Regulatory regulation

Depending on the terms of the agreement (clauses 1-2 of article 624 of the Civil Code of the Russian Federation, clause 1 of article 19, clause 1 of article 28 of the Federal Law of October 29, 1998 N 164-FZ):

- the leased property becomes the property of the tenant upon expiration of the lease term or before its expiration, subject to the tenant paying the entire redemption price stipulated by the agreement (if this is expressly stated in the agreement);

- The parties have the right to enter into an additional agreement, establishing in it the conditions for early redemption.

The redemption price of the leased asset is determined by agreement of the parties (Article 421 of the Civil Code of the Russian Federation, clause 1 of Article 424 of the Civil Code of the Russian Federation, clause 1 of Article 485 of the Civil Code of the Russian Federation).

The lease purchase price is written off through depreciation

How to correctly write off the redemption price of leased items if it includes the total amount of lease payments?

The company took into account lease payments in full in other expenses. Is it correct?

We will consider the answer in the Resolution of the Arbitration Court of the Moscow District dated October 8, 2019 in case No. A40-72107/2018.

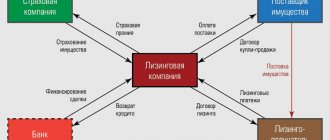

About leasing

Leasing or finance lease agreements are a type of rental agreement. They are regulated by Chapter 34 of the Civil Code and Federal Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)”.

The main difference between a leasing agreement and a lease is the acquisition of property by a leasing company specifically for rental and, as a rule, with the subsequent transfer of ownership to the lessee.

Under the leasing agreement, the lessee, in particular:

- accepts the leased asset under the contract;

- pays lease payments to the lessor;

- upon expiration of the lease agreement, returns the leased item or acquires it into ownership.

Payments are established in cash. Natural form is also possible.

Most often, the lease payments also include the purchase price of the property.

What nuances are important to consider:

- on whose balance sheet it is listed;

- who bears the costs of delivery, installation and bringing the leased item to a condition suitable for use. Please note that the lessee can take them into account as part of other expenses during the term of the leasing agreement;

- who pays for maintenance, current and major repairs of the leased asset.

The following must be drawn up: a leasing agreement, an act of acceptance and transfer of the leased asset, invoices for payment issued by the lessor, payment documents for payment of these invoices, invoices, an act of acceptance and transfer of the leased asset upon return to the lessor.

The lessee is obliged to pay lease payments from the moment the leased asset begins to be used.

Who depreciates the leased property?

Depreciation is calculated by the party to the transaction that has the leased asset on its balance sheet (Clause 2, Article 31 of Law No. 164-FZ).

In addition, the parties to the leasing agreement have the right, by mutual agreement, to apply accelerated depreciation of the leased asset, but for this, the condition for accelerated depreciation must be enshrined in the agreement. The coefficient value is not higher than 3.

The special coefficient does not apply to property, incl. and vehicles belonging to the third depreciation group (clause 2 of article 259.3 of the Tax Code of the Russian Federation).

Purchase price and leasing payments

The purchase price for the leased asset is determined by the parties to the contract. These are cases of transfer of ownership of the leased asset to the lessee.

The ransom amount can be paid in a single lump sum or in regular installments.

It should be noted that the redemption value of the leased asset is not a payment for the use of the leased asset (unlike current payments), but an expense for the acquisition of a fixed asset. Therefore, it should be isolated from current expenses and taken into account separately (keep separate records), since when determining the tax base for income tax, expenses for the acquisition of depreciable property are not taken into account (clause 5 of Article 270 of the Tax Code of the Russian Federation).

Thus, the lease payment is an expense to the extent that it is paid for receiving the leased asset for temporary possession and use. And the redemption price is written off at the end of the lease agreement upon redemption. If the lessee pays it in parts simultaneously with the lease payments, then these partial amounts are advances.

Leasing payments are classified as other expenses and taken into account on the date of payment or on the last day of the month (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

The redemption price forms the initial cost of the leased asset (Article 257 of the Tax Code of the Russian Federation). When it is transferred into ownership by the lessee, the redemption price cannot be taken into account in current expenses. It must be written off through depreciation.

What do the courts note?

The judges note that the legality of accounting for parts of the redemption price as an advance, which cannot be written off as current income tax expenses, complies with the accounting rules and numerous clarifications of the Russian Ministry of Finance. For example, letters dated November 24, 2015 No. 03-03-06/1/68220, letters dated February 12, 2016 No. 03-03-06/3/7617, letters dated November 6, 2018 No. 03-03-06/ 2/79754.

The Arbitration Court of the Moscow District, in its Resolution dated October 8, 2019 in case No. A40-72107/2018, considered this situation. The company took into account the entire amount of leasing payments (including redemption amounts) in other expenses. During the inspection, the Federal Tax Service identified an error, because the redemption price should form the initial cost of the object and then be written off through depreciation.

The arbitration court recognized the tax authority's decision to hold the person liable as legal and justified.

Accounting for the “redemption” of the leased asset

If, during the period of validity of the contract, the leased property was accounted for on the balance sheet of the lessee, then on the date of transfer of ownership, the asset must first be transferred to its own fixed assets. This is done by internal entry in accounts 01 “Fixed Assets” and 02 “Depreciation of Fixed Assets”.

Example. Leased property on the balance sheet of the lessee

Amega LLC entered into a leasing agreement for a period of three years in October 2022. Cost of leased property (amount of lease payments for the entire period of validity of the contract) RUB 1,500,000. Let's look at an example without VAT.

The useful life of the object is 5 years (60 months). Under the agreement, the leased property becomes the property of the lessee after payment of the entire amount of lease payments stipulated by the agreement. During the term of the agreement, the leased asset is recorded on the balance sheet of the lessee. In October, the property was received and put into operation. Depreciation is calculated using the straight-line method.

The following entries were made in the accounting of Amega LLC:

on the date of transfer of the leased property

DEBIT 08 CREDIT 76

— 1,500,000 rub. — the debt to the lessor is reflected;

DEBIT 01 SUBACCOUNT “LEASING PROPERTY” CREDIT 08

— 1,500,000 rub. — the cost of leased property is reflected in fixed assets.

during the period of validity of the leasing agreement (monthly):

DEBIT 20 CREDIT 76

— 41,667 rub. (RUB 1,500,000: 36 months) - monthly lease payment accrued;

DEBIT 76 CREDIT 51

— 41,667 rub. — the leasing payment is transferred.

during the contract period, monthly starting from November 2019

DEBIT 76 CREDIT 02 SUBACCOUNT “LEASING PROPERTY”

— 25,000 rub. (RUB 1,500,000: 60 months) - depreciation has been calculated.

on the date of transfer of ownership (at the end of the contract)

DEBIT 01 SUB-ACCOUNT “OWN FIXED ASSETS” CREDIT 01 SUB-ACCOUNT “LEASING PROPERTY”

— 1,500,000 rub. — the leased asset is transferred to its own fixed assets;

DEBIT 02 SUB-ACCOUNT “LEASING PROPERTY” CREDIT 02 SUB-ACCOUNT “OWN FIXED ASSETS”

— 900,000 rub. — the amount of accrued depreciation is transferred to the depreciation subaccount for own fixed assets.

If during the term of the agreement the leased property was accounted for on the lessor’s balance sheet, then on the date of transfer of ownership the lessee writes off the cost of the leased asset from off-balance sheet account 001 “Leased fixed assets”. At the same time, the accountant must make an entry for this cost:

Debit 01 “Fixed assets” Credit 02 “Depreciation of fixed assets” subaccount “Depreciation of own fixed assets”.

Example. Leased property on the lessor's balance sheet

Let's take the conditions from the previous example.

During the term of the contract, the leased asset is recorded on the lessor's balance sheet. In October 2022, the property was received and put into operation. Depreciation is calculated using the straight-line method.

The following entries have been made in the accounting of the lessee organization:

on the date of transfer of the leased property

DEBIT 001

— 1,500,000 rub. — the cost of the leased property is reflected off the balance sheet.

during the contract period, monthly

DEBIT 20 CREDIT 76

— 41,667 rub. — monthly leasing payment has been accrued;

DEBIT 76 CREDIT 51

— 41,667 rub. — the leasing payment is transferred.

at the end of the contract

CREDIT 001

— 1,500,000 rub. — the cost of the leased property is written off;

DEBIT 01 CREDIT 02

— 1,500,000 rub. — the cost of the purchased leased property is reflected in fixed assets.

Step-by-step instruction

The organization is a lessee under a lease agreement for a BMW 520d car. The leased object is recorded on its balance sheet:

- total cost under the contract (initial cost in the used book) - RUB 3,513,600. (including VAT 20%);

- cost according to the acceptance certificate (cost of the lessor's expenses) - 2,040,000 rubles;

- The useful life of used and used units is 60 months.

On April 20 (12 months later) the Organization entered into an additional agreement with the lessor on early repurchase:

- the contract amount was reduced by 600,000 rubles. (including VAT 20%);

- the redemption price was RUB 2,210,880. (including VAT 20%).

On April 20, the Organization transferred the final payment under the leasing agreement in the amount of the redemption value of RUB 2,210,880. (including VAT 20%).

On April 21, the lessor provided documents for redemption.

The lease payment for April was not paid before the buyout.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Adjustment of settlements with the lessor | |||||||

| 20 April | 76.07.1 | 76.07.9 | 100 000 | Reducing calculations for input VAT by the difference under the agreement | Debt Adjustment - Other Adjustments | ||

| 76.07.1 | 91.01 | 500 000 | Write off the difference in the value of the contract in accounting | Debt Adjustment - Other Adjustments | |||

| Transfer of advance payment to the lessor | |||||||

| 20 April | 60.02 | 51 | 2 210 880 | 2 210 880 | Transfer of payment to the supplier | Debiting from the current account - Payment to the supplier | |

| Adjustment of the value of leased property in NU | |||||||

| 20 April | 000 | 01.K | 500 000 | Reducing the difference in cost in NU and BU by the amount of reduction in liabilities | Manual entry - Operation | ||

| Redemption of leased property, acceptance of own fixed assets for accounting | |||||||

| April 21 | 60.01 | 60.02 | 2 210 880 | 2 210 880 | 2 210 880 | Advance offset | Redemption of leased items |

| 76.07.1 | 60.01 | 1 842 400 | 1 842 400 | Redemption of leased property | |||

| 19.01 | 60.01 | 368 480 | 368 480 | Acceptance for VAT accounting | |||

| 76.07.1 | 76.07.9 | 368 480 | Reducing calculations for vehicle input VAT | ||||

| 26 | 02.03 | 48 000 | Calculation of the latest depreciation | ||||

| 01.01 | 01.03 | 2 928 000 | 2 040 000 | 2 040 000 | Moving the OS to your own | ||

| 02.03 | 02.01 | 585 600 | Transfer of depreciation | ||||

| 02.03 | 01.01 | 374 000 | 374 000 | Transfer of depreciation to NU | |||

| 01.01 | 01.K | 176 400 | 176 400 | Transferring the non-depreciable part to the NU | |||

| Registration of SF supplier | |||||||

| April 21 | — | — | 368 480 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 368 480 | Acceptance of VAT for deduction | ||||

| — | — | 368 480 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

Essential terms of the leasing agreement

Let us remind you that such conditions are considered essential, without the agreement of which the parties can recognize the contract as not concluded. The first such condition for a leasing agreement is the subject of the agreement, i.e. description of the leased property , and it must be specified even more clearly and in detail than in a regular lease agreement.

So, if a vehicle is transferred under a leasing agreement, then it is necessary to indicate not only the model and make of the car, but also its year of manufacture, body type and gearbox, engine size and power. Such specification of the subject of the agreement also reduces the risk that the lessee will file a claim with the lessor that the property that he indicated in the application was not leased.

The second essential condition is the leasing term , i.e. the period for which the lessor provides the lessee with the property for temporary possession and use. When determining the lease term, it is necessary to take into account the useful life of the leased property.

It is also important not to confuse the leasing term with the validity period of the agreement itself, because the obligation to transfer leasing payments arises from the moment the lessee receives the property under the acceptance certificate, and not from the moment the agreement is signed. In addition, the lease term must coincide with the term of the contract.

If, for example, the contract is concluded for five years, and the leasing term is specified as three years, then a dispute may arise over what rights and obligations the parties have after the end of the leasing term. The court, as a rule, recognizes that the contract terminated simultaneously with the expiration of the leasing term, but it is better to synchronize these terms in advance.

It is important that, unlike a regular lease agreement, it is not allowed to conclude an open-ended lease agreement or conclude it for an indefinite period.

As for information about the seller , although the law does not explicitly state this condition as essential, the courts give a broad interpretation of the subject, citing Article 665 of the Civil Code of the Russian Federation and considering this information necessary. At the same time, the Presidium of the Supreme Arbitration Court of the Russian Federation in one of its decisions indicated that even if the parties do not determine the seller in the leasing agreement, the agreement will still be considered concluded. And yet, in order to reduce the risk of recognizing the leasing agreement as not concluded or its reclassification into a lease agreement, the condition on the seller must be agreed upon.

Another condition regarding the purpose of using the leased property was essential until 2010, because Article 665 of the Civil Code of the Russian Federation contained the wording “for business purposes.” Despite this, in judicial practice there are still court decisions in which indicating the purpose of use of leased property is called necessary.

Additionally, it is necessary to agree on such terms of the leasing agreement, in relation to which the law does not establish mandatory (mandatory) norms, but which can significantly expand the scope of the party’s obligations:

- the responsibility for maintenance, major and current repairs of the leased property (in the general case lies with the lessee);

- obligation to insure the leased asset;

- responsibility for the safety of the leased item and the risks associated with its damage, theft, loss, premature breakdown, installation or operation error (in general, lies with the lessee);

- the risk of failure by the seller to fulfill its obligations under the purchase and sale agreement and the risk of the leased asset not meeting its intended purpose of use (in general, it is borne by the party that chose the seller).

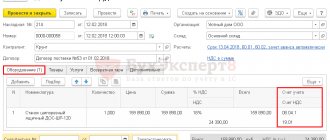

Transfer of payment to the lessor

Repayment of debt to the lessor is reflected in the document Write-off from the current account transaction type Payment to the supplier in the Bank and cash desk - Bank statements section.

Please indicate:

- Amount - the amount under the additional agreement on early repurchase (in our example - RUB 2,210,880);

- Expense item - Acquisition, creation, modernization and reconstruction of non-current assets (in our example, the entire amount is the redemption value of the fixed assets).

Postings according to the document

The document generates the posting:

- Dt 60.02 Kt - advance payment transferred to the lessor.

Adjustment of the value of leased property in NU

The initial cost in the NU of the OS that has become its own is the redemption price of the leased property. In the future, it is recognized as expenses through the calculation of depreciation (clause 1 of Article 256 of the Tax Code of the Russian Federation, clause 1 of Article 257 of the Tax Code of the Russian Federation).

Analyze the report Balance sheet for account 01 with selection by fixed asset - leasing object. Indicators - BU and NU.

In the program, account 01 in the accounting system reflects the initial cost of the fixed assets, taking into account all leasing (rental) payments. In connection with the decrease in the lease obligation, the difference between the cost of the used book and the standard for it decreases, accordingly. Therefore, you need to reduce the balance in account 01.K on the date of conclusion of the agreement using the Transaction document entered manually in the Transactions .

Please indicate:

- Debit - 000 “Sub account”;

- Loan - 01.K “Adjustment of the value of leased property”; Subconto 1 - leasing OS.

FSBU 25/2018: how a lessee can reflect a buyout in 1C:Accounting 8

How in “1C: Accounting 8” edition 3.0 the lessee can reflect additional costs associated with the receipt of the leased asset

Based on the conditions of the Example, the Tax accounting of property switch should be set to the Lessor position.

It is also known that the lessee determines the initial discounted value of the obligations directly using the actual discount rate.

What does this mean?

According to the recommendation of the BMC dated September 11, 2015 No. R-65 “Discount rate”, the initial discounted value of the lessee’s obligations is considered to be the price of acquisition by the lessor of the leased asset from the supplier minus advance payments.

Because the original present value of the liability can be determined directly, the entity applies the actual discount rate. The effective discount rate is the interest rate that, when applied, brings future cash amounts payable to the original discounted value of the liability, determined directly.

In other words, determining the initial discounted value of an obligation directly means determining it directly on the basis of the conditions and circumstances of concluding the relevant transaction without applying the discounting procedure.

In this case, in “1C: Accounting 8 KORP” in the Valuation in accounting field, select the value Equal to the lessor’s expenses.

The actual rate and interest expenses are calculated based on the payment schedule. To fill out the payment schedule using the Payment Schedule hyperlink, you should go to the form of the same name, where you indicate the amounts and dates of payments in accordance with the leasing agreement (you can use the Fill button to automatically fill it out). The amount calculated in the Total field (7,344 thousand rubles) of the tabular part of the document must correspond to the total amount of the payment schedule indicated in the Total payments line.

Accounting accounts in the Lease Receipt document are set by default.

By clicking the Print button, a Help-calculation of interest expenses is available, which illustrates the procedure for calculating the actual discount rate and the total amount of interest expenses (Fig. 2). All amounts in the certificate are indicated excluding VAT.

Rice. 2. Help-calculation of interest expenses

Let's analyze the indicators indicated in columns 1-6 of the first tabular part of the Help-calculation of interest expenses:

- column 1 - total amount of payments under the agreement (RUB 6,120 thousand);

- column 2 - advance payment made on the date of provision of the leased asset (500 thousand rubles);

- column 3 - nominal value of the lease obligation (6,120 thousand rubles - 500 thousand rubles = 5,620 thousand rubles);

- column 4 - the actual cost of the leased asset, which corresponds to the price of purchase by the lessor of the leased asset from the supplier (5,000 thousand rubles);

- column 5 - discounted (present) value of the lessee's obligations, calculated as the price of acquisition by the lessor of the leased asset from the supplier minus advance payments (RUB 4,500 thousand);

- Column 6 - actual discount rate (59.2553% per annum), which is calculated using a mathematical formula for determining the current present value of a set of cash flows based on data on the nominal and discounted value of the lease obligation, taking into account the payment schedule.

The amount of accrued interest is determined as the product of the lease obligation at the beginning of the period for which interest is accrued and the interest rate. Interest is accrued on the date of the lease payment and at the end of the month (clause 19 of FSBU 25/2018). The results of calculating interest expenses are reflected in the second tabular part of the Certificate of Calculation of Interest Expenses. According to the terms of the Example, the total amount of interest under the leasing agreement is 1,120 thousand rubles.

When posting the document Acceptance of leasing, accounting entries are generated, as well as entries in the registers of the OS accounting subsystem. The accounting entries are presented in Table 1.

Table 1. Postings upon receipt of the leased asset

At the end of January 2022, when performing the routine operation Accrual of interest expenses, which is included in the Month Closing processing (this routine operation is available only in 1C: Accounting 8 KORP), the following entry is generated in accounting:

Debit 91.02 Credit 76.07.5

- for the amount of interest expenses, which is 6 thousand rubles. according to the Help-calculation of interest expenses (see Fig. 2).

Regular leasing operations

Since February 2022, the lessee has been accounting for monthly lease payments using the Leasing Services document (Purchases section - Receipts document (acts, invoices, UPD) with the Leasing Services transaction type), Fig. 3.

Rice. 3. Leasing services

The transactions generated when posting the Leasing Services document are shown in Table 2.

Table 2. Postings when reflecting monthly lease payments

At the end of February, when performing monthly routine operations Depreciation and depreciation of fixed assets, Recognition of lease payments in tax accounting and Accrual of interest expenses, the recognition of expenses is reflected in accounting and tax accounting. The postings are shown in Table 3.

Table 3. Postings when performing routine operations

The calculation of expenses for leasing operations in accounting and tax accounting can be analyzed using reference calculations:

- Depreciation;

- Recognition of expenses on fixed assets received for rent;

- Accrual of interest expenses.

From March to July 2022, the lessee reflects monthly transactions for calculating lease payments.

When processing Month Closing, the routine operations of Depreciation and Depreciation of Fixed Assets, Recognition of Rental Payments in Tax Accounting, and Accrual of Interest Expenses are performed.

A complete picture of leasing payments at the end of July can be obtained by generating a balance sheet for account 76.07 “Lease payments” (Fig. 4):

Rice. 4. SALT according to account 76.07

- the nominal amount of the balance of lease obligations, including VAT, is RUB 3,744 thousand. (600 thousand rubles x 6 months + 144 thousand rubles). This is the credit balance of account 76.07.1;

- there are no outstanding lease payments. This is evidenced by the zero credit balance of account 76.07.2;

- the balance of the amount of interest to be included in expenses until the end of the contract is reflected in the debit of account 76.07.5 and amounts to 281 thousand rubles;

- the amount of VAT on the balance of lease obligations (624 thousand rubles) is separately accounted for as the debit of account 76.07.9;

- the reduced (discounted) amount of the balance of lease obligations is RUB 2,839 thousand. This is the collapsed credit balance of account 76.07.

In addition, account 60.02 “Settlements for advances issued” takes into account the advance paid to the lessor in July 2022 in the amount of 600 thousand rubles. (including VAT 20%).

This advance is credited in August 2022 when calculating the lease payment.

Changing the terms of the leasing agreement

According to the terms of the Example, in August 2022, the parties agreed on the early purchase of the leased asset in November 2022, and therefore the total amount of the contract, including VAT, is reduced by 60 thousand rubles. This means that the nominal amount of the balance of lease obligations, including VAT, is now RUB 3,684 thousand. (3,744 thousand rubles - 60 thousand rubles).

Changes in leasing conditions in the program are reflected in the document of the same name (section OS and intangible assets). Figure 5 shows the completed document.

Rice. 5. Change of leasing terms

When changing the leasing terms in 1C:Accounting 8 (in the basic and PROF versions), you must indicate the new balance of lease obligations and the new expiration date of the contract.

Based on these indicators, the cost of PSA and the amount of monthly depreciation are recalculated in accounting.

In “1C: Accounting 8 KORP” you will additionally need to adjust the payment schedule and discount rate (if necessary).

According to the conditions of the Example, in the Valuation in accounting field, you should select the value Calculated at the rate and indicate the actual discount rate (59.2553%), the value of which was automatically determined in the program when posting the document Acceptance of leasing. It is also necessary to make changes to the payment schedule, since the amounts and the expiration date of the leasing agreement change.

Let’s assume that, according to an additional agreement to the leasing agreement, the organization must pay the balance of lease payments and the redemption value of the leased asset on November 25, 2021.

Now the total amount in the new payment schedule is 3,684 thousand rubles, and it is equal to the amount of the document Change of leasing terms specified in the Total field. If these amounts are not equal, the program will indicate an error and will not post the document.

Changing the payment schedule entails a recalculation of the present value of the obligation, as well as the amount of interest expenses for the remaining term of the agreement. The procedure for such recalculation is given in the Help-calculation of interest expenses, which is available from the document Change of leasing terms by clicking the Print button (Fig. 6).

Rice. 6. Certificate of calculation of interest expenses after changes in leasing conditions

Let's analyze the indicators indicated in columns 1-5 of the first tabular part of the Calculation Certificate (all amounts are indicated excluding VAT):

- column 1 - the amount of remaining lease payments and the redemption value of the leased asset in case of early redemption (RUB 3,070 thousand);

- column 2 - advance payment made on the date of change in leasing conditions (500 thousand rubles);

- column 3 - the nominal value of the balance of lease obligations minus the advance payment (3,070 thousand rubles - 500 thousand rubles = 2,570 thousand rubles);

- column 4 - discount rate (59.2553% per annum);

- column 5 - present value of the balance of lease obligations minus the advance payment (RUB 2,323 thousand).

The amount of interest to be included in expenses until the end of the contract is now 247 thousand rubles. The results of calculating interest expenses are reflected in the second tabular part of the Calculation Certificate.

Thus, as a result of changes in leasing conditions:

- The present value of the balance of lease obligations is reduced by 16 thousand rubles. (2,839 thousand rubles - 500 thousand rubles - 2,323 thousand rubles);

- the actual cost of PSA is also reduced by 16 thousand rubles. and now amounts to 4,984 thousand rubles. (5,000 thousand rubles - 16 thousand rubles) (clause 21 of FSBU 25/2018);

- rental interest is reduced by 34 thousand rubles. (281 thousand rubles - 247 thousand rubles).

When posting the document Change of leasing terms, transactions are generated (Table 4).

Table 4. Postings when changing leasing conditions

From August to October 2022, the lessee continues to accrue lease payments in the amount of 600 thousand rubles. per month (including VAT 20%). Regulatory operations are also carried out: Recognition of lease payments in NU (in the amount of 500 thousand rubles) and Accrual of interest expenses (in amounts according to the Calculation Certificate).

The routine operation Depreciation and depreciation of fixed assets is not performed in August, since depreciation of PSA for August has already been accrued when the leasing conditions change. From September 2022, when performing the routine operation Depreciation and depreciation of fixed assets, depreciation of PSA is calculated based on new parameters:

- 4,984 thousand rubles. — actual cost of PSA;

- RUB 1,458 thousand — accumulated depreciation ((5,000 thousand rubles / 24 months) x 7 months);

- RUB 3,525 thousand — residual value of PSA, taking into account rounding to the nearest thousand rubles. (4,984 thousand rubles - 1,458 thousand rubles);

- 17 months - remaining useful life (24 months - 7 months);

- 207 thousand rubles. — amount of depreciation (3,525 thousand rubles / 17 months).

The depreciation calculation can be analyzed using the Depreciation Calculation Help.

Redemption of the leased asset

In November 2022, according to the payment schedule, the lessee pays the last lease payment to the lessor (1,140 thousand rubles, including 20% VAT), as well as the redemption value of the leased asset (144 thousand rubles, incl. VAT 20%).

The leasing payment for November 2022 is accrued on the remaining amount of payments under the contract without taking into account the redemption price (RUB 1,740 thousand, including VAT 20%). This payment takes into account an advance payment in the amount of 600 thousand rubles. (incl. VAT 20%), paid in October.

Thus, at the end of November 2022, before performing routine operations in the lessee’s accounting:

- on account 60.02, as an advance issued to the lessor, the amount of the redemption value of the leased asset is taken into account (144 thousand rubles, including VAT 20%);

- the debt on lease payments, recorded on account 76.07.1, corresponds to the amount of the redemption price and amounts to 144 thousand rubles. (including VAT 20%);

- in accounting, the actual cost of PSA is 4,984 thousand rubles;

- in the accounting system, accrued depreciation on PPA is 1,873 thousand rubles. ((5,000 thousand rubles / 24 months) x 7 months + (3,525 thousand rubles / 17 months) x 2 months);

- in accounting book the residual value of PSA is 3,111 thousand rubles. (4,984 thousand rubles - 1,873 thousand rubles);

- in NU recognized expenses on leasing payments amounted to 4,550 thousand rubles. (500 thousand rubles x 9 months - adjustment of 50 thousand rubles);

- the balance of lease payments, the amount of which will be included in NU expenses, is 1,570 thousand rubles. (6,120 thousand rubles - 4,450 thousand rubles).

To reflect the transfer of ownership of the leased asset, it is necessary to create a document Redemption of leased assets (section OS and intangible assets).

The header of the document should indicate the lessor, the agreement with the lessor, the event occurring with the leased asset (for example, Transfer of ownership).

On the Leasing Items tab, you should indicate the leased item and its redemption value (Fig. 7).

Rice. 7. Redemption of the leased asset

Invoices are automatically entered on the Accounting tab:

- for rental obligations - account 76.07.1;

- accounting for own fixed assets - account 01.01;

- accounting for depreciation of own fixed assets - account 02.01.

The Tax Accounting tab is filled out as follows:

- in the field The procedure for including the redemption value in expenses, set the value Accrual of depreciation, since the redemption price exceeds 100 thousand rubles;

- leave the Calculate depreciation flag set by default;

- in the Useful life (in months) field, indicate the period for determining the depreciation rate of your own fixed assets. The useful life can be reduced by the number of months of operation of this property as a leased fixed asset (Clause 7, Article 258 of the Tax Code of the Russian Federation). According to accounting data, SPI is 14 months. (24 months - 10 months);

- in the Special coefficient field - leave the default coefficient of 1.00.

In relation to the purchased property, the lessee has the right to apply a depreciation bonus (clause 9 of Article 258 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 18, 2012 No. 03-03-06/1/253), but such a condition is not provided for in the Example, therefore the Depreciation bonus tab not filled in.

When posting the document Redemption of leased items, accounting entries are generated, as well as entries in the registers of the OS accounting subsystem. The accounting entries are presented in Table 5.

Table 5. Postings when purchasing the leased asset

When performing monthly routine operations in November 2021, depreciation on a car with a trailer is not accrued in accounting, and leasing payments are also not recognized as tax expenses, since these operations have already been taken into account when carrying out the document Redemption of leased items.

When performing the operation Accrual of interest expenses, interest expenses for the last month of the financial lease are reflected in accounting (see Fig. 7):

Debit 91.02 Credit 76.07.5

- in the amount of 34 thousand rubles.

Thus, upon expiration of the leasing agreement on November 30, 2021, after the document Redemption of leased items and the completion of routine operations, the lease obligation is fully repaid, therefore the balance on all subaccounts of account 76.07 is reset to zero. For a vehicle with a trailer transferred to its own OS, depreciation parameters are set:

- in accounting, the initial cost of the object does not change and amounts to 4,984 thousand rubles;

- accrued depreciation in accounting records is RUB 2,080 thousand;

- in accounting book, the residual value, taking into account rounding to the nearest thousand, is 2,903 thousand rubles. (4,984 thousand rubles - 2,080 thousand rubles);

- in BU the remaining SPI is 14 months;

- in NU the cost of the object is equal to the redemption value and amounts to 120 thousand rubles;

- in NU the useful life is 14 months.

Accounting for your own OS after its redemption

From December 2022, when performing the routine operation Depreciation and depreciation of fixed assets for a car with a trailer transferred to its own fixed assets, depreciation is calculated in accounting and tax accounting. The postings are shown in Table 6.

Table 6. Postings for depreciation of own fixed assets

In January 2023, a car with a trailer will be completely depreciated in used and used units.

From the editor. On April 1, 2021, 1C:Lecture Hall hosted an online lecture “FSBU 25/2018 “Rent Accounting”: support in “1C:Accounting”” with the participation of a 1C expert.

See in particular:

- E. Kalinina. Features of accounting for leasing operations by the lessee;

- E. Kalinina. FSBU 25/2018 for the lessor;

- E. Kalinina. Answers on questions.

Redemption of leased property

Complete the redemption of property in the same way as redemption at the end of the contract with the document Redemption of leased items , from the section OS and intangible .

Specify the redemption date, Counterparty and Agreement . On the Lease Items , clicking the Fill will fill the tabular part automatically with the balances of lease obligations accounts as of the specified date.

On the Accounting , check the completion:

- Lease obligations : Accounting account - 76.07.1 “Rease obligations”.

- Accounting account - 01.01 “Fixed assets in the organization”;

On the Tax Accounting , specify:

- The procedure for including the redemption value in expenses - you can choose from 3 options: Depreciation - if the redemption value of the fixed asset is more than 100 thousand rubles. (in our example we choose this order);

- Inclusion in expenses upon acceptance for accounting - if the redemption value of the fixed asset is 100 thousand rubles. or less;

- The cost is not included in expenses - if the cost of the OS cannot be taken into account in the NU;

Postings according to the document

The document generates transactions:

- Dt 60.01 Kt 60.02 - offset of the advance payment to the supplier at the purchase price;

- Dt 76.07.1 Kt 60.01 - redemption of fixed assets;

- Dt 19.01 Kt 60.01 - acceptance of VAT for accounting;

- Dt 76.07.1 Kt 76.07.9 - write-off of lease liability in terms of VAT;

- Dt Kt 02.03 - accrual of depreciation for fixed assets in leasing for the last time;

- Dt Kt 02.03 - adjustment in NU of excessively accrued depreciation;

Under the conditions of our example, the lease payment was not paid in April, so there is no recognition of expenses in the NU.

- Dt 01.01 Kt 01.03 - transfer of fixed assets to the composition of our own;

- Dt 02.03 Kt 02.01 - transfer of depreciation accrued in accounting for the period of the leasing agreement;

- Dt 02.03 Kt 01.01 - adjustment of the cost of fixed assets in NU due to depreciation;

- Dt 01.01 Kt 01.K - adjustment of the cost of fixed assets in NU due to the non-depreciable part.

Check the balance sheet for account 01.

After adjustment, the cost of fixed assets in NU is equal to the redemption value (2,210,880 – 368,480 = 1,842,400 rubles).

Starting from the next month after the purchase of fixed assets, depreciation accrual in NU is reflected based on the new initial cost using the routine operation Depreciation and depreciation of fixed assets in the Month Closing procedure.

Let's check the calculation of depreciation at the new cost in NU:

- 1 842 400 / 48 = 38 383, 33

In accounting, the amount of depreciation continues to be accrued in the same order:

- 2 928 000 / 60 = 48 800

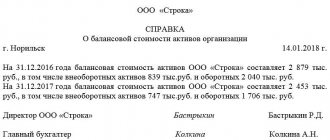

Reflection of leasing transactions by the Lessee when accounting for property on the lessee’s balance sheet

Accounting

The initial cost of leased property in accounting is the sum of all payments under the leasing agreement (security payment, preliminary payments, leasing payments, redemption value).

The useful life is equal to the term of the contract.

The property purchased at the end of the contract term is accepted as a new fixed asset or inventory, depending on the value of the redemption value.

Table 1 - Typical entries for leasing transactions*

| Contents of operation | Debit | Credit |

| Accounting for leased property | ||

| Received property from the lessor | 08 | 76-L/AO |

| The total amount of VAT under the agreement is reflected | 19 | 76-L/AO |

| Leased property is included in the fixed assets | 01-L | 08 |

| Depreciation accrued on leased property | 20 (25,26,44) | 02-L |

| The cost of depreciated leased property was written off at the end of the contract | 02-L | 01-L |

| Property received at redemption price | 10 (08) | 76-L/V |

| The property was accepted for accounting at the redemption value | 01 | 08 |

| Accounting for security deposit | ||

| Security payment transferred | 76-L/A | 51 |

| VAT reflected on the security deposit | 19 | 76-L/A |

| Accepted for deduction of VAT from the security deposit | 68 | 19 |

| Security deposit credited | 76-L/TP | 76-L/A |

| Recovered VAT from advance payment | 76-L/TP | 68 |

| Accounting for leasing payments | ||

| Lease payment paid | 76-L/TP | 51 |

| Lease payment accrued | 76-L/AO | 76-L/TP |

| Accepted for deduction of VAT on leasing payment | 68 | 19 |

| Accounting for redemption value | ||

| Redemption price paid | 76-L/V | 51 |

| VAT is reflected on the redemption price | 19 | 76-L/V |

| Accepted for deduction of VAT from the redemption price | 68 | 19 |

| Property received at redemption price | 10 (08) | 76-L/V |

| The property was accepted for accounting at the redemption value | 01 | 08 |

Tax accounting

The initial cost of leased property in tax accounting is the price of its acquisition, which is specified in the leasing agreement (the cost of the leased asset).

The useful life is determined according to general rules (in accordance with OKOF). If the property belongs to the fourth to tenth depreciation groups, then accelerated depreciation can be charged with an increasing factor of up to 3 inclusive.

Leasing payments are included in other expenses on a monthly basis. In this case, the amount of such expense is determined as the difference between the accrued lease payment and accrued depreciation (for the current month). If the calculation results in a negative value, then the lease payment is not taken into account in expenses.

It is necessary to ensure that the total amount of expenses recognized by you does not exceed the total amount of payments provided for in the agreement. In case of such an excess, it is necessary to stop recognizing lease payments as expenses.

Important: the leasing company is exempt from the obligation to issue monthly certificates of services rendered, so you can accept expenses for accounting based on accrual schedules, offset of advance payments and received invoices.

The redemption value can be taken into account only after the expiration of the lease agreement and the transfer of ownership of the leased property to your organization. There are two options for attributing the redemption value to expenses:

- if it is less than or equal to 100,000 rubles. - one-time as material expenses;

- if it is more than 100,000 rubles. - as the cost of purchasing a new OS object. In this case, the asset is accepted for accounting; according to the general rules, its useful life is established and depreciation is calculated.

You can fully deduct VAT on lessor invoices in the periods in which they are received. In this case, the lessor issues two types of invoices: for advance payment and for sale.

The first type of invoice is issued for the security payment (if it is not credited as a lump sum in the month of payment) and the difference between the accrued and actually paid lease payment (if it is negative). At its discretion, the lessee may not accept such invoices for accounting. However, if you have deducted VAT on the basis of an advance invoice, this VAT will need to be restored in the period when the security payment is credited and the leasing payment is accrued.

Invoices for sales are issued by the lessor in accordance with the schedule for calculating lease payments and offsetting the advance payment. An invoice for the surrender value is issued at the end of the lease agreement. Such documents are accepted by the lessee in accordance with the general procedure.

Registration of SF supplier

To register an incoming invoice, indicate its number and date at the bottom of the form of the document Redemption of leased items , click the Register .

If in the document Invoice received for receipt, the Reflect VAT deduction in the purchase book by date of receipt checkbox is selected , then when it is posted, a posting will be made to accept VAT for deduction Dt 68.02 Kt 19.04.

- Operation type code : “Receipt of goods, works, services.”

Reporting

Transactions on early redemption of fixed assets are not reflected in the income tax return.

The amount of income from writing off part of the lease payments will be reflected in the Financial Results Report:

- page 2340 “Other income”. PDF

See also:

- Is it possible to deduct VAT when purchasing a leased asset early?

- Step-by-step accounting of leasing in 1C 8.3 on the lessee’s balance sheet

- Accounting for leased property on the balance sheet of the lessee under PBU 18/02

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Early repurchase of the leased asset from the tenant until 2022 (PROF) The 1C: Accounting 8.3 PROF program has implemented opportunities for early use…

- Early repurchase of the leased asset from the lessee (KORP) In the 1C: Accounting 8.3 CORP program, opportunities for early use…

- On accounting for leasing payments and the redemption value of the leased asset, the Ministry of Finance explained the nuances of accounting for leasing payments for the purpose of calculating tax...

- Sales of products during the month of production at planned cost and in subsequent periods at actual cost Sales of finished products are the final stage of the turnover of funds spent on...

What changes in accounting for expenses in the form of rent in tax accounting?

So far, it was necessary to follow numerous bureaucratic explanations: monthly payments in the form of redemption value were classified as advances associated with the acquisition of property. They are not taken into account in tax accounting until ownership of the object passes from the lessor to the lessee.

From January 1, 2022, this approach was applied directly in Tax Code.

If the lease payment includes the redemption value of the property, then the lessee forms its expenses minus this value.

Please note that this new policy applies if the lease agreement is entered into in 2022 or later. If the agreement was concluded in 2022 or earlier, tax accounting of leased property must be maintained according to the previous rules until the expiration of the agreement (Article 2 of Law No. 382-FZ).

Law No. 382-FZ introduced another innovation that concerns property tax. From January 1, 2022, property that is rented out is taken into account on its balance sheet only by the lessor, as the owner.