Account 19 “Value added tax on acquired assets” is used to collect and process information about the tax paid or required to be transferred to the state budget. These amounts are included in the cost of the purchased property or material assets, as well as the services provided and work performed. The debit shows the amounts attributable to the purchase of property, and the credit shows the amounts accepted for deduction in correspondence with Dt 68.

The created products, works performed or services provided are sold to the buyer not at cost, but at the final price, which, in addition to cost, also includes added value. This premium represents the profit of the organization, which is used to expand the business or implement strategic decisions. The added value is subject to value added tax, which is displayed on account 19 “VAT on acquired values.”

It is active, and the following amounts are taken into account:

- the debit indicates the amounts collected for the purchase of tangible and intangible property;

- the loan takes into account the accumulated amounts, which will then be presented as a deduction.

With this approach, only the amount of tax is collected on the account, and the cost of the purchased property is indicated on accounts that are intended specifically for this.

| Subaccount | Name | Description of the subaccount |

| VAT on the purchase of fixed assets | Used when purchasing or constructing fixed assets, for example, buildings, structures, equipment or vehicles, as well as land | |

| VAT on the purchase of intangible assets | Used when purchasing intangible assets, for example, software, patents, copyrights, databases, trademarks | |

| VAT on the purchase of inventories | Used when purchasing various material and production resources, including semi-finished products, components, goods, raw materials and materials |

It should be noted that taxation arises both when purchasing property and selling one’s own products, and therefore there is a certain connection between these two operations. Account 19 is intended to display the tax on purchased material assets, and it can be used as a deduction. It corresponds according to Dt with property accounting accounts. The transfer of collected amounts (Kt 19) corresponds with Dt 68 “Calculations for taxes and fees”, where at the same time the tax on goods or products sold is collected.

Postings and operations

Business transactions and activities related to this issue are recorded in accounting account 19 with such entries as:

- Purchase of goods and materials

Dt 01,02,10 Kt 60 - reflects the cost of the purchased propertyDt 19 Kt 60 - indicates the tax on the purchased property

D 68 Kt 19 - indicates the tax that will be used as a deduction

- When selling products or goods

Dt 90 K 68 - sales tax is charged

| Score 19 | |||

| Debit | Credit | ||

| Cor. check | Description | Cor. check | Description |

| Kt 60 | VAT on purchased property is indicated | Dt 68 | The VAT to be deducted is indicated |

Moreover, if VAT is also established during the sale, then it is necessary to consider the formation of the result on account 68. Typical wiring can be presented as follows:

Dt 68 Kt 19 - 30,000 rub. (VAT to be deducted is displayed)

Dt 90 Kt 68 - 50,000 rub. (VAT required to be paid is displayed)

Result = 50,000 rub. — 30,000 rub. = 20,000 rub. according to Kt 68

The result means that this exact amount of value added tax must be transferred to the budget. When transferring, a posting is made Dt 68 Kt 51 - the purpose of payment indicates the standard wording “1/3 of VAT accrued for the 3rd quarter of 2016”

It should be noted that the amount of VAT on intangible assets or fixed assets can be deducted only if the acquired property is taken into account in full.

Victor Stepanov, 2016-12-06

Features of account accounting 68

This accounting account is classified as an active-passive account, that is, the balance of account 68 is not only debit, but also credit. It all depends on whose benefit the debt is: in favor of the company or the state.

Transactions should be reflected by type of tax liability. To organize this detailing in the working PS, special subaccounts are provided for account 68:

Please note that the company is not required to enter all of the above subaccounts. It is enough to include in the accounting policy only those that are used in the business activities of the company. Most Russian organizations use only two sub-accounts: accounting account 68-01 - to reflect personal income tax transactions for each employee, and accounting account 68-02 - for settlements with the VAT budget.

The final balance of account 68 in terms of tax obligations varies. Consequently, an expanded balance is formed for the existing subaccounts. For example, a debt on one tax is reflected in credit 68 of account, and an overpayment on another is recorded as a debit. In this case, when including accounting indicators 68 in the annual balance sheet and other financial statements, make sure that debit balances are included in the balance sheet assets, and credit balances are included in liabilities.

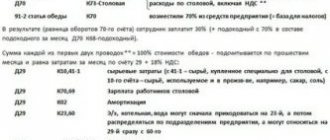

Formation of wiring Kt 19.04 Dt 68.02

IThe document “Receipt of goods and services” reflects the service and indicates the VAT account 19.04. As a result of the posting, the posting Dt 19.04 - Kt 60.01 is formed. An invoice has been entered based on the document. But for some reason this document does not end up in the “Creating Purchase Ledger Entries” document. And accordingly, the posting Dt 68.02 Kt 19.04 is not generated. Why? In general, only the invoice 19.03 is included in the “purchase book form”... Maybe something else needs to be indicated?

Try the new free service for quick code analysis of typical configurations 1c-api.com

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The thread has been archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

Postings in accounting

Let's look at typical accounting entries that use account 08.

| Debit | Credit | Operation name |

| Acquisition of fixed assets | ||

| 08/4 | 60 | OS object purchased |

| 19 | 60 | The VAT tax on the asset is reflected |

| 68 | 19 | VAT tax credited |

| 08/4 | 76 | Commissioning work completed |

| 01 | 08/4 | The OS object is put into operation |

| Creating an OS in-house | ||

| 10 | 60 | Materials for creating an OS have been purchased |

| 19 | 60 | VAT reflected on the material |

| 68 | 19 | VAT tax credited |

| 08/3 | 10 | Materials written off for the creation of the OS |

| 08/3 | 70 | The salaries of employees involved in the creation of the operating system have been calculated |

| 08/3 | 69 | Salary contributions have been calculated |

| 08/3 | 23, 26 | The costs of auxiliary and other types of production were written off |

| 01 | 08/3 | The created OS was put into operation |

| Creation of OS by contract method | ||

| 08/3 | 60, 76 | The services of a contractor for the construction of an environmental facility are reflected |

| 19 | 60, 76 | VAT on the contractor's work is reflected |

| 08/3 | 07 | The cost of equipment given to the contractor for installation is reflected |

| 08/3 | 70 | The salaries of the workers who brought the facility to a condition suitable for use are reflected. |

| 08/3 | 69 | Social contributions on salaries have been calculated |

| 08/3 | 23, 26 | Other production costs reflected |

| 01 | 08/3 | The completed OS object has been accepted for operation |

| 68 | 19 | VAT tax credited |

Postings Dt 68 and Kt 68, 19, 51 (nuances)

Naturally, the accounting department must have reasons for this. Firstly, such a basis may be the order of the manager, mentioned above. Secondly, this may be an order from the manager for a one-time payment of money. Thirdly, it could be his resolution (such as “pay”, “issue”) on some document (memorandum, invoice, etc.). A resolution can be put forward not only by the manager, but also by another person (deputy manager, chief engineer, branch manager, etc.). Other persons may give orders for the issuance of accountable amounts only if they are authorized to do so by order of the manager. In general, you should immediately clearly define the range of documents on the basis of which the accounting department issues expense vouchers for the issuance of accountable amounts.

Power of attorney

If a company issues a power of attorney to an employee, then he acts on behalf of his company, and all documents that he receives from other companies will be issued in the name of the company he represents. He will receive both a delivery note and an invoice (which will allow VAT to be offset). If an employee does not have a power of attorney, for other companies he is a private person. All this employee can count on is cash receipts and sales receipts. In either case, these expenses can be accepted by the business, but the accounting entries are slightly different. These differences will be shown in the journal entry table.

The power of attorney is issued in one copy, registered in a special register of powers of attorney and handed over to the employee, and the accountant remains with the spine of the power of attorney, which indicates all its details. Since the employee represents his home company in another organization, the power of attorney remains in that organization. When the employee returns to the employer, the accountant will make a note on the counterfoil of the power of attorney that the order has been completed.

The power of attorney indicates the date of its issue and validity period. If the power of attorney does not indicate a validity period, then such a power of attorney is valid for 1 year from the date of issue. If the power of attorney does not indicate the date of its issue, then such power of attorney is invalid. To receive material assets, power of attorney form No. M-2 has been approved (approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a).

Date added: 2015-10-28; | Copyright infringement

Accounts | Four types of business transactions | Dt 50 Kt 51 1000 rub. | Who can tell an accountant | About company registration | About signatures and seals | Responsibilities of a cashier | Cash book | About cash register equipment (CCT) | Payment orders | mybiblioteka.su - 2015-2018. (0.009 sec.)

| Olya_KT | |

| zbv | Confa? |

| Olya_KT | 8.1.15.14 |

| Olya_KT | accounting |

| shuhard | (1) asked in vain |

| Olya_KT | boo 1.6.20.6(4) why in vain? |

| zbv | (3) in the accounting policy - Simplified VAT accounting - is used? (4) why? |

| Olya_KT | (6) no, don’t use it |

| zbv | (7) movement according to the VAT register submitted to the Receipt? |

| Olya_KT | (8) Yes, it is in the register |

| zbv | (9) is everything okay with the invoice? carried out? date of this period? |

| Olya_KT | yes, carried out, date matches |

| zbv | (11) well then... |

What is account 08 used for in accounting?

08 accounting account is an account designed to accumulate costs for the acquisition or construction of a non-current asset in order to form its initial cost.

At the same time, non-current assets include fixed assets, intangible assets, profitable investments in non-current assets, land plots, and other environmental management facilities.

This account reflects information on the costs of capital new construction, reconstruction, modernization of re-equipment of existing facilities, the cost of acquiring movable and immovable property, land plots, purchasing intangible assets, productive and working livestock included in the main herd, costs of creating perennial plantings.

Reflection of this data on account 08 allows you to generate in a timely manner complete information on all costs incurred, monitor all stages of commissioning of objects, and also establish the initial cost of a non-current asset in accordance with current rules.

On the account, the initial cost of each object is formed on the basis of actual expenses incurred by the company.

Attention! It is important to understand that once an object is put into operation, its value can no longer continue to be taken into account on account 08. For this, the appropriate accounting accounts must be used - 01, 03, 04

Account 68 - common accounting entries

- Accrual of Dt70 Kt68.01 – withholding of personal income tax from employee wages

Dt99 Kt68.04 – tax deductions from the profit of the organizationDt90.03 Kt68.02 – accrual of VAT payable to the budget on sales

- Payment to regulatory authorities Dt68 Kt50,51,55 – in cash or by bank transfer

- Inclusion of accrued amounts in the costs of the enterprise Dt20.23 Kt68 - costs of main or auxiliary production

Dt26 Kt68 – inclusion in general business expensesDt91.02 Kt68 – reflection of amounts as part of other expenses (for example, settlements on enterprise property)

- Acceptance for deduction of VAT amounts presented by suppliers, Excise taxes

- Offset of advance payments from buyers against accrued VAT

Natalya Vasilyeva, 2017-03-26