Accounting for accounts receivable on account 62

The rules that need to be kept in mind when working with account 62 “Settlements with buyers and customers” are indicated in the chart of accounts and instructions for it, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Count 62 is used to reflect:

- accounts receivable (hereinafter referred to as receivables) of buyers and customers for goods, works, services sold (hereinafter referred to as GWS);

- accounts payable in the form of advances received.

Turnover in the debit of account 62 occurs when reflecting the debt of buyers when the sale of goods and services takes place. The second side of the posting will be income accounts 90.1, 91.1 or account 46 for the gradual reflection of income from long-term work. Thus, receivables are reflected simultaneously with revenue. In accordance with the accounting rules, revenue is shown in accounting if a number of conditions are met (clause 12 of PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n):

- existence of a legally valid right to receive proceeds;

- availability of total revenue value;

- having confidence in receiving payment;

- a transfer of ownership was carried out, i.e. the buyer accepted the GWS;

- the presence of the total value of the corresponding expenses incurred to obtain this revenue.

If at least one condition is not met, then the payment received by the organization should be reflected as accounts payable, and not repay accounts receivable.

When payment is received from the buyer, account 62 is credited, and a debit entry is made in the cash accounts.

Analytics of 62 accounts should allow checking its balances for the presence of overdue debts, that is, carried out in the context of counterparties, issued invoices, and payment terms. To ensure transparency of reporting, overdue debt must be reserved by posting Dt 91.2 Kt 63 (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In the balance sheet, receivables are shown minus reserves. Debts that cannot be repaid and debts with an expired statute of limitations must be written off (clause 77 of the PBU) at the expense of the reserve by posting Dt 63 Kt 62, and if they were not reserved, then they are written off to the financial results of Dt 91.2 Kt 62. When In this case, for another 5 years, the written off debt is reflected on the balance sheet (account 007) in order to track changes in the financial condition of the debtor and the possibility of repaying the debt.

VAT deduction on advances and prepayments

In accordance with clause 12 of Article 171 of the Tax Code of the Russian Federation, taxpayers-buyers have the right to claim “input” VAT for deduction not only at the time of taking into account purchased goods (works, services), but also upon transfer of an advance payment on account of the upcoming delivery of goods ( works, services), property rights (clause 12 of article 171 of the Tax Code of the Russian Federation). However, when claiming VAT on the advance amount, you need to take into account the problems that may be encountered in practice.

In accordance with the Tax Code of the Russian Federation, the mechanism for using deductions for advance payments is as follows.

The buyer, who has transferred the prepayment to the supplier, receives from him an invoice for the amount of the prepayment (let's call it an “advance invoice”) and, on the basis of this invoice, claims VAT for deduction (registers the specified invoice in his purchase book).

Then the buyer receives from the supplier those goods (work, services, property rights) for which he previously made an advance payment. When shipping these goods (works, services, property rights), the supplier again issues an invoice to the buyer (let’s call it a “shipping invoice”), on the basis of which the buyer again claims VAT for deduction (registers the received shipping invoice in his purchase book ). And at the same time, the buyer restores for payment to the budget the amount of VAT that was declared by him for deduction when transferring the prepayment (i.e., registers in the sales book the advance invoice received from the supplier when transferring the prepayment) (subclause 3 of paragraph. 3 Article 170 of the Tax Code of the Russian Federation).

Example

A supply agreement has been concluded between organizations “Plus” (buyer) and “Minus” (seller). The cost of supplied goods is 118,000 rubles. (including VAT – 18,000 rubles). The contract provides for 100% advance payment.

In January 2011, the Plus organization transferred an advance in the amount of 118,000 rubles to the supplier’s account. and received from him an advance invoice in the amount of 118,000 rubles.

Supply of goods in the amount of 118,000 rubles. was carried out in February 2012. When shipping goods in February 2012, the supplier issued a shipping invoice in the name of the Plus organization in the amount of 118,000 rubles.

The following entries are made in the accounting records of the Plus organization.

January 2011:

Account number 60 – Account number 51 – 118,000 rubles. – the advance payment is transferred to the supplier’s account;

Account number 68 – Account item 76 – 18,000 rubles. – VAT on advance payment is deductible on the basis of the supplier’s advance invoice.

February 2012:

Account number 41 – Account number 60 – 100,000 rubles. – goods received from the supplier are accepted for accounting at cost excluding VAT;

Account number 19 – Account number 60 – 18,000 rubles. – VAT on purchased goods is reflected;

Account number 68 – Account item 76 – 18,000 rubles. – the amount of VAT claimed for deduction when transferring the advance was restored (reversal entry);

Account number 68 – Account number 19 – 18,000 rub. – the amount of VAT on goods accepted for accounting is presented for deduction based on the supplier’s shipping invoice.

End of example

In practice, as usual, everything is somewhat more complicated.

For example, the following situation is possible.

The organization has entered into several agreements with the service provider. At the end of the tax period, under some of these agreements the organization is a debtor, and under other agreements an advance was paid and an overpayment is recorded.

The question arises: does the organization in this situation have the right to deduct VAT on the amount of the advance payment under some contracts, if it is in debt under other contracts concluded with the same supplier?

In our opinion, the organization has every right to take advantage of the deduction for the listed advance payment, since the norms of the Tax Code of the Russian Federation do not make this right dependent on the presence or absence of debt from the purchasing organization to the seller under other contracts.

The validity of this conclusion is confirmed by letter of the Ministry of Finance of Russia dated 03/05/2011 No. 03-07-11/45.

Note!

Payment of an advance to the supplier is not the only condition for deducting VAT on the amount of this advance.

To deduct VAT on the prepayment amount, the taxpayer must (see clause 9 of Article 172 of the Tax Code of the Russian Federation):

- firstly, receive a correctly executed advance invoice from the supplier;

- secondly, have documents confirming the actual transfer of the prepayment;

- thirdly, have an agreement providing for the transfer of an advance payment.

Note!

The Tax Code of the Russian Federation does not indicate that the right to deduction arises only for those advances that are transferred on account of the upcoming supply of goods (work, services) intended for use in transactions subject to VAT.

However, there is a corresponding restriction in clause 19 of the Rules for maintaining a purchase ledger (Appendix No. 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). It states that buyers do not register in the purchase book invoices for advances transferred against the upcoming supply of goods (work, services), property rights that are acquired exclusively for use in transactions not subject to VAT. Therefore, no deduction is available on such advances.

If goods (work, services) are purchased to carry out both taxable and non-VAT-taxable transactions, then the deduction for the amount of the prepayment is provided in full (i.e., the entire amount of VAT indicated in the corresponding invoice can be deducted) . This is expressly provided for in paragraph 15 of the Rules.

Below we will look at the problems that you may encounter in practice.

Problem 1. Cash and non-cash advances

Clause 9 of Article 172 of the Tax Code of the Russian Federation states that a deduction for the amount of advances and prepayments is provided if there are documents confirming the transfer of the prepayment.

This wording led officials to the conclusion that the deduction can only be used if the prepayment is made by bank transfer.

If the prepayment is made in cash or in non-cash form, no deduction can be made for such prepayment. This opinion is set out in the letter of the Ministry of Finance of Russia dated March 6, 2009 No. 03-07-15/39.

The conclusion is, of course, controversial. But in practice, tax authorities follow precisely this approach.

Note that in the Rules for maintaining a purchase book (Appendix No. 4 to Resolution No. 1137), which, unlike letters from the Ministry of Finance of Russia, are a regulatory document, a ban on deductions is established only in relation to prepayments for non-cash forms of payment (clause 19 of the Rules). There is not a word in the Rules about prepayment in cash. However, taking into account the position of the Russian Ministry of Finance stated above, the deduction of VAT on an advance paid in cash may lead to a dispute with the tax inspectorate.

As for the prohibition on deducting VAT on advances paid in non-cash form, it is clearly established only in the Rules for maintaining a purchase ledger. There is no such prohibition in Chapter 21 of the Tax Code of the Russian Federation; there is only an indication of the need to have “documents confirming the transfer of an advance payment.”

Tax authorities, guided by the Rules for maintaining a purchase book, have and will continue to refuse taxpayers the deduction of VAT on advances in non-cash form.

At the same time, one cannot help but say that arbitration practice has already appeared, showing that the taxpayer has a good chance of challenging such a refusal to deduct in court.

For example, the FAS of the Volga District considered that the norms of Chapter 21 of the Tax Code of the Russian Federation do not limit the right of a taxpayer to deduct VAT on an advance paid in kind (Resolution No. A12-22832/2010 dated October 3, 2011).

A similar decision was made by the Federal Antimonopoly Service of the North-Western District. The Resolution No. A05-5313/2011 dated January 19, 2012 confirmed the legality of deducting VAT on an advance paid by transferring bills of exchange from third parties to the seller. At the same time, the court pointed out that in this case the document confirming the transfer of the advance payment is the act of acceptance and transfer of the bill.

The same conclusions can be found in the Resolution of the Federal Antimonopoly Service of the Ural District dated September 14, 2011 No. F09-5136/11.

Problem 2. Agreement providing for the transfer of an advance payment

Clause 9 of Article 172 of the Tax Code of the Russian Federation states that a deduction for the amount of an advance payment is provided if there is an agreement providing for the transfer of such an advance payment.

The Ministry of Finance believes that in order to deduct VAT on an advance payment, an agreement must be concluded between the parties in the form of a single document signed by the parties, which must contain a condition for advance payment. It is not necessary to indicate the specific amount of the prepayment; it is enough to simply include a condition that payment is made by prepayment.

If there is no provision for prepayment in the contract, or there is no contract at all, and payment is made on the basis of an issued invoice, then the buyer does not have the right to deduct the prepayment (letter of the Ministry of Finance of Russia dated March 6, 2009 No. 03-07-15/39).

Of course, one can argue with this approach by proving that the concept of “agreement” includes not only a single document signed by the parties.

In accordance with Article 434 of the Civil Code of the Russian Federation, an agreement in writing can be concluded by drawing up one document signed by the parties, as well as by exchanging documents via postal, telegraphic, teletype, telephone, electronic or other communication, which makes it possible to reliably establish that the document comes from parties to the contract. In addition, the written form of the agreement is considered to be complied with if the written proposal to conclude an agreement is accepted in the manner prescribed by paragraph 3 of Article 438 of the Civil Code of the Russian Federation.

However, you need to understand that tax authorities will most likely be guided by the approach of the Ministry of Finance.

It must be said that the first court cases have already appeared, confirming the validity of our point of view that the concept of “agreement” should be interpreted not in the narrow sense of the word (as a single document), but in the broad sense - in accordance with Article 434 of the Civil Code of the Russian Federation .

This position is expressed, for example, in the Resolution of the Federal Antimonopoly Service of the Central District dated August 2, 2011 No. 64-6563/2010. It states that the absence of a single text of the contract signed by both parties cannot be regarded as the absence of a contractual relationship between the supplier and the buyer.

The court considered the following procedure for formalizing contractual relations: the buyer submits an application for manufactured products, the seller transmits an invoice to the buyer via fax (indicating the names of the parties, name, quantity, price and delivery time of the goods), the buyer pays for it, after which, by agreement of the parties , either the buyer picks up the goods from the seller’s warehouse, or the seller sends them by parcels. At the same time, a delivery note and an invoice are issued. The buyer, by paying the invoice, actually confirms the conclusion of the contract.

As a result, the judges came to the conclusion that formalizing the contractual relationship in the manner described above gives the buyer the full right to deduct VAT on the amounts of prepayments listed on the basis of the invoices.

* * *

Considering the many difficulties associated with the use of deductions for advance payments, many taxpayers have a question: is it possible not to use deductions for advance payments, but to claim VAT for deduction only as goods (work, services) are taken into account?

Without a doubt it is possible.

The Tax Code gives taxpayers the right to take advantage of deductions. Moreover, each taxpayer independently decides whether to use this right or not. Accordingly, the taxpayer may decide not to take advantage of the advance payment deduction.

Note that you have the right to decide whether or not to take the deduction for each individual advance.

That is, this is not an element of accounting policy, and no one is saying that the taxpayer should apply any uniform procedure - either use the deduction for all advances, or not use all of them. No. In each specific case, having transferred the advance payment, the taxpayer decides whether to claim VAT for deduction or not.

Moreover, the Russian Ministry of Finance believes that the taxpayer has the right to decide what amount of VAT he will claim for deduction: the entire amount indicated in the advance invoice, or only a part (letter of the Russian Ministry of Finance dated November 22, 2011 No. 03-07-11/ 321).

On the one hand, such freedom of action, of course, pleases.

But you need to understand that this freedom can significantly complicate your work.

If you do not always use deductions, but only in certain cases, then when you take into account goods (works, services) paid for at that time, you will constantly have to check whether a deduction was claimed when transferring the corresponding advance payment. If there was no deduction, then you simply record the shipping invoice in the purchase ledger and that’s it. If there was a deduction, then in the sales book you need to restore the amount previously declared for deduction by registering an advance invoice in it.

It is clear that with a large number of incoming deliveries, these checks can consume a huge amount of time. Therefore, the accountant will have to come up with some kind of methodology that allows, at the time goods (work, services) are accepted for accounting, to quickly receive information about whether there was a deduction for the advance payment. Otherwise, preparing a VAT report threatens to turn into a madhouse.

Based on materials from the book “VAT: Deductions and Invoices”

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

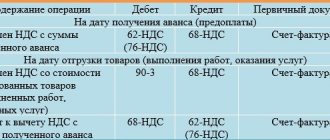

Accounting for advances received

Payment of goods and materials prior to their shipment or transfer is accounted for separately on account 62; subaccount 62.2 “Advances received” is usually used, while subaccount 62.1 “Settlements with buyers and customers” is used to account for receivables from buyers. In the balance sheet, advances received are included in accounts payable, that is, they are shown as a liability; it is impossible to show advances minimized from accounts payable. In addition, upon receipt of an advance payment, the supplier must charge VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Example:

In July, Pchelka LLC (buyer) and Vasilek LLC (seller) signed an agreement for the purchase of paving slabs worth RUB 944,590. In the same month, Pchelka LLC made a full prepayment. The following entries are made in the accounting of Vasilek LLC:

Dt 51 Kt 62.2 - 944,590 rub. — an advance payment from Pchelka LLC has been received into the bank account;

Dt 76 subaccount “VAT on advances received” Kt 68 subaccount “VAT” 157,431.67 rub. (944,590 × 20/120) - VAT is charged upon receipt of an advance payment.

In August, Vasilek LLC shipped all the paving slabs to the buyer and recorded the following entries:

Dt 62.1 Kt 90 — 1,944,590 rub. — revenue accrued;

Dt 90.3 Kt 68 subaccount “VAT” - 157,431.67 rubles. — VAT is charged on sales;

Dt 68 subaccount “VAT” Kt 76 subaccount “VAT on advances received” 157,431.67 rubles. — previously accrued VAT on the prepayment received is accepted for deduction;

Dt 62.2 Kt 62.1 - 944,590 rub. — the previously received prepayment has been offset.

For more information about the actions of the seller when receiving an advance payment, read the article “What is the general procedure for accounting for VAT on advances received?”

ConsultantPlus experts explained how to reflect advances received in the VAT return. Get trial access to the system and proceed to examples of filling out the report for free.

Tax accounting: what to pay attention to

When working with advance payments, you must be careful when filling out invoices. Tax authorities, in particular, pay attention to the correct indication of the tax rate - 10/110 or 20/120, and not 10% and 20%. When making advance payments, VAT calculations are carried out only at estimated rates.

When registering an invoice for an advance payment in the purchase book in case of a return, the seller uses transaction type code 22 (List of codes for transaction types indicated in the purchase book, attached to the Federal Tax Service order No. ММВ-7-3 / [email protected] dated 14/03 /16).

The details of the invoice for the advance payment, a document confirming the return of money to the buyer - usually a payment order (column 7, see letter of the Ministry of Finance No. 03-07-11/16044 dated 24/03/15) are also indicated. In the relevant In the columns you need to indicate the name of your company, INN, KPP, the full amount of the advance, VAT on the advance is only deductible. The tax must correspond to the refund amount (column 16).

The buyer in the same situation is obliged to restore the tax by reflecting the seller’s invoice for the advance payment in the sales book (it was already reflected in the purchase book). Operation type code 21 is used (Federal Tax Service order No. ММВ-7-3/136, appendix).

Payments by bill of exchange

The instructions for the chart of accounts also pay attention to the peculiarities of settlements with bills of exchange. If the buyer issues his own bill of exchange to the supplier, then the debt is not repaid, but by this action a deferred payment is issued and a guarantee of payment is issued. To account for bills received, it is recommended to allocate a separate sub-account, for example, 62.3 “Bills received”. The following entries are made in the seller's accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 62.3 | 62.1 | Received own bill from buyer |

| 51 | 62.3 | Received funds upon presentation of a bill of exchange |

| 51 | 91.1 | Interest received on the bill |

Another situation arises if the debt is paid by a bill of exchange from third parties. Such a bill of exchange is recognized as a financial investment and is accounted for in account 58. The entries shown in the table are made in the supplier’s accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 58.2 | 62.1 | Received a third party promissory note as payment |

Results

For different types of debt, the chart of accounts provides for special accounts. One of them is account 62, which can be either active or passive, since it is used to account for both debt from buyers and customers, and creditors in the form of advances and prepayments received.

Read about accounting for accounts receivable in the article “Keeping records of accounts receivable and accounts payable.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.