General provisions for conducting cash transactions

Accountable amounts are issued for travel expenses, payment for services and goods for the needs of the enterprise, and other needs necessary to ensure the activities of the organization. It is advisable to determine the procedure for making settlements with accountable persons in the local regulatory act of the organization or individual entrepreneur. The document defines the circle of accountable persons, the goals and timing of the issuance of money. Reduces questions from accountable persons, cashiers and regulatory authorities.

The procedure for receiving funds in the hands of employees is regulated by new rules for issuing accountable amounts adopted in 2022 and consists of the following stages:

- Permission (order or application).

- Receipt of money by an individual.

- Report on amounts spent.

- Return of unspent money or repayment of debt.

Storage periods for advance reports

According to Part No. 1 of Article No. 29 of Federal Law No. 402-FZ, advance reports must be stored for 5 years. Each organization chooses the order in which reports are stored. Most often, advance reports along with the necessary documents are filed quarterly or in chronological order.

The rules for issuing funds to the account were simplified by introducing amendments to Instruction No. 3210-U (Instruction of the Central Bank dated 05/10/20 No. 5587-U).

The following changes came into force on 30/11/2020:

- in the application for the issuance of money it is not necessary to indicate the period of issue and the amount of the advance. You can issue one order for several cash payments to one or several employees at once.

- Individual entrepreneurs and organizations can themselves determine the deadline for submitting an advance report.

- Even those employees who did not report on previous amounts received can receive money on account.

- from 2022, accountable money can be transferred to an employee’s salary card. The card details must be reflected in the director’s order or in the application for reporting. To prevent the tax authorities from thinking that the transferred money is a salary, payment orders must be drawn up in a special way. In the “payment name” field, you must indicate for what purpose the money was transferred. For example: payment of travel expenses, payment of household needs, etc.

If you comply with all legal requirements, then issuing accountable funds will not turn into a headache for the organization.

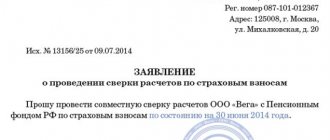

Order or statement

From August 19, 2017, the issuance of cash to an employee for expenses is formalized according to an administrative document or a written application from the accountable person (clause 6.3 of instructions No. 3210-U). In other words, if there is no order, the employee writes an application for the issuance of accountable amounts, and if this application is satisfied, he will receive the money. Before the changes came into force, the application had to be completed without fail. Currently, it is applied only at the request of organizations.

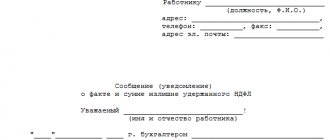

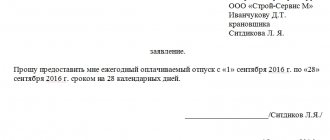

An application for the release of money to the account is drawn up in any form, contains a record of the amount of cash and the period for which the cash is issued. The document is signed by the head of the organization or individual entrepreneur. The manager’s signature is also “permitting”. An individual in an application has the right to indicate any bank (salary) card for transferring funds (letter of the Ministry of Finance dated July 21, 2017 No. 09-01-07/46781).

Sample application for reporting travel expenses

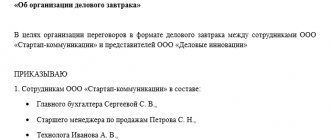

Organizations or individual entrepreneurs have the right to issue money on the basis of an internal administrative document. The form of the document is chosen independently and approved by the LNA. This could be a memo, order, instruction or any other administrative document.

Sample memo for the issuance of funds report

The internal administrative document must contain records of the amount of cash and the period for which cash is issued, the signature of the manager and the date.

Do I need to write an application for an advance on travel expenses?

The regulations for conducting cash transactions dictate that it is mandatory for workers to write an application for the issuance of money on account to fulfill the assignment of the enterprise management.

With the entry into force of new regulations, it is allowed to issue money to a contractor with whom a civil contract has been signed. He also reflects his request for cash in writing.

The main purpose of the application is a detailed recording of the goals and timing of the allocation of funds.

Having received the application, the director, upon approval, puts his signature on the form for the accounting department, approving the timing of the trip and the amount of issue.

Based on the request of the worker, an expense cash order is issued. If the director put his signature on the application for the advance, then its presence on the expenditure document is not necessary. Payment to the employee is carried out on the basis of an order, funds are transferred to a current account or issued in cash.

When do you need to obtain consent for a business trip?

Who can apply for travel expenses?

Each time you pay money for a business trip, you must fill out an application; this rule also applies to the head of the enterprise.

In many companies, it is the head of the company who is the accountable person and the application is still completed. It is more logical to issue only an order, but a written request is a mandatory condition for issuing funds for a business trip.

In large corporations, the manager does not write a statement to himself, but, for example, the addressee is the financial director.

The advance is issued to an employee sent on a business trip by order of the director upon presentation of an identity card.

If there is a notarized power of attorney, payment can be made to the employee’s representative.

Correct design

The application is drawn up in free form. If the company already has a ready-made template, then fill it out in accordance with the developed sample.

At the legislative level, there are no special requirements for the document; it is usually written in the name of the director of the company.

Information contained in the text part of the form: deadline for issuing cash, date and signature of the applicant, purposes for which the funds are issued.

To accept a document, an accounting employee must have the following information:

- details of the manager’s order for the business trip;

- date of departure and arrival;

- name of destination (country, city);

- the amount of the advance payment (in digital and letter designation);

- breakdown of the amounts of individual expense items (accommodation, daily allowance, travel).

Applications containing errors or typographical errors will not be accepted for consideration. The form must contain the signature of the accountant, which proves his consent to the release of funds and indicates that the workers have completed reports on previous trips.

An advance for a business trip can be transferred to the employee’s bank account; in this case, it is also necessary to take an application from the employee (clarification of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288).

The text part contains all the recipient's bank details. This statement is also proof that the transfer to the card is not income (the purpose of the payment indicates “accountable money”), and personal income tax withholding is not required.

Private entrepreneurs fill out a form if they use money for business needs; the document is not issued for personal use.

Government Decree No. 749 dated October 13, 2008 is devoted to business trips, paragraph 10 provides for the mandatory issuance of an advance for business trips. An employee should not travel outside the enterprise at his own expense to carry out the director’s assignment. The specific amount given to the worker is based on a preliminary assessment of the costs of travel to the destination, hotel accommodation in the locality, and the amount of daily allowance regulated by the local act of the company.

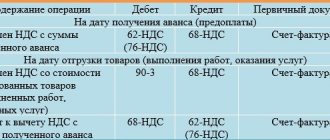

After the trip, it is necessary to submit an advance report to an accountant, who carries out the actual expenses with the declared ones. As a result, inappropriate use of funds may be found, to which the employee did not have the right (these expenses are not taken into account by the accounting employee).

It should be remembered that the presence of an application when issuing travel expenses is mandatory. When issuing funds without a written request, there is a risk of imposing a fine under Article 15.1 of the Administrative Code in the amount of a fine of up to 50,000 rubles.

.

How to withdraw money from the cash register

Let's take a closer look at the new rules for issuing accountable amounts. The transfer of cash is formalized by a cash receipt order drawn up in the KO-2 form (approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). RKO is compiled in one copy. The cashier of the organization draws up a cash order on the basis of an internal administrative document or a written statement. In RKO, in the “Bases” field, you should indicate the document on the basis of which their transfer is made.

Individual entrepreneurs are given the right not to draw up cash receipts and expenditure orders and, as a result, not to maintain a cash book (subclauses 4.1 and 4.6, clause 4 of Directive No. 3210-U).

Check the outstanding balances

Paragraph 3 of clause 6.3 of Directive No. 3210-U establishes a ban on the issuance of funds on account to an employee if he has not reported on previously issued amounts. For violating this prohibition, some tax authorities may even be fined under Article 15.1 of the Code of Administrative Offenses of the Russian Federation (Part 1):

- company - in the amount of 40,000 rubles. up to 50,000 rubles;

- official or individual entrepreneur - in the amount of 4,000 rubles. up to 5,000 rub.

Although such a penalty can be challenged in court, since Article 15.1 of the Code of Administrative Offenses of the Russian Federation (Part 1) provides for liability for violation of cash discipline, and not for the procedure for issuing funds on account (Resolution of the Seventh Arbitration Court of Appeal dated March 18, 2014 No. A03-14372/2013, Resolution of the Ninth Arbitration Court of Appeal dated January 31, 2013 No. 09AP-34612/2012). But it is not a fact that the decision will be in your favor (Resolution of the Ninth Arbitration Court of Appeal dated March 6, 2013 No. 09AP-2451/2013).

If the company is not ready for litigation, then it is better to follow the sequence: first, the employee pays off the debt under the old report (or the company reimburses him for the overexpenditure), and only then he receives a new amount.

Accountable Tools and Report

Another relaxation of the legislation, which came into force on August 19, 2017, affected the transfer of money if there is a debt owed to an employee. There is no longer any need to track the availability of a full report for previous accountable amounts, and issuing a new amount is allowed at any time. Previously, until the employee fully repaid the previous debt, it was impossible to issue a report. Now it is possible to write an application for accountable money and, if the decision is positive, receive it.

IMPORTANT!

Please note that a large amount of accumulated imprest amounts attracts the attention of regulatory authorities. These amounts qualify as borrowed (interest-free) funds.

Let us recall that income from the amount of savings on interest when receiving borrowed funds in terms of exceeding the amounts specified in clause 2 of Art. 212 of the Tax Code of the Russian Federation, are subject to personal income tax at a rate of 35%.

What is the responsibility for missing a statement?

There is no special liability for legal entities for violating the procedure for drawing up an application or administrative document for the issuance of funds on account. However, tax inspectors, when checking compliance with cash discipline in an organization, and discovering the absence of documents for reporting, may charge a violation:

- The procedure for storing cash amounts exceeding the established limit. The basis for imposing liability in accordance with Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the tax inspector most often concludes that funds from the cash register were issued unlawfully, and therefore must remain in the cash register. If the limit is exceeded, excess cash must be deposited at the bank on the same day. There is judicial practice unfavorable for taxpayers based on such conclusions (resolution of the 9th Arbitration Court of Appeal dated May 6, 2013 No. 09AP-11841/2013-AK).

- The procedure for maintaining cash discipline in general.

But there is also a practice that is positive for taxpayers, thanks to which it is clear that not all judges see the need to impose liability for such violations of cash discipline as the lack of documents for reporting (resolution of the 9th Arbitration Court of Appeal dated May 13, 2013 No. 09AP-10884/2013) .

At the same time, if there are significant (in the opinion of tax authorities) violations of cash discipline, such as the lack of instructions on the timing of the release of funds for reporting, judges usually take the side of the tax service employees (resolution of the 9th Arbitration Court of Appeal dated March 6, 2013 No. 09AP -2451/2013).

In order to avoid imposing a fine (if the inspection has already begun), you can exercise your right and submit the requested documents the next day (clause 31 of the regulations approved by order of the Ministry of Finance dated October 17, 2011 No. 133n). During this day, the manager will be able to draw up the missing papers for the issuance of the report, and the cashier will pin them to the corresponding cash receipt order.

Errors of this kind should be corrected only in the last 2 months, because in accordance with paragraph 1 of Art. 4.5 of the Administrative Code, the statute of limitations for imposing administrative liability is two months from the date of the violation.

IMPORTANT! If accountable funds are transferred to a payment card (salary, corporate), an application from the accountable person or an administrative document, in the opinion of the Russian financial department, is also necessary. This is stated in the letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288.

Return of unspent funds

In case of a balance of unspent funds, the accountable person hands them over to the cash desk of the organization or individual entrepreneur within the time period established by the manager. For the funds deposited, a cash receipt order is drawn up in form No. KO-1 (clause 4.1 of instructions No. 3210-U).

According to the new changes, a receipt for an electronic cash receipt order can be sent to the email address of the accountable person (clause 5.1 of instructions No. 3210-U).

IMPORTANT!

KKM checks are not issued for the return of imprest amounts. A cash register receipt is issued only when goods (work, services) are sold.

Features of issuing funds for reporting to the director

According to instruction No. 3210-U, accountable persons independently indicate in their application the amount and period for which funds are issued on account, and the director only approves them. When the director issues money on account to himself, a number of possible contradictions are eliminated, since there will be no discrepancies in the amount and timing of planned expenses by the accountable person with what the head of the company himself planned.

Therefore, it would be more logical to draw up an administrative document, for example an order for the release of funds for reporting.

The administrative document must record (letter of the Bank of Russia dated September 6, 2017 No. 29-1-1-OE/20642):

- date and registration number;

- Full name of the accountant;

- the amount and period for which it was issued;

- visa for a company manager or individual entrepreneur.

Whether it is possible to create one reporting order for several employees, find out here.

An advance report on accountable funds issued to the director himself must also be provided to the accounting department, and the balances must be returned to the cash desk no later than 3 days after the end of the period for which they were provided for reporting, or (if the director is on a business trip or he is on sick leave) within 3 days after the date the manager returns to work.