We buy used fixed assets

If you bought a fixed asset (fixed asset), which was previously operated by another owner, then you need to correctly determine the useful life (SPI) of such fixed asset and set the depreciation rate for it for profit tax purposes.

Indeed, for tax accounting purposes, you, firstly, must include an asset that was in operation in the same depreciation group (subgroup) in which it was listed by the previous owner and clause 12 of Art. 258 Tax Code of the Russian Federation. And secondly, when applying the linear method of calculating depreciation, in certain situations you can reduce the useful life of the resulting object by the actual life of its operation by the previous owner, clause 7 of Art. 258 Tax Code of the Russian Federation. Let's look at examples of how to do this.

Used OS costing no more than 40,000 rubles. immediately write off as expenses

Our organization bought for 35,000 rubles. used OS, which was under-depreciated by the previous owner. Can we write off the cost of such an object as a tax expense or should we continue to depreciate it?

: Property whose value does not exceed 40,000 rubles, regardless of the SPI, is not depreciable. This means that you can take its cost into account at the same time in the “profitable” expenses x item 1 of Art. 256, sub. 3 p. 1 art. 254 Tax Code of the Russian Federation.

By the way, the residual value of this object from the previous owner, which he indicated in the act in form No. OS-1, does not in any way affect the procedure for recognizing the object as depreciable property.

Property fully depreciated by the previous owner may be OS for you

We bought property for 70,000 rubles, which is more than 50 years old. The previous owner had this OS fully depreciated. Do we need to take it into account as depreciable property?

: If you think that the SPI of this property is more than 12 months, then you must include this object in the depreciable property, because its cost is more than 40,000 rubles. clause 1 art. 256 of the Tax Code of the Russian Federation Despite the fact that the previous owner had the object completely depreciated, you need to determine the SPI of the object based on the period during which you plan to operate it. And after that, accrue depreciation until its cost is completely written off and clause 7 of Art. 258 Tax Code of the Russian Federation.

Increasing factors also apply to used OSes

Is it possible to apply an increasing factor to a purchased “used” OS if it belongs to the 5th depreciation group and we are going to use it around the clock?

: Yes, it's possible. The application of the increasing factor does not depend on whether the OS is new or used. 1 clause 1 art. 259.3 Tax Code of the Russian Federation.

But remember that you need to confirm the 24-hour work schedule of the OS with documents and Letter of the Federal Tax Service for Moscow dated April 25, 2011 No. 16-12/ [email protected] :

- by order of the manager on the application of a special coefficient in relation to specific fixed assets indicating their inventory numbers;

- an administrative document on the operating mode of the organization and its individual divisions;

- employee timesheets.

A foreigner can also confirm the service life of the sold OS

We bought tractor units in Germany from a foreign company. The previous owner, of course, did not provide any information about the calculation of depreciation and the period of their use. In which depreciation group should these fixed assets be included and is it possible to somehow take into account their previous service life?

: Since you do not have documented information about the period of operation of the objects from the previous owner, then on the date of putting the OS into operation, independently determine their group and SPI clause 1 of the Letter of the Ministry of Finance dated July 16, 2009 No. 03-03-06/2/ using the government Classification 141. In your case, this will be the 5th depreciation group with a useful life of over 7 and up to 10 years inclusive (OKOF codes from 15 3410210 to 15 3410216).

Acceptance of fixed assets for accounting

So, the company has an operating system on which depreciation is calculated in accounting and tax accounting. It doesn’t matter whether the property was purchased, donated or contributed as payment for the authorized capital, the procedure for calculating depreciation does not depend on the method of obtaining fixed assets. But initially the asset is reflected as an investment in non-current assets. When should it be transferred to the operating system and start accruing depreciation?

In accounting, this should be done when the asset is ready to be used for its intended purpose. For example, a purchased machine that does not require installation is transferred to the OS immediately after it is received by the organization, since it is at this moment that you can begin to use it. In tax accounting, the situation is different: property that is used to generate income is initially recognized as depreciable (see Table 1).

Acceptance of fixed assets for accounting and choice of depreciation calculation procedure

Acceptance of fixed assets for accounting

The property is transferred to the fixed assets at the moment of readiness for operation (clause 4 of PBU 6/01 “Accounting for fixed assets”), the actual use of the fixed assets does not matter

Depreciable property is property that is used to generate income (clause 1 of Article 256 of the Tax Code of the Russian Federation), the actual use of fixed assets matters

State registration of property rights does not affect the acceptance of fixed assets for accounting:

see PBU 6/01 and clause 52 of the “Methodological guidelines for accounting of fixed assets” (approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n)

see paragraph 4 of Art. 259 of the Tax Code of the Russian Federation, valid from 01/01/2013

Methods for calculating depreciation and conditions for their selection

Selected once for all operating systems or for a group of operating systems:

— reducing balance method;

— method of writing off value by the sum of the numbers of years of useful life;

— method of writing off cost in proportion to the volume of products (works)

Selected for all OS in accordance with the accounting policy of the organization:

— linear method (always prescribed for 8–10 depreciation groups, see clause 3 of Article 259 of the Tax Code of the Russian Federation);

The “tax” method can be changed from January 1 of the next year, but you cannot leave the non-linear method earlier than 5 years from the start of its use

How to fix the situation with the useful life?

In this situation, two possible corrective actions can be proposed.

Corrective actions for fully depreciated assets.

Method 1: Review of useful lives in each financial year.

The useful resource of an asset is its accounting value. And if you find that it is different from what you originally estimated, you need to account for this change in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

This means you simply establish a new remaining useful life, take the carrying amount and recognize the depreciation cost based on the carrying amount and the new remaining useful life.

Restated depreciation expense = Carrying amount (as of date of revision) / Remaining useful life

Revision of useful life for previous periods is not allowed! IAS 8 requires prospective application of changes in accounting estimates and policies (ie, now and in the future).

Now you may be asking: What should I do if the book value of my assets (net book value) is zero?

If you have regularly reviewed and reviewed the useful life of assets in the past and during the current reporting period, and find that you want to use the assets even longer, then there is nothing to do. All that remains is to leave these assets as they are and try to avoid this situation in the future.

However, if you actually forgot to revise the useful life in the previous reporting period, this results in an accounting error when applying IAS 16.

If the error is material, you must correct it retrospectively in accordance with IAS 8. This means restating prior periods using the revised estimated useful life. This means a lot of work!

Depreciation calculation

In both accounting and tax accounting, depreciation is accrued monthly from the first day of the month following the month the asset was accepted for accounting. The organization itself chooses which procedure to use when calculating depreciation in its accounting policies.

Thus, for accounting purposes, you can choose one of four methods: the linear method, the reducing balance method, the method of writing off the cost by the sum of the numbers of years of the useful life, the method of writing off the cost in proportion to the volume of production (work). The depreciation calculation method can be selected for all fixed assets or for a particular group of fixed assets. For example, you can determine that the linear method is used for office equipment, and the reducing balance method is used for machine tools.

In tax accounting, you can choose a linear or nonlinear method, but for all operating systems. The exception is buildings, structures, transmission devices included in depreciation groups 8–10. The linear method is always used for them.

Please note the significant difference between accounting and tax accounting. In accounting, the method of calculating depreciation is selected once in relation to each fixed asset and in the future the fixed asset does not change for this purpose. And in tax accounting, at each specific moment, the method specified in the accounting policy is used. That is, if an organization wants to change the “tax” method, it can do so from January 1 of the next year.

The only limitation is that you cannot “leave” the nonlinear method earlier than 5 years after the start of its use. Let's look at the procedure for calculating depreciation using examples.

Example 1. An organization uses a linear method (method). In April 2014, she commissioned an operating system with an initial cost of 96,000 rubles and set its useful life at 4 years (48 months). This means that in tax accounting, fixed assets are included in the third depreciation group (fixed assets with a useful life of 3 to 5 years inclusive). Thus, starting from May 2014, depreciation will be accrued monthly in accounting and tax accounting in the amount of 2,000 rubles.

Example 2. In the conditions of example 1, we assume that to calculate depreciation for all fixed assets in accounting, the reducing balance method is established (paragraph 3 of clause 19 of PBU 6/01) with a coefficient of 2. In this case, the annual depreciation rate will be 50% (100 %/4 years × 2). Let us remind you that during the year, depreciation is accrued monthly in the amount of 1/12 of the annual amount, regardless of the method used (paragraph 5, clause 19 of PBU 6/01).

Then in 2014, the organization will accrue depreciation in the amount of 28,000 rubles (96,000 rubles × 50% / 12 × 7). At the beginning of 2015, the residual value of fixed assets will be 68,000 rubles, and the amount of depreciation will be 34,000 rubles (68,000 × 50%).

Accordingly, in 2016, accrued depreciation will be 17,000 rubles (34,000 × 50%), and for 5 months of 2022 (by the end of the useful life) - 3,541.67 rubles.

As a result, the amount of 13,458.33 rubles will remain unwritten. The current regulations do not say what to do with this amount. This means that the organization must determine the procedure for repaying the remaining value of an asset at the end of its useful life when calculating depreciation using the reducing balance method (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”). The Russian Ministry of Finance also pointed this out in letter No. 07-05-06/18 dated January 29, 2008.

In particular, due to the insignificance of the remaining amount, one can provide for its one-time attribution to expenses in the month of expiration of the useful life.

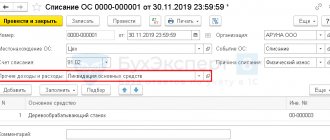

How to write off an operating system from the balance sheet if it is completely depreciated?

Based on the rules of PBU 6/01, fixed assets can be written off from the balance sheet of an enterprise only in the process of disposal (sale, transfer) or complete loss of their ability to generate income.

It is necessary to reflect losses in connection with the write-off of fixed assets that have ceased to be profitable and cannot be restored as part of other expenses for the period to which they relate.

When calculating income tax, you need to take into account expenses for liquidation of fixed assets in non-operating expenses.

Important! depreciation cannot be regarded as a write-off of property. Even if this resource is completely exhausted, the property can be recorded on the balance sheet at zero residual value.

Moreover, if fully depreciated property consists of several components, then partial write-off is possible, since some elements of the fixed asset may be beneficial.

If the fixed assets are fully depreciated, then the company has the right to write it off the balance sheet.

Such a fixed asset has no residual value, so losses from this procedure will only be associated with payment for the process of dismantling, dismantling, and disposal.

Repair and modernization of depreciated operating systems

Fully depreciated OS objects may require repair or modernization.

If you are modernizing such facilities, then in accounting the costs for it will increase the current cost. For tax calculations, the useful life of such fixed assets does not change. Expenses will be written off according to the same standards that were adopted when the OS was put into operation.

Find out about the position of the tax authorities regarding the start of depreciation of the modernized fixed asset from the publication “The Federal Tax Service supported a profitable option for depreciation of the modernized fixed asset.”

For accounting purposes, the organization has the opportunity to choose whether to extend the useful life of the operating system or not. The decision is made based on how much time will be used or how much product still needs to be released on this upgraded OS.

You will learn about accounting and tax accounting for modernization in the article “Modernization of fixed assets - accounting and tax accounting.”

If you are repairing fully depreciated operating systems, then the costs are taken into account immediately in the period in which the repairs were carried out. For tax purposes, these expenses must be taken into account as part of other expenses, and in accounting, repair expenses are classified as expenses for ordinary activities.

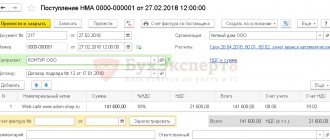

OS commissioning

Acceptance for accounting of fixed assets with the accrual of depreciation bonus for non-relevant assets is formalized by the document Acceptance for accounting of fixed assets, type of operation Equipment in the section fixed assets and intangible assets - Receipt of fixed assets - Acceptance for accounting of fixed assets.

The document states:

- MOL - the materially responsible person to whom the commissioned OS is assigned, is selected from the directory Individuals ;

- OS location - location of operation of the OS, selected from the Division directory;

- OS event - an event associated with a change in the state of an asset in an organization, selected from the OS Events . During commissioning, the OS event type should be Acceptance for accounting with commissioning .

Non-current asset tab

On the Non-current asset , the data of the acquired asset before commissioning is indicated:

- Method of receipt - the method of receipt of a non-current asset into the organization, in our example it is Purchase for a fee ;

- Equipment is a non-current asset put into operation. Selected from the Nomenclature directory ;

- Warehouse - a place where a registered object is stored;

- Account - a cost accounting account on which the initial cost of an object is formed.

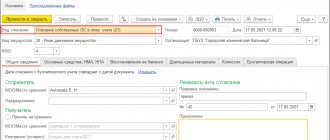

Fixed assets tab

On the Fixed Assets , the operating systems to be put into operation are selected from the Fixed Assets directory .

The following data must be filled in the OS object card:

- OS accounting group ;

- Classification section ;

- section Information for the inventory card .

Accounting tab

On the Accounting it is indicated:

- Accounting account - 01.01 “Fixed assets in the organization.”

- Accounting procedure - Depreciation : in our example, the cost of fixed assets is repaid through depreciation;

- The method of calculating depreciation is the accrual method established in the accounting policies of the organization.

- Depreciation (wear and tear) account - 02.01 “Depreciation of fixed assets accounted for on account 01.”

- Calculate depreciation checkbox must be checked: it is this that affects the automatic calculation of depreciation when closing the month.

- The method of reflecting depreciation expenses is the method of accounting for the costs of depreciation of fixed assets, selected from the directory Methods of reflecting expenses .

In our example, costs are taken into account according to Dt 26 “General operating expenses”, since depreciation costs are included in general operating expenses according to accounting accounting (indirect expenses in NU).

- Useful life (in months) - the established useful life;

- The depreciation schedule for the year is not filled out, since the use of the fixed asset is not seasonal.

Tax Accounting Tab

On the Tax Accounting the following is indicated:

- The procedure for including cost in expenses is depreciation , since in tax accounting the asset is recognized as depreciable property.

- Calculate depreciation checkbox must be checked: it is this that affects the automatic calculation of depreciation when closing the month.

- Useful life (in months) - useful life, according to the established depreciation group of fixed assets (Resolution of the Government of the Russian Federation of 01.01.2002 N 1, clause 1 of Article 258 of the Tax Code of the Russian Federation).

- A special coefficient is a decreasing or increasing coefficient if it is established by the accounting policy. In our example, it is not installed, so we do not fill in this field.

Method 2. Revalue your assets at fair value.

IAS 16 allows you to use 2 models for the subsequent valuation of your fixed assets: the initial cost model and the revaluation model.

If you still plan to use the existing fixed assets in the future, their fair value will likely be greater than zero.

Revaluing an asset with a carrying amount of zero actually means that you are changing your accounting policy, and here you again need to be guided by the IAS 8 standard.

Under IAS 8, you should only change your accounting policy if:

- The change is required in accordance with IFRS. But in this case that is definitely not the case.

- This change results in financial statements providing true and more relevant information about the impact of transactions, events or conditions on a company's financial position, financial performance or cash flows.

You (and your auditors) may argue that paragraph 2 accurately reflects your situation. But is this really true?

This method definitely solves the problem of having a zero book value at the end of the current accounting period - just like the pill provides immediate relief from headaches.

Accounting policies include certain rules and standards that determine how you will present certain transactions in your financial statements—not only now, but also in the future.

It's not like a pill that provides immediate relief. It is like a cure for the cause of the disease, making you healthy for a long time so that you no longer need to take pills. But what if you take the wrong pill?

So, think about it, if you change your accounting policy from a cost model to a revaluation model, will you provide better information about your fixed assets not only now, but also in the future?

Before you answer this question to yourself, think about this too:

- To determine the fair value of your machinery, you need to apply IFRS 13 Fair Value Measurement. This is very difficult, impractical and not always feasible.

- How will you estimate the market value of used production machines?

- The revaluation model is used 99.9% of the time for buildings and land as it is easy to establish the market value of these assets on a regular basis.

- Is the problem with used production machines that are so specific that only a few companies like yours use them?

- You need to re-evaluate your technique fairly regularly. Can you estimate fair value, say, annually?

- You need to revalue the entire asset class, not individual items of fixed assets. Can you really determine fair value for all equipment? How practical is this?

If after considering all these aspects, you still want to move from a cost model to a revaluation model, then IAS 8 will make your job easier. You do not need to apply the new policy retrospectively—an assessment of prior periods is not required.

Depreciation calculation

Regulatory regulation

In accounting:

- The cost of fixed assets is repaid through depreciation, starting from the next month after the object is accepted for accounting and ceases to be repaid from the next month after disposal of the fixed assets or full repayment of the cost of the fixed assets (clause 17, clause 21, clause 22 of PBU 6/01).

- Depreciation is calculated on the credit of account 02 “Depreciation of fixed assets” in correspondence with cost accounts.

In our example, fixed assets are taken into account for general business needs, therefore, the costs of accrued depreciation are taken into account as part of general business expenses in the debit of account 26 “General business expenses.”

In tax accounting:

- The cost of an asset is repaid through depreciation, starting from the next month after the commissioning of the asset, regardless of the date of state registration of rights to it, and ceases to be repaid from the next month after disposal of the asset or full repayment of its cost (clause 4 of Article 259 of the Tax Code of the Russian Federation , clause 5 of article 259.1 of the Tax Code of the Russian Federation).

- Accrued depreciation may be recognized as direct, indirect or non-operating expenses in accordance with accounting policies. In our example, depreciation is taken into account as part of indirect (other) expenses at a time on the last day of the accrual month.

- When putting an asset into operation, you can take into account at a time the amount of depreciation bonus as a percentage of the original cost as part of the costs of capital investments (clause 9 of Article 258 of the Tax Code of the Russian Federation). Expenses on capital investments are recognized at a time as part of indirect expenses in the period in which the start date of depreciation accrual falls (clause 3 of Article 272 of the Tax Code of the Russian Federation).

Accounting in 1C

The parameters for calculating depreciation are set:

- initially - in the document Acceptance for accounting of fixed assets;

- when changing depreciation parameters - in the document Changing fixed asset depreciation parameters .

Monthly depreciation is calculated when performing the Month Closing procedure, operation Depreciation and depreciation of fixed assets in the Operations – Period Closing – Month Closing section.

In our example, the Ford Mondeo car was registered as a fixed asset and put into operation on April 6, therefore, depreciation in accounting and accounting records is accrued from May.

Postings according to the document

Depreciation for May

The document generates transactions:

- Dt 26 Kt 02.01 - depreciation;

- Kt KV - writing off the accrued depreciation premium from the off-balance sheet account;

- Dt 26 Kt 01.01 - depreciation bonus is taken into account in expenses for NU.

Depreciation for June

Similarly, depreciation is calculated for the following months until the cost is fully repaid. When disposing of fixed assets, depreciation for the last month is accrued in the disposal document, for example, in the document Transfer of fixed assets .

Control

The monthly depreciation amount in 1C is calculated correctly.

In 1C, the amount of accrued depreciation can be viewed in the report Fixed assets depreciation statement in the section Fixed assets and intangible assets - Reports - Fixed assets depreciation statement.

Documenting

The organization must approve the forms of primary documents, including the document for calculating depreciation and bonus depreciation, for example, an Accounting Certificate.

In 1C, you can print a depreciation calculation form using the Help-calculation of depreciation in the Operations section - Closing the period - Closing the month - button Help-calculation - Depreciation.

It presents the calculation of depreciation in accounting and accounting records separately, but with the ability to disclose the amount of depreciation by month of accrual.

print the form for calculating the depreciation bonus - Help for calculating the depreciation bonus - in the Operations section - Closing the period - Closing the month - button Help for calculations - Depreciation bonus.