulations.

- “Ishd” – the original (original) form. Indicated upon initial reporting.

- “extra” is an additional form. It should be provided if necessary to supplement the initial report (for example, not all information is provided about the insured person).

- “cancel” is a form of cancellation (cancelling).

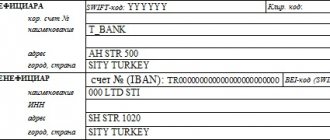

PFR details for paying a fine for SZV-M

Moscow and Moscow region); Recipient bank of the State Bank of Russia for the Central Federal District; BIC 044525000; Account 40101810045250010041.

And payers registered in the Moscow region are as follows: TIN 7703363868; Gearbox 770301001; Recipient of the Federal Financial Institution for the Moscow Region (for the State Branch of the Pension Fund for the city of Moscow)

Moscow and Moscow region); Recipient bank of the State Bank of Russia for the Central Federal District; BIC 044525000; Account 40101810845250010102.

Penalties for errors in reporting or late reporting are imposed by employees of the Pension Fund. Therefore, to pay penalties, it is necessary to use the Pension Fund details. They can be found both independently and in sent payment requests.

Budget Classification Codes (BCC) will vary depending on the law violated:

- 39211607090066000140

for payment under Federal Law No. 27 (late, errors in the SZV-M form, paper form instead of electronic); - 39211601151019000140

for payment under Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation (administrative penalties).

In connection with the transfer of control over the funds of insurance funds, except for contributions for injuries, to the Federal Tax Service from October 2, 2021, a specialist needs to pay attention to changes in payment codes for insurance premiums administered by the tax office. Step 12: Fill in the fields TIN, KPP, name, payment details, contribution amount. Step 13: Click “next”, “generate payment order”.

- 06 - this code is provided for participants in foreign economic activity - legal entities (except for the recipient of international mail).

- 03 - it is indicated in the payment order by the federal postal service organization when drawing up an order to transfer money for each payment by an individual (except for payment of customs duties);

- In detail 105, OKTMO is filled in - the code of the territory of the municipality where funds from paying fines are collected.

- Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, the letters TR are used (which means a requirement when the tax office issued this document under Article 69, 101.3 of the Tax Code of the Russian Federation).

- Props 107 (tax period) has a value of 0.

- Detail 108 indicates the requirement number; the symbol No. does not need to be inserted.

- Indicator 109 contains the date of the document, the number of which is reflected in detail 108, in the format “DD.MM.YYYY”.

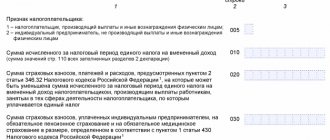

How to fill out a payment order for taxes and contributions in 2022

From January 1, 2022, the Federal Tax Service will switch to a system of treasury services for budget revenues. Therefore, in payments it will be necessary to indicate two accounts, as well as new BICs (Treasury Order No. 15n dated 04/01/2020).

The changes will affect four fields of the payment order:

- field 13 - the name of the recipient's bank has been specified;

- field 14 - the BIC of the recipient's bank has changed;

- field 15 - now indicates the account number of the recipient's bank, which is part of the single treasury account (STA), previously this field was filled with zeros;

- field 17 — treasury account number (TAN) has been added.

In Externa, tax payments are generated automatically.

Try it

We hasten to calm you down. The Federal Tax Service announced a transition period from January 1 to April 30, 2022, as it expects a large number of errors in payments. Until May 1, you can indicate old treasury accounts, but from May 1 - exclusively new ones. Otherwise, the payment will fall into the unknown.

Each region will have its own details - there are 85 of them in total. The Federal Tax Service provided information about the details in the table, which is given in the letter dated 10/08/2020 No. KCH-4-8 / [email protected] Here is some of them:

Subject of the Russian Federation Name of the recipient's bank BIC of the recipient's bank Account number of the recipient's bank Treasury account number field 13 field 14 field 15 field 17

| Moscow | GU BANK OF RUSSIA FOR THE Central Federal District//UFK FOR MOSCOW Moscow | 004525988 | 40102810545370000003 | 03100643000000017300 |

| Moscow region | GU BANK OF RUSSIA FOR THE Central Federal District//UFK FOR THE MOSCOW REGION, Moscow | 004525987 | 40102810845370000004 | 03100643000000014800 |

| Saint Petersburg | NORTH-WEST GUIDE OF BANK OF RUSSIA//UFK for St. Petersburg St. Petersburg | 014030106 | 40102810945370000005 | 03100643000000017200 |

| Leningrad region | LENINGRAD BRANCH OF THE BANK OF RUSSIA//UFK for the Leningrad region, St. Petersburg | 014106101 | 40102810745370000006 | 03100643000000014500 |

| Sverdlovsk region | URAL GUIDE OF THE BANK OF RUSSIA//UFK for the Sverdlovsk region, Ekaterinburg | 016577551 | 40102810645370000054 | 03100643000000016200 |

| Krasnodar region | SOUTHERN GUIDE OF BANK OF RUSSIA//UFK for the Krasnodar Territory, Krasnodar | 010349101 | 40102810945370000010 | 03100643000000011800 |

| Novosibirsk region | SIBERIAN GU BANK OF RUSSIA//UFK for the Novosibirsk region, Novosibirsk | 015004950 | 40102810445370000043 | 03100643000000015100 |

| Rostov region | ROSTOV-ON-DON BRANCH OF THE BANK OF RUSSIA//UFK for the Rostov region, Rostov-on-Don | 016015102 | 40102810845370000050 | 03100643000000015800 |

| Chelyabinsk region | CHELYABINSK BRANCH OF THE BANK OF RUSSIA//UFK for the Chelyabinsk region, Chelyabinsk | 017501500 | 40102810645370000062 | 03100643000000016900 |

New rules for filling out payment order fields

Amendments to the rules for processing payments for transfers to the budget were approved by Order of the Ministry of Finance of the Russian Federation dated September 14, 2020 No. 199N. The changes come into force on January 1, but some of them will take effect later.

Field 60 “TIN”

Foreign organizations and individuals will be able to indicate “0” in the “TIN of the payer” field if they are not registered with the tax office. An exception is payments administered by tax authorities. The amendment comes into force on January 1, 2022.

When deducting money from the income of an individual debtor to pay off the debt, indicate his TIN in the “TIN of the payer” field. You cannot enter an organization’s TIN from July 17, 2022.

If a payment order was drawn up by an individual without an account and intends to transfer money to the budget using it, the details must indicate the individual’s tax identification number or “0” if the number has not been assigned. It is prohibited to indicate the TIN of a credit institution. This rule is effective from October 1, 2022.

Field 101 “Taxpayer status”

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2022, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

Field 106 “Basis of payment”

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

Field 108 “Document number - grounds for payment”

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

Let's sum it up

- From August 2022, the Pension Fund of the Russian Federation will not be able to sue to collect a fine from the violator if the amount of the fine is less than 3,000 rubles. The fund will accumulate fines until it reaches this amount.

- The procedure for levying sanctions will remain the same. Violators will also continue to receive demands to pay fines.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up