To whom and at whose expense is sick leave paid?

According to Article 2 of Law No. 255-FZ of December 29, 2006, temporary disability benefits are mandatory paid only to employees hired under an employment contract. Is sick leave subject to personal income tax in the case of payments to performers providing services under a civil contract? No, because these individuals cannot qualify for sickness compensation from the employer and the Social Insurance Fund, respectively, and tax withholding does not occur due to the lack of a tax base.

The benefit for the first three days of illness of an employee is paid at the expense of the employer, the remaining days until the restoration of working capacity or the establishment of disability - at the expense of the Social Insurance Fund. Insurance premiums are not charged on the benefit amount. The employer must accrue the money within 10 days from the date of presentation of the certificate of incapacity for work, and transfer it along with the payment of the next salary.

Sample filling

Let's look at a sample of filling out a certificate form for individuals and tax authorities.

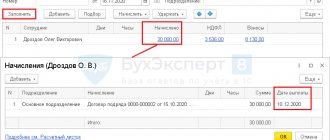

Let's say Savelyeva A.P. provided sick leave issued from November 5, 2019 to November 15, 2019 to her employer on November 16, 2019. She was awarded temporary disability benefits in the same month. But the amount was paid in December, along with the salary for November and financial assistance.

We recommend additional reading: Where to get a certificate of income 2nd personal income tax if you do not work

When issuing a certificate for an employee, this type of remuneration must be reflected in section 3, which records information on income accrued and received by individuals in cash and in kind (in value terms) and types of material benefits in chronological order by month of the tax period using the provisions deductions.

In the first column, denoting “month,” the months from January to December are indicated chronologically in digital values. We are interested in November and December. Which field is the correct one to show income in?

According to Art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of benefits for personal injury is considered to be the moment of payment, therefore it is correct to indicate in the certificate the amount accrued for sick leave in December.

Therefore, in the form, in the line corresponding to the 12th month, we enter the income code “2300” and indicate the amount accrued according to the LN - 3000 rubles.

Let's consider how to correctly reflect “carrying-over personal income” if payments were accrued in December, and actual receipt took place in January. According to the letter of the Federal Tax Service R No. BS-3-11 / [email protected] dated October 21, 2016, the amount must be paid in the month when it is directly paid.

For example, Ivashov V.I. was on sick leave from December 10, 2019 to December 16, 2019. LN was provided to the HR department on the first working day. Calculations were made in the accounting department, and on December 27, 2019, temporary disability benefits were accrued in the amount of 5,456 rubles. 50 kopecks for 7 days. The personal income tax amount was 709.3 rubles. But to receive money is 4747.2 rubles. Ivashov V.I. will be able only on January 10, 2020, because payments in December have already taken place. Consequently, this type of remuneration will be included in the certificate for 2022.

By analogy, Appendix to Personal Income Tax Certificate 2 for the tax office is filled out.

Another nuance that is worth paying attention to is how to correctly reflect in the reporting the additional payment up to the average earnings under code 4800. The question is whether it is worth breaking the accrued benefit into 2 parts - separately the amount paid at the expense of the Social Insurance Fund and separately the additional payment by the employer itself.

Due to the fact that the tax is calculated on the total amount, it should not be divided into two indicators and recorded in the reporting as total income.

We recommend additional reading: Why do you need a certificate of income 2nd personal income tax from your previous place of work?

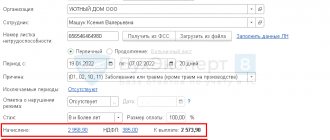

Transfer of personal income tax from sick leave in 2022

When paying for sick leave, the employer acts as a tax agent, i.e. must withhold income tax and transfer it to the budget. The personal income tax rate in 2022 when paying sick leave has not changed and is set at 13%.

As for the tax base for calculating personal income tax, it depends on whether your region is participating in the Social Insurance Fund pilot project. In general, income tax is withheld from the entire payment, without dividing it into the part that is paid by the employer and the part that is paid additionally by social insurance.

Example: Employee of Vega LLC Alekseeva N.A. I was treated in the hospital for 10 days. Based on the certificate of incapacity for work, the accountant calculated the patient’s benefit in the amount of 12,780 rubles. Of these, three days were paid for at the expense of the organization (1278 * 3 = 3834 rubles), and another 7 days were paid for at the expense of the Social Insurance Fund (1278 * 7 = 8946 rubles). Considering that the entire amount was paid by the company along with the salary, personal income tax is withheld by the organization as a tax agent. Let's calculate the income from benefits: 12780 * 13% = 1661.4 rubles. Alekseev will receive 12780 – 1661.4 = 11118.6 rubles.

Personal income tax on sick leave: pilot project of the Social Insurance Fund

In the example above, the employer withheld tax on all income, including the portion paid from the social security fund. In general, the FSS reimburses this amount after the employer submits an application for debt reimbursement according to Form 4-FSS.

Since 2012, the Social Insurance Fund launched a pilot project “Direct Payments”, within the framework of which the part that is supposed to be paid from social insurance funds is sent directly to the employee. The goal of the project is to effectively use budget funds, protect the interests of workers from unscrupulous employers who delay or fail to pay benefits, reduce cases of insurance fraud, and reduce errors in calculations.

According to the Decree of the Government of the Russian Federation dated April 21, 2011 No. 294, the following regions are participating in the implementation of the pilot project:

| Region | Period of participation in the project |

| Karachay-Cherkess Republic and Nizhny Novgorod region | 01.01.2012 – 31.12.2019 |

| Khabarovsk Territory and Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions | 01.07.2012 – 31.12.2019 |

| Republic of Crimea, Sevastopol | 01.01.2015 – 31.12.2019 |

| Republic of Tatarstan and Belgorod, Rostov, Samara regions | 01.07.2015 – 31.12.2019 |

| Republic of Mordovia and Bryansk, Kaliningrad, Kaluga, Lipetsk, Ulyanovsk regions | 01.07.2016 – 31.12.2019 |

| Republic of Adygea, Republic of Altai, Republic of Buryatia, Republic of Kalmykia, Altai and Primorsky territories, Amur, Vologda, Magadan, Omsk, Oryol, Tomsk regions and Jewish Autonomous Region; | 01.07.2017 – 31.12.2019 |

| Republic of Sakha (Yakutia), Trans-Baikal Territory, Vladimir, Volgograd, Voronezh, Ivanovo, Kemerovo, Kirov, Kostroma, Kursk, Ryazan, Smolensk, Tver regions; | 01.07.2018 – 31.12.2019 |

| Republic of Dagestan, Republic of Ingushetia, Republic of Karelia, Republic of Komi, Republic of North Ossetia-Alania, Republic of Khakassia, Kabardino-Balkarian Republic, Udmurt Republic, Chechen Republic, Chuvash Republic, Arkhangelsk, Tula, Yaroslavl regions | 01.07.2019 – 31.12.2019 |

Is personal income tax deducted from sick leave during the pilot project? Yes, of course, but in a special order:

- The employer pays from his own funds only three sick days and withholds personal income tax only from this amount;

- Starting from the 4th day of illness, the benefit is transferred at the expense of the Social Insurance Fund, which also acts as a tax agent for this amount.

If we return to our example, the accountant of Vega LLC will withhold income only from the amount that was paid from the organization’s funds (1278 * 3 = 3834 rubles). The income tax will be 3834 * 13% = 498.42 rubles, and the employee will receive 3335.58 rubles. The rest of the money will be transferred directly to her by the FSS.

In this case, the tax agent for the amount transferred from social insurance funds is the fund itself. The employer is not responsible for withholding and transferring income tax to the budget from this part of the income.

When to transfer income tax from sick leave

When to transfer personal income tax from sick leave in 2022? Before January 1, 2016, the deadlines for paying income tax on employee income were as follows:

- no later than the day of receipt of cash from the bank or transfer to the account of an individual;

- in other cases (for example, when paying income from proceeds) - no later than the day following the day of actual receipt of income.

By Law No. 113-FZ of May 2, 2015, this procedure was changed, and from January 1, 2016, personal income tax on sick leave and vacation pay must be transferred no later than the last day of the month in which such income was paid (Article 226 (6) of the Tax Code of the Russian Federation).

Don’t want to experience difficulties in maintaining accounting and tax records? Open a current account with Tinkoff Bank and get online accounting for free.

Samples

A sample certificate for employees, which contains the sick leave income code (“2300”), which is relevant today:

The same document, when submitted to the Federal Tax Service, looks different and is drawn up on two sheets. Typically, a report is submitted to the tax office based on the results of the past year. The document is generated automatically and sent electronically. A separate certificate is generated for each employee.

Personal income tax from sick leave in certificate 2-NDFL

In 2022, the form of a certificate of income for individuals is in effect, approved by order of the Federal Tax Service dated January 17, 2022 No. ММВ-7-11 / [email protected] The code for payment for temporary disability has not changed, so code 2300 must be indicated on the help page. This category includes only sick leave payments, because maternity payments are not subject to income tax.

Please note that although the benefit is paid on the same day as the next next salary, the dates for receiving these two types of income differ:

- the date of receipt of income in the form of wages is the last day of the month for which it was accrued;

- the date of receipt of income for the period of illness is the day of payment to the employee.

For example, in August 2022, the employee was accrued wages and benefits for the period of incapacity for work in the same month, and on September 5 they were paid. The month of receiving income in the form of salary (code 2000) in the certificate will be August, and sick leave (code 2300) will be September, although both amounts were paid at the same time.

What is the code for?

Help 2-NDFL consists of sections:

- Information about the tax agent (employer).

- Information about the individual who is the recipient of the income.

- Payments taxed at different rates.

- Standard and social tax deductions.

- Tax base and tax amount.

Taking into account the fact that the document fits on one sheet, and some names of types of income and deductions consist of several dozen words, they are replaced with digital designations that are selected from the reference book in the accounting program when generating the report. The list of types of income and deductions is contained in the Federal Tax Service order No. ММВ-7-11/ dated September 10, 2015 (as amended by the Federal Tax Service order No. ММВ-7-11/633 dated November 22, 2016).

ConsultantPlus experts discussed how to submit reports in Form 2-NDFL. Use these instructions for free.