General information about accounts

The payment invoice must include the details used to transfer money from the customer to the supplier for goods or services. The seller issues an invoice and the buyer must pay it.

This document is important for both parties to the transaction. It confirms the validity of the transaction. The invoice is also a supporting document for debiting money from the buyer’s bank account. It can be issued for transactions:

- supply;

- purchase;

- provision of service;

- and so on.

Typically, an invoice is issued for prepayment.

This type of documentation does not have a strict unified form. Accounts are prepared in accordance with the organization's accounting policies.

If, when issuing invoices, there was a change in balance sheet positions or financial results, it would make sense to regulate the information in it.

Invoice for payment: details of its completion

— Useful — Our publications

An invoice is required to document the agreement on the sale of goods or provision of services. During the sale of goods or services, this document is drawn up, which is sent to the buyer and is an important document for both parties to the transaction. The buyer will be able to confirm the fact of payment based on the invoice, and the seller will use it as a basis for accounting for goods in the warehouse.

Filling out an invoice for payment

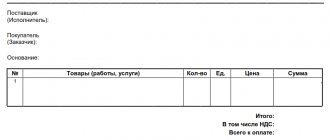

How to correctly fill out an invoice to document the sale of goods (services)? The invoice form is not regulated by anyone, so the organization has the right to independently create an invoice form. The only rule is the presence in the form of the main details that are needed in order to document the facts of economic activity. To correctly fill out an invoice for payment, you must provide the following required information:

- Invoice date and serial number. All invoices must be unique and numbered in order; duplicate numbers are not allowed. This information is indicated in the header of the invoice for payment.

- Payment details of both parties (name, INN, KPP, BIC, current account number). The supplier's details can be used as a sample for filling out a payment order.

- Information about goods (services). The name, quantity, cost (in words) and units of measurement are indicated.

- VAT information. The tax consequences of the transaction depend on the seller's tax system. VAT is credited on the basis of the invoice, but if VAT is not highlighted in the invoice for payment, then there may be arithmetic errors in the further preparation of invoices.

Additional account details

You can also provide additional information about the transaction:

- Invoice date. This will allow the recipient to easily recognize the basis of the funds received.

- Account basis. It explains why this invoice is being issued.

- Address, telephone and fax of the seller.

- Terms of payment

- Delivery times of goods

- Information about prepayment, etc.

If detailed information about the transaction is indicated, the invoice for payment is equivalent to a cooperation agreement. If the invoice is filled out incorrectly, then the conclusion of the contract occurs only after the actual transfer of the goods and the process of signing the invoice. Then the buyer who has already paid for the goods will not be able, on the basis of this invoice, to demand from the supplier a replacement of the goods, a change in its quantity, etc. In this case, the buyer may demand a refund of the money paid due to unjust enrichment.

Do I need to stamp the invoice for payment?

How to issue an invoice for payment without breaking the rules? Russian legislation does not require invoices for payment to be certified with a personal signature and seal. Despite this, it is advisable to indicate them in order to avoid misunderstandings in the future. It is allowed to sign invoices that are sent to the buyer by fax or e-mail, with a facsimile copy of the signatures of authorized persons and the organization's seal. It’s even better if the invoice form is decorated with the logo of the organization.

The meaning of the invoice for payment

This document is considered non-binding as it does not confirm anything. The fact of sending funds to the seller can be seen by payment order, the provision of services and the transfer of goods and materials - by acts and invoices. But if you want to avoid unpleasant moments with delayed payments, you need to know how to correctly prepare an invoice for payment and present it to the client.

Required details

Clause 1 Art. 9 Federal Law No. 409 dated July 18, 2017 “On Accounting” states that all business transactions carried out in an organization must be accompanied by supporting documents on the basis of which accounting is conducted at the enterprise.

According to clause 2 of the same regulatory act, the mandatory details of such documentation are:

- Document's name.

- Date of preparation.

- The name of the company that is drawing up the document.

- Household contents operations.

- Household units of measurement operations.

- Job titles of persons responsible for the operation.

- Signatures of responsible persons.

As can be seen from the list provided by law, the seal is not part of the required details. Accordingly, it cannot be considered a mandatory requirement.

Is there a stamp on the balance sheet?

The customer does not want to put a stamp on the “Certificate of Acceptance of Completed Work” (Form N KS-2). What are the consequences of recognizing for profit tax purposes expenses confirmed by an unstamped act?

The absence of a seal imprint in the act of acceptance of work performed cannot be a basis for non-acceptance of this document for tax and accounting purposes. According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for the purpose of taxing the profits of organizations, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Art.

270 of the Tax Code of the Russian Federation). In this case, expenses are recognized as justified and documented expenses incurred by the taxpayer.

Inspectors calculate the amount of the fine based on the complete list of documents that a specific organization must submit.

For example, for 2022 you need to submit the following forms: Balance Sheet, Statement of Income, Statement of Changes in Equity, Statement of Cash Flows, explanations in tabular and text form. If you do not submit your reports on time, the fine will be 1000 rubles. (200 × 5).

And the chief accountant faces an administrative fine in the amount of 300 to 500 rubles.

Is it obligatory to print on the invoice for payment?

A payment invoice is a paper that does not have a special unified form. Accordingly, this document must include exclusively the items listed in Art. 9 Federal Law No. 409. The seal is not indicated in this list. Therefore, its presence on the account is not considered mandatory.

Accordingly, the opinion that the absence of a seal makes the invoice invalid is a mistake. Printing on the invoice for payment is required only according to the customs of business document flow. If the organization has a rule for the mandatory presence of such details, it will have to be included in the document. But we must remember that not all organizations and individual entrepreneurs have a seal, because this is permitted by law. So the lack of a stamp on the invoice is quite understandable.

Organizations often ask to embed a logo and a seal with a signature directly into the invoice for payment to the buyer. This makes the account look more solid and representative. Facsimile printing on an invoice is not prohibited by regulations and therefore many people take advantage of this opportunity.

Today I will tell you how to make a similar setup for 1C: Accounting 8.3 (edition 3.0) yourself, without the help of a programmer.

Please note the change in BP version 3.0.64.34. About him here.

We customize the seal, signature and logo

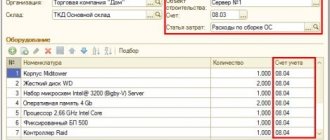

So, go to the “Main” section and select the “Organizations” item:

Open the card of our organization and expand the “Logo and seal” item:

Click the “Upload Logo” link.

Immediately after this we will be asked to indicate the picture that we want to use as our logo. You need to prepare a file with such a picture in advance (order it from the designer) or find something suitable on the Internet.

For our experiments, I took the 1C company logo:

In general, any image in formats (png, jpg, bmp) will do.

The logo was inserted into the field and displayed on the form, great!

We will take care of the production of fax stamps and signatures. To do this, click on the item “Instructions 'How to create a fax signature and seal'”:

Let's print and follow the instructions indicated on the printed sheet:

After that, we will have at our disposal 3 pictures in one of the formats (png, jpg, bmp) with a seal and signatures, in my case they look like this:

Let’s download them using the appropriate links in the organization’s card:

We see that pictures with stamps and signatures have been substituted and displayed on the form. Click the “Record and close” button in the organization card:

Please note the change in BP version 3.0.64.34. About him here.

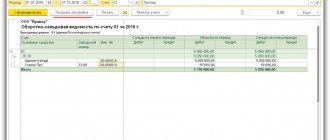

Finally, go to some invoice for payment to the buyer and click the “Print” -> “Invoice for payment (with stamp and signatures)” button:

A printed form of the invoice with a logo, seal and signatures has appeared:

If the pictures with the seal and signatures are too small, rescan the sheet with a higher resolution.

We're great, that's all it seems

But what if we want the seal to fit over the signature?

Not everyone needs this, and apparently that’s why 1C by default made an option with a separate location for the signature and seal.

For those who need to combine them, instructions are below.

We combine the seal and signature of the manager

To do this, go to any account and create a regular printed form (without stamps and signatures):

It will turn out like this:

Next, we print out this invoice, put a stamp and signatures on it with the location we need.

Then we cut off along the bold line at the bottom (before the signatures and seal) and scan the bottom part and save it as a picture on the desktop.

I got it like this (the stamp and signature are fictitious):

Again, go to the organization’s card, section “Logo and Printing”.

Here we delete the pictures with the signatures of the manager and accountant, and instead of the old seal picture, we upload the large picture we just made, combining the seal and signatures:

Click the “Record and close” button in the organization’s card, and then create a printed form of any invoice along with a seal and signatures:

In the printed form that opens, from the “More” item, select the “Change layout...” command:

Next, be very careful, because if you change the layout incorrectly (remove something from it), the printed form will stop working altogether and you will have to restore it according to this instruction (link).

In the layout that opens, go almost to the very bottom (about the 90th line) and select the invisible square below the inscription “manager”:

Our task is to drag this square a little higher (determined experimentally) than the inscription head and stretch it across the entire width of the printing form, like this:

Don't change anything else! Click the “Record and close” button, the printed invoice form will be reformatted automatically:

Exactly what we wanted happened - the seal climbed onto the signature.

Well done again

By the way, subscribe to new lessons...

Change in BP version 3.0.64.34

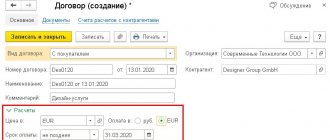

Now, having set up a signature and seal in the organization, we still must select the “Invoice for payment” item in the invoice, and in the printed form itself, check the “Signature and seal” checkbox:

You only need to install it once. Its value is saved between calls to the print form.

Addition from a site reader . If the invoice form has been edited, the checkbox will not appear - you must return to the standard form.

When are seals applied?

According to Federal Law No. 82 of 04/06/2015 “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies,” the use of round seals is not mandatory. The exception is a limited list of documents. Unified forms that do not have the abbreviation “MP” do not need to be stamped.

Therefore, when the question arises whether the invoice is stamped for payment, the answer is clear - this is not necessary.

However, it is necessary to remember about the business document flow of each enterprise individually. In addition, the buyer can be more confident in documentation with the presence of a seal. After all, printing is part of the company’s image. If organizations are accustomed to working with documentation that has stamps, the requirement often extends to the invoice.

Therefore, whether a seal is needed on the invoice for payment depends on the document flow of the enterprise.

At the legislative level, business entities do not have such an obligation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to upload a seal and signature into 1C

Go to the Main-Organizations section.

Open the organization's card and click on the Logo and seal .

Click on the link Instructions “How to create a fax signature and seal” .

A printable form with a template opens.

- Print the template:

- Follow the instructions:

After completing all the steps, you have saved 3 separate image files in PNG format.

Upload the seal and signature into 1C 8.3 by clicking on the link Upload seal , select the file with the seal and upload it into the program.

The same must be done with the signatures of the manager and chief accountant.

After that, click Burn . To check the display of the seal and signatures, follow the link Preview of the “Invoice to the buyer” printed form.

Next, you need to continue the settings in the printed form Invoice to the buyer .