Is it easy to fill out a payment order online?

Active development and implementation of modern innovations in the field of accounting allows them to be used in any situation without inconvenience or damage to the quality of accounting. Today it is possible to generate a payment order online on many Internet resources. By contacting any of the sites where this service is available, you can easily issue a payment document for both a legal entity, an individual entrepreneur or an individual.

When you get to the form to fill out, you should start with the basic details of the payer. This is the region and address of the location of the company, INN and KPP, as well as the details of the recipient (territorial fiscal authority). The interactive search system helps you do this accurately and without errors. The administrative-territorial unit is presented in the form of a drop-down list, from where you need to select the one in which you are located.

Basically, people turn to the service to create a payment slip when the usual accounting program is not at hand, and it is also convenient to clarify payment information that is not enough to make a payment.

Important! The online system contains current data and other details for preparing payments.

How the payment order system works in the Sberbank Business system

A service is provided for transferring finances from a current account to the recipient's account. There are standards for documentation at the legislative level. In the program, instructions are issued according to the sample. To fill out a payment order, please indicate:

- Certificate about the recipient;

- Name of the sender's bank and recipient's bank;

- Payment amount;

- Recipient details.

A correctly executed payment order has an expiration date.

Please note: A paper payment order loses its relevance 10 calendar days from the next day after the document is issued. The same is true for payment orders in SberBusiness. No more than 10 calendar days should pass between its creation in the system and sending to the bank.

Do I need to check my payment online?

The service for generating payment orders online is very simple to use. Since the user selects the main identification details from ready-made information and reference books, the likelihood of error is reduced to zero. When filling out the BCC, as well as the recipient's bank and federal treasury account, manual entry of numbers is eliminated. Therefore, there will be no typos or extra/incorrect data. The system will not allow the use of outdated data and payment details, except for those for which payment must be received in accordance with legal requirements.

Pay attention to the pop-up tips that the system offers. If for some reason you do not have enough data, you can always take advantage of additional consultations that are posted on the interactive platform.

It’s more convenient to have a ready-made template at hand that you can use to navigate when filling out payments. When paying taxes, a lot of ambiguities always arise, which can be resolved by referring to the article on errors in payment slips with samples of filling out.

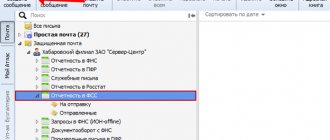

How is the payment signed and sent?

A payment order is an important financial document that defines the flow of funds and must be approved. You will need:

- After creating the document, the message “Receive SMS code” will appear on the right.

- To sign the payment, enter the password received via SMS.

- If there are several people in the organization who need to approve the order, everyone confirms the same.

- Double-check all the information - your document must be sent to the bank, otherwise the payment will not be accepted for execution.

- An alternative option allows you to sign a payment card using a token.

Be careful when filling out forms. If you made a mistake, you have the opportunity to revoke the payment. Remove the erroneous order from the list if the payment has recently been generated. You cancel the signature and you can edit the document or completely delete it.

Stages of filling out a payment order online

One of the most authoritative services is located on the Federal Tax Service website. The first step in filling out a payment form begins with determining the legal form of the payer: individual entrepreneur, organization or individual. On the right half of the screen there are tips that correspond to the data that is entered at each stage of forming the payment, as well as details of the data to be filled out.

For example, if the payment will be made by a company, then by selecting the status of a legal entity, other data will be inactive for selection, the information will be colored gray. That is, you will not create a payment document that is intended for payment by individuals through the cash desks of public banks in cash.

KBC and UIN for taxes paid by individuals are also excluded. If you do not know the required budget classification code to which you plan to make a payment, the system will allow you to fill in the name of the tax manually and then select the desired direction of payment (the desired BCC) from the additional directory.

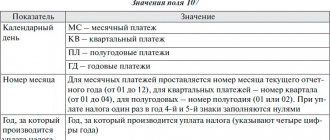

After you decide on the codes, you should select the payment type:

- Basic tax;

- Penalties on taxes or contributions;

- Penalties.

The entire filling system is divided into blocks, which cannot be accessed until all required details are filled out and verified.

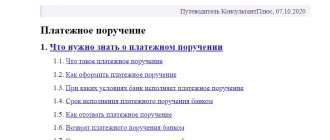

Filling rules

Documentation must be drawn up taking into account a number of rules. To sleep peacefully, pay your taxes as an individual entrepreneur, and you can print the payment document immediately after making the payment. It is better to fill out the payment form following the instructions, especially if a person is doing this for the first time. The Federal Tax Service Inspectorate payment system has mandatory fields to fill out and a transaction code. The filling requirements are covered in the Regulations of the Banks of the Russian Federation No. 383-P, and the sample must contain the details of both parties, which corresponds to Order of the Ministry of Finance of the Russian Federation No. 107n. Below are the basic rules and features of the process:

- It is mandatory to register the details of the sender and recipient in full.

- The form must be of a strictly established form.

Before filling out the form in the system, you need to make sure that you have an Internet connection. If there is a failure, some data may not be displayed correctly. If a person sends a transfer at this moment, he may get lost in the system.

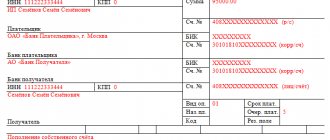

Deciphering some payment items

- The document number is indicated at the top of the online PP. If a payment is drawn up by a private person, but this line is not filled in, and the organization is obliged to record the numbering of each form.

- The type of form is determined in the form of a code value. Payment order code - 0401060.

- The transfer amount is indicated in capital letters and numbers.

- An individual taxpayer number is registered.

- The sender's full name is entered in full. If the payment is made by a legal entity, then the full name of the company must be indicated.

It is important that all data is reliable.

Where can you fill out a payment order online (list possible options, it must be the Federal Tax Service, Federal Border Guard Service).

Additional Information! You can fill out a payment form online on several platforms. If a person needs to pay tax contributions, then it is better to use the official resource of the Federal Tax Service. If you need to pay off debts to bailiffs, then you should use the FPS portal.

If you need to pay for credit debt, goods or services, you can visit third-party services. The most popular system is located at: https://service-online.su/forms/bank/platejnoe-poruchenie/. Just enter this address in the search bar and follow the step-by-step instructions. The only inconvenience of the service is that there is no data substitution using the entered BIC code. Another convenient resource is even the possibility of electronically filling out the PP at: https://formz.ru/forms/platezhka/. There are not only tooltips for each field, but also the ability to save a template. If you pay again, you will not need to enter your information again.

Payment on the Federal Tax Service website

In addition to important payments, filling out the PP may be necessary to make transfers for everyday or work needs: payment for supplier services, advance payments, placing an order. It is important that if you need to pay for the goods, the PP must indicate whether this amount already contains VAT or not.

Important! If any required line is left blank, the system will not skip the payment and you will have to enter the data again.

On the UFSSP website

Where can I find the service of filling out online payment forms?

Having assessed the attractiveness and convenience of filling out an online payment order, you need to try its capabilities in practice. From what was said earlier, you can evaluate the capabilities of the service on the Federal Tax Service website. Here you can also find the necessary information about taxes and insurance premiums.

The online service website has a similar service. All steps of forming a payment order are accompanied by tips and necessary comments. One of the small inconveniences that catches your eye is that the ability to determine the payer’s bank is not implemented here if you enter the bank’s BIC in the form.

On other Formz.ru platforms and operbank.ru network resources, the system is more flexible and allows you to choose the bank’s BIC (it is available on the site resource). In addition, it is always possible to check the details and other payment data for compliance with current legal requirements.

Each of the Internet resources has the ability to print a document, as well as save the completed online payment in a convenient format for sending by email.

Electronic payment method eliminates the need to certify the payment for the court

The organization applied to recover from its opponent in a legal dispute the costs of attorneys' fees. As confirmation of their payment under the contract, the institution submitted to the court a printout of the payment order. The first instance refused to recognize the document as appropriate evidence, pointing out that the blueprint of the payment order was not certified by the bank.

However, the appeal drew attention to the fact that the court did not have a copy at its disposal, but an electronic payment order printed for convenience of review by the court, executed in accordance with the rules on non-cash payments established by the Central Bank of the Russian Federation. The judges referred to Regulation No. 383-P and the position of senior colleagues from the cassation of the North-Western District, who explained that the requirement for a bank stamp and the signature of the responsible executor on the payment order applies only to the execution of a document on paper. When transferring funds electronically, the payment order must indicate: type of payment - “electronic”, date of debiting the funds, bank mark confirming the payment.

The arbitrators also noted that the Bank of Russia does not certify either copies or originals of payment orders used in settlements between non-governmental organizations. The cassation judges of the Moscow District confirmed the correctness of the position of their lower colleagues.

Resolution of the Arbitration Court of the Moscow District dated June 3, 2019 No. F05-7698/2019

Editor's note:

Regarding the “Bank Mark” details, please note that in accordance with clause 45 of Appendix No. 1 to Regulation No. 383-P, in the specified field of the payment order, the payment execution date must be indicated by the recipient’s bank. If there is an appropriate mark on the printout of the electronic payment order, the courts consider the fact of incurring expenses proven. Thus, the intellectual property rights court, in its Resolution No. S01-262/2019 dated April 8, 2019, did not accept the party’s arguments about the non-compliance of payment documents with regulatory requirements due to the lack of stamps on them. The judges noted that from the provisions of the current legislation it follows that the original payment document is drawn up in a single copy. In accordance with paragraph 1 of Art. 6 of the Federal Law of 04/06/2011 No. 63-FZ, information in electronic form signed with a qualified electronic signature is recognized as equivalent to a paper document signed with a handwritten signature. Consequently, the original of a payment order generated electronically in the Bank-Client system is an electronic document drawn up in the format established by the Central Bank of the Russian Federation and signed with a qualified electronic signature.

Copies of electronic payment bills presented to the court with marks from the recipient’s bank do not require seals and comply with Regulation No. 383-P.

Reasons for filling out payments online

The online service has significant advantages for all types of businesses. Its use does not require special reasons or additional resources in the software. There is no need to install additional programs to generate payments. All you need is Internet access, and you can access the site that provides this service from any device, including portable electronic gadgets.

The main condition remains to avoid mistakes when creating a payment order. After all, the consequences of mistakes will have to be corrected, incurring financial losses in the form of penalties or fines.

What to pay attention to to eliminate errors in payments:

- Correctness of the specified data about the payee;

- Details of the recipient's account in the federal treasury;

- KBK, OKTMO tax or insurance premiums that are paid.

You should also check the correctness of the payer’s details (TIN, KPP, name of organization) for identification in the future when crediting tax amounts to taxpayers’ personal accounts.