What securities can be called valuable?

Securities are, first of all, shares and shares, bonds, bills, checks and mortgages. To make these terms more understandable, we can give them the following brief definitions:

- Shares secure the right of the owner of this security to claim part of the company's profits in the form of dividends.

- The bond allows the holder to claim its face value, as well as a specified interest.

- The share assigns to its owner the opportunity to receive part of the property assets of the enterprise.

- A bill of exchange is a document certifying that a certain person (citizen or organization) must pay a second person a specific amount of money within a limited time period.

- A check is a piece of paper that is directly associated with the bank. On a check, the owner specifies an amount and instructs the bank to pay that amount to a specific person or business.

What are securities?

Securities are documents confirming special property rights. Let's look at their types:

- Shares that give the right to receive part of the JSC's profits in the form of dividends.

- Bonds pay their face value as well as interest.

- A share gives the right to part of the company's property.

- A promissory note implies confirmation that one participant in the relationship must pay money to the other participant within a given period.

- Based on the check with the specified amount, the banking institution pays the funds to the other participant.

Typically, commercial firms purchase stocks and bonds.

Features of securities valuation

Accounting for securities involves valuation. It can be carried out in various directions:

- Nominal cost. This is the price that is indicated on the paper itself. Considered a conditional value. That is, it does not reflect the actual cost of the paper.

- Market price. It is formed based on the values of supply and demand. The greater the demand, the higher the price. This type of cost gives an idea of the actual cost of the paper for a certain period.

- Book value. Represents the cost on the basis of which securities are recorded on the balance sheet.

- Accounting value. This is the value that is recorded in the accounting accounts.

- Liquidation value. It represents the cost of the liquidated joint-stock company, accrued per share.

If there is a difference between the nominal and market valuation, appropriate entries are made.

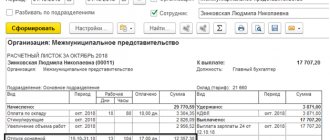

Example of securities accounting

Securities, the information on which is presented above, can be divided into main and auxiliary. The first ones include shares and shares (account 58.1), and the auxiliary ones include the remaining papers (bills, checks, bonds, etc.) (account 58.2). Securities are primarily involved in the processes of acquisition, sale, disposal and accrual of interest. In some cases, it is possible to transfer and write them off.

Ordinary legal entities and entrepreneurs, as well as legal entities and individual entrepreneurs who are engaged in the movement of such securities at a professional level, can participate in the movement of securities on the market. In accounting, there are entire sets of operations for specific situations, where it is necessary to make a large number of transactions and identify absolutely all operations performed in a certain situation. Let's give an example involving securities.

The simplest example: a company purchased shares of a bank at a price of 1,500 rubles, although the par value of the shares was 1,000 rubles. The only forced expense is payment to the issuer. Meanwhile, the maximum maturity of bonds was only 2 years. The income on the bonds was paid to their owner every six months at a rate of 40% per annum. Next, we will create a table in which we will record all the operations that occurred in this situation.

| No. | The content of the action | Debit | Credit | Transaction amount |

| 1 | The value of the bonds is paid to their original owner (issuer) | 76 | 51 | 1500 |

| 2 | The book value of the bonds is reflected | 58.1 | 76 | 1500 |

| 3 | Dividends accrued | 76 | 91 | 300 |

| 4 | Dividends transferred | 51 | 76 | 300 |

| 5 | The share by which the bond price has decreased is reflected | 91 | 58 |

Similar transactions can occur with shares (which happens most often), and with bills, and with other types of securities. This example includes five transactions, but most often transactions in such examples can reach twenty. The main thing here is to correctly calculate the amount and debit with credit. In accounting, securities are reflected at their book value.

Difficulties of balance sheet classification of securities

The result of accounting for transactions with the Central Bank is ultimately reflected in the accounting reports presented to interested users.

Wherein:

- the presence of securities at the end or beginning of the reporting period is indicated in the balance sheet;

- the result of manipulations with the Central Bank is reflected in the financial performance report (financial results report), even if the Central Bank is not listed in the accounting accounts as of the reporting date.

The balance sheet of the Central Bank may be reflected as follows:

- long-term or short-term financial investments (subject to the compliance of the Central Bank with the requirements of PBU 19/02 “Accounting for financial investments”, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n);

- own capital (own shares purchased from shareholders);

- other assets and liabilities (for example, in relation to bills or bonds, depending on their type and purpose of acquisition).

The issue of classification by maturity in the balance sheet of financial investments recognized by the Central Bank has a number of features.

ATTENTION! To reliably divide the value of securities listed in accounting at the end of the reporting period into long-term and short-term, it is necessary to have information about the period of their expected circulation (repayment).

Let's look at a few examples:

- shares: purchased for the subsequent formation of a financial group are long-term investments, and those purchased for immediate enrichment through quick resale are short-term financial investments;

- to reflect a bill of exchange with a circulation period of 1.5 years (18 months) as part of long-term financial investments means to mislead users of financial statements (distort the indicators of balance sheet lines), if the bill of exchange was purchased by a company with the purpose of resale in a short period of time (in a month or two) .

ATTENTION! When reflecting the Central Bank in the balance sheet, it is necessary to adhere to the principle of the predominance of the economic content and business conditions over the legal form (clause 6 of PBU 1/2008 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n).

In order to streamline the process of reflecting the Central Bank in the reporting, it is better not to be lazy and “invent” an internal local act based on the norms of the law on the procedures for recognition in accounting and classification in the reporting of the Central Bank. It will allow a businessman to protect himself from fines for distorting reporting lines in situations of disagreement with tax authorities and will bring uniformity to intra-company approaches to accounting and reporting algorithms.

The materials on our website will tell you what internal company local acts look like:

- “Regulations on official business trips - sample 2021”;

- “Regulations on remuneration of employees - sample 2021.”

Common mistakes in securities accounting

It's no secret that accounting is a delicate matter, and you can't make a mistake. Even the smallest mistake will have consequences. Below we list the most common mistakes that accountants make when accounting for securities. The first common mistake is related to the execution of bills. Incorrect design will result in incorrect wiring.

The next mistake is in accounting for the buyer’s own bill. It is reflected by 58 scores. But here it is very important to know whether the buyer issued his bill or transferred it to third parties. In the first case, the bill must be reflected in the debit of account 62 (settlements with buyers and customers). And in the second case, you need to reflect the bill as a debit and assign it to the short-term debt account.

The third mistake is again related to bills. A bill of exchange (and any other security) can be obtained free of charge from the supplier (contractor). And many companies mistakenly believe that they do not have to report to the tax authorities for this. But this is not so, even for gratuitous receipts a legal entity is obliged to report to the Federal Tax Service. And the last common mistake is that the costs of selling securities are indicated in the expense item. This cannot be done; the costs of selling securities will not help reduce tax payments.

Results

Accounting for securities in accounting is carried out differently for the seller and the buyer; a set of nuances is taken into account: the purpose and type of the security, the purpose of its purchase, etc.

To reliably reflect securities in reporting, it is necessary to adhere to the principle of priority of the economic content of business transactions over their form.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical entries for accounting for the sale of securities (CB)

Valuation method based on average initial cost.

The cost of securities being written off is determined by multiplying the number of securities being retired by the average initial cost of one security of this type.

The average initial cost of one security of a given type is calculated as the quotient of dividing the cost of securities by their number, respectively adding up

The data is provided for one type of securities (table)

from the value and quantity of the balance at the beginning of the month and of securities received this month.

1) Average initial cost of one security:

(RUB 100,000 + RUB 50,000 + RUB 66,000 + RUB 96,000): 290 = RUB 1,075.86

2) The cost of the balance of securities at the end of the month: 130 x 1075.86 rubles. = 139,862 rub.

3) Cost of retiring securities:

312,000 rub. — 139,862 rub. = 172,138 rubles, or 160 x 1075.86 rubles. = 172,138 rub.

FIFO method.

Valuation of securities using the FIFO method is based on the assumption that they are sold within a month in the order in which they were received. The valuation of securities in balance at the end of the month is carried out at the actual cost of the most recent acquisition, and the sale price takes into account the cost of the earlier securities.

1) The cost of the balance of securities at the end of the month, based on the cost of recent purchases: (80 × 1200) + (50 × 1100 rub.) = 151,000 rub.

Income tax on the sale of securities

Transactions with securities can be carried out by both professional securities market participants and non-professional participants.

Let's consider accounting for income tax on transactions with securities of organizations that are not professional participants in the organized securities market (hereinafter referred to as ORTS).

Calculation of the tax base

The receipt of income by an organization leads to the obligation to calculate and pay income tax in the manner prescribed by Article 280 of the Tax Code.

The calculation of the tax base of organizations conducting both ordinary types of activities and transactions with securities depends on whether they are listed on the ORS or not (clause 8 of Article 280 of the Tax Code of the Russian Federation). This is expressed in more detail as follows:

- the tax base for transactions with securities is calculated separately from the tax base for other business transactions;

- the tax base for securities traded on the ORSM and the tax base for securities not traded on the ORSM are determined separately.

We would like to remind you that the criteria for recognizing securities as traded on the securities market are determined by paragraph 3 of Article 280 of the Tax Code.

Profit (loss) from these operations should also be accounted for separately (Article 329 of the Tax Code of the Russian Federation).

it is important

The sales price indicator depends on whether the securities being sold (retired) are listed on the securities market or not.

What goes into income

When selling securities, the organization’s income consists of:

- selling prices of securities;

- accumulated interest (coupon) income (ACI) paid by the buyer.

Presentation of securities for redemption leads to the receipt of income consisting of:

- amount repaid by the issuer (drawer);

- interest (coupon) income paid by the issuer (issuer).

These norms are established by paragraph 2 of Article 280 and Article 329 of the Tax Code.

The amounts of interest (coupon) income previously taken into account when taxing profits are not included in the amounts of income from sales. It should not be forgotten that these rules are not applicable when donating securities, since in this case there is no economic benefit.

For profit tax purposes, income and expenses from operations in core activities and from operations with securities are accounted for separately.

If the amount of loss from the main activity exceeds the profit received from transactions with securities, the object of taxation for income tax does not arise.

Determine the selling price of securities

When selling securities traded on the securities market, it is necessary to calculate the market price. It corresponds to the actual sales price if certain conditions are met (clause 5 of Article 280 of the Tax Code of the Russian Federation).

The market price interval must be between the minimum and maximum prices of transactions with a security that is registered by the organizer of trading on the securities market on the date of the relevant transaction.

If transactions are carried out on a specified date through more than one trade organizer, the taxpayer independently selects the organizer to determine the price range.

If the selling price is lower than the minimum price established on the ORTS, the minimum price of the interval is accepted. In the absence of information about the price interval of interest, the organizers take the trading interval for the nearest date, accepted for at least one auction completed over the last 12 months.

If, on the date of the securities transaction, trading was carried out through two or more trade organizers, then you can independently select the trade organizer whose price interval indicators you will use when determining the selling price (paragraph 2, clause 5, article 280 of the Tax Code of the Russian Federation).

The fact of a transaction is recognized either on the date of the auction or on the basis of the terms of the contract.

When taxing securities that are not traded on the securities market, the actual selling price is also taken into account. A necessary condition is that the price must fall within the price range registered by the trade organizer on the date of the transaction or on the nearest of the last 12 months of dates of transactions on a similar security.

Also, the actual price must be within 20 percent of the price deviation downward and upward from the weighted average price of a similar security on the date of the transaction.

If there is no information about similar securities or if the market price for them has not been established, the transaction price is subject to adjustment to the settlement price. If the estimated price turns out to be lower than the actual price, the actual price is accepted (clause 6 of Article 280 of the Tax Code of the Russian Federation).

The estimated price of a share is determined by the taxpayer independently or with the assistance of an appraiser. To determine the settlement price of a debt security, the refinancing rate of the Bank of Russia is used. When independently determining the estimated share price, the cost estimation method must be enshrined in the company's accounting policies.

If the selling price of a security exceeds the maximum limit from the price range on the securities market on the date of the transaction, the company should not reduce income to the level from the interval. The tax base must be calculated based on the sales price (letter of the Ministry of Finance of Russia dated March 21, 2006 No. 03-03-04/1/269).

Accumulated interest (coupon) income

Interest income should be understood as any pre-declared income, including in the form of a discount, received on a debt obligation of any type (clause 3 of Article 43 of the Tax Code of the Russian Federation). Such income is taken into account when calculating profit tax on transactions with securities as part of non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation). When accounting for it, it is necessary to maintain analytical records for each type of securities. It reflects the interest due in accordance with the terms of the issue, and for bills of exchange - with the conditions of their issue or transfer (clause 1 of Article 328 of the Tax Code of the Russian Federation).

When applying the accrual method, income in the form of interest on securities whose maturity spans several reporting periods is recognized at the end of each reporting period. It is necessary to proceed from the profitability established for the security and the number of days it is held by the organization (clause 6 of Article 271, clause 1 of Article 328, clause 4 of Article 328 of the Tax Code of the Russian Federation). Interest income is recognized on the date of its repayment if the security is redeemed before the expiration of the reporting period (clause 6 of Article 271 of the Tax Code of the Russian Federation).

Under the cash method, interest income is taken into account on the day the funds are received in the current account or at the cash desk, as well as on the date the debt is repaid in another way (clause 2 of Article 273 of the Tax Code of the Russian Federation).

attention

A loss received in the current reporting period on transactions with securities is not taken into account as a reduction in profit from core activities.

Taking into account expenses

The procedure for determining sales costs is established by paragraph 2 of Article 280 of the Tax Code. The general procedure for determining expenses is expressed in the formula:

| Expenses upon sale (disposal) | = | Purchase price (including purchase costs) | + | Accumulated interest paid to the seller | + | Implementation costs |

The amounts of accumulated interest income previously taken into account for taxation are not included in expenses associated with the sale of securities.

Three methods of accounting for the price of securities for profit tax purposes (clause 9 of Article 280 of the Tax Code of the Russian Federation):

- at the cost of the first acquisitions (FIFO);

- at the cost of recent acquisitions (LIFO);

- at unit cost (clause 9 of article 280, article 329 of the Tax Code of the Russian Federation).

The use of FIFO and LIFO methods is more suitable for accounting for issue-grade securities. The cost estimation method is used for non-equity securities, such as a check, bill of exchange, bill of lading, etc.

As a rule, the FIFO method is used when prices are expected to fall, and LIFO when prices rise. Their use is possible when the taxpayer has at least two securities of the same issuer, of the same type and of the same category.

Additional expenses when purchasing securities are included in the purchase price.

Since the listed expenses are direct, that is, subject to write-off as securities are sold (disposed of), they should be taken into account in proportion to the disposed securities. Accordingly, the part of such expenses that falls on unrealized securities is not taken into account for tax purposes.

All expenses associated with the acquisition of securities and taking into account their features are included in the price of such a security, but are taken into account only when selling securities (clause 2 of Article 280 of the Tax Code of the Russian Federation).

Profit from the sale of securities

In accordance with paragraph 1 of Article 247 of the Tax Code, profit is understood as the positive difference between income and expenses from operations for the sale of securities obtained at the end of the reporting period. It is taxed at a general tax rate of 24 percent.

A negative difference between income and expenses from operations on the sale of the corresponding category of securities is recognized as a loss (clause 8 of Article 274 of the Tax Code of the Russian Federation). A loss from transactions with securities reduces only the profit from transactions with securities, taking into account the division into securities traded and not traded on the securities market (clause 10 of article 280 of the Tax Code of the Russian Federation).

I would like to remind you that the rules given in this article have a general procedure for organizations that are not professional participants in the securities market. The taxation procedure for certain securities may have its own characteristics depending on the type of security, the terms of the transaction, the parties to the transaction, and the transactions themselves may have a special nature, for example, repo transactions. In addition to legal entities, transactions with securities can also be carried out by individuals, and naturally, we will now be talking about the personal income tax, and not about the profit tax. For organizations, the correct organization of accounting and the formation of accounting policies are fundamental.

A. Khimichev , expert "PB"

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition