Placing money on deposit - what is it?

If an organization generates free funds, then so that they do not lie like a dead weight on the current account, the organization can make them work. Thus, money not involved in circulation can generate additional income. One of the ways to obtain such income is to place funds on deposit.

A deposit account is an account in a banking institution in which a person places available funds, and the bank, according to the terms of the signed agreement, accrues interest on them in the established amount. Typically, deposit agreements are concluded for a specific period. Upon expiration, the funds are returned to their owner. Funds can only be credited to this account as a deposit.

The deposit account is not intended for settlements with third parties.

What is capitalization?

According to the provisions of 395-1-FZ, a deposit is the placement of a citizen’s funds in rubles or foreign currency for their preservation or increase. Only banks licensed by the Central Bank have the right to attract financial resources from the population.

Federal legislation stipulates that deposit income is paid strictly in cash, in the form of interest. The frequency of their accrual is determined by the terms of the deposit agreement signed by the parties. The following options are possible:

- monthly;

- quarterly;

- Every year;

- upon expiration of the deposit period.

The depositor can choose one of two options: receive accrued interest on the card or in cash at the bank’s cash desk, or apply capitalization. It means that the “accumulated” amount is added to the initial deposit, the size of which increases.

Capitalization is not used if interest is paid at the time the parties' contract ends. If a different frequency is set, the use of this option is possible at the request of the client. The deposit amount increases with each increase in accrued %%, which leads to an increase in the profitability of invested funds.

Also see “What is the difference between a deposit and a deposit?”

Which accounts are involved in accounting entries for accounting for deposit transactions?

The deposit account refers to the so-called special accounts in the bank, for the accounting of which account 55 is intended in the accounting department. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts for this account. Deposits are accounted for in subaccount 55.3 “Deposit accounts”.

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account in account 58 “Financial investments” by opening the corresponding sub-account.

The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

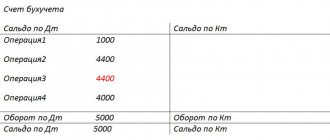

Accounts 55 and 58 are active, so an increase in funds on deposit will be by debit, and a decrease in the deposit account or returned to the owner to the current account will be by credit.

As for the entries on the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Subaccount 1 to this account “Other income” is intended to reflect various income, including interest received, from activities not related to the main one.

We reflect the deposit and the accrual of interest on it in accounting

How to reflect in the accounting of an organization the placement of funds in a deposit account and the receipt of interest if, in accordance with the agreement, they are calculated by the bank monthly on the day corresponding to the date of receipt of funds in the deposit account, and are transferred to the deposit account with addition to the amount of the deposit )?

On June 24, 2019, the organization placed available funds in a deposit account in accordance with a fixed-term bank deposit agreement (hereinafter referred to as the agreement) for a period of 3 months in the amount of RUB 200,000.

According to the agreement, for storing funds in a deposit account, the bank monthly on the day corresponding to the date of receipt of funds in the deposit account accrues and transfers interest, which is calculated on the daily actual balance of funds in the deposit account at the end of the operating day for each calendar day for the period from the day funds are credited to the deposit account (the day of the previous interest payment) to the day preceding the date of calculation and transfer of interest (the day the deposit is returned). Interest is credited to the organization's deposit account and added to the amount of the deposit.

The interest rate is 12% per annum. Interest is calculated based on the actual (365) number of days in a year and the actual number of days in a month.

On July 24, 2019, interest for the period from June 24 to July 23 in the amount of RUB 1,972.60 was credited to the organization’s deposit account. <*>

General provisions

Legal entities (depositors) under a bank deposit agreement, which is concluded in writing, can place funds in Belarusian rubles in the bank (depositor) for the purpose of storage for a period (either on demand or until the occurrence (non-occurrence) specified in the agreement circumstances (events) in the agreement and receiving income in the form of interest, which the bank pays on the terms and in the manner determined by this agreement. The contribution (deposit) is returned to the depositor in the manner established by the bookmaker and the relevant agreement <*>.

One of the types of bank deposit agreement is a fixed-term bank deposit agreement, according to which the depositor is obliged to return the deposit (deposit) and pay the interest accrued on it after the expiration of the period specified in the agreement <*>.

The essential terms of the deposit agreement include, but are not limited to:

— currency of the deposit (deposit) and the amount of the initial contribution to the deposit (deposit);

— the amount of interest on the deposit (deposit), the procedure for their calculation and payment, including when the deposit is returned;

- term for return of the deposit (deposit) - for a fixed-term bank deposit agreement <*>.

Interest on a deposit (deposit) is accrued from the day it is received by the depositor until the day preceding the day it is returned to the depositor, unless otherwise provided by the bank deposit agreement.

Interest on the deposit is paid to the depositor on a monthly basis, unless otherwise provided by the bank deposit agreement. When the deposit is returned, interest is accrued and paid in full <*>.

Interest can be calculated based on the actual (365 or 366) number of days in a year. In this case, interest is accrued for each calendar day of the year <*>.

The amounts of calculated interest are reflected by banks in statements of accrued interest, containing the necessary information to verify the correctness of interest calculation <*>.

Accounting

Accounting for the availability and movement of funds in Belarusian rubles held in a deposit account in banks is carried out on account 55 “Special accounts in banks” (sub-account 55-1 “Deposit accounts”) <*>.

The receipt of funds into the deposit account is reflected in the debit of account 55 “Special accounts in banks” and the credit of account 51 “Current accounts” <*>.

A bank deposit refers to the financial assets of an organization. To reflect settlements with the bank for accrued and received interest for storing funds in a deposit account, an organization can use account 76 “Settlements with various debtors and creditors”, to which it has the right to open a separate sub-account. Interest on a deposit (deposit) receivable is included in income from investment activities on a monthly basis and is reflected in the debit of account 76 “Settlements with various debtors and creditors” and the credit of account 91 “Other income and expenses” (subaccount 91-1 “Other income") <*>.

The accrual principle is one of the principles of accounting and means that business transactions are reflected in accounting and reporting in the reporting period in which they were completed, regardless of the date of settlements for them <*>. Consequently, in accounting, interest receivable on a deposit is reflected as part of income from investment activities of the month for which they are accrued.

Receipt of interest on a deposit (deposit) with their addition to the amount of the deposit (deposit) to the deposit account is reflected in the debit of subaccount 55-1 “Deposit accounts” (account 55 “Special accounts in banks”) and the credit of account 76 “Settlements with various debtors and creditors" <*>.

In the situation under consideration, the organization, in order to monthly reflect interest on the deposit as part of income from investment activities, has the right to request from the bank a statement of accrued interest broken down by month.

In addition, the organization has the right to calculate interest itself in accordance with the terms of the concluded term bank deposit agreement. In this case, the calculation of interest is formalized by a primary accounting document developed by the organization in accordance with the requirements established by law and approved by the accounting policy of the organization, for example, an accounting certificate <*>.

Let's calculate interest in the situation under consideration, broken down by month:

| Deposit period | Number of days of deposit placement | Deposit amount, rub. | Interest rate on deposit | Interest calculation | Amount of interest, rub. |

| June 24 - 30, 2022 | 7 | 200 000 | 12 | ((200,000 x 12% / 365) x 7) | 460,27 |

| July 1 - 23, 2022 | 23 | 200 000 | 12 | ((200,000 x 12% / 365) x 23) | 1512,33 |

| Total | 30 | 1972,60 |

VAT

Interest on a bank deposit is not subject to VAT, and the ESCF is not compiled <*>.

Income tax

Interest on a bank deposit is included in non-operating income taken into account for profit taxation on the date of recognition as income in accounting <*>.

Accounting Entry Table

In the situation under consideration, a subaccount 76-8 “Settlements with the bank for interest on a bank deposit (deposit)” was opened to account 76 “Settlements with various debtors and creditors.”

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| Accounting entries for June 2022 | ||||

| Funds were transferred from the current account to the deposit account | 55-1 | 51 | 200 000 | Bank account statement, bank statement for deposit account, payment order |

| Interest on the deposit is reflected as part of income from investment activities (from June 24 to June 30) <*> | 76-8 | 91-1 | 460,27 | Statement of accrued interest, accounting certificate-calculation, agreement |

| Accounting entries for July 2022 | ||||

| Interest on the deposit is reflected as part of income from investment activities (from July 1 to July 23) <*> | 76-8 | 91-1 | 1512,33 | Statement of accrued interest, accounting certificate-calculation, agreement |

| Interest received on the deposit account for storing funds and added to the deposit amount | 55-1 | 76-8 | 1972,60 | Bank statement for deposit account |

| ——————————— <*> Taken into account when taxing profits as part of non-operating income <*>. | ||||

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

Interest accrued on the deposit - accounting entry and its significance for tax accounting

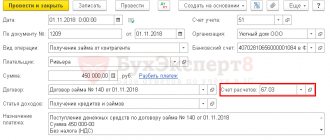

As we have already noted, the frequency of interest calculation, as well as their rate, is one of the mandatory conditions of the contract. When calculating interest from an organization that owns funds on the basis of bank documents, the following entry must be generated:

Dt 76 Kt 91.1

Interest on deposits must be taken into account as non-operating income when calculating income tax if the organization applies the main regime, or a single tax under the simplified tax system as they are accrued (or received) - clause 6 of Art. 250 Tax Code of the Russian Federation.

Interest can be transferred to a person’s current account as it accrues, or it can accumulate in a deposit account and be paid in a lump sum only upon expiration of the contract. The transfer of interest to the current account will be reflected in correspondence:

Dt 51 Kt 76

Agreement for opening a deposit account

The provisions of the agreement on opening a deposit account are regulated by Chapter 44 of the Civil Code of the Russian Federation. When signing, be sure to pay attention to the following points:

- type of deposit - demand deposit (the bank will return the funds at the request of the depositor) or time deposit (the bank will return the funds after a certain period);

- the amount of the deposit being placed;

- interest rate and amount of accrued interest;

- frequency of interest payment - for short-term deposits, interest is accrued at the time the money is returned, for long-term deposits, interest is accrued periodically, for example, once a month;

- the amount of the account maintenance fee;

- the period for which the deposit is opened;

- liability of the parties;

- conditions for termination of the contract, and so on.

Money is usually transferred to the deposit account from the organization's current account, and then returned to it along with interest.

What is capitalization: example

A citizen deposited 1,000,000 rubles in the bank for one year at a rate of 7% per annum. Interest is calculated quarterly. The client chose not to receive them on the card, but chose a deposit with monthly capitalization. How to calculate deposit income?

The %% amount for the first quarter of the deposit will be:

1,000,000* 7/(4* 100) = 17,500 rub.

This amount of interest will be added to the initial deposit amount due to capitalization. For the second quarter, income will be equal to:

(1,000,000 + 17,500)* 7/(4* 100) = 17,806.3 rub.

In the third quarter, interest will be calculated as follows:

(1,000,000 + 17,500 + 17,806.3)* 7/(4* 100) = 18,117.9 rub.

In the fourth quarter, %% will be calculated using the formula:

(1,000,000 + 17,500 + 17,806.3 + 18,117.9)* 7/(4* 100) = 18,434.9 rub.

Total annual storage of funds in the bank will bring the investor income:

17,500 + 17,806.3 + 18,117.9 + 18,434.9 = 71,859.1 rub.

If a citizen withdrew the interest amount quarterly, his annual income would be equal to:

1,000,000* 7% = 70,000 rub.

It turns out that capitalization helped increase the profitability of the deposit by 1,859.1 rubles. To make such calculations and evaluate the difference in profitability, depositors can use special calculators that are posted on bank websites.

For example, you can find out about the capitalization of interest on deposits in Sberbank on the bank’s official website using the link.