Net profit remains at the disposal of the organization after paying all taxes and payments to the budget

It takes into account all the expenses of the enterprise and can be presented as a formula:

PE = B – SP – KR – UR – PR + PD – N – NP

Fig.1 Formula for calculating net profit

Using the example of the 1C: ERP, 1C: Holding Management and WA: Financier programs, we will look at how to work with net profit in 1C.

How to view net profit in 1C

Let's start with the fact that for transactions displayed in 1C, all income and expenses are automatically recorded in the database. Before starting profit analysis in 1C:ERP, it is important to run the routine operation “Closing the month”. To do this, let's go to the "Financial result and controlling" section.

This operation calculates fixed costs - depreciation and property tax, calculates the cost and closes accounts, determining the financial result of its activities.

By completing month-end closing operations and clicking the “More details” hyperlink, the user can analyze the generated document records.

Fig.2 Formation of financial result

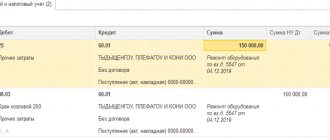

In the journal “Routine operations for closing the month” that opens, select the document “Formation of financial results” and, by clicking the “Reports” button or the Ctrl+Shift+A key combination on the keyboard, select the “Document movements” command.

Fig.3 Registration journal operations

The accounting entry reflects the amount of calculated profit of the enterprise:

- Debit account 90.09 “Profit/loss from sales”

- Credit 99.01.1 Profits and losses from activities with the main tax system

In the considered option, the organization Zimniy Sad LLC uses OSN.

We will select a 1C program to automate the calculation of the company’s net profit

Fig.4 Report on the movement of the document according to finance. result

The document “Calculation of income tax” reflects the accrual of income tax – “Conditional income tax expense”:

- Debit of account 99.02.1 “Conditional income tax expense”

- Loan 68.04.2 “Calculation of income tax”

Fig.5 Report on the movement of income tax calculations

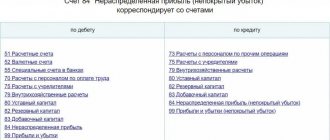

When reforming the balance sheet, the net profit of the enterprise is determined. The calculation record is visible in the report reflecting the movement of the “Year Closing” document:

- Debit account 99.01.1 “Profits and losses from activities with the main tax system”

- Credit to account 84.01 “Profit subject to distribution”

Fig.6 Year-end closing report

The same information can be obtained using the standard report “Account balance sheet”, indicating account 84.01 “Profit to be distributed”.

Fig.7 SALT by count. 84.01

Calculation of profit (loss) before tax and reporting

The amount of profit (loss) received before tax is included in line 2300 of the Financial Results Report (Appendix No. 1 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n). The loss in the report is shown in brackets, which means a negative indicator.

The pre-tax financial result is calculated in several stages, and if the result is positive, then a profit is made, if negative, a loss:

- First you need to determine the gross profit (loss), for which the amount of the cost of sales of goods or services is subtracted from the amount of revenue, excluding excise taxes and VAT. The cost includes expenses associated with core activities, minus VAT and excise taxes. The result is reflected in line 2100 of the Financial Results Report.

- Next, profit (loss) from sales is calculated (line 2200 of the Financial Results Report): commercial and administrative expenses are subtracted from the gross profit.

- Profit (loss) before tax (line 2300 of the Financial Results Report) is determined as follows: income from participation in other legal entities, interest receivable and other income are added to the amount of profit (loss) from sales, and then interest payable and other income are deducted from the amount received. expenses.

The profit received before tax is an indicator that is further reduced by the amount of tax (line 2410 of the Financial Results Report).

If the company is a payer of income tax, its amount must correspond to the tax specified in the declaration. Those who work in a special regime must indicate on line 2410 the amount of “their” tax - “imputed”, tax under the simplified tax system, unified agricultural tax (attachment to the letter of the Ministry of Finance of the Russian Federation dated 02/06/2015 No. 07-04-06/5027). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

An example of calculating profit in 1C:ERP

In our example, the profit indicator of the organization Winter Garden LLC, taking into account all income and expenses for December 2022, amounted to 120,620 rubles.

The amount of calculated income tax (20%) is 24,124 rubles.

The net profit of Winter Garden LLC for December 2022, according to accounting data, amounted to 96,496 rubles. (RUB 120,620 – RUB 24,124).

1C:ERP - an innovative solution for accounting for net profit and other financial results

To visually display the analysis of data for calculating net profit in 1C:ERP, there is a tool “Analysis of income tax accounting”, which can be used by going to the “Regulated accounting” section using the “Reports” link.

Fig.8 Reports section

By selecting the section of interest, the user can analyze the composition of income or expenses and the calculation of the taxable base.

Let's open the "Tax" section.

Fig.9 Layout of report sections

The calculation of profit and income tax is schematically presented. The accountant, without waiting for the month-end closing operation and balance sheet reformation, can see the result of a preliminary calculation of the activities of his company.

Fig. 10 Details of the “Tax” section

Some report cells can be deciphered and detailed information can be seen by clicking on them with the mouse. The user will see what the profit before tax is made up of and its components.

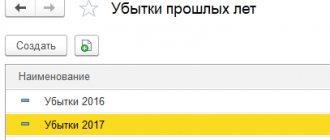

How to view net profit in 1C: Holding Management

The interface and menu sections of the 1C: Holding Management program are somewhat different from 1C: ERP. It is more reminiscent of 1C: Accounting 8.3. Let's look at examples of generating profit reports using the example of the organization TC Megapolis.

Accurate accounting of net profit in holdings based on 1C: Holding Management

As in 1C:ERP, in order to determine the financial result of the company’s activities and calculate the amount of income tax, in 1C:UH we carry out a list of operations to close the month, for which we go to the “Operations” - “Month Closing” section.

Fig. 11 Closing the month

As a result of regulatory operations, cost accounts determined by the type of activity of the company are closed, and its financial result is determined - profit or loss. “Month Closing”, carried out in December, was supplemented by “Balance Reformation”.

Fig. 12 Closing the month in 1C:UH

Click on the hyperlink of the transactions performed and click on the line - “Calculation of income tax”. The form will display indicators for calculating profit and calculating income tax.

Fig. 13 Indicators for determining profit in 1C:UH

An example of calculating profit in 1C: Holding Management

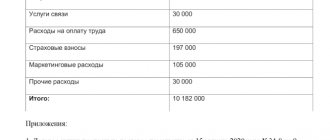

In the example considered, the amount of income from the sale of the Megapolis shopping center amounted to 573,750 rubles. (column 2. “Calculation certificates”, section “Tax base”).

The organization's expenses amounted to 483,500 rubles. (column 3. “Calculation certificates”, section “Tax base”).

Profit of TC "Megapolis" - 90,250 rubles. (column 4 “Calculation certificates”, section “Tax base”)

Amount of income tax (20%) gr. 3. “Calculation certificates”, section “Income Tax” – 18,051 rubles. (90,250 RUR * 20%).

Net profit of TC Megapolis – 72,199 rubles. (90,250 rubles – 18,050 rubles).

How to determine and view net profit in 1C: Holding Management? What transactions are involved in the formation of the financial result? Hints on these questions can be obtained by clicking on the hyperlink “Closing accounts 90, 91” and “Balance sheet reformation” by clicking on the “Show transactions” command.

Consultation on accounting for net profit in 1C

Free consultation with an expert on net profit accounting and automation based on 1C

Learn more

Let's set up net profit accounting in 1C

We will professionally set up 1C for correct accounting of net profit and other financial results.

Learn more

The document “Closing accounts 90, 91” reflects the amount of profit (loss) from sales on account 99.01.1.

Fig. 14 Postings for closing the account. 90, 91

During the reformation of accounts, net profit for distribution has already been determined and allocated to subaccount 84.01.

Fig. 15 Accounting entries for “Balance Sheet Reformation”

Using the standard report “Turnover Balance Sheet” (SBL) from the “Reports” section, you can also view the turnover of accounts to determine net profit and its value.

Fig. 16 OSV in 1C:UH

Subaccounts of account 90 “Sales” collect and reflect data on the amount of revenue from sales, cost, and taxes.

Fig. 17 SALT according to account 90 in 1C:UH

And after the balance sheet reformation, the month-closing data discussed above will be reflected in account 99 “Profits and losses”.

Fig. 18 SALT according to account 99 in 1C:UH

The undistributed net profit of TC Megapolis is reflected in account 84.01 “Profit subject to distribution”.

Fig. 19 SALT according to Account 84.01

This data is used to generate the “Income Tax Return” report.

Free audit and recommendations for accounting for net profit based on 1C

Let's go to the "Regulated reporting" section and create the above report - the "Create" button.

Fig.20 1C-Reporting in 1C:UH

Having selected the report, we will set its settings - we will indicate the organization for which to display data, and we will set the reporting period. Click “Create”.

Fig.21 Creating a report in 1C:UH

Let's fill out the report using the "Fill" button. Let's move on to "Sheet 02". The table shows the indicators for calculating profit and the amount of calculated tax.

Fig. 22 Declaration form in 1C:UH

By right-clicking on a cell and selecting "Decrypt", the user can get the details of the specified cell. For example, the detail of cell 060 is “Profit (Loss)”.

Fig. 23 Detail of the “Profit (loss)” cell in the report

Closing

Every month, the accounting department calculates financial results for all balance sheet accounts, and then their amounts are transferred to account 99 and accumulated there throughout the reporting period.

Closing scheme

Account 99 “Profits and losses” is written off only at the end of the reporting period (often the end of the year). Closing account 99 is the final posting on the last day of each year, otherwise called the reformation of balance sheet indicators. The reformation involves resetting subaccounts 90 and 91 (first stage) and resetting account 99 (second stage). Balance sheet reformation is carried out only when each transaction is entered into accounting.

Attention! After the reformation, no more entries are made, and the accounting department can generate a financial report for the reporting period.

How account 99 is closed depends on the current financial result. Closing is carried out by one of two possible transactions:

- Dt99 Kt84 - the implementation of this posting provides information about which account reflects the organization’s profit received in the current year.

- Dt84 Kt99 - this entry is made in order to reflect and write off the net loss of the enterprise in the reporting year.