At the end of November or beginning of December each year, car owners across the country receive notices about the need to pay vehicle tax. Legal entities and individual entrepreneurs independently calculate the amount to be transferred to the budget. And for individuals, the tax office makes the calculations. Inspectorate employees calculate the exact amount of transport tax based on the car model, year of manufacture, power and other conditions. However, not always all the necessary information is received by the Federal Tax Service on time. Therefore, errors are inevitable in some situations, and transport tax may need to be recalculated.

In what cases is transport tax recalculated?

- The car has been sold. Most likely, the data has not yet been received by the tax office, or has not reached the required department. You must inform the inspector about this and present the purchase/sale agreement.

- The car was stolen. In this case, the owner must provide a copy of the theft certificate received from the police. This can be done before the receipt for payment arrives. Then recalculation can be avoided.

- An individual owns several cars, but tax is assessed on only one.

- The tax was calculated incorrectly. The human factor is present in the tax office to the same extent as in other organizations. If, after receiving a receipt for payment of transport tax, you notice that the wrong brand of car or the wrong power is indicated in the calculations, you need to contact the tax office as soon as possible for recalculation.

- No benefit applied. In this case, you also need to write an application for recalculation, indicating the reason for the right to a benefit.

Application procedure

For individuals, paragraph 3 of Art. 363 of the Tax Code of the Russian Federation, which gives the right to recalculate tax only for three years preceding the date of notification of payment. For a period exceeding 3 previous years, recalculation is not performed. The notification for tax payment is delivered to the citizen no later than 30 days before the payment date.

When a citizen does not agree with the above calculation, he can:

- Personally contact the tax authorities, explaining to employees orally your disagreement and presenting the necessary documentation confirming the grounds for the objection.

- By mail, send a completed application to the Federal Tax Service, the form of which is usually attached to the notification.

Tax officers will check the documentation provided by the citizen. If the grounds for recalculation are confirmed, the Federal Tax Service will recalculate the amount of tax and send a new notice to the taxpayer.

If the notification from the Federal Tax Service on payment of transport tax has not been received by mail, you are obliged to independently notify the service that you have transport that is subject to taxation.

Recalculation is possible only on the basis of provided documents confirming the circumstances of the change in the amount, as well as the submitted application.

The form to fill out can be obtained from the nearest branch of the Federal Tax Service, at your place of residence or registration.

Application methods:

- in person by visiting a tax office;

- with the help of a representative, on the basis of a power of attorney;

- by post;

- in electronic form on the official tax website.

To submit an application online, you must register on the Federal Tax Service website and create a personal account or issue an electronic signature and confirm it. You can also download a sample application for recalculation of transport tax on the relevant websites and forums.

What to include in the application:

- Provide the taxpayer's personal information.

- Express a request to change the amount and recalculate it.

- Provide links to the relevant provisions of law confirming the right to recalculation.

- Indicate the details of the car for which you want to change the accrued tax amount (registration plates, make, model, identification numbers, year of manufacture and other characteristics).

- Explain the reason why you are requesting to recalculate the transport tax.

- Inform how you want to receive the result of the application review (by mail, at your residence address, in person, by email).

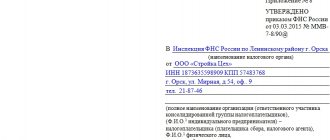

Sample application to the tax office for recalculation of transport tax

A package of documents must be attached to the application. Their list varies depending on the situation. But there is also a mandatory list of documentation.

Documents that must be provided:

- citizen's passport;

- TIN;

- documents for transport subject to taxation.

Additional documents:

- certificate from the State Traffic Inspectorate (if the vehicle was deregistered in the reporting year);

- a certificate stating that the property was stolen (if such a situation occurred);

- a document confirming the power of the vehicle;

- results of the examination (in case of any disagreement);

- a document confirming the right to preferential taxation (this may be a certificate of dependent status of a disabled child, a certificate of a WWII veteran and other documents).

Documents must be provided in originals, since copies are not the basis for recalculation.

Recalculation of tax on a sold car

The transport tax calculation period is calculated in months. Therefore, in order to understand when it should stop accruing, you need to know the date of conclusion of the purchase/sale agreement.

If the sale was completed in the first half of the month before the 15th, then the tax will be charged to the new owner from this month. If the contract is dated in the second half of the month, then the current month will have to be paid to the former owner.

Thus, using the receipt you can check the correctness of the accrual after the sale.

Why might the calculation be wrong? The reason is simple. The tax office did not receive information from the traffic police. Or the employee who calculated the tax was inattentive.

What should the former owner do in this case? First of all, you need to contact the tax office to find out the reasons. Perhaps the mistake was made due to inattention and, in connection with the sale of the car, the inspector will correct it himself. If not, the individual needs to confirm the fact of selling the car by submitting a purchase/sale agreement.

- Take a certificate from the traffic police about your deregistration for a specific car;

- Contact the tax office at your place of registration;

- Fill out the application for recalculation;

- Attach a copy of the purchase/sale agreement to confirm the information provided.

You can fill out the application yourself and send it to the tax office by mail.

The situation will become more complicated if, after receiving ownership of the car, the new owner does not register the car in his name. Then you won’t be able to avoid unnecessary expenses on someone else’s tax.

How is recalculation carried out in case of vehicle theft?

When a car is stolen, the owner can do the following:

- demand recalculation of transport tax;

- deregister the vehicle with the traffic police.

If a citizen requests a recalculation, then the tax will not be charged until the car is found and returned to the owner.

Tax officers do not have the right to request information about vehicle theft from the police. Therefore, the motorist obtains the relevant certificate independently. If the vehicle was stolen after the 15th, then no tax will be charged for that month. If the theft was committed earlier than the 15th, then the recalculation will be made only from the next month.

Recalculation for a stolen car

Car theft causes a storm of negative emotions. Therefore, there is not the slightest desire to remember about the transport tax. However, when at the end of the year it becomes necessary to pay for a car that the owner has not used, you have to pull yourself together.

According to the Russian Tax Code, the owner of a car has the right not to pay tax during the theft. However, you still need to notify the tax office about this. To recalculate, the owner must contact the police and report the theft.

Traffic police officers will issue the owner with a certificate of theft and initiation of a criminal case. You must contact your local Federal Tax Service with these documents. There the motorist fills out an application.

What to do if the transport tax is calculated incorrectly?

According to Article 362 of the Tax Code of Russia, citizens do not calculate taxes for their vehicles. This function is assigned to the Federal Tax Service inspectorates - they not only calculate the tax for each payer, but also prepare a tax notice and payment notice and send them by letter.

The letter is sent to:

Paper and email letters are no different in appearance:

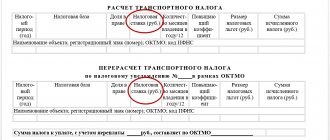

- the notification looks like this:

- the notice looks like this:

.

Important!

Only after receiving a notification from the Federal Tax Service can you find out whether the tax was calculated correctly or incorrectly.

The Russian Federal Tax Service database is huge and the workload of inspection staff and delays in the functioning of the interdepartmental information exchange system lead to the fact that you may receive an incorrectly calculated tax or a tax for a non-existent object, etc.

Examples of errors:

- incorrect rate used;

- the person’s benefit is not taken into account;

- the calculation was made based on incorrect data - for example, incorrect machine power;

- tax has been charged for a car sold or donated;

- the car is stolen or deregistered;

- the car is equipped for disabled people or received from social authorities (with a power of up to 100 hp).

In any of these situations, you will need to contact the inspectorate that sent the letter.

Important!

The absence of a letter from the tax office before November 1 of the year is also a reason to contact the inspectorate - such an obligation has been assigned to payers since 2022.

There are several ways to contact the Federal Tax Service:

- personally visit the inspection;

- send a notarized representative;

- call the hotline 8-800-222-22-22;

- use the service in the “Taxpayer’s Personal Account”;

- write to the inspectorate using the “Contact the Federal Tax Service” form.

If the reason is that there is no information in the AIS-tax database that you do not have to pay for the car - due to the applied benefit, alienation of the car, deregistration, theft, etc. - then it is enough to present a document confirming this fact. The inspector will enter the information into the database, and you will be released from the incriminated amounts.

And in situations where you have to pay, but the amount is calculated incorrectly, a recalculation of the transport tax is required. This also includes the case when you have not yet applied, but are going to apply the benefit for past periods - in all these situations, you need an application with a request to recalculate the transport tax.

If you have questions or need help, please call Free Federal Legal Advice.

Recalculation of transport tax in connection with the benefit

A certain category of citizens has the right not to pay vehicle tax. These include pensioners, large families, disabled people of groups 1 and 2, as well as heroes of Russia and the USSR. If the tax at the end of the year does not take into account the car owner’s right to a benefit, you need to contact the tax office with an application and documents confirming the legality of applying the benefit.

It is not necessary to use the benefit. That is why the tax office does not begin to apply it automatically.

To receive your legal deduction, the beneficiary must submit an application for a transport tax benefit and, if necessary, an application for recalculation for the last three years.

Owners of large trucks weighing more than 12 tons are required to pay tax according to Plato. It provides for tolls on federal highways. For such motorists, a tax benefit is also provided. If the calculation is incorrect, the owner has the right to recalculate the accrued tax.

How to write an application for transport tax benefits?

Documents for recalculation

To recalculate transport tax, you will be required to provide the following set of documentation:

- Identity document (general passport).

- Taxpayer Identifier (TIN).

- All documentation for the vehicle (registration certificate, sale/purchase agreement, certificate of disposal or theft).

Additional information may be required:

- A certificate from social security about the allocated tax benefit.

- Acts of local governments determining the transport tax rate for the region.

Attention! All documentation is submitted only in original versions. Even notarized documents are not accepted.

How to submit an application for recalculation of fuel tax?

Taxpayers have the right to submit an application to the Federal Tax Service at the place of registration in person to the inspector, through an authorized representative with the provision of the original power of attorney, as well as through the Russian Post by sending a letter with a list of attachments. In addition to standard methods, the State Services service is gaining popularity. You can also submit an application through it if you have a verified account.

The application form can be found and obtained from the Federal Tax Service or found on our website. The Tax Code does not have an approved application form, so you can write it in free form.

Dear reader! Didn't receive an answer to your question? Our expert lawyers work for you. It's absolutely free!

- Moscow ext 152

- St. Petersburg ext 152

- All regions ext 132 (Toll free)

The samples differ in the reasons for requesting a recalculation, but in general they have the same structure.

- In the upper right corner it is necessary to write that the application is intended for the head of the tax office in which the individual is registered, and the full name, telephone number, address of the taxpayer;

- Next, indicate the name of the application, for example, “Application for recalculation of transport tax in connection with the theft of a car”;

- In the text, indicate a link to the article in the Tax Code of the Russian Federation and the reason why the individual is asking to recalculate the accrued amount;

- List the technical characteristics of the car (make, license plate, year of manufacture, power, etc.);

- Indicate the method of contacting the taxpayer. The tax office can send a response by mail or deliver it during a personal visit;

- List the attached documents confirming the legality of the recalculation;

- Signature and current date.

applications for recalculation of transport tax

How and where to make a recalculation

If the receipt contains incorrect information about the car’s engine power, its make or age, it is best to start processing documents at the local traffic police department:

- Submit an application to clarify information about your car.

- Prepare all the documentation confirming your case: registration certificate, purchase and sale agreement, etc.

- Take a clarifying certificate certified by the head of the department.

It will be required to make changes to the taxpayer’s tax base at the inspectorate office at the place of permanent registration of the car owner.

You can do it differently - first contact the tax authorities and ask them for documents about your vehicle, and then use them to make changes to the unified traffic police database for vehicle registration.

You can submit an application in various ways:

- Send a registered letter to your tax office.

- Submit your application in person.

- Use online services.

Registration online

For those taxpayers who confidently use the Internet, the same can be done by contacting the State Services service or the Federal Tax Service portal. The principle of filing a transport tax return with correctly specified calculations is similar. Let's use the example of State Services:

- Go to the portal and select the “Acceptance of declarations (settlements)” section.

- Make a choice of actions: generating a document and sending it online.

- After selecting the functionality, a page with a form to fill out will open. Write all columns correctly, without corrections or errors.

- The finished document can be sent from the portal page to the tax office selected from the drop-down list.

But in order for the document to have legal force, it is first necessary to generate a qualified (unqualified) electronic signature in a company specialized in this type of activity. However, this can be done online on the Federal Tax Service website. The system will generate your signature and save it in a secure special storage server.

Attention! To avoid possible errors in filling out a new declaration, it is better to use the software provided in the taxpayer’s personal account on the Federal Tax Service website. She will tell you where to send the document, report any mistakes made, and offer options for correction.

To use the online mode, the user must have a verified account on both services.

What documents need to be attached to the application?

When submitting in person or sending by mail, the car owner who is counting on recalculation of the technical tax must attach the following documents to the application.

- Passport of a citizen of the Russian Federation (or other identification document);

- TIN, if any;

- Documents confirming ownership (PTS);

Copies of these documents are attached to the application, regardless of the reason for the recalculation.

In addition to them, the inspector may request supporting documents upon admission. These include:

- Purchase/sale agreement and document on deregistration of the car from the traffic police;

- Certificate of car theft;

- PTS or other document confirming technical characteristics;

- A document allowing the benefit to be applied.

The most convenient way is to come to the tax office with the specified documents and fill out an application for recalculation on the spot, since most inspectors require you to provide original documents.

Recalculation after selling the car

If you sold movable property, and after that you received a new notice about accrual for the time after the sale, you need to urgently correct this error. Otherwise, ignoring the notifications will result in the car owner being charged a fine for late payments to the state.

In this case, it is important to know exactly for what period the notice was sent. If for the past year, you must pay the debt, and if for the time when the sale was made, you must give notice to the buyer, in the case of using the car by proxy.

If a requirement arises to pay transport tax after the sale of property, you should visit the tax service and traffic police authorities to provide reasons for refusing to pay the accrued amount.

When a notification is sent erroneously, due to incorrect actions of traffic police or the Federal Tax Service, it is necessary to fill out an application requesting adjustments to the databases.

If the transport has already been re-registered you need to:

- Obtain a certificate from the State Traffic Inspectorate confirming the re-registration of the car.

- Go to the tax office and provide them with the original certificate.

- Fill out an application indicating the date of the transaction and the buyer’s details.

- The application is accompanied by a sales contract (copy) showing signatures, the date of conclusion and the amount of the car sold.

After this, the inspection staff will issue a decision to withdraw the illegal payment.

There is another way to avoid consequences immediately at the time of registration of the sale. You just need to request information about the car from the traffic police 10 days after concluding the purchase and sale agreement. Specifically, you need to find out whether the car is still registered with you or has been re-registered to a new owner.

If the car is still registered in your name, you need to try to contact the other party to the transaction and request registration. If a person does not cooperate, you can contact the traffic police with an application to scrap the car or put the car on the wanted list.

But be that as it may, the seller will have to pay the transport tax. Then it makes sense to seek help from a competent lawyer, or try to resolve the issue yourself.

During what period is it possible to recalculate TN for individuals?

Usually, owners quickly discover the error and recalculate for the previous year. However, this does not always happen. Tax officials have the right to recalculate incorrectly calculated tax for the last three years. However, they cannot do this without a written statement from the owner of the car. Thus, if an error was discovered in 2022, recalculation can be made for 2022, 2022 and 2022.

After recalculation, the applicant can offset the overpayment against future payments or refund the money. The owner must indicate this in the application for refund of the overpaid tax. It indicates the recipient's bank details.

Reasons for action

Registration of recalculation of transport tax is allowed:

- in case of errors in the tax notice (incorrect vehicle engine power, incorrect tax rate, non-application of benefits);

- with the sale of a car during the reporting period. When selling a vehicle, you should notify the tax authority in a timely manner. If this is not done, then at the end of the tax period you can receive a notification with the amount of tax calculated for the full period. The owner of the vehicle pays the fee only for the period of actual use of the vehicle;

Therefore, if these inaccuracies are discovered, you should visit the tax office and submit the necessary documents confirming the sale of the vehicle (the original sales contract).

- in connection with the theft of a car. The car will be considered stolen only if the owner has the appropriate certificate from the traffic police. As in the case of a sale, in case of theft, the car owner is obliged to report the incident to the tax office. If for some reason this did not happen and the citizen received a notification with an incorrectly calculated tax, you should visit the tax office and provide the above-mentioned document;

If a vehicle is stolen in the first half of the month, no tax is charged for this period. If the theft of transport occurred in the second half, then the month is included in the calculation of transport tax.

- when changing the place of residence of the car owner and registering (registration) of the car. Recalculation can be performed only on the basis of submitted documents that certify any inaccuracies in the calculation of the transport duty.

When using an incorrect indicator of vehicle engine power in the calculation of transport tax, tax officials request the relevant information from the traffic police department in which the vehicle was registered.

In some cases, you have to first correct data on indicators in the traffic police, and then in the tax office. But, if inaccuracies are detected, the car owner must first visit the tax office.

Recalculation of transport tax in the redistributed territory is carried out upon execution of a written application on behalf of the car owner.

In the event that the taxpayer has paid an amount greater than that indicated in the tax notice for the transport fee, the funds may be:

- included in payment for the next reporting period;

- returned to an individual or legal entity.

In the latter case, it is necessary to submit a corresponding application to the tax office.

Can the Federal Tax Service recalculate the technical tax on its own?

The situation when a motorist did not submit an application to the tax office, but a new receipt with an adjustment arrived, occurs quite often. Usually in such cases there is an increase in the amount payable.

Additional charges have to be made for the same reasons as recalculation: inattention of tax officials who indicated less power than needed, information that was received at the wrong time, and so on.

Despite the indignation of car owners, the Federal Tax Service has the right to do this in accordance with Articles 31 and 32 of the Tax Code of the Russian Federation. The taxpayer, in case of disagreement with the additional assessment, may contact the tax office to clarify the circumstances. If there is no result, you can fight for your innocence in court.

Tax payments of the car owner are his direct responsibility to the state. Money received by the budget as a transport tax is spent on building new roads and repairing old ones. However, there is no such thing as extra money. And paying additional tax amounts is expensive. Therefore, the car owner must independently control the tax accrued on the receipt. If it is necessary to submit applications for recalculation, the motorist needs to collect supporting documents and submit the originals to the Federal Tax Service at the place of registration. After considering the issue, you need to write an application for a refund or offset in favor of future payments. The main thing is not to delay in correcting tax mistakes. After all, the period for which recalculation is possible is only 3 years.

Let's sum it up

There are quite a few situations in which there is an urgent need to apply for recalculation of transport tax. Evasion of payment will lead to liability, and unnecessary expenses are not beneficial to anyone.

To carry out this procedure correctly, you must provide all the necessary packages of documents and give reasons why you need to recalculate. And if you disagree with the decision of government agencies, you can always challenge the tax service’s decision and achieve a reduction in the amount in your next notification.

In what cases is it used?

The recalculation procedure can be carried out based on the following factors:

- there is an error in the received tax document or in connection with the benefit. If a citizen discovers an inaccuracy in the notification itself (incorrect tax rate, lack of a corresponding benefit, etc.), he should contact the tax authority and point out that the inspectorate made an error. Moreover, the appeal should occur as quickly as possible in order to avoid unnecessary problems in carrying out recalculation.

When applying, the citizen must present a personal passport and papers that serve as confirmation of inaccuracy in the calculation of transport tax. To carry out the recalculation itself, the citizen is obliged to write a corresponding application.

- in connection with sales during the reporting period. Data on the sale of a car is received by the tax authority late or not received at all, and in connection with this, the taxpayer receives a notification with the tax calculated for the entire tax period. To confirm the sale of a vehicle, a corresponding contract must be prepared and submitted to the appropriate tax office employee for amendments. When the procedure for changing the reporting period is completed, the citizen will receive a new tax document;

- in connection with theft. To carry out the procedure for changing the tax amount, you will need a corresponding certificate from the traffic police department. Duplicate PTS? When recalculating, the actual period of use of the vehicle will be taken into account;

- change of residence of a citizen. When the taxpayer’s place of residence changes, the place of registration of the vehicle also changes. To recalculate, you will need a completed application from the taxpayer and documents confirming the change of residence.

Each recalculation procedure must be accompanied by the provision of the necessary documents proving the right to this procedure. Without the necessary documents, recalculation cannot be made.

Documents can be provided either by the taxpayer himself or by an authorized representative, if the latter has a notarized power of attorney.

Legality of action

Despite the fact that the recalculation procedure often occurs when the taxpayer discovers certain inaccuracies in the tax notice and according to the application he has completed, the tax authorities can arbitrarily change the tax amount.

Typically, the amount of tax on a vehicle changes upward, and the taxpayer receives arrears, for which penalties are subsequently charged.

Despite the ambiguity of the situation, the tax authority has the right to recalculate previously paid transport tax indicating the changes in the relevant notification. This action is regulated by Articles 31 and 32 of the Tax Code of the Russian Federation.

In cases where the taxpayer does not agree with the recalculations made on behalf of the tax inspectorate, he is obliged to prove the illegality of these actions by submitting the necessary documents.

In order to avoid the accrual of penalties, the taxpayer should carefully read the tax notice received and immediately report any errors found in the document to the tax office, regardless of the direction in which the tax amount changes when the recalculation is made.

How to pay transport tax if there is no receipt is explained in the article: receipt for transport tax.

Where to find out the transport tax debt, see the page.

Find out the list of cars eligible for luxury vehicle tax in 2020 from this information.

How to write an application to the tax office for recalculation of transport tax

The basis for recalculation is an application drawn up on behalf of the car owner, as well as supporting documents submitted to the tax authority.

The application is filled out on a form issued by the tax authority or on the website of the Federal Tax Service.

The written application is submitted personally by the owner of the vehicle or an authorized representative who has the appropriate notarized document.

Submitting an application to the tax authority is possible using the website of the Federal Tax Service or the Russian Post. In order to fill out an application on the website and send it to the tax office, the owner of the vehicle must have access to his personal account, through registration, or have an electronic signature.

The header of the application indicates information about the owner of the vehicle (full name, residential address, contact information). The title of the document begins with the word “Statement” and the reason for writing is written below.

The body of the application contains the following information:

- request for recalculation;

- reference to a specific article of the legislative act, which confirms the right to this petition;

- characteristics of the vehicle for which the tax needs to be recalculated (model, make, state number, VIN, year of manufacture, engine power rating, etc.);

- reasons why the transport tax should be re-calculated;

- ways to receive a response from the tax service after considering this application (by mail, by hand, by email).

The penultimate stage in filling out an application for recalculation is a description of the attached documents confirming the need for this action.

The final part of the application contains the date of registration of the paper and the signature of the owner of the vehicle.

When filling out an application by another person, you must issue a power of attorney certified by a notary, which gives the right to authority in resolving this issue.

Below is a sample application:

A selection for you!

Download forms and sample documents for motorists to a safe place.

Which service should I contact?

A citizen who has drawn attention to inaccuracies in vehicle tax calculations made in the notification must contact the tax office located at the place of his actual residence.

If the taxpayer was denied the recalculation procedure, and the fundamental documents for this are in hand, then the citizen has the right to go to court with a corresponding claim.

The statement of claim is submitted to the judicial authority, which is located in the same territory as the defendant (tax office).

To apply to the judicial authorities with a statement of claim for refusal to recalculate transport tax, you must submit the following papers:

- document-basis for making changes to the relevant tax;

- a response received from the tax authorities with a justified refusal in this procedure;

- a receipt confirming payment of the state duty;

- other documents, the provision of which may be necessary (at the request of the judicial authority).

After all the documents have been collected, they, along with the statement of claim, are submitted to the judicial authority. Only after filing a claim and the necessary documents can a date and time be set for a trial on this issue.

Both the plaintiff (taxpayer) and the defendant (tax authority employee) are present at the trial.

Only a court decision can be considered the final answer to the disagreements that have arisen.