Let's look at setting up and reflecting VAT, the most “popular” tax, in the 1C: Accounting program and start with setting up the “Accounting Policy” for correct VAT accounting.

Fig. 1 Window of the 1C 8.3 Accounting 3.0 program, selecting the “Accounting Policy” section

Fig.2 Window for setting up the organization's accounting policies. Go to setting up taxes and reports

Fig.3 Window for setting up VAT accounting policies

Within the framework of this article, we will not be able to consider all the issues and features of VAT accounting in the program, so we will analyze the main points using simple examples.

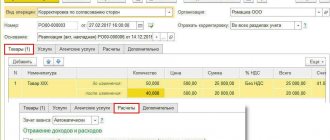

Our company is a VAT payer; we purchased 5 desks at a price of 1,600 rubles. for the amount of 8000 rubles. (including VAT 1333.33 rubles). Then they sold these tables, in the amount of 5 pieces, at a price of 3,000 rubles, for a total amount of 15,000 rubles. (including VAT 2288.14 rubles).

- Let's enter the documents into the program;

- We will create a purchase book and a sales book;

- Let's fill out the VAT return for the 1st quarter of 2022.

What are registers

Due to the fact that the most detailed description of the rules for maintaining tax registers is given in Chapter.

The Tax Code of the Russian Federation, dedicated to profit (Articles 313, 314 of the Tax Code of the Russian Federation), and a small article is devoted to VAT registers. 169 of the Tax Code of the Russian Federation, it would be logical to consider this issue using a set of provisions of the Tax Code of the Russian Federation and the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Registers used for tax purposes are designed to register and accumulate information contained in primary documents, accounting statements and analytical tables. At the same time, there are strict requirements for maintaining such registers: there should be no omissions or corrections in them, registration of imaginary or feigned accounting objects is not allowed, etc.

Registers in tax accounting are special forms for compiling and systematizing data for the reporting period. The data entered into the registers must be compiled in accordance with the requirements established by Chapter. 21 Tax Code of the Russian Federation. This information is grouped and registered without reflecting transactions, that is, a record is simply made for the taxable object. In this case, data entry into registers must be carried out continuously and in chronological order.

It is important for the taxpayer to ensure the creation of such an analytical accounting of incoming information that would reveal the procedure for forming the tax base. The registers accumulate and are subject to systematization of information contained in primary documents that are accepted for accounting.

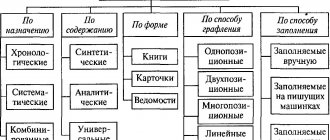

There are registers for tax accounting and accounting. Based on formal characteristics, the following differences can be distinguished:

- accounting registers, which are drawn up in the form of books, contain records of primary documents;

- Only information from accountant’s certificates and calculation tables, which can also be equated to primary accounting documents, is entered into analytical registers for tax purposes.

How to maintain accounting and tax registers , learn from the materials :

- “Accounting registers (forms, samples)”;

- “How to maintain tax registers (sample).”

Tax accounting registers must be formed for all business transactions taken into account for tax purposes. And if, as mentioned above, the procedure for recording and systematizing taxable objects corresponds to the order of grouping and reflection in accounting, then accounting registers can also be declared as tax accounting registers. This means that all objects recorded in such registers will also be used to determine the tax base.

What tax registers exist for VAT? See the answer to this question in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

In this regard, the taxpayer, having analyzed his business operations, must choose for which accounting objects he should approve the forms of registers created for tax purposes. This must be done to ensure that all information that is required to correctly determine the tax return figures is reflected.

Registers are drawn up in the form of summary forms both on paper and in electronic format. Moreover, if the registers are maintained in the form of machine diagrams, in accordance with clause 19 of the Regulations on accounting and accounting in the Russian Federation, approved. By order of the Ministry of Finance dated July 29, 1998 No. 34n, it must be possible to print them on paper.

You are allowed to enter your details into the form of tax accounting registers if it is not possible to enter into the proposed standard ones all the information necessary to designate the tax base (Article 313 of the Tax Code of the Russian Federation). It is important that there is no duplication of records.

The need to make changes to the register form usually arises for the taxpayer if the accounting procedure differs from the tax accounting procedure. The format of these analytical reports, the method of maintaining them and reflecting the data are fixed in the accounting policy of the enterprise. Those officials who compile and sign them (responsible accounting employees) will be responsible for the correct reflection of taxable items in the registers.

Register data should be stored securely to protect it from unauthorized modifications. In this case, corrections can be made if an error was discovered and corrected in a timely manner by the person responsible for maintaining the registers. Each correction must not only be justified, but also confirmed by the signature of the person responsible for maintaining the registers, indicating the date.

Document “Creating a purchase book”

- The “VAT deduction on purchased valuables” tab is filled in with the balances from the “VAT presented” register, without selecting according to the contract.

- tab “Deduction of VAT from advances received” - is filled in with the balances as of the date of the document in the register “VAT from advances”, “Type of value” - advances received, in terms of closing (!) the register “Calculation on sales (accounting)”, i.e. e. turnover on arrival. This is where errors often occur.

- generates the “VAT claimed” expense

- generates turnover according to the “VAT Purchases” register

- generates the expense for “VAT on advances”

Register requirements

In accordance with the requirements established by clause 4 of Art. 10 of Law No. 402-FZ for accounting and analytical registers prescribed in Art. 313–314 of the Tax Code of the Russian Federation, the mandatory attributes of any register are:

- its name;

- the period it covers;

- quantities in physical and monetary terms;

- the name of taxable transactions recorded in chronological order;

- signature of the responsible official.

Registers are necessary to systematize and collect information from primary documents, analytical and calculated summary data for their display when determining the tax base. Analytics of all collected tax accounting information should be organized in such a way that with its help it is possible to determine the entire progress of the formation of the tax base.

At the same time, fiscal authorities are strictly prohibited from establishing other forms of documents (Article 313 of the Tax Code of the Russian Federation), therefore the taxpayer should only take care of using the above details in the registers used.

If corrections need to be made to the register, they are made by the person responsible for its maintenance, indicating the date, initials and signature. In cases where the seizure of registers is expected, copies of the seized registers are included in the accounting documents.

Tax legislation defines only general points that taxpayers should adhere to when preparing tax registers. At the same time, the absence of registers is equated to a gross violation of the rules for accounting for taxable items; the fine for such a violation ranges from 10,000 to 40,000 rubles. (Article 120 of the Tax Code of the Russian Federation).

Registers for tax accounting are consolidated forms in which data is systematized without distribution among accounting accounts (Article 314 of the Tax Code of the Russian Federation), and the requirements regarding mandatory details coincide with the requirements for the preparation of accounting documents. Thus, it can be assumed that the documents used in accounting and tax accounting can also be classified as tax registers.

Only if some information is missing in the accounting register, you can add the corresponding details and use the modified version as a tax accounting register.

An enterprise can be held liable only for the absence of those registers that are specified in its accounting policy (Resolution of the Federal Antimonopoly Service of the North-Western District dated October 10, 2005 No. A42-7611/04-15). There is also judicial practice that is positive for taxpayers, according to which an enterprise itself can not only determine the form of registers, but also decide which lines it needs to fill out in them.

What is required to be displayed in the accounting policy

Each enterprise, in its accounting policy approved for tax purposes, also needs to provide for the procedure for maintaining and compiling documents and registers for tax accounting, including VAT. It will be necessary to describe in detail the rules that must be followed when issuing invoices, maintaining books of purchases and sales, as well as log books and other registers.

In addition, VAT payers must provide in their accounting policies:

- frequency of updating the numbering of invoices;

- the procedure for maintaining separate VAT accounting if the taxpayer carries out taxable and non-taxable transactions or applies different VAT rates;

- scheme for maintaining separate accounting of input VAT.

ConsultantPlus experts explained in detail how to keep separate records of “input” VAT when combining taxable and non-taxable transactions. If you do not have access to the K+ system, get a trial demo access and go to the material for free.

For details, see the material “How separate accounting for VAT is maintained (principles and methods)” .

You should not neglect your right to establish in your accounting policy the list of registers used for tax accounting. This may be an additional argument in a dispute with the tax authority.

You will find step-by-step instructions for filling out accounting policies for tax purposes in ConsultantPlus. Get trial access to the system for free and upgrade to a ready-made solution.

Recording movement type Consumption

Input VAT is deregistered from the register when posting documents:

- Generating purchase ledger entries;

- Invoice received;

- VAT write-off.

When they are posted, entries with the type of movement Expense . Such an entry means that the conditions for accepting VAT for deduction have been met or that VAT is written off and will not be accepted for deduction.

VAT is deductible

VAT is accepted for deduction if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- goods (work, services) must be purchased for activities subject to VAT;

- a correctly executed SF (UPD) is available;

- goods (work, services) are accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

When accepting VAT for deduction, a record of the type Expense ; it is created when posting documents:

- Invoice received - with the checkbox selected Reflect VAT deduction in the purchase book by the date of receipt ; PDF

- Generating purchase ledger entries - if separate VAT accounting is maintained in the program or in the previously received invoice, the Reflect VAT deduction in the purchase ledger by date of receipt . PDF

Upon receipt of goods from the supplier Computers Lab LLC, incoming invoice No. 125 dated January 16, 2018 was registered.

All conditions for accepting VAT for deduction have been met, so the accountant in the Invoice received for receipt checked the Reflect VAT deduction in the purchase book by the date of receipt .

When posting the document, the program generated a record of the type of movement Expense in the VAT register presented for the amount of input VAT accepted for deduction.

At the same time, a registration entry was made to reflect the deduction of VAT in the purchase book in the VAT Purchases .

VAT write-off

It should be noted that deducting VAT is the right of the taxpayer, and he does not always want to use it. Often, an accountant decides not to deduct input VAT, but to write it off as expenses.

To write off VAT in 1C, there is a special regulatory document Write-off of VAT : section Operations - Closing the period - Regular VAT operations - button Create - Write-off of VAT.

This document reverses in the VAT register the presented movement of the type Receipt , i.e. an entry is made with negative amounts.

The accountant decides to write off VAT on invoice No. 20 dated January 10, 2018 from the supplier “Flower Symphony”. PDF

The document generates a posting for writing off VAT according to accounting and writes off VAT according to the VAT register presented .

Now the program will not “monitor” the fulfillment of the conditions for VAT deduction. When writing off VAT from the VAT register, the submitted parallel entry in the VAT will not result in the Purchase.

What VAT registers are there?

Tax accounting registers for VAT include:

- invoice journal;

- sales book;

- shopping book.

Information from these registers is used when preparing a VAT return, namely to calculate the taxable base.

The log of received and issued invoices starting from 01/01/2015 reflects only documents drawn up as part of intermediary business activities, in the implementation of the developer’s tasks or on the basis of the following agreements: agency, commission or transport expedition. Both VAT taxpayers and those who are not VAT taxpayers (clause 3.1 of Article 169 of the Tax Code) must register invoices issued as part of the implementation of these business operations: firms or individual entrepreneurs exempt from the taxpayer’s obligation for value added tax in accordance with Art. 145 of the Tax Code of the Russian Federation, as well as special regime officers who issue (receive) invoices in the interests of other persons on the basis of intermediary agreements, transport expedition agreements or performing the functions of a developer.

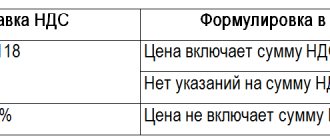

The sales book records all outgoing invoices and data on the cost of sales and the amount of tax, broken down by tax rate:

- in columns 14,14a, 15,16 of the sales book, information is entered on the cost of sales taxed at rates of 20, 18, 10 or 0%;

- in columns 17, 17a and 18, the tax amount is broken down into 20, 18 or 10%.

All information for each column is summarized, and the resulting data is transferred to the corresponding lines of the declaration.

The purchase ledger records all incoming invoices in chronological order.

The amount of input VAT from the purchase book is reflected in the VAT tax return for the reporting period (clause 7 of the rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, hereinafter referred to as Decree No. 1137). The amounts of tax accepted for deduction at rates of 20 and 10% are reflected in line 120 of section 3 of the tax return, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. MMB-7-3/ [email protected]

Important features are not only the correct execution of VAT registers, but also income tax registers. And ConsultantPlus experts talk about them in detail. Get free demo access to K+ and go to the ready-made solution to find out all the details of this procedure.

How to find VAT registers in 1C 8.3

Cumulative registers for accounting for value added tax contain all the necessary information. After setting the appropriate settings in the accounting policy section, all VAT accounting operations will fall into the required registers.

Where to find VAT registers in 1C 8.3

On the main menu tab “All functions” we see a list - these are the registers.

The recorder clearly displays all the information. Which section each individual register is responsible for can be determined from its name:

- the “Purchase VAT” register is responsible for the accuracy of incoming VAT;

- the “VAT sales” register serves as the basis for the sales ledger;

- The “VAT submitted” register contains information about the VAT amounts submitted by suppliers.

The registers are of the same type in structure, but depending on the information content of each individual register, differences are also observed in the form of additional rows or columns. Register lines are active and are associated with the document. By double clicking the mouse you can open a document from the list. The concept of “Posting a document” in the 1C program means not only the formation of transactions, but also the creation of a line in the appropriate register, and sometimes even in several.

It happens that situations arise in accounting that require re-entering the VAT registers. This occurs when an error is detected, or when closing a period, when all documents of the closing period are reposted. For example, there was a change in the price of already sold products or services. What should I do? The documents “Adjustment of sales” and “Adjustment invoice” are created. If the total sales amount has increased, then the adjustment documents go into the sales book, otherwise - into the purchase book. Similarly, changes are made in the event of changes in the prices of purchased goods or services. We create the “Receipt Adjustment” document, post it and check the movement according to the registers.

At the end of the reporting period, the balances in the registers must agree with the balances according to accounting data. If discrepancies occur, the data must be brought into compliance.

Is it possible to align VAT registers? In the event that errors were made in the previous period, the document “Adjustment of register entries” is applied. Errors of the current period are corrected by adjustment documents.

Let's take a closer look at the main VAT accounting registers in 1C. To begin with, let’s look at the principles of tax accounting, the transactions that reflect transactions, which entries are included in the registers and at what stage. When accounting for VAT, the following transactions are generated:

- Dt 19 Kt 60 - input VAT upon purchase;

- Dt 68 (VAT) Kt 19 - input VAT for deduction (inclusion of the amount in the purchase book).

- Dt 90, 91 Kt 68 (VAT) - VAT calculation (sale of goods, work, services).

Based on the results of the reporting period:

- debit balance of account 68 - VAT is refundable;

- credit balance of account 68 - subject to payment to the budget.

The debit and credit turnover on account 68 for the reporting period should be equal to the incoming VAT from the sales ledger and the outgoing VAT from the purchases ledger, respectively.

Read more about this in the article “Reflection of VAT in accounting and tax accounting.”

VAT register of purchases

The register is a list of acquisition documents; data from it forms the “Purchases Book” report.

Entries are entered into the purchase book after the following documents have been processed (clause 2 of Appendix 4 to Rules No. 1137):

- shipping invoice;

- invoice for prepayment;

- adjustment invoice when the cost decreases;

- invoice in connection with changes in the terms of the contract or its termination.

In order for the operation to be correctly reflected in the program and included in the required register, you need to remember to click the “Register invoice” button when filling out all the information fields in the invoice.

VAT register presented

This is an intermediate register, it records information on incoming VAT. In the “Incoming” line, an entry is made after posting the incoming invoice, which coincides with the debit of account 19 “VAT on purchased assets.” The entry in the “Expense” line comes from the credit of account 19, incoming VAT is accepted for deduction, and the document “Creating purchase ledger entries” duplicates the entry in it.

Procedure for maintaining an invoice journal

The rules for maintaining a journal of issued/received invoices and the approved form of this register are also established by Resolution No. 1137. The journal itself consists of 2 parts, with the first part recording issued invoices, and the second - received ones. According to the current rules, in the invoice journal:

- it is possible to reflect information about intermediary activities in the first and second parts of the journal;

- It is possible to carry out separate registration of corrected invoices, including corrected adjustment documents.

See also the material “How to fill out an invoice journal.”

In accordance with paragraphs. 3, 3.1 and 9 art. 169 of the Tax Code of the Russian Federation, the journal of invoices can be kept not only on paper, but also in electronic format.

NOTE! Only the electronic form of the journal is submitted to the Federal Tax Service.

You should also take into account the norms of Resolution No. 1137 regarding the fact that all pages of purchase and sales books must be laced and numbered. The same resolution also contains requirements for the form of filling out and maintaining books. Let's look at them in more detail.

Tax registers for value added tax

Tax registers in terms of VAT accounting include an invoice, journals of issued and received invoices, a purchase book and a sales book.

An invoice is a document that serves as the basis for accepting the presented tax amounts for deduction or reimbursement from the budget.

Errors in invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as the tax rate and tax amount when conducting a tax audit, presented to the buyer are not grounds for refusal to accept tax amounts for deduction.

The invoice issued for the sale of goods (work, services), transfer of property rights must indicate:

1) serial number and date of the invoice;

2) name, address and identification numbers of the taxpayer and buyer;

3) name and address of the shipper and consignee;

4) the number of the payment and settlement document in case of receiving advance or other payments for upcoming deliveries of goods (performance of work, provision of services);

5) name of the goods supplied (shipped) (description of work performed, services provided) and unit of measurement (if it is possible to indicate it);

6) quantity (volume) of goods (work, services) supplied (shipped) according to the invoice, based on the units of measurement adopted for it (if it is possible to indicate them);

6.1) name of the currency;

7) price (tariff) per unit of measurement (if it is possible to indicate it) under the agreement (contract) excluding tax, and in the case of using state regulated prices (tariffs) that include tax, taking into account the amount of tax;

the cost of goods (work, services), property rights for the entire quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights without tax;

9) the amount of excise tax on excisable goods;

10) tax rate;

11) the amount of tax imposed on the buyer of goods (works, services), property rights, determined based on the applicable tax rates;

12) the cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, taking into account the amount of tax;

13) country of origin of the goods;

14) number of the customs declaration.

The procedure for maintaining a log of received and issued invoices, purchase books and sales books is established by the Government of the Russian Federation. Thus, Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” was approved:

-form of the invoice used in calculations of value added tax, and the rules for filling it out in accordance with Appendix # 1;

- the form of the adjustment invoice used when calculating value added tax, and the rules for filling it out in accordance with Appendix No. 2;

-form of the journal for recording received and issued invoices used in calculations of value added tax, and the rules for its maintenance in accordance with Appendix No. 3;

-the form of the purchase book used in calculations of value added tax, and the rules for its maintenance in accordance with Appendix No. 4;

-the form of the sales book used in calculations of value added tax, and the rules for its maintenance in accordance with Appendix No. 5.

Procedure for maintaining a purchase book

The obligation to maintain a purchase book is established for buyers who are VAT payers (clause 3 of Article 169 of the Tax Code of the Russian Federation). You can keep a purchase book in both paper and electronic format. The rules for maintaining and the form of the book are fixed by Resolution No. 1137.

IMPORTANT! Tax authorities will not accept for deduction an invoice signed in facsimile. It will not be possible to defend the right to deduction even in court.

If you enter a corrected invoice into the purchase ledger, you should cancel the erroneous invoice with negative values and enter the corrective invoice with positive values. If an adjustment invoice is submitted at the end of the tax period, you should draw up an additional sheet of the purchase book and submit an updated declaration if the amount of tax claimed for deduction turned out to be overstated.

Learn how to fill out a purchase ledger.

Recording the type of movement Arrival

For tax amounts accepted for accounting, when posting receipt documents, entries with the type of movement Receipt are entered into the register . Such an entry is a potential entry in the purchase ledger. She is “waiting” for all conditions to be met for the right to accept VAT as a deduction in the program.

According to invoice No. 125 dated January 16, 2018, goods were received from the supplier Computers Lab LLC in the amount of RUB 3,204,880. (including VAT RUB 488,880).

When posting goods under the Receipt document (act, invoice), the program generated a record of the Receipt in the VAT register presented for the amount of incoming VAT.

Read more in the articles:

- Acceptance of VAT for deduction for 3 years

- Acceptance of VAT for deduction on fixed assets entered into the Criminal Code

- Acceptance of VAT for deduction on purchased fixed assets

Procedure for maintaining a sales book

The sales book records invoices, including adjustment ones, as well as other documents that are provided for by the rules for maintaining the sales book, approved by Decree No. 1137. The same resolution approved the form of this document. The format for maintaining the sales book in electronic form was approved by order of the Federal Tax Service of the Russian Federation dated 03/04/2015 No. ММВ-7-6/ [email protected] (as amended on 04/01/2019).

The obligation to maintain a sales book is assigned to both taxpayers and those who are exempt from paying tax (Articles 145 and 145.1 of the Tax Code of the Russian Federation, clause 3 of the rules for maintaining a sales book, approved by Resolution No. 1137). The obligation to maintain a sales book is also assigned to all enterprises and individual entrepreneurs that are not taxpayers, but perform the functions of tax agents in situations provided for in paragraphs. 1–5 tbsp. 161 Tax Code of the Russian Federation.

As for the procedure for making corrections in the sales book, the moment of their entry plays a big role here. So, if changes are made in the current reporting period, then only the deleted invoice with a negative value is reflected and the corrected document with a positive value is entered (clause 11 of the rules for maintaining a sales ledger). In cases where the tax period has ended, corrections can only be made by filling out an additional sheet of the book for the reporting period in which the erroneous document was registered.

Read about the nuances of filling out a sales book here.

Blog

What is product traceability?

In short, traceability refers to control over certain categories of goods when imported into the Russian Federation and when they are sold. This control is planned to be carried out by assigning registration numbers of batches of goods (RNPT). Such numbers will be assigned by the customs/tax service to each batch of goods.

In this way, the path of goods imported from other countries from the importer to the final buyer or other disposal will be traced. This is necessary in order to exclude illegal goods from circulation on the Russian market.

In this regard, all individual entrepreneurs and companies, regardless of the taxation system they choose, will have to reflect the following:

- VAT payers - in their invoices;

- VAT defaulters - in shipping documents.

Electronic invoice

For controlled goods, invoices, including adjustment ones, should be prepared electronically and exchanged with buyers or suppliers using electronic document management operators. This requirement is absolutely mandatory for every individual entrepreneur and company. This means that buyers must independently ensure the ability to accept documents electronically.

We are announcing summer discounts on EDI setup!

Setting up electronic document management in your 1C - 1,800 rubles.

1,300 rub. Please check with the manager for special conditions for our clients. ORDER A CONSULTATION Please note that there is no need for an electronic invoice if state-controlled goods:

- sold to a self-employed individual (not for business purposes);

- implemented and transferred from the Russian Federation to the EAEU;

- transferred for export or re-export.

When working with an electronic invoice, you should rely on.

Invoice

Let's analyze all the innovations, dividing them into groups.

1. Innovations for all taxpayers:

| Added line 5a – “Shipment Document” | Column 1 “Item No.” appeared |

| This line is needed to record the number and date of the shipment document, i.e. the document on the basis of which the invoice was generated. Note that line 5a remains empty for advances. | This column carries enormous meaning and is connected with the new line 5a. The fact is that an invoice can be issued on the basis of several shipping documents, and then in line 5a you will need to indicate the line numbers in which the goods relate to a specific shipping document. Such documents should be separated by a “;”. It will look like this: Shipping document: No. 1-3 No. 24 dated 07/16/2021; No. 4-6 No. 32 dated July 22, 2021. |

2. Changes for companies transacting with traceable goods:

| Column 11 acquired the name “Registration number of the declaration for goods or registration number of a batch of goods subject to traceability” | Two new columns 12 and 12a have been added | Column 13 appeared |

| It should be filled out as follows: 1. RNPT - for regulated goods; 2. Registration number of the customs declaration for the rest. It is important to remember that the invoice can simultaneously reflect data on both state-controlled goods and all others. | These columns reflect information about the product code and unit of measurement. Information is entered in accordance with the OKEI directory. | The quantity of controlled goods is indicated here. |

This is what the new invoice looks like (see Figure 1).

Rice. 1. New invoice form

It is worth noting that if the traced goods have the same name, unit of measurement and price, but have different RNPT, then one line of the product in the invoice will correspond to several lines in columns 11-13. In this case, the data in columns 2, 2a and 12, 12a, as a rule, will coincide.

Please note that individual entrepreneurs or companies should not fill out new details if they have not made transactions with tracked goods.

Adjustment invoice

The innovations will also affect the adjustment invoice. Let's look at the main ones in the table.

| Columns 10 and 10a appeared | Columns 11-13 appeared |

| In these columns you must indicate the code and name of the country of origin of the product. Please pay attention to the original invoice; if these columns are filled in, then the adjustment columns should not be empty. Let us remind you that columns 10 and 10a are filled in for goods whose country of origin is not the Russian Federation. | The rules for filling out columns 11-12a are discussed above. If there are no indicators in these columns in a regular invoice, then they should not be in the adjustment invoice. As for column 13, it provides for the reflection of information in the line “A (before the change)”, “B (after the change)”, “C (increase)” or “D (decrease)”. |

Having undergone such changes, the invoice forms became almost identical (see Fig. 2).

Rice. 2. Adjustment invoice

VAT return, tax registers and report on transactions with goods subject to traceability

Amendments to legislation naturally led to changes in reporting forms and tax registers, and a new report appeared.

The composition of the submitted reporting on transactions with traceable goods directly depends on whether the individual entrepreneur or organization is a VAT payer.

| VAT payers | VAT evaders |

| If the VAT payer has made transactions with controlled goods for which he issued an invoice, then for the 3rd quarter of 2022 he reflects information about such goods in a new VAT return (Federal Tax Order No. ED-7-3/228 dated March 26, 2021), and in updated sales and purchase books. In other cases, for example, if the goods were purchased from a VAT non-payer or excluded from traceability, the taxpayer is required to submit a report on transactions with goods subject to traceability. | VAT defaulters are required to reflect all transactions with traceable goods in the report. |

The report will be quarterly. It should be submitted to the Federal Tax Service in electronic form, starting from the 3rd quarter of 2022, no later than the 25th day of the month following the reporting quarter.

Traceability is not labeling

Do not confuse traceability and labeling. These accounting systems have completely different approaches. For clarity, we present their main differences in the table.

| Tracking | Marking |

| · consignment of goods is tracked; · the code is not physically applied to the product; · a report or a new VAT declaration is submitted. | · each unit of goods is tracked; · physically apply the code to the product; · no special report. |

Errors in invoices and fines for violations

Please note that taxpayers have the right to claim a VAT deduction, even if the invoice contains incorrect information on regulated goods or does not contain them at all.

There are sanctions for violating the established rules, but they will be in effect starting in 2022.

| Violation | Amount (rub.) |

| For each document on the shipment/sale of goods without indicating traceability information | 1 000 |

| Failure to submit required reports on time | 5 000 |

| Repeated violation within a year | 20 000 |

Accounting in the 1C: Enterprise Accounting 3.0 program

In order to automate these changes, it is necessary to update the program to release 3.0.95. In 1C, traceability information has been added to the form of regular and adjustment invoices. Accounting for traceable goods according to RNPT has also been implemented - the receipt and disposal of such goods.

Of course, it is very important to update to this release in a timely manner. Since it is necessary to make program settings in advance to make it easier to work with traceable goods. We strongly recommend that you familiarize yourself with all the innovations in the program in order to carry out competent accounting of transactions with traceable goods in the future.